Real Estate Tokenization: Complete 2025 Guide & Platform Solutions

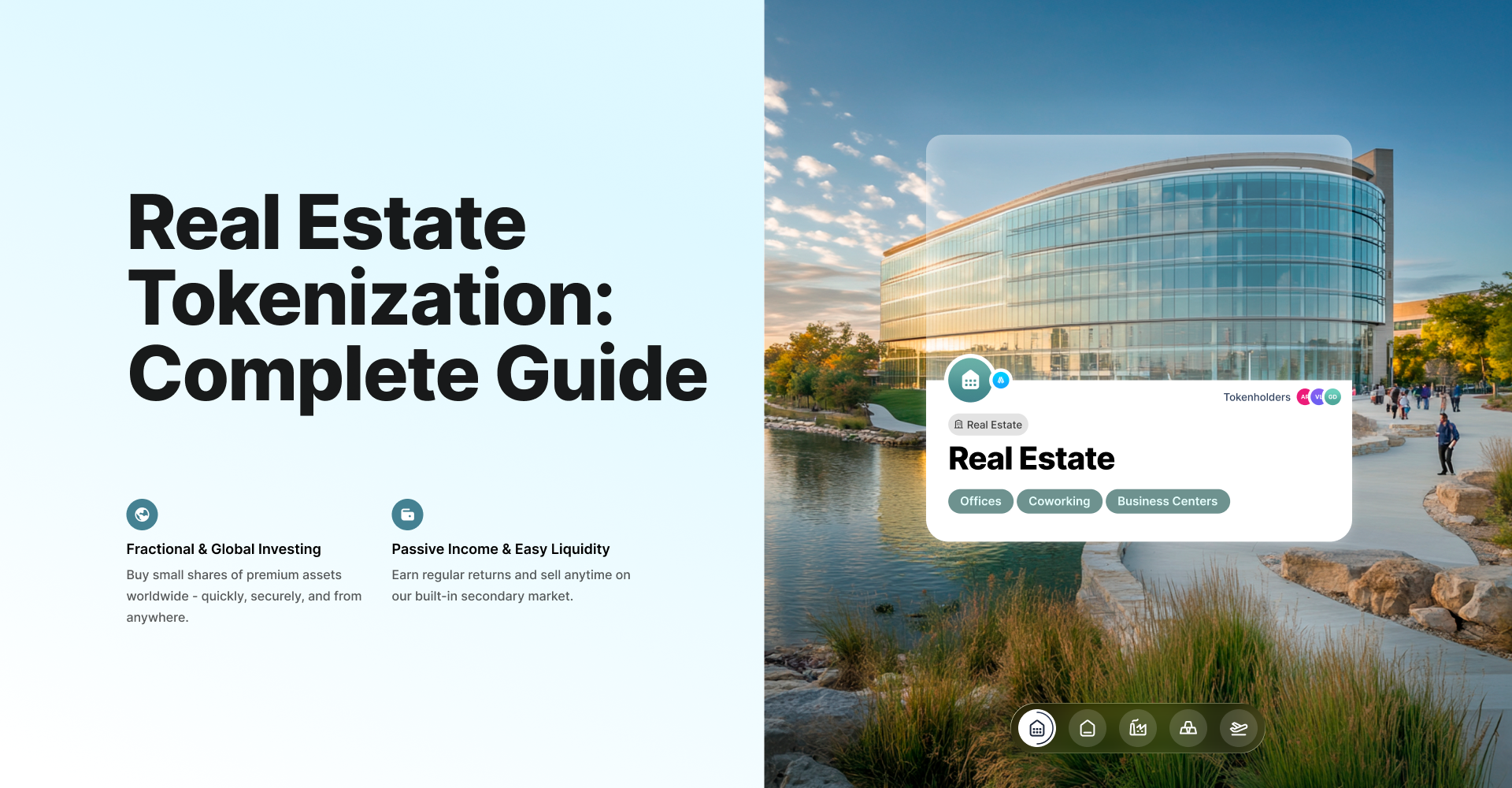

Real estate tokenization democratizes access to the $280 trillion global property market through blockchain technology, enabling fractional ownership, automated management, and enhanced liquidity - with Stobox 4 providing complete SaaS infrastructure for institutional tokenization.

Real estate tokenization transforms property ownership into digital tokens, enabling fractional access to premium properties that traditionally required hundreds of thousands in capital for full ownership participation.

The real estate landscape is undergoing a fundamental transformation through blockchain technology. For decades, premium property access has been exclusive to wealthy individuals and institutions who could afford minimum participation of $500,000 or more. Today, real estate tokenization platforms are democratizing access to luxury properties worldwide.

Real estate tokenization converts property ownership rights into digital tokens on blockchain networks. Each token represents a specific percentage of ownership in the underlying property, similar to how company shares represent business ownership. This process enables participants to acquire fractional shares of expensive properties, access global real estate markets, and manage their holdings through digital platforms.

The technology has moved beyond experimental phases into successful real-world applications. Property tokenization case studies show projects worth hundreds of millions being fractionalized into accessible participation units. From luxury condominiums in Manhattan to heritage preservation projects in Germany, tokenization is creating new opportunities for both property owners seeking capital and participants wanting portfolio diversification.

Whether you're a real estate developer looking to configure token offerings, a participant seeking portfolio diversification, or simply curious about the future of property ownership, understanding real estate tokenization is essential for navigating tomorrow's landscape. With platforms offering comprehensive tokenization services that handle everything from technical structuring to secondary market integrations, the infrastructure for tokenized real estate is already operational.

Ready to explore real estate tokenization for your property projects? Discover how blockchain technology is transforming property ownership and creating new opportunities for developers and participants worldwide.

What is Real Estate Tokenization?

Real estate tokenization is the process of converting ownership rights in physical properties into digital tokens that exist on a blockchain. Instead of holding traditional paper deeds or physical certificates, participants own digital tokens that represent legally-backed ownership stakes in real estate assets.

The fundamental process involves creating a digital representation of property ownership through smart contracts – self-executing contracts with terms directly written into code. These smart contracts automatically handle token transfers, distribution automation, and ownership records without requiring traditional intermediaries like banks, brokers, or transfer agents.

This transformation addresses critical limitations in traditional real estate participation. How real estate asset tokenization works demonstrates how blockchain technology creates immutable ownership records, enables fractional participation, and provides transparent transaction histories that build trust between participants and property managers.

Key Differences from Traditional Real Estate:

Traditional Real Estate Limitations:

- Minimum participation requirements typically exceed $200,000

- Geographic constraints limit access to local markets only

- Transaction completion requires 60-90 days of processing time

- Combined transaction fees range from 5-7% of property value

- Trading restricted to standard business hours and market availability

- Complex paperwork and manual processes create delays and errors

Tokenized Real Estate Advantages:

- Minimum participation starts from $100, democratizing access

- Global market access eliminates geographic investment barriers

- Digital transactions complete within minutes to hours

- Streamlined processes reduce fees to 1-2% through automation

- Potential for 24/7 trading through digital marketplace infrastructure

- Automated smart contracts eliminate manual paperwork and human error

Modern tokenization platforms like Stobox utilize advanced protocols including STV3 (Security Token Version 3) that ensure regulatory compliance while maintaining the efficiency benefits of blockchain technology. These platforms support multiple blockchain networks, automated compliance monitoring, and comprehensive participant management systems.

⚖️ Legal Framework Tokenized real estate typically qualifies as securities, subjecting them to regulatory requirements including participant verification, disclosure obligations, and ongoing compliance monitoring through automated systems.

The legal structure usually involves establishing Special Purpose Vehicles (SPVs) that own the underlying properties and issue tokens to participants. This structure protects both property owners and token holders by creating clear legal boundaries and limiting liability exposure while ensuring proper regulatory compliance.

The Traditional Real Estate Problem

Traditional real estate participation faces fundamental barriers that exclude most potential participants from lucrative property markets. Understanding these limitations reveals why tokenization represents such a significant advancement for both property owners and participants seeking real estate exposure.

High Capital Requirements

Real estate participation typically requires substantial upfront capital that most individuals cannot afford. Purchasing property demands $100,000 to $500,000 or more in initial capital, plus additional funds for maintenance, taxes, and unexpected expenses. This high barrier excludes approximately 90% of potential participants from direct real estate ownership.

Even real estate funds often require significant minimum participation for institutional-quality properties. Private funds targeting premium assets frequently set minimums at $25,000 to $100,000, while the best opportunities remain exclusive to accredited participants with substantial net worth requirements.

Geographic and Market Limitations

Traditional real estate participation constrains participants to properties within their local markets or regions they can easily visit and manage. This geographic limitation prevents portfolio diversification across different real estate markets, economic conditions, and currency exposures.

International real estate participation involves complex legal procedures, foreign exchange risks, tax implications, and local regulatory requirements that make cross-border property ownership impractical for most individual participants. Even domestic participation outside one's immediate area presents challenges in due diligence, property management, and ongoing oversight.

Illiquidity and Long Transaction Times

Real estate ranks among the most illiquid asset classes, with transactions typically requiring 30-90 days to complete. Property owners cannot quickly access their capital when financial needs arise, making real estate unsuitable for participants who may need liquidity on short notice.

Transaction costs further compound liquidity problems. Traditional real estate sales involve 5-7% in combined fees including real estate agent commissions, legal fees, title insurance, and transfer taxes. These high costs make frequent trading impractical and force participants to maintain positions longer than desired.

Complex Administrative Processes

Real estate transactions require extensive documentation, multiple intermediaries, and lengthy approval processes. Buyers must navigate financing approvals, property inspections, title searches, legal reviews, and regulatory compliance procedures that create opportunities for delays and additional costs.

Property management adds ongoing administrative complexity including tenant relations, maintenance coordination, tax reporting, and compliance with local regulations. These responsibilities often require professional property management services that reduce net distributions for participants.

Limited Transparency and Information Access

Traditional real estate markets suffer from information asymmetries where sellers often have significantly more knowledge about property conditions, market trends, and potential than buyers. Property histories, previous transactions, and ownership records are frequently scattered across multiple databases and not easily accessible.

Financial performance data for comparable properties is often unavailable or unreliable, making accurate valuations difficult for individual participants. This information gap creates risks and reduces confidence in decisions, particularly for properties outside participants' immediate geographic knowledge.

How Tokenization Solves These Problems

Real estate tokenization addresses each traditional barrier through innovative blockchain technology and comprehensive platform solutions. Understanding these solutions demonstrates why tokenization is rapidly gaining adoption among both institutional and retail participants seeking real estate exposure.

Fractional Ownership Revolution

Tokenization breaks expensive properties into accessible participation units through digital fractionalization. Instead of requiring $500,000 to purchase an entire property, participants can buy tokens representing fractional ownership starting from $100 or less, democratizing access to premium real estate markets.

This fractional model enables superior portfolio diversification strategies. Rather than concentrating $100,000 in a single local property, participants can spread holdings across multiple tokenized properties in different markets, asset classes, and geographic regions, significantly reducing concentration risk while accessing premium real estate opportunities.

Modern asset tokenization platforms provide sophisticated portfolio management tools that help participants optimize their fractional holdings across diverse tokenized assets, including automated rebalancing features and performance analytics that rival institutional-grade systems.

Global Market Access and 24/7 Trading

Blockchain technology eliminates geographic constraints by enabling participants worldwide to participate in international real estate markets. A participant in Tokyo can easily own tokens representing properties in New York, London, or Dubai without dealing with international banking complexities or local regulatory barriers.

⚡ Trading Efficiency Digital marketplaces operate continuously, allowing participants to buy and sell tokenized real estate positions within minutes rather than waiting months for traditional property transactions.

Tokenized real estate can potentially trade on digital platforms around the clock, providing unprecedented liquidity compared to traditional property participation. While actual liquidity depends on market demand and regulatory frameworks, the infrastructure for continuous trading creates opportunities for more dynamic portfolio management.

Advanced platforms support multiple fiat currencies and payment methods, making global participation accessible to participants from different financial backgrounds. Integration with traditional banking systems and emerging payment rails reduces friction for international participants seeking real estate exposure.

Automated Processes and Smart Contracts

Smart contracts eliminate many intermediaries by automatically executing processes that traditionally required manual intervention. Rental distribution automation, voting rights, profit sharing, and compliance monitoring execute automatically based on predefined conditions, reducing administrative costs and human error.

These automated features enable more sophisticated structures through programmable logic. For example, tokenized real estate projects can automatically reinvest rental income, distribute profits based on token holdings, or adjust management fees based on property performance, creating dynamic vehicles that adapt to market conditions.

Comprehensive platforms provide automated compliance monitoring, regulatory reporting, tax documentation, and cross-border payment processing, significantly reducing operational burden for both issuers and participants while maintaining full regulatory compliance through real-time monitoring systems.

Enhanced Transparency and Trust

Blockchain technology creates immutable records of all property transactions, ownership changes, and financial distributions. This transparency builds trust between participants and property managers by providing verifiable proof of all financial activities through publicly accessible blockchain records.

This level of transparency is impossible with traditional real estate participation, where financial information is often limited to quarterly reports and difficult to verify independently. Blockchain records provide real-time access to performance data and property management activities.

Advanced platforms integrate Internet of Things (IoT) sensors and satellite monitoring with tokenized assets, creating real-time asset tracking and automated performance measurement that provides unprecedented visibility into property conditions and market performance.

Reduced Costs and Improved Efficiency

Smart contracts reduce transaction costs by eliminating multiple intermediaries including brokers, transfer agents, clearinghouses, and traditional escrow services. While traditional real estate transactions involve 5-7% in combined fees, tokenized transfers can reduce costs to 1-2% or less through streamlined digital processes.

These cost savings make micro-participation strategies economically viable, enabling portfolio diversification strategies that were previously impractical due to high transaction fees. Lower costs also improve overall performance by reducing the drag of fees and expenses on portfolio performance.

Multi-blockchain support allows platforms to optimize costs by selecting the most appropriate network for each transaction type, whether prioritizing low fees, fast settlement, or specific regulatory requirements, maximizing efficiency while maintaining security and compliance.

Who Benefits from Real Estate Tokenization

Real estate tokenization creates value across diverse market participants, from individual property developers to institutional fund managers and technology platforms. Understanding how different stakeholders benefit reveals the comprehensive ecosystem that tokenization enables through advanced platform solutions.

Real Estate Funds and Asset Managers

Private real estate funds and asset managers gain significant advantages through tokenization that address traditional limitations in fund liquidity and participant access. Fund managers can offer more flexible redemption terms, automated distribution mechanisms, and enhanced transparency to limited partners through blockchain-based reporting systems.

Traditional real estate funds face liquidity constraints where participants must wait years for fund distributions or face penalties for early withdrawal. Tokenized fund structures can provide secondary market trading opportunities for fund interests, enabling limited partners to exit positions before planned fund termination dates.

How asset managers benefit from tokenization demonstrates how blockchain technology creates hybrid fund structures that combine traditional real estate expertise with enhanced liquidity and operational efficiency through automated systems.

Fund tokenization also enables smaller fund sizes to be economically viable by reducing administrative costs and enabling fractional fund interests that attract smaller institutional participants and family offices previously excluded from private real estate funds.

Family Offices and High-Net-Worth Individuals

Family offices benefit from tokenization through improved estate planning capabilities, enhanced asset liquidity, and sophisticated governance mechanisms that enable better wealth management across generations. Tokenization creates opportunities for family members to diversify holdings while maintaining exposure to family real estate assets.

Estate planning benefits include simplified inheritance processes through blockchain-based ownership records, automated succession planning through smart contracts, and reduced probate complexity for tokenized assets that transfer according to predetermined rules.

Family governance improvements through tokenization include democratic voting mechanisms for property decisions, transparent financial reporting accessible to all family members, and automated distribution of rental income or property appreciation gains according to ownership percentages.

Liquidity benefits enable family office diversification strategies where families can maintain real estate exposure while accessing capital for other opportunities, family business initiatives, or philanthropic activities through partial tokenization of family properties.

PropTech Companies and Technology Platforms

Property technology companies can integrate tokenization capabilities into existing platforms to offer enhanced services including fractional ownership, automated property management, and blockchain-based transaction processing that differentiates their offerings in competitive markets.

API integration opportunities enable existing property management software, asset management platforms, and real estate marketplaces to incorporate tokenization features seamlessly into current workflows while maintaining familiar user experiences for existing clients.

B2B partnership opportunities include collaboration with tokenization platforms to offer comprehensive solutions that combine traditional real estate expertise with advanced blockchain capabilities, creating competitive advantages through technological innovation.

Revenue model enhancement through tokenization includes transaction fee opportunities, premium service offerings for tokenized properties, and new SaaS revenue streams from blockchain-based property management and participant relations tools.

Institutional Asset Managers and Pension Funds

Large institutional asset managers including pension funds, insurance companies, and endowments gain access to previously illiquid real estate markets through tokenization while maintaining fiduciary responsibilities and risk management requirements through institutional-grade platforms.

Portfolio management improvements include enhanced liquidity for real estate allocations, automated reporting and compliance monitoring, and integration with existing institutional asset management systems through comprehensive APIs and reporting tools.

Risk management benefits through tokenization include improved diversification across smaller asset sizes, enhanced transparency through blockchain records, and automated compliance monitoring that reduces operational risks associated with traditional real estate asset management.

ESG (Environmental, Social, Governance) benefits include transparent impact reporting for sustainable real estate assets, automated measurement of environmental metrics, and enhanced governance through blockchain-based voting and decision-making processes.

International Participants and Cross-Border Access

International participants benefit from simplified access to foreign real estate markets without traditional complications of international property ownership including complex legal structures, local banking relationships, and regulatory compliance requirements.

Regulatory compliance simplification through professional platforms reduces barriers to international real estate participation by handling cross-border regulatory requirements, tax optimization, and participant verification processes through automated compliance systems.

Geographic diversification becomes accessible to smaller participants who can build international real estate portfolios through fractional ownership of premium properties in multiple countries, reducing concentration risk while accessing global real estate markets.

Participation efficiency improvements include reduced transaction costs for international participation, simplified currency conversion and payment processing, and automated distribution of international rental income through blockchain-based payment systems.

The Promise: Benefits of Real Estate Tokenization

Real estate tokenization delivers transformative advantages that address fundamental limitations in traditional property participation markets. These benefits create new opportunities for both sophisticated institutional participants and retail participants seeking real estate exposure through innovative blockchain-based solutions.

Democratized Access

Tokenization removes traditional gatekeepers from real estate markets by reducing minimum participation requirements from hundreds of thousands to hundreds of dollars. This democratization enables middle-class participants to access premium real estate opportunities that were previously exclusive to wealthy individuals and institutions.

🌍 Global Participation A retail participant in Poland can own tokens representing luxury Manhattan real estate or commercial properties in Singapore, expanding opportunities beyond local markets through comprehensive multi-jurisdictional compliance.

This expanded access creates larger participant pools for real estate projects, potentially improving valuations for property owners while providing participants with unprecedented diversification opportunities. Professional tools typically available only to institutional participants become accessible to retail participants through advanced tokenization platforms.

The removal of geographic barriers enables participants to build globally diversified real estate portfolios that provide exposure to different economic cycles, currency fluctuations, and market dynamics, reducing overall portfolio risk while maximizing potential through strategic asset allocation.

Enhanced Liquidity Potential

While tokenization doesn't automatically guarantee liquidity, it creates infrastructure for more efficient trading compared to traditional real estate transactions. Digital marketplaces can operate with lower transaction costs and faster settlement times, making position adjustments more practical when market conditions change.

Advanced platforms integrate with decentralized finance (DeFi) protocols, enabling token holders to use their real estate holdings as collateral for loans while maintaining ownership exposure. This innovation provides liquidity without requiring asset sales, creating new financial strategies previously impossible with traditional real estate.

Market-making mechanisms and liquidity pools help ensure continuous buying and selling opportunities, while cross-platform compatibility maximizes trading venues and participant access. However, actual liquidity development requires sufficient market participation and may take time to mature for newer asset classes.

Automated Management and Governance

Smart contracts enable sophisticated property management automation that reduces costs while improving efficiency and transparency. Automated systems can handle rent collection, expense payments, profit distribution, and compliance monitoring without manual intervention, reducing operational overhead and human error.

🤖 Smart Automation Tokenized properties can automatically collect rent, pay operating expenses, distribute profits to token holders, and generate comprehensive financial reports – all executed through programmable smart contracts.

Governance mechanisms allow token holders to participate in major property decisions through blockchain-based voting systems. Participants can vote on property improvements, management changes, or sales decisions proportional to their token holdings, providing democratic control over decisions.

These automated features scale efficiently across multiple properties and thousands of participants, making professional property management economically viable for smaller assets that couldn't previously support comprehensive management services through traditional approaches.

Improved Risk Management

Fractional ownership enables superior diversification strategies that reduce concentration risk compared to traditional real estate participation. Instead of concentrating $200,000 in a single property, participants can spread exposure across multiple tokenized assets in different markets, property types, and geographic regions.

🛡️ Risk Mitigation Portfolio diversification across 20 different tokenized properties reduces the impact of any single asset's poor performance, while exposure to different markets provides protection against local economic downturns.

Advanced platforms provide comprehensive risk assessment tools including property analytics, market trend analysis, and portfolio optimization features that help participants make informed decisions about asset allocation and risk exposure through data-driven insights.

Real-time performance monitoring and automated reporting enable proactive risk management, while blockchain-based transparency ensures participants have complete visibility into property operations and financial performance through immutable record-keeping.

Cost Efficiency and Improved Outcomes

Reduced transaction costs through smart contract automation improve net outcomes for participants while making smaller participation economically viable. Lower barriers to entry and reduced fees create opportunities for more dynamic trading strategies and portfolio optimization.

💰 Outcome Enhancement Eliminating traditional intermediaries can reduce costs by 3-5% per transaction, directly improving participant outcomes while enabling more frequent portfolio adjustments when beneficial.

Automated administrative processes reduce ongoing management costs, enabling higher net income distribution to token holders. Efficiency improvements benefit both property owners seeking capital and participants seeking outcomes through streamlined operations.

Global participant access can improve property valuations by expanding the pool of potential buyers, while 24/7 trading capabilities enable participants to capitalize on market opportunities and optimize exit timing for maximum outcomes.

The Reality Check: Challenges and Risks

While real estate tokenization offers significant opportunities, it also presents substantial challenges that must be carefully understood and addressed. Recognizing these risks enables informed decision-making and proper risk management for both issuers and participants participating in tokenized real estate markets.

Regulatory Complexity and Uncertainty

Real estate tokenization operates in a complex regulatory environment where securities laws vary significantly between jurisdictions. Tokenized real estate typically qualifies as securities, subjecting projects to strict compliance requirements including participant accreditation, disclosure obligations, and ongoing reporting responsibilities.

⚠️ Regulatory Reality Regulatory changes can dramatically impact existing tokenization projects. New rules might require additional compliance measures, restrict participant categories, or prohibit specific tokenization structures entirely.

Different countries maintain varying rules about foreign property ownership, token trading, and participant protection standards. This regulatory fragmentation creates compliance challenges for projects seeking global participant access while maintaining legal compliance across multiple jurisdictions.

However, leading platforms address regulatory uncertainty through proactive compliance strategies and comprehensive legal frameworks. The Stobox platform features built-in regulatory intelligence that tracks changes across multiple jurisdictions and automatically updates compliance requirements, ensuring projects remain compliant as regulations evolve.

Professional regulatory guidance and compliance support helps navigate complex requirements effectively while maintaining participant protection standards and regulatory compliance throughout the project lifecycle.

Technology and Security Risks

Smart contract vulnerabilities represent persistent threats to tokenized assets. Programming errors, inadequate security audits, or unforeseen attack vectors can result in permanent loss of funds or unauthorized token transfers. Unlike traditional finance, blockchain transactions are typically irreversible, making security paramount for participant protection.

🔒 Security Challenges Custody and key management present additional risks. Participants must secure private keys while issuers need robust security for administrative functions. Human error or compromised security can lead to irreversible losses.

Advanced tokenization platforms have revolutionized security through innovative technologies that exceed traditional financial security standards. Multi-Party Computation (MPC) technology ensures private keys are never stored in single locations, dramatically reducing security risks while maintaining user control.

Comprehensive security audits, formal verification processes, and real-time monitoring systems provide continuous security oversight. Insurance options and institutional-grade custody solutions protect against potential losses through professional risk management frameworks that address both technical and operational security concerns.

Market Liquidity Limitations

Despite tokenization's promise of improved liquidity, many tokenized real estate assets still struggle with limited trading volumes and wide bid-ask spreads. Creating genuine liquidity requires sufficient market participants, which can take years to develop for newer asset classes.

📊 Liquidity Reality Regulatory restrictions often limit eligible traders, constraining liquidity development. Transfer restrictions, holding periods, and participant qualification requirements prevent the free trading necessary for robust secondary markets.

However, advanced platforms address liquidity challenges through comprehensive market development strategies and automated liquidity provision systems. Integrated market-making tools, liquidity pools, and cross-platform trading capabilities enhance liquidity across multiple venues while maintaining regulatory compliance.

Multi-blockchain support enables tokens to access liquidity across different networks, maximizing trading opportunities while automated market-making mechanisms provide continuous buying and selling opportunities even during periods of lower natural trading volume.

Information Asymmetry and Due Diligence

Participating in tokenized real estate often requires trusting property managers and platforms to provide accurate information about asset conditions, rental income, and market valuations. Participants may have limited ability to conduct independent due diligence on distant properties, particularly international assets.

🔍 Due Diligence Challenges Property management quality directly affects token value, but token holders typically have minimal control over management decisions. Poor maintenance, tenant relations, or financial management can significantly impact outcomes.

Leading platforms address information asymmetry through comprehensive transparence tools and standardized reporting requirements. Real-time property monitoring, automated financial reporting, and blockchain-based documentation provide participants with unprecedented visibility into property operations and performance.

Advanced due diligence tools including satellite monitoring, IoT sensors, and third-party verification services help participants assess property conditions and market valuations independently, reducing reliance on issuer-provided information while maintaining transparency.

Integration and Operational Complexity

Most real estate markets still operate on traditional systems that don't easily integrate with blockchain technology. This creates friction when tokenized properties need to interact with conventional real estate processes including insurance claims, property taxes, major repairs, and local regulatory compliance.

⚙️ Integration Challenges Technical infrastructure requirements include blockchain integration, wallet management, compliance monitoring, and participant communication systems that can overwhelm organizations lacking sufficient technical expertise.

However, comprehensive tokenization platforms address operational complexity through complete automation and user-friendly interfaces. Turnkey solutions eliminate technical barriers while providing professional-grade compliance and operational support that requires minimal technical expertise from users.

API integration enables seamless connection with existing business systems, while white-label solutions allow organizations to maintain brand identity while leveraging advanced tokenization infrastructure and professional operational support throughout the project lifecycle.

Stobox 4 transforms complex blockchain technology into accessible business tools, enabling real estate professionals to focus on their core expertise while leveraging institutional-grade tokenization infrastructure.

Proof of Concept: Real-World Success Stories

Real estate tokenization has moved beyond theoretical concepts into successful real-world applications across diverse markets and property types. These proven case studies demonstrate both the potential and practical considerations for tokenized real estate participation, providing valuable insights for future projects.

The Manhattan Breakthrough: $30 Million Luxury Condo

In 2018, the first major Manhattan property worth over $30 million was successfully tokenized on the Ethereum blockchain. This luxury condominium building consisted of 12 apartments, each spanning 1,700 square feet, located in one of New York's most prestigious neighborhoods.

🏢 Project Innovation The project's unique feature was offering participants choice between digital tokens and traditional analog securities, demonstrating flexibility in meeting different participant preferences while maintaining regulatory compliance.

This groundbreaking tokenization proved that high-value commercial real estate could be successfully fractionalized and managed on blockchain platforms. The project attracted significant attention from institutional participants and regulatory bodies, establishing tokenized real estate as a legitimate participation vehicle for luxury properties in major metropolitan markets.

The success demonstrated that sophisticated participants were willing to participate in blockchain-based real estate when proper legal structures and regulatory compliance were maintained, paving the way for larger and more complex tokenization projects in premium markets.

European Pioneer: AnnA Villa Paris (€6.5 Million)

France welcomed its first property tokenization case in 2019 when a luxury villa worth €6.5 million was tokenized in Boulogne-Billancourt, a prestigious suburb of Paris. The AnnA Villa project divided ownership into ten tokens, each representing significant stakes in the property.

European Market Entry This project demonstrated that tokenization could work effectively under different regulatory frameworks and cultural contexts, establishing viability for luxury real estate development across European markets.

The AnnA Villa tokenization showed how blockchain technology could be adapted to comply with European securities regulations while maintaining the benefits of fractional ownership and enhanced liquidity. The project's success helped establish tokenization as viable method for luxury real estate development across European markets.

This case study proved that tokenization could navigate complex international regulatory environments while providing property owners with access to capital and participants with access to premium European real estate opportunities previously restricted to local high-net-worth individuals.

Inspired by these successful tokenization projects? Learn how Stobox 4 can help you launch your own real estate tokenization project with the same professional infrastructure used by leading developers worldwide.

Smart Fractional Approach: Hello World Project

The Hello World case study illustrates an important strategic approach to real estate tokenization. Rather than tokenizing entire properties, the project successfully raised 200,000 SEK, representing 20% of the initially planned 1,000,000 SEK target through partial tokenization strategies.

💡 Strategic Innovation This partial tokenization approach proved that fractional business tokenization is as viable as full tokenization, allowing property owners to maintain majority control while accessing capital markets.

The Hello World project demonstrates that tokenization doesn't require transferring 100% of real estate to blockchain networks. Instead, strategic partial tokenization can provide capital for renovation, expansion, or debt refinancing while preserving owner control and reducing regulatory complexity.

This approach appeals to property owners who want to access blockchain-based funding without relinquishing complete control, while providing participants with exposure to real estate appreciation and income potential through carefully structured fractional ownership arrangements.

Community-Driven Success: Lüneburg Heritage Project ($1.5 Million)

The historic town of Lüneburg in Germany used tokenization to preserve its medieval architecture and cultural heritage. This community-driven project successfully raised $1.5 million to renovate and maintain historically significant buildings through innovative blockchain funding mechanisms.

🏛️ Cultural Preservation The project utilized Stellar blockchain instead of Ethereum, demonstrating that tokenization can work across different blockchain networks based on specific project requirements and cost considerations.

The Lüneburg case proves that tokenization extends beyond pure financial outcomes to community development and cultural preservation, showing broader social impact potential of blockchain-based real estate financing that benefits both participants and local communities.

This project demonstrated how tokenization can mobilize global participation for local cultural preservation projects, enabling international participants to participate in heritage conservation while receiving financial outcomes through property appreciation and community development initiatives.

Large-Scale Enterprise: Legend Siam Theme Park ($50 Million)

The Legend Siam Theme Park project represents large-scale commercial real estate tokenization. The project aims to configure $50 million for park renovation and expansion by tokenizing 25% of equity shares, equivalent to 1,000,000 shares through sophisticated institutional-grade structures.

The scale of this project shows how tokenization can handle complex commercial real estate projects involving significant capital requirements, multiple stakeholders, and sophisticated operational structures while maintaining regulatory compliance and participant protection standards.

The Legend Siam case proves that tokenization works for major commercial real estate developments that require institutional-level capital configuration capabilities, professional management structures, and sophisticated participant relations throughout long-term development and operational phases.

Key Success Factors Across Projects

Successful real estate tokenization projects share several critical characteristics that contribute to positive outcomes for both issuers and participants:

Clear Legal Structures: All successful projects establish comprehensive legal frameworks that define participant rights, token holder protections, and regulatory compliance procedures through professional legal guidance and proper documentation.

Quality Assets: Successful tokenizations typically involve high-quality properties in desirable locations with strong rental income potential, appreciation prospects, or unique value propositions that attract participant interest and maintain long-term value.

Professional Management: Projects with experienced property management teams and transparent operational procedures tend to attract more participants and maintain higher token values through consistent performance and clear communication.

Regulatory Compliance: All successful projects prioritize regulatory compliance from project inception, working with legal experts to ensure proper securities registration and participant protection while maintaining operational efficiency.

Technology Reliability: Successful tokenizations use established blockchain platforms and undergo thorough security audits to protect participant interests while providing reliable technical infrastructure for ongoing operations and participant management.

The Stobox 4 Solution: Complete Real Estate Tokenization Platform

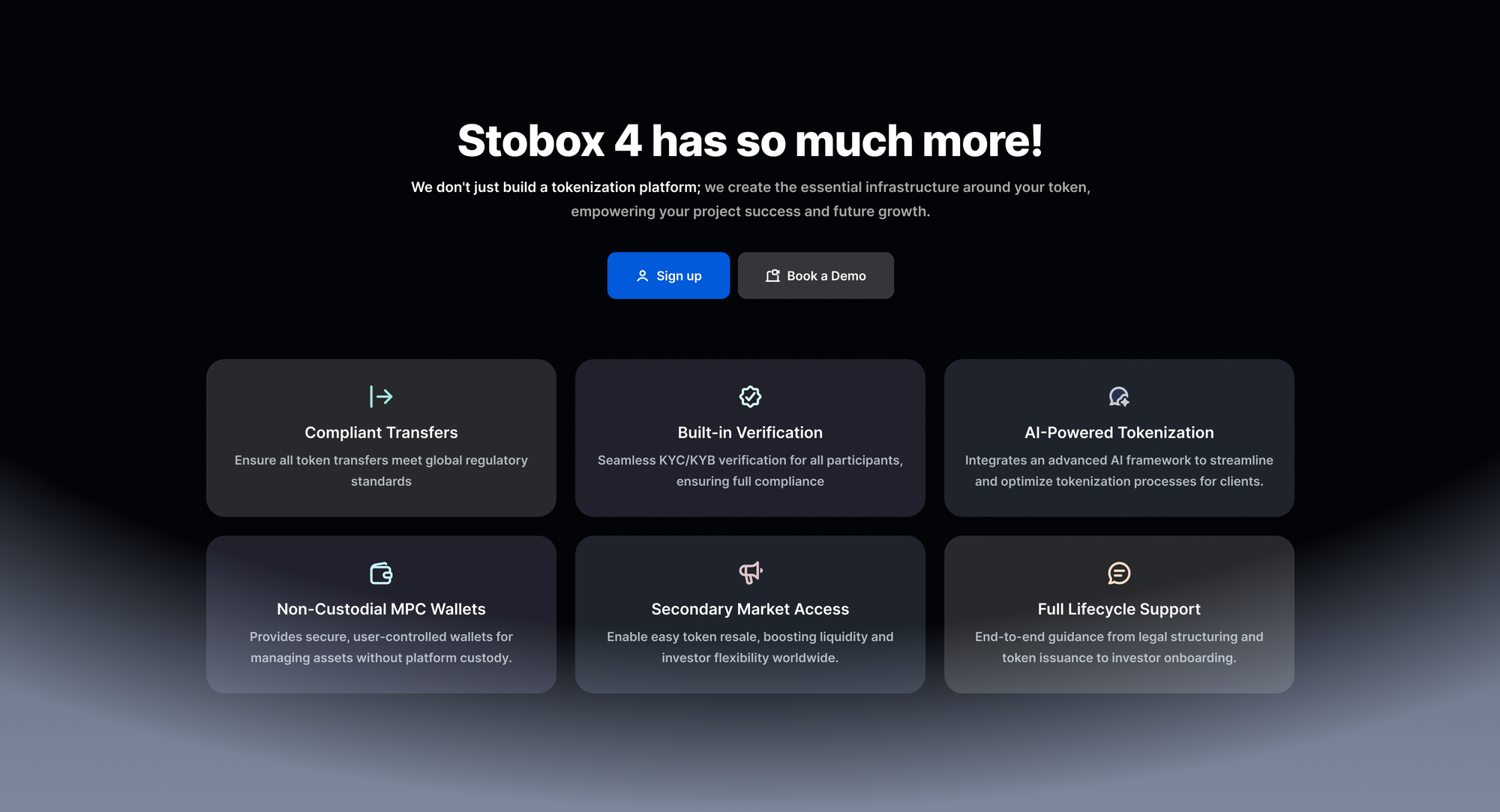

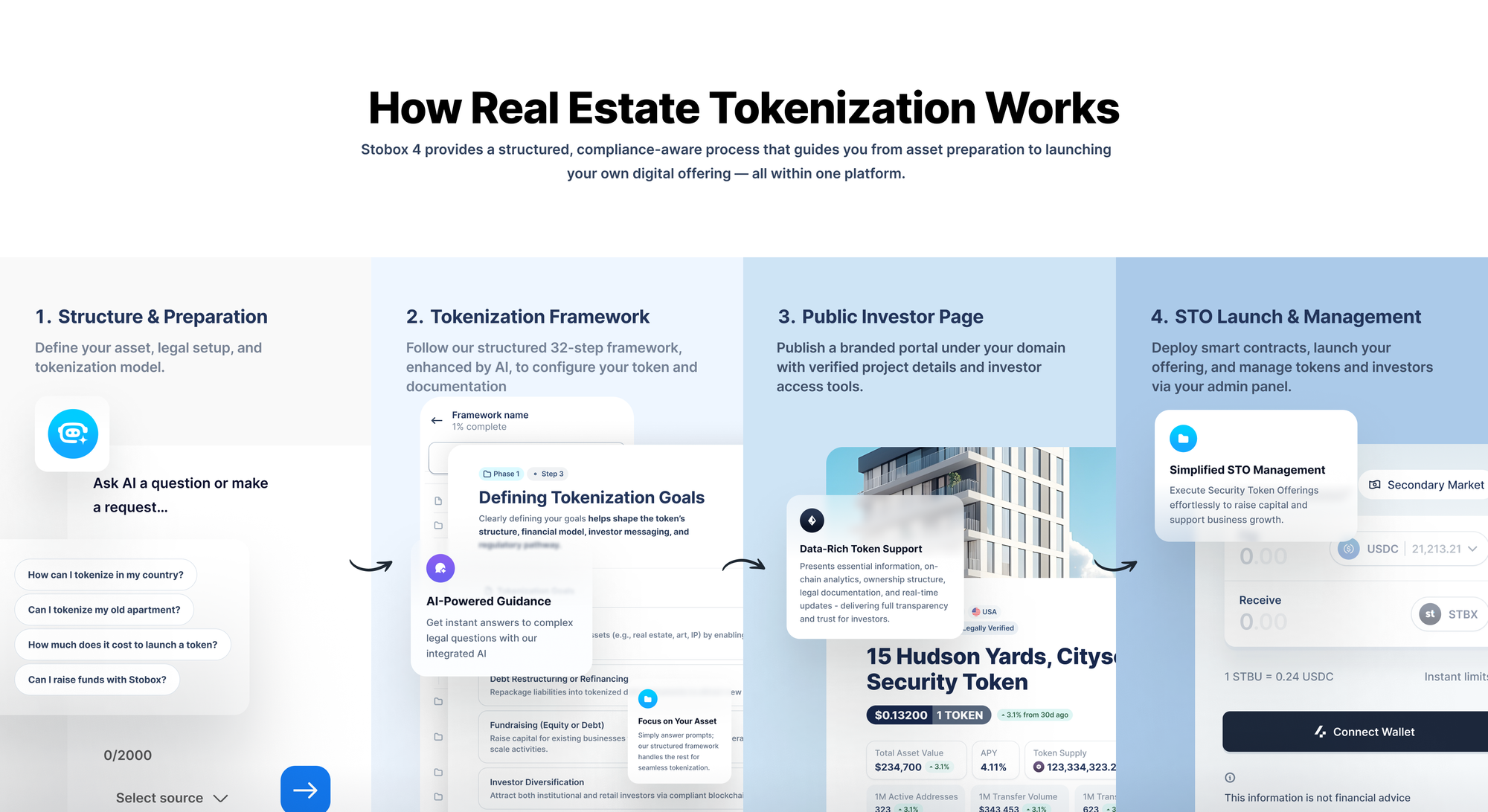

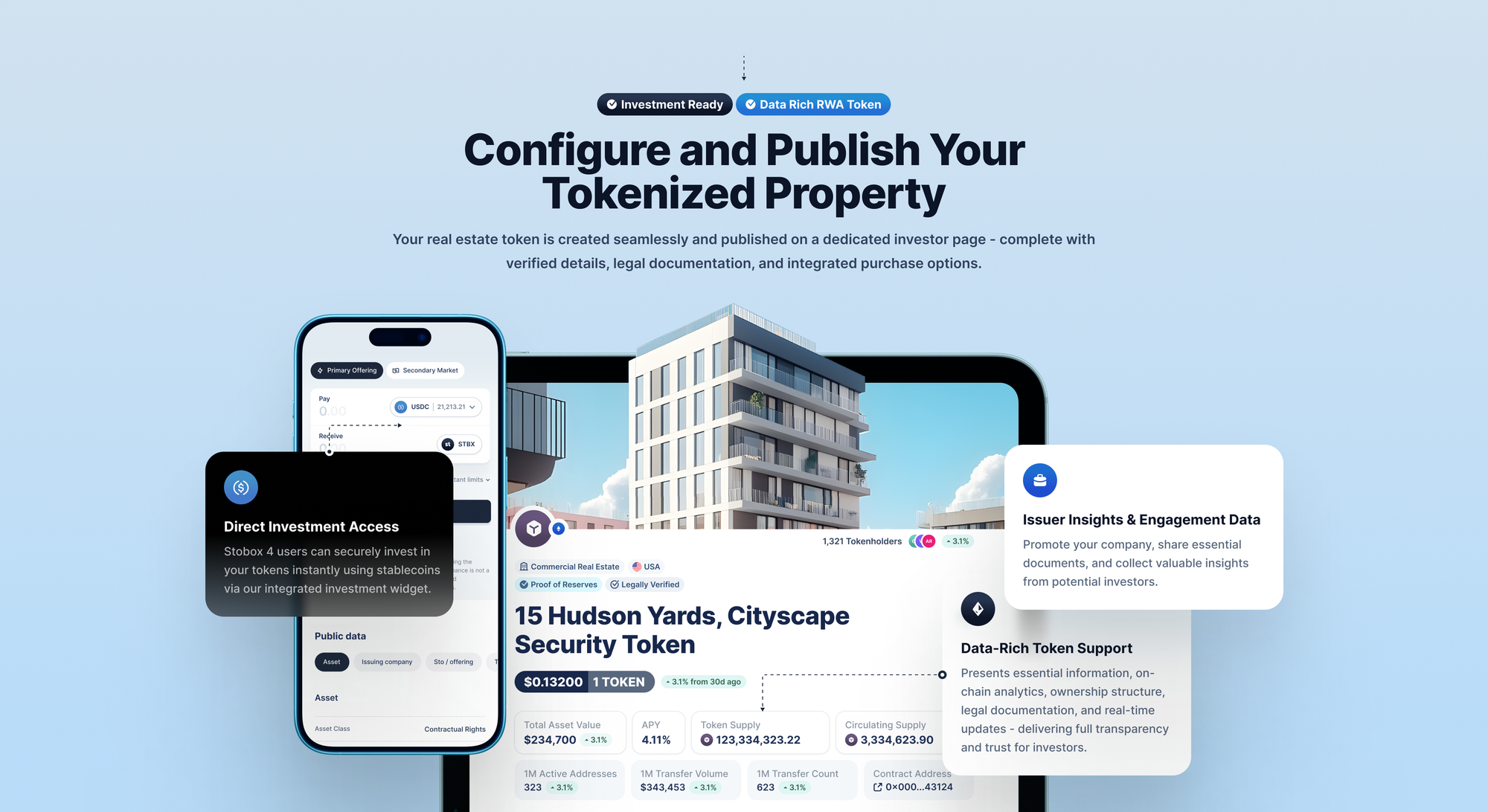

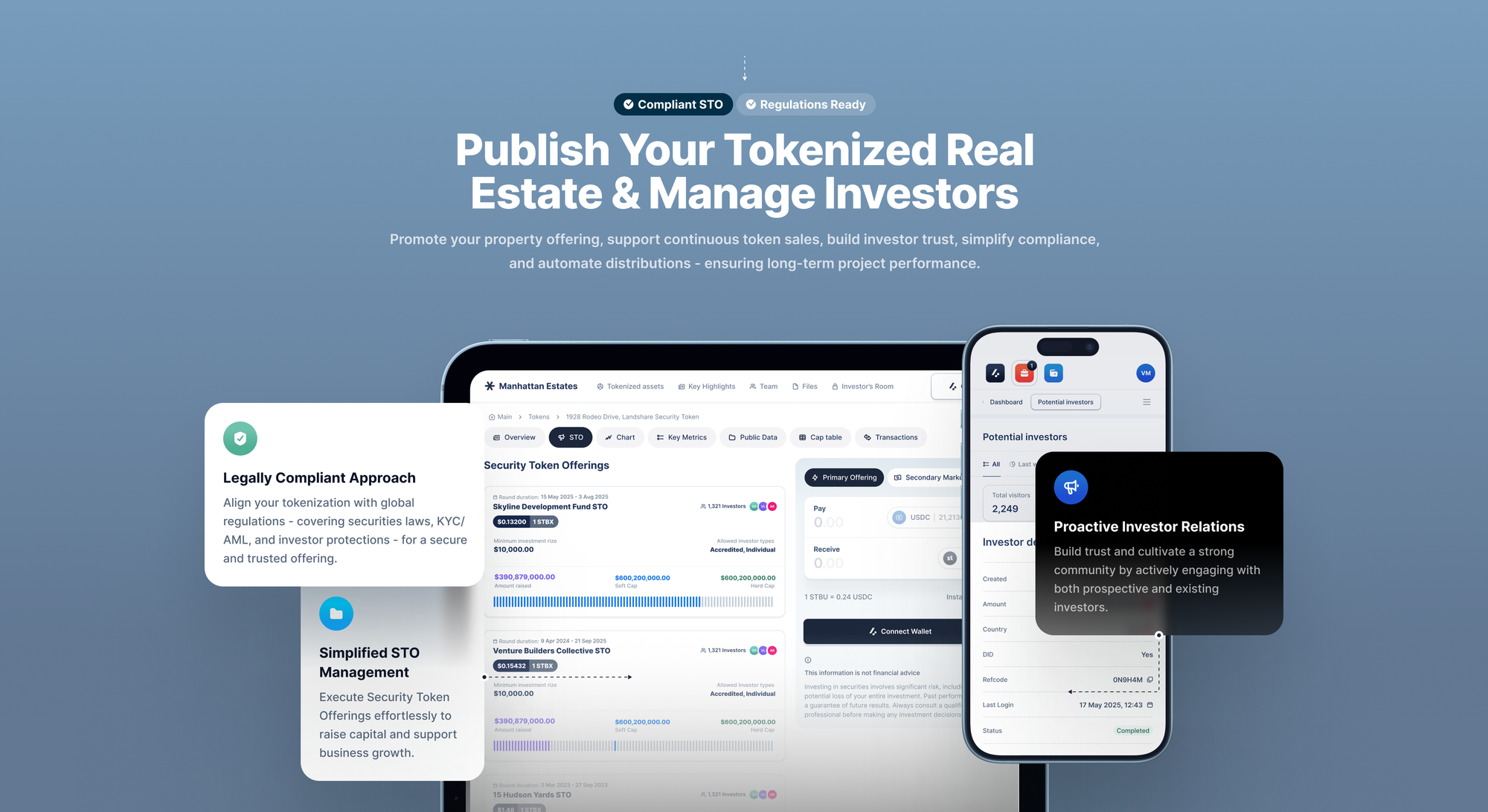

Stobox 4 represents the next generation of tokenization technology - a comprehensive SaaS platform specifically designed for real estate tokenization. Unlike previous solutions requiring extensive technical expertise, Stobox 4 provides an intuitive, all-in-one platform that enables property developers and asset managers to tokenize real estate projects without blockchain programming knowledge.

With over $500 million in tokenized assets across 100+ successful projects and seven years of industry experience, Stobox 4 addresses every aspect of real estate tokenization through a single, integrated platform that transforms complex blockchain technology into accessible business tools.

Stobox 4: The Complete Real Estate Tokenization Platform

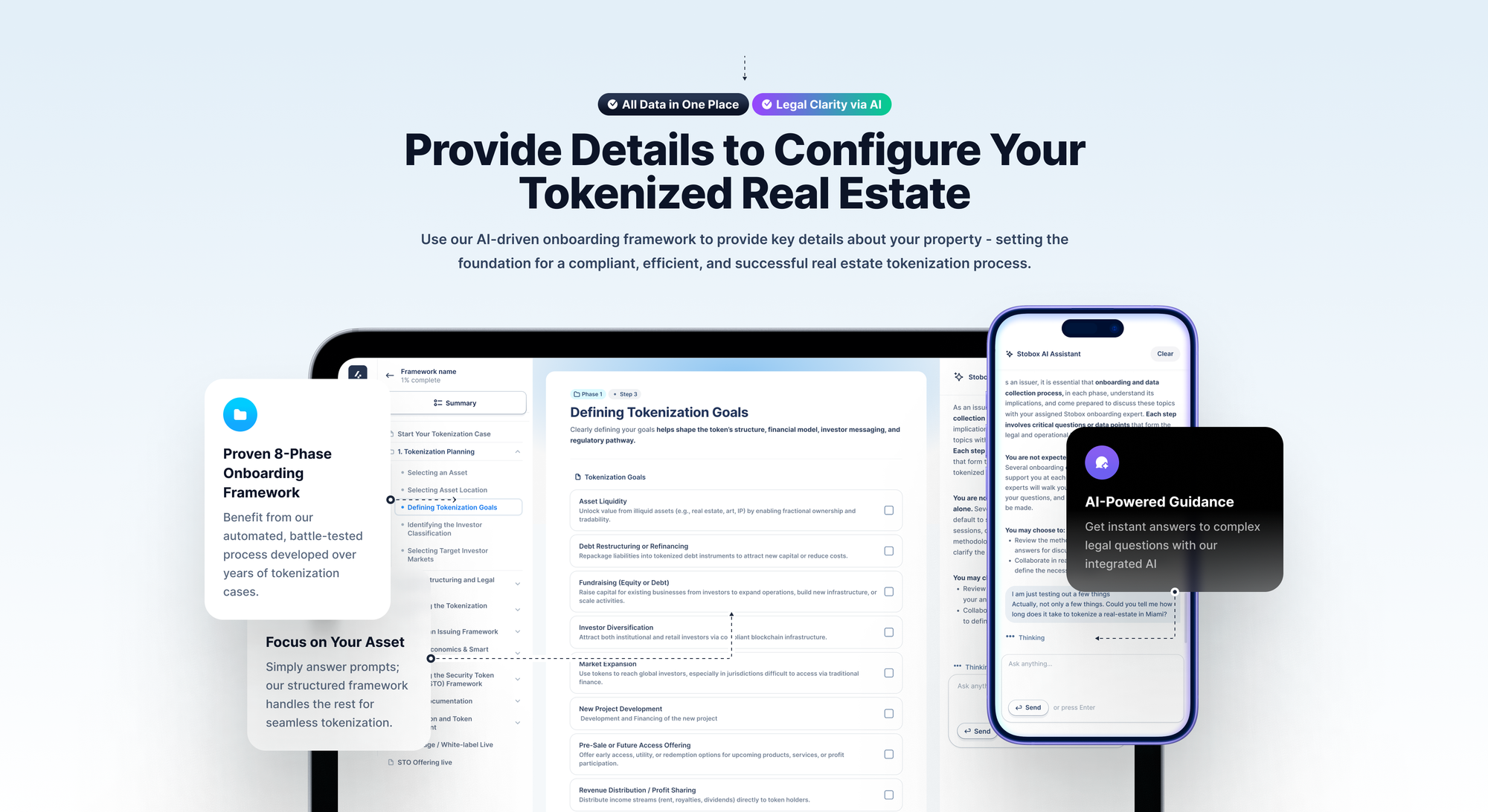

Stobox 4 is the world's first comprehensive SaaS platform specifically engineered for real estate tokenization. Built on seven years of tokenization expertise, the platform transforms the complex process of real estate tokenization into a streamlined, user-friendly experience that requires no technical background.

Platform Architecture: Stobox 4 operates as a cloud-based Software-as-a-Service solution, accessible through any web browser. The platform integrates all necessary components for real estate tokenization including smart contract deployment, compliance management, participant onboarding, and ongoing asset administration through a single, unified interface.

Target Users: The platform serves real estate developers seeking capital configuration, property investment funds exploring tokenization strategies, family offices managing real estate portfolios, and PropTech companies integrating tokenization capabilities into existing services.

Key Stobox 4 Features for Real Estate Projects

AI-Powered Project Setup Stobox 4's artificial intelligence guides users through optimal project configuration by analyzing property characteristics, regulatory requirements, and market conditions. The AI system automatically recommends token structures, compliance frameworks, and distribution mechanisms tailored to specific real estate projects.

The intelligent setup wizard eliminates guesswork by providing data-driven recommendations for:

- Optimal token supply and pricing strategies

- Jurisdiction selection based on regulatory requirements

- Compliance frameworks appropriate for target markets

- Distribution mechanisms aligned with project goals

One-Click Smart Contract Deployment The platform's revolutionary one-click deployment system generates, audits, and deploys smart contracts without requiring programming knowledge. Users simply configure project parameters through intuitive forms, and Stobox 4 automatically creates compliant smart contracts using the advanced STV3 protocol.

Smart contract features include:

- Automated compliance rules and transfer restrictions

- Built-in governance mechanisms for token holder voting

- Programmable distribution logic for rental income and profits

- Multi-signature security for administrative functions

Integrated Compliance Management Stobox 4 includes comprehensive compliance tools that automatically handle KYC/AML requirements, regulatory reporting, and ongoing monitoring. The Digital Compliance Platform (DCP) integrates seamlessly with global databases to verify participant identities and screen for sanctions violations.

Compliance features include:

- Automated KYC/AML verification workflows

- Real-time transaction monitoring and reporting

- Regulatory intelligence tracking across multiple jurisdictions

- Automated generation of compliance documentation

Professional Asset Pages The platform automatically generates professional, branded asset pages that showcase tokenized real estate projects to potential participants. These pages include property documentation, financial projections, legal disclosures, and secure participation mechanisms.

Asset page features include:

- Customizable branding and design templates

- Integrated property documentation and media galleries

- Real-time project metrics and performance dashboards

- Secure participant onboarding and verification

How Stobox 4 Simplifies Real Estate Tokenization

Step 1: Project Configuration (15 minutes) Users begin by entering basic property information including asset type, location, valuation, and ownership structure. Stobox 4 AI analyzes this data to recommend optimal tokenization parameters including token supply, pricing strategy, and regulatory framework.

The platform's intelligent forms guide users through:

- Property documentation upload and verification

- Financial structuring and tokenomics design

- Regulatory compliance selection

- Participant targeting and access rules

Step 2: Smart Contract Generation (5 minutes) Based on project configuration, Stobox 4 automatically generates compliant smart contracts using the STV3 protocol. The platform handles all technical complexity including security audits, compliance rules, and governance mechanisms without requiring programming knowledge.

Automated smart contract features include:

- Compliance-first architecture with built-in restrictions

- Governance voting mechanisms for major decisions

- Automated distribution logic for income and profits

- Multi-party computation security for administrative functions

Step 3: Compliance Setup (10 minutes) The Digital Compliance Platform automatically configures KYC/AML requirements, regulatory reporting, and ongoing monitoring based on project jurisdiction and participant targeting. Users simply select compliance levels, and the platform handles technical implementation.

Compliance automation includes:

- Participant verification workflows

- Regulatory reporting generation

- Transaction monitoring and screening

- Audit trail documentation

Step 4: Asset Page Creation (20 minutes) Stobox 4 automatically generates professional asset pages using uploaded property documentation, financial projections, and compliance disclosures. The platform provides customizable templates that maintain regulatory compliance while showcasing project benefits.

Asset page components include:

- Property overview and documentation

- Financial modeling and projections

- Legal disclosures and risk factors

- Secure participation mechanisms

Step 5: Launch and Management (Ongoing) Once configured, Stobox 4 handles ongoing project management including participant onboarding, compliance monitoring, distribution automation, and performance reporting. The platform's dashboard provides real-time visibility into all project metrics and activities.

Ongoing management features include:

- Automated participant onboarding and verification

- Real-time compliance monitoring and reporting

- Scheduled distribution automation

- Performance analytics and reporting

Stobox 4 vs Traditional Tokenization Approaches

Speed and Efficiency Traditional tokenization projects require 3-6 months of development time and extensive technical teams. Stobox 4 reduces this to 1-2 hours of configuration time with no technical expertise required, enabling real estate professionals to focus on their core business.

Cost Reduction Custom tokenization development typically costs $50,000-$200,000 per project. Stobox 4 SaaS model reduces costs to a fraction of traditional approaches while providing superior functionality and ongoing support.

Technical Complexity Traditional tokenization requires blockchain developers, smart contract auditors, compliance specialists, and ongoing technical maintenance. Stobox 4 eliminates these requirements through automated systems and professional-grade infrastructure.

Discover how Stobox 4 can eliminate technical complexity and reduce costs for your real estate tokenization project. Compare your current approach with our streamlined platform solution.

Regulatory Compliance Custom tokenization projects often struggle with evolving regulatory requirements and multi-jurisdictional compliance. Stobox 4's built-in regulatory intelligence automatically adapts to changing requirements while maintaining compliance across global markets.

Real Estate-Specific Innovations in Stobox 4

Property Oracle Integration Stobox 4 integrates with property data oracles to automatically update token valuations based on real estate market conditions, rental income performance, and property improvements. This creates dynamic token economics that reflect actual property performance.

Rental Distribution Automation The platform includes sophisticated rental income distribution mechanisms that automatically calculate and distribute payments to token holders based on ownership percentages, while handling tax implications and regulatory requirements.

Property Management Integration Stobox 4provides APIs and integrations with leading property management systems, enabling seamless data flow between traditional property operations and tokenized ownership structures.

ESG Reporting Tools The platform includes comprehensive ESG (Environmental, Social, Governance) reporting tools specifically designed for real estate assets, enabling automated sustainability reporting and impact measurement for tokenized properties.

Complete Ecosystem Advantage

Unlike companies focusing on single aspects of tokenization, Stobox provides end-to-end solutions including technical framework development, technical implementation, regulatory compliance tools, participant management systems, and secondary market integrations. This comprehensive approach reduces complexity for clients while ensuring seamless project execution through integrated services.

🎯 Comprehensive Solutions Stobox handles everything from initial asset evaluation and technical structuring to ongoing participant management and secondary market trading integrations, eliminating the need to coordinate multiple service providers.

The company's extensive track record demonstrates proven ability to navigate complex regulatory environments, implement robust technical solutions, and deliver successful outcomes for diverse real estate tokenization projects across multiple jurisdictions and asset classes.

Stobox's integrated platform approach means clients work with a single provider for all tokenization needs, reducing coordination complexity, ensuring consistent service quality, and maintaining unified project management throughout the entire tokenization lifecycle.

Compliance-First Philosophy

Stobox operates with a compliance-first philosophy that prioritizes regulatory adherence from project inception. As a technical infrastructure provider with regulatory intelligence, Stobox ensures all projects meet current securities regulations while anticipating future regulatory developments through proactive compliance strategies.

The company's compliance expertise spans multiple jurisdictions including the United States, European Union, and MENA regions, enabling clients to access global markets while maintaining regulatory compliance across different legal frameworks and cultural contexts.

Stobox's regulatory-first methodology includes automated compliance monitoring, real-time regulatory updates, and proactive technical guidance that protects clients from regulatory violations while enabling access to global participant markets through professional technical structuring.

Proven Track Record and Industry Recognition

Stobox's industry leadership is demonstrated through high-level participation in regulatory discussions and government initiatives. Co-founder Ross Shemeliak participates as official delegate at the prestigious SelectUSA Investment Summit and represents Stobox at SEC Tokenization Roundtables.

🏛️ Government Recognition These government-level engagements demonstrate institutional recognition of Stobox expertise and thought leadership in real estate tokenization while contributing to industry standard development.

The company's involvement in regulatory discussions helps shape industry standards and ensures clients benefit from cutting-edge compliance strategies while maintaining access to evolving regulatory frameworks and policy developments.

Stobox's expansioninto new markets, including recent licensing to operate in Qatar, demonstrates ability to navigate diverse regulatory environments and establish trusted relationships with international financial authorities through professional regulatory engagement.

Repository RWA Partnership: Strategic U.S. Expansion

Stobox's strategic partnership with Repository RWA represents significant expansion into the U.S. real estate market through collaboration focused on tokenizing high-value real-world assets beginning with breakthrough projects in Florida's premium markets.

Florida Innovation The partnership's flagship project, The Grayton Beach Motor Lodge, represents a $23+ million resort property development in South Walton's booming tourism market, demonstrating capability for large-scale luxury real estate tokenization.

The Repository RWA partnership includes ambitious projects such as $50 million hemp company tokenization structured to support expansion into U.S. markets, and tokenization of high-value alternative assets including gold, silver, and fine art collections.

This strategic partnership demonstrates Stobox's ability to execute complex multi-asset tokenization projects while maintaining regulatory compliance and participant protection standards across diverse asset classes and structures.

How Stobox Works: Technical Foundation

Stobox's technical infrastructure provides enterprise-grade security, regulatory compliance, and operational efficiency through innovative blockchain technology and comprehensive platform integration. Understanding these technical capabilities demonstrates why Stobox has successfully tokenized over $500 million in assets across diverse markets and jurisdictions.

STV3 Protocol: Next-Generation Security Token Standard

The Stobox Token Version 3 (STV3) protocol provides a comprehensive framework for creating compliant security tokens that represent real estate assets. STV3 ensures compatibility with Ethereum Virtual Machine (EVM) networks while incorporating advanced compliance features required for regulated securities.

The protocol supports various token types including equity tokens for fractional ownership, debt tokens for real estate loans, and hybrid structures that combine multiple characteristics. This flexibility enables Stobox to structure tokenization projects that meet specific client requirements and participant preferences.

STV3's compliance-first design includes automated transfer restrictions, participant verification requirements, and regulatory reporting capabilities that ensure ongoing compliance throughout the token lifecycle while maintaining operational efficiency and user experience.

AI-Powered Tokenization Framework

Stobox's artificial intelligence framework automates many aspects of the tokenization process, reducing project timelines while improving accuracy and decision-making capabilities. The AI system analyzes property data, assesses regulatory requirements, and recommends optimal token structures based on project characteristics and market conditions.

Process optimization through AI reduces manual work and minimizes human errors in complex tokenization projects. The system automatically generates compliance documentation, monitors regulatory changes, and alerts project managers to potential issues before they become problems.

AI-powered guidance systems provide personalized recommendations throughout the tokenization process, helping clients optimize their projects for maximum success while maintaining regulatory compliance and participant appeal through data-driven insights.

Multi-Blockchain Architecture

Stobox supports multiple blockchain networks including Ethereum, Arbitrum, and Polygon, enabling clients to choose optimal platforms based on transaction costs, processing speeds, and technical requirements. This blockchain-agnostic approach ensures projects can adapt to evolving technology landscapes.

⚡ Network Optimization Multi-chain architecture provides flexibility for different project requirements: Ethereum for maximum security and institutional recognition, Polygon for lower costs, and Arbitrum for enhanced scalability.

Cross-chain compatibility ensures tokenized assets can potentially move between different blockchain networks as technology evolves and client needs change. This future-proofing protects client assets while maintaining long-term token utility and market access.

Network selection optimization enables projects to choose the most appropriate blockchain based on specific requirements including transaction volume, cost considerations, regulatory preferences, and target participant demographics.

Digital Compliance Platform (DCP)

The Stobox Digital Compliance Platform automates Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures required for regulated securities offerings. The platform integrates with global databases to verify participant identities and screen for sanctions violations through comprehensive automated processes.

The platform adheres to FATF Travel Rule requirements by capturing and transmitting required information for digital asset transfers. Interoperability with other Virtual Asset Service Providers (VASPs) ensures seamless compliance across different platforms and jurisdictions.

Automated compliance reporting generates required documentation for regulatory authorities while maintaining comprehensive audit trails that demonstrate ongoing compliance throughout the project lifecycle and participant relationship management.

DS Swap: Advanced Liquidity Solutions

DS Swap provides automated market-making functionality specifically designed for security tokens representing real estate assets. Unlike traditional decentralized exchanges that primarily serve utility tokens, DS Swap incorporates compliance checks and regulatory features required for securities trading.

Regulatory compliant trading features include participant verification, transfer restrictions, and reporting capabilities that meet securities law requirements. This compliance integration enables legitimate secondary market trading while protecting both issuers and participants from regulatory violations.

Multi-blockchain support allows DS Swap to optimize for cost efficiency by selecting the most appropriate network for each transaction type, whether prioritizing low fees, fast settlement, or specific regulatory requirements while maintaining security and compliance standards.

Implementation Process: From Idea to Token

Successfully tokenizing real estate requires a carefully orchestrated process that spans legal, technical, and operational domains. Stobox's comprehensive methodology guides clients through each phase while maintaining institutional-grade compliance and security standards throughout the entire tokenization journey.

Phase 1: Asset Evaluation and Documentation

The Stobox Real-World Asset (RWA) Tokenization Methodology begins with comprehensive asset evaluation and documentation. This phase involves selecting the asset country and jurisdiction, defining specific asset types and characteristics, and identifying optimal underlying asset structures for tokenization success.

📋 Documentation Requirements Asset ownership documentation must include clear title records, property deeds, and any existing liens or encumbrances. Legal status documentation verifies compliance with local property laws and zoning regulations.

Proof of reserves connects physical assets to digital tokens through verified custody arrangements, professional property valuations, and regular audits. This documentation ensures tokens represent genuine asset ownership and provide legal recourse for participants through proper asset backing.

The Stobox platform's intelligent Asset Selection wizard guides users through comprehensive evaluation processes including automated asset classification, valuation frameworks, and market analysis tools that determine tokenization viability through data-driven assessment methodologies.

Phase 2: Technical Framework and Jurisdiction Selection

The issuing framework phase involves selecting optimal jurisdictions for token issuance, participant targeting, and asset custody. Jurisdiction selection considers regulatory clarity, tax implications, participant protection standards, and enforcement mechanisms through comprehensive technical analysis.

⚖️ Technical Structure Design Technical entity formation typically involves establishing Special Purpose Vehicles (SPVs) that hold property assets and issue tokens to participants, providing technical separation between operating companies and tokenized assets.

Token rights definition specifies exactly what each token represents, including ownership percentages, voting rights, profit-sharing arrangements, and redemption mechanisms. Clear rights definition prevents disputes while ensuring regulatory compliance and participant protection.

The Stobox platform provides automated Technical Structuring tools that streamline SPV formation across multiple jurisdictions with pre-configured templates, automated document generation, and guided workflows that ensure proper corporate structure and regulatory compliance.

Phase 3: Token Design and Economics

Token economics design determines total token supply, pricing methodology, distribution schedules, and ongoing revenue sharing mechanisms. Economic models must balance participant outcomes with project viability and management incentives through sophisticated financial modeling.

💰 Tokenomics Structure Rights definition includes voting mechanisms for major property decisions, profit distribution formulas, and procedures for handling property sales or refinancing to ensure clear participant understanding and protection.

Distribution models specify how tokens will be allocated between public participants, project sponsors, management teams, and strategic partners. Vesting schedules may apply to management tokens to ensure long-term commitment to project success and alignment with participant interests.

The Stobox Token and Financial Modeling service provides comprehensive economic analysis and strategic planning with detailed financial projections, tokenomics development, and strategic implementation timelines that ensure sustainable project economics.

Phase 4: Technical Implementation

Smart contract deployment involves programming specific token characteristics, compliance rules, and operational procedures into blockchain code. Contracts undergo extensive testing and security audits before deployment to production networks to ensure participant protection and operational reliability.

🔧 Technical Execution Oracle integration connects smart contracts to real-world property data including rental income, property valuations, and operational expenses through reliable data feeds that enable automated dividend distributions.

Platform testing verifies all technical components work correctly including token transfers, compliance checks, participant onboarding, and reporting systems. Comprehensive testing prevents technical issues that could disrupt project operations or compromise participant funds.

The Stobox platform's Multi-Party Computation (MPC) technology ensures critical operations require multiple authorized parties, eliminating single points of failure while maintaining operational efficiency through distributed key management systems.

Phase 5: Launch and Secondary Market

Token issuance involves actual creation and distribution of tokens to verified participants according to predetermined allocation plans. Initial distribution may occur through private placements, regulated public offerings, or hybrid approaches based on regulatory requirements and participant targeting strategies.

🚀 Market Launch Participant onboarding includes KYC/AML verification, accreditation checks, and platform education to ensure participants understand their rights and responsibilities while reducing regulatory risks and improving satisfaction.

Trading activation enables secondary market transactions through DS Swap or other compliant trading platforms. Liquidity provision and market-making support ensure participants can buy and sell tokens efficiently while maintaining regulatory compliance through automated monitoring systems.

The Stobox White-Label Issuer Page tools enable projects to create professional, branded participant portals with integrated documentation, videos, and marketing materials that streamline the participation process while maintaining regulatory compliance.

Service Packages: Technical Infrastructure Levels and Deliverables

Stobox provides flexible service packages designed to meet different project requirements and budgets. Understanding these options helps clients select appropriate service levels while ensuring successful tokenization outcomes through professional guidance and comprehensive platform support.

Basic Package ($5,000)

The Basic Package provides foundational support for straightforward tokenization projects with standard requirements. This entry-level offering includes dedicated account management, general tokenization process setup, and basic guidance throughout the project lifecycle.

📞 Core Support Account management provides single point of contact for project coordination, timeline management, and technical support while helping navigate the tokenization process and coordinate between service providers.

General tokenization process setup includes initial project structuring, basic timeline development, and identification of key requirements and potential challenges. This package suits simple projects with minimal customization needs and standard regulatory requirements.

The Basic Package includes access to the Stobox platform's automated tools and guided workflows, enabling clients to manage many aspects of the tokenization process independently while receiving professional support when needed.

Token and Financial Modeling Package ($10,000)

The Token and Financial Modeling Package provides comprehensive economic analysis and strategic planning for tokenization projects. This service develops complete token economics models with detailed financial projections and strategic implementation timelines.

📊 Economic Analysis Tokenomics development includes token supply analysis, pricing strategies, distribution mechanisms, and revenue sharing models that ensure sustainable project outcomes while maintaining participant appeal and regulatory compliance.

Financial modeling provides detailed projections for property performance, token valuations, participant outcomes, and cash flow distributions. These models help clients make informed decisions about project viability and terms through comprehensive analysis.

Strategic roadmap development outlines complete tokenization processes including milestone timing, resource requirements, and risk management strategies that provide clear guidance for project execution and stakeholder coordination.

Technical Management Package ($25,000)

The Technical Management Package provides comprehensive documentation and regulatory compliance support for complex tokenization projects. This service includes full technical framework development, SPV establishment, and ongoing compliance management.

⚖️ Technical Compliance Technical documentation includes private placement memorandums, token purchase agreements, participant disclosures, and regulatory filing preparation that comply with relevant securities laws and provide appropriate participant protections.

SPV setup and management includes entity formation, corporate governance structures, and ongoing administrative support. Professional SPV management ensures proper separation between operating companies and tokenized assets while maintaining compliance.

Compliance framework development includes KYC/AML policies, participant verification procedures, and ongoing monitoring systems that reduce regulatory risks and build participant confidence through professional compliance management.

Platform Integration Package (Custom Pricing)

The Platform Integration Package connects clients with Stobox's network of trusted partners specializing in capital configuration and participant relations. This service facilitates introductions while providing strategic guidance for successful platform campaigns.

🎯 Platform Support Partner introductions connect clients with experienced platform specialists who understand tokenization markets and can develop targeted capital configuration strategies tailored to specific project requirements and participant demographics.

Platform strategy development helps clients identify optimal participant segments, develop compelling narratives, and structure offerings to maximize appeal to target audiences while improving success rates and timeline efficiency.

The package includes guidance on regulatory requirements for platform activities, helping clients understand disclosure obligations, participant verification requirements, and ongoing reporting responsibilities throughout the capital configuration process.

Enterprise Custom Development

Enterprise development services operate on Time and Materials (T&M) basis utilizing Stobox's internal development team and specialized contractor network. This service provides tailored blockchain solutions for large-scale institutional requirements.

🏢 Enterprise Solutions Custom smart contract development supports unique token structures, specialized compliance requirements, and integration with existing enterprise systems through extensive testing and security auditing processes.

API and SDK development provides integration tools for enterprise clients who need to connect tokenization capabilities with existing business systems, ensuring seamless workflow integration and operational efficiency.

White-label solutions enable enterprise clients to offer tokenization services under their own branding while leveraging Stobox's technical infrastructure and regulatory expertise, accelerating time-to-market for enterprise tokenization initiatives.

Conclusion

Real estate tokenization represents a fundamental transformation in property ownership, powered by advanced blockchain platforms that convert complex technology into accessible, institutional-grade solutions. By converting physical properties into digital tokens, we're creating unprecedented opportunities for fractional ownership, global access, and automated management that surpass traditional real estate participation limitations.

The technology has evolved beyond experimental phases into proven real-world applications across diverse markets and property types. From the $30 million Manhattan luxury condo tokenization to the €6.5 million Paris villa and innovative community-driven projects, the technology demonstrates value through sophisticated infrastructure that addresses complex requirements of modern real estate markets.

Success requires careful attention to regulatory compliance, security implementation, and realistic expectations about market development, all addressed by advanced platforms like Stobox that provide automated compliance monitoring, enterprise-grade security, and comprehensive market development tools through proven methodologies and professional expertise.

For property owners, tokenization offers innovative capital-configuration opportunities and methods to unlock value from illiquid assets through turnkey solutions that eliminate traditional barriers while maintaining professional-grade compliance and security standards throughout project lifecycles.

For participants, tokenization provides access to previously exclusive opportunities with lower barriers to entry, enhanced transparency, and sophisticated portfolio management tools that rival institutional-grade systems while enabling global diversification and improved liquidity potential.

For the broader real estate market, tokenization promises greater efficiency, transparency, and global connectivity through automated smart contract execution, real-time settlement capabilities, and seamless integration with existing financial infrastructure that transforms how property markets operate.

The transformation is accelerating, and tokenization will play a central role in the future of real estate ownership – not as replacement for traditional systems, but as powerful enhancement that makes markets more accessible, efficient, and globally connected through innovative technology and comprehensive platform solutions.

Ready to explore how advanced real estate tokenization can benefit your property development or asset management strategy? Start your tokenization journey with expert technical guidance tailored to your specific needs and objectives, leveraging cutting-edge technology that's shaping the future of real estate markets.

Transform your real estate strategy today. Book your free consultation and take the first step toward unlocking the power of blockchain technology for your property investments.

Disclaimer: Stobox is not a broker-dealer, advisor, or law firm. Templates are technical drafts only and must be reviewed by licensed professionals in the client's jurisdiction.

This comprehensive guide represents current best practices in real estate tokenization as of 2025. Regulatory requirements and technical capabilities continue evolving rapidly. Always consult with qualified legal and technical advisors before beginning any tokenization project.