STO Market Statistics. Insights from Stobox proprietary dataset.

We are happy to share the main metrics regarding the issuance of security tokens by Stobox clients.

It's no secret that information regarding the release of security tokens is very limited. There is no single system for collecting data on all cases that are released in terms of tokenization. Much of the information is incorrect or out of date. Understanding this problem, we are pleased to present to your attention the statistics collected on the basis of exclusively Security Token Offerings cases within the Stobox company.

Since 2018, we at Stobox have been working with various businesses that see an advantage in tokenizing their own assets. Often these are companies from different regions and industries and have their own requests, but decide to use Security Token Offerings as the main fundraising tool.

We are happy to share the main metrics regarding the issuance of security tokens by our clients. We see the formation of distinct trends and focus on improving the variability of solutions and expanding the geography of our services.

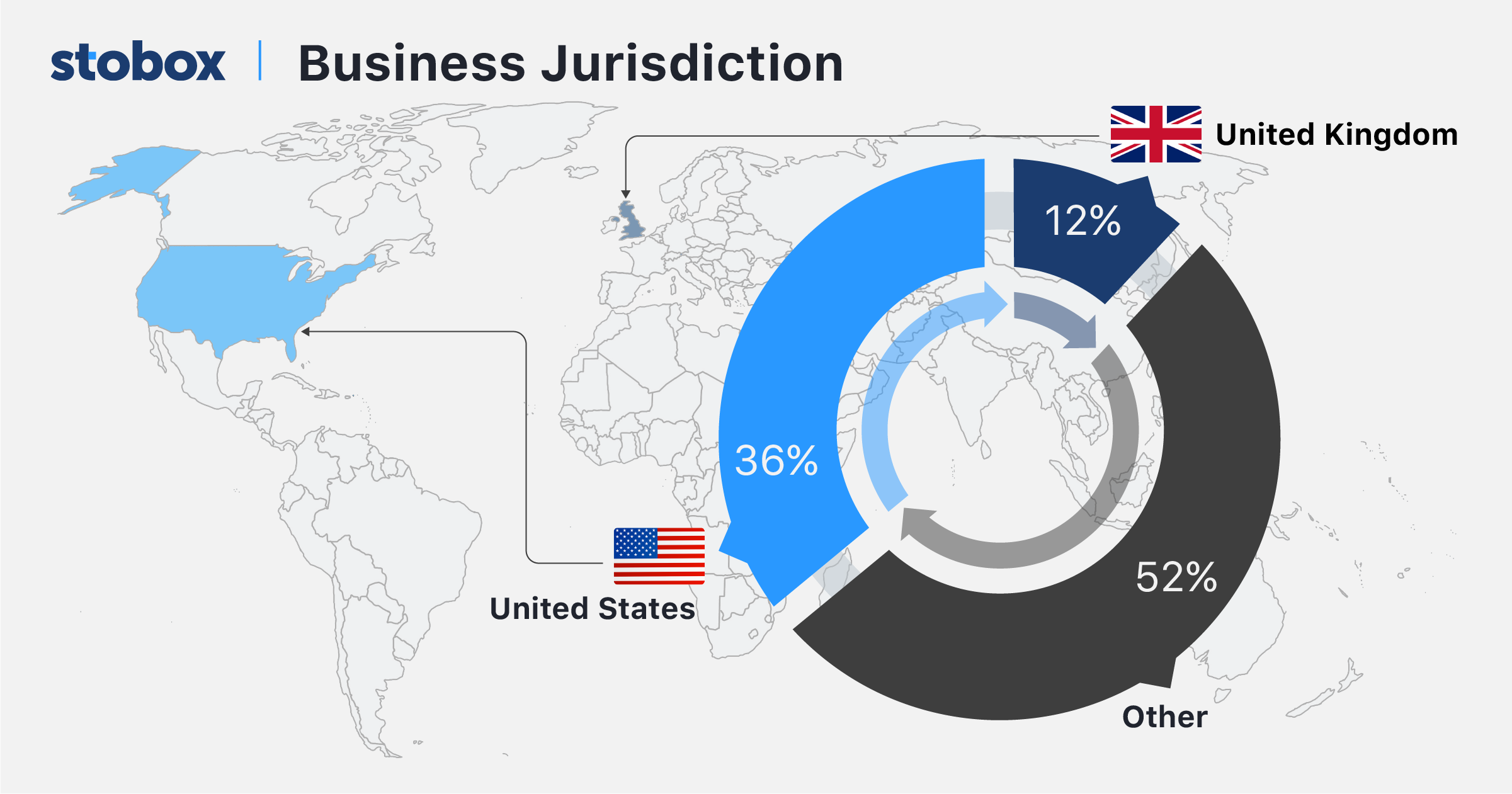

Clients' jurisdictions

More than a third of all clients interested in tokenization are companies from the USA. This is due to high business activity, the level of development of innovations, regulatory clarity, and a simplified form of corporate reporting.

We can also note that in the United Kingdom business is actively interested in tokenization and we see great potential in this region. Other jurisdictions include Switzerland, the EU, South Africa, Asia and South America.

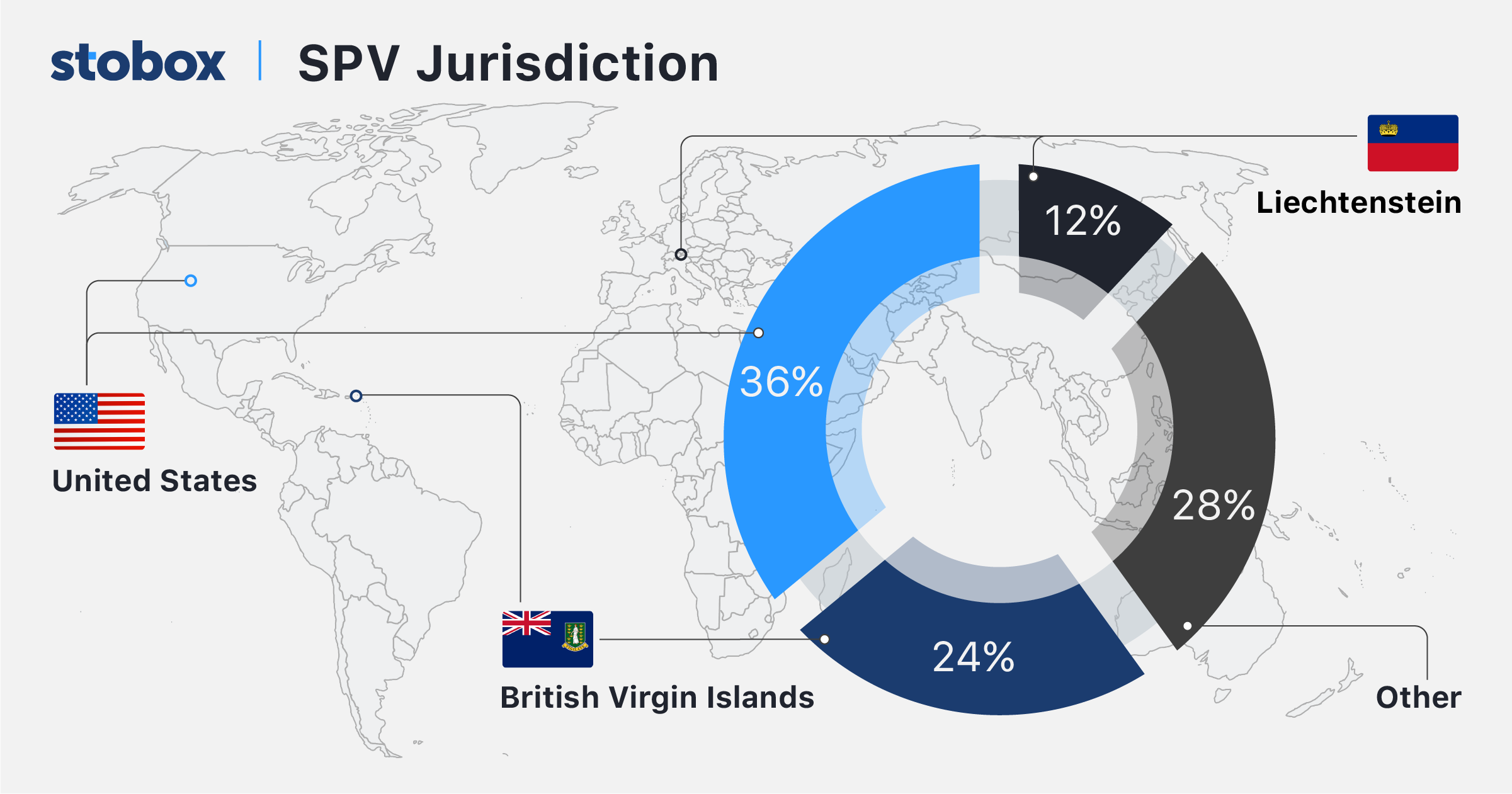

Often, companies raising funds through STOs use separately created special companies (SPVs) for these purposes. These companies are not necessarily structured in the jurisdictions where the business activity itself is located.

The form and jurisdiction of a new company to conduct an STO are determined by various factors, such as protecting the interests of investors, adequate regulation, ease of doing business, taxation, and many other factors.

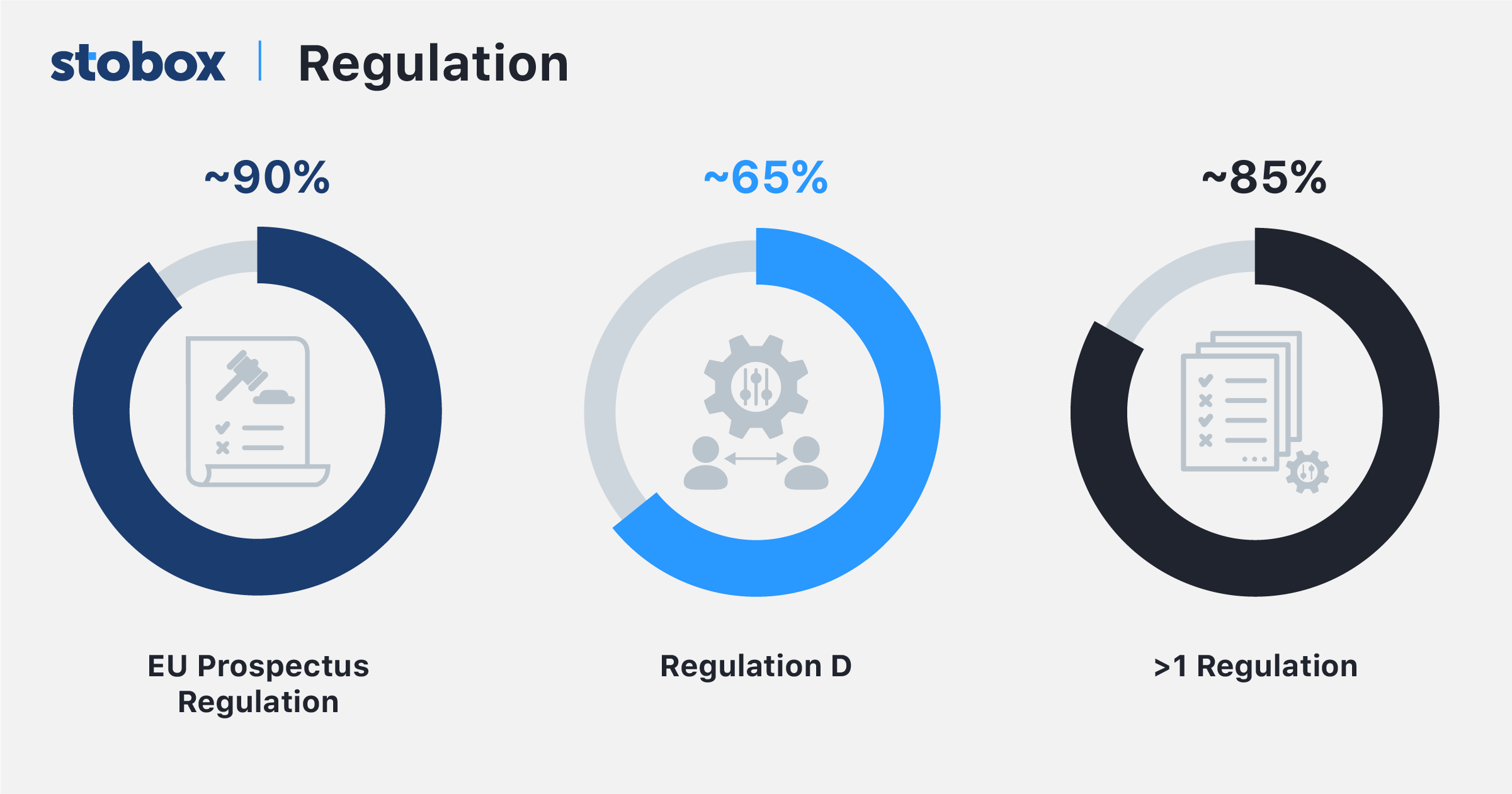

Regulations

Any investment offering for tokenized securities must be regulated in accordance with the current legislation of the country of the issuer. The vast majority of Stobox clients issue tokenized securities in accordance with the rules described in EU Prospectus Regulation, as well as in accordance with the rules of the SEC described in Regulation D. Thus, the issuer single-handedly targets accredited investors from the US and Europe, and can also raise additional funds from non-accredited investors from Europe and other regions where applicable law allows.

85% of customers choose to conduct tokenization taking into account several regulations.

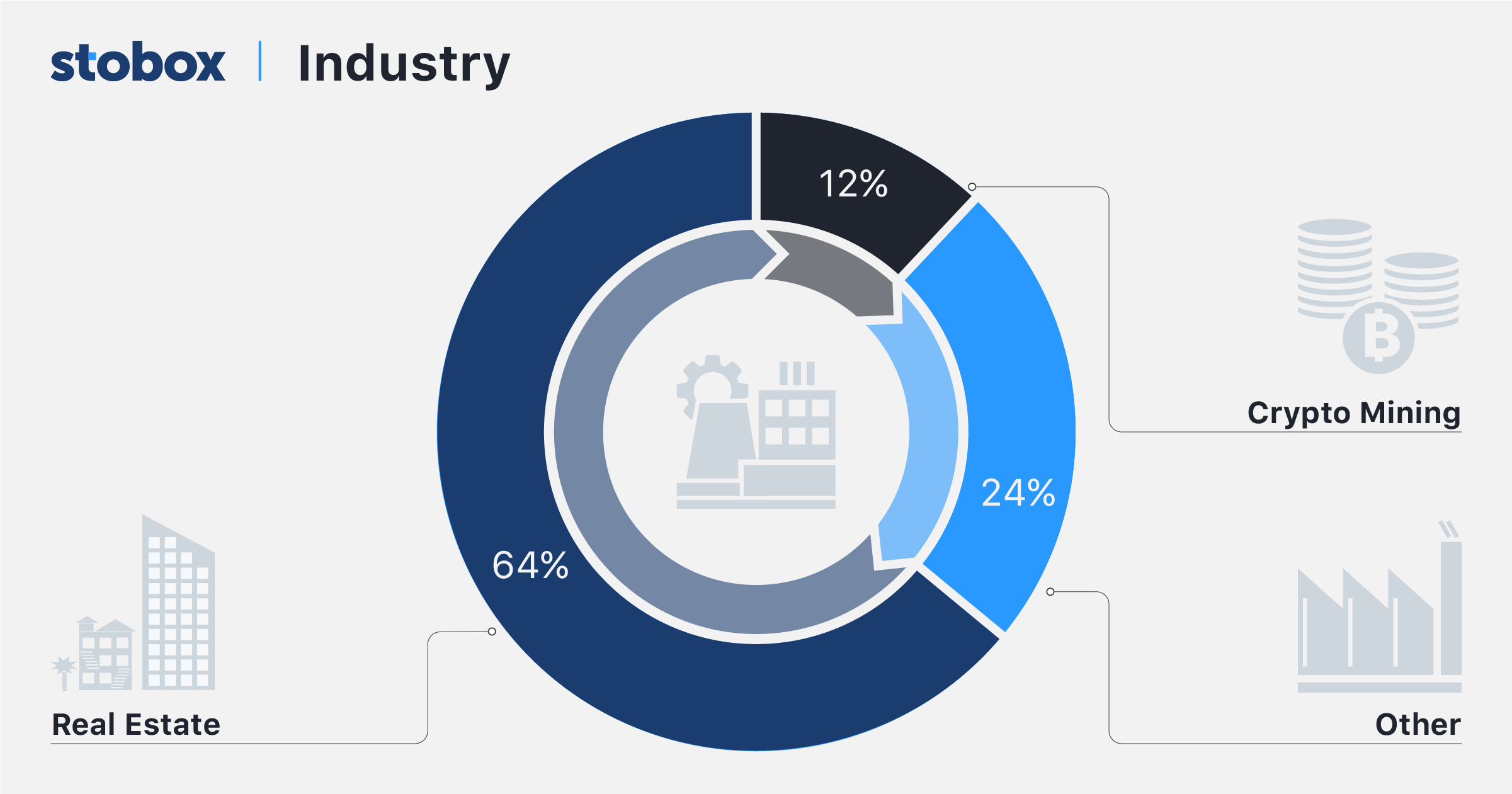

Industries of Security Tokens Issuers

The vast majority of issuers come from the real estate industry. And this is very logical, because real estate is one of the most illiquid asset classes, while it is very financially intensive. We are convinced that real estate is one of the main asset classes that are ideal for tokenization. In addition to real estate, issuers tokenize crypto-mining activity, bringing income to their investors through cryptocurrency mining.

Under other industries lies the tokenization of resources such as gold or other precious metals, the implementation of infrastructure projects, SMEs, and others.

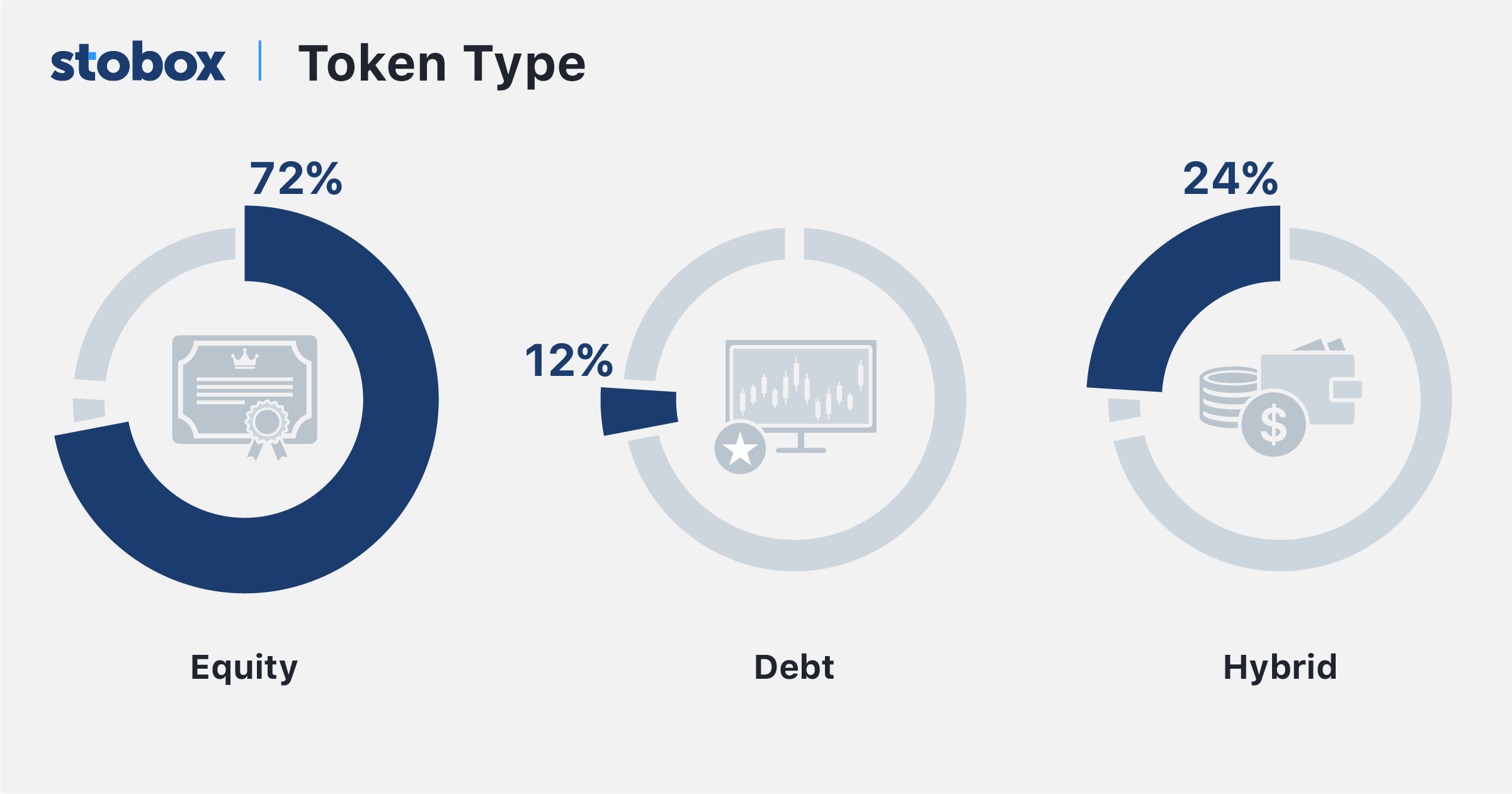

Types of Security Tokens

Most issuers prefer tokenization directly of the shares of a company that acts as an investor in a particular project. This is the most commonly used case, as it is a fairly clear and secure mechanism for investors. Often, one share is equal to one security token, which is convenient for making calculations. But other options are also possible.

Some companies choose to issue debt securities, but this is rare. Investors prefer to own a stake in a business rather than finance it at a fixed percentage.

We at Stobox also see great potential in the development of the issuance of non-equity securities. This mechanism will allow the issuance of security tokens in a number of other jurisdictions while maintaining protection for investors. We will cover this in more detail in the future.

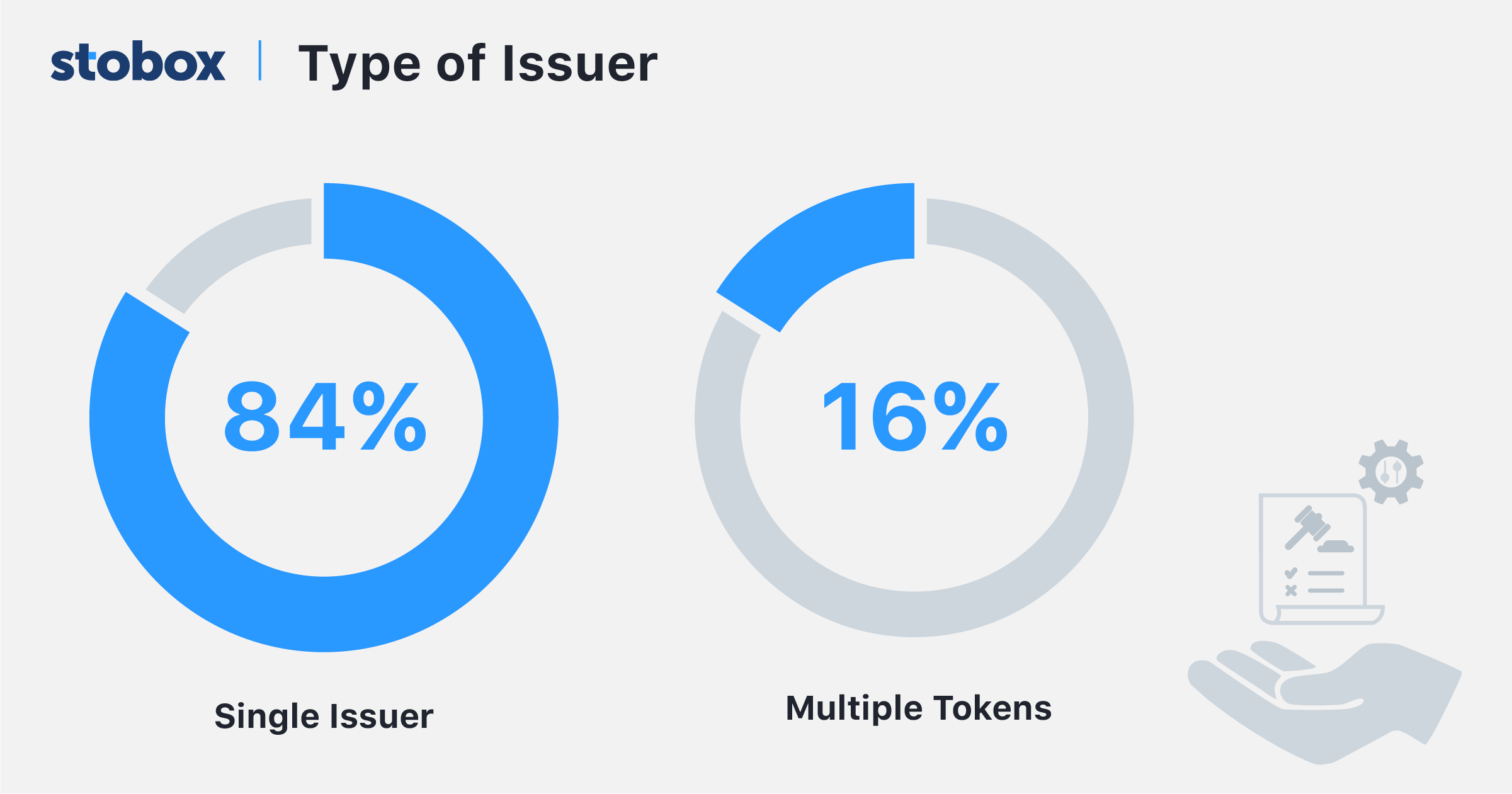

Types of Issuers

84% of Stobox customers start with the option of issuing a single security token, although many see the potential in launching multiple tokens at once. We see cases where issuers prefer to give their investors a choice between various security tokens that have fundamental differences. For example, one token is a tokenized share of the company, whereas the second is a profit participation certificate or debt token.

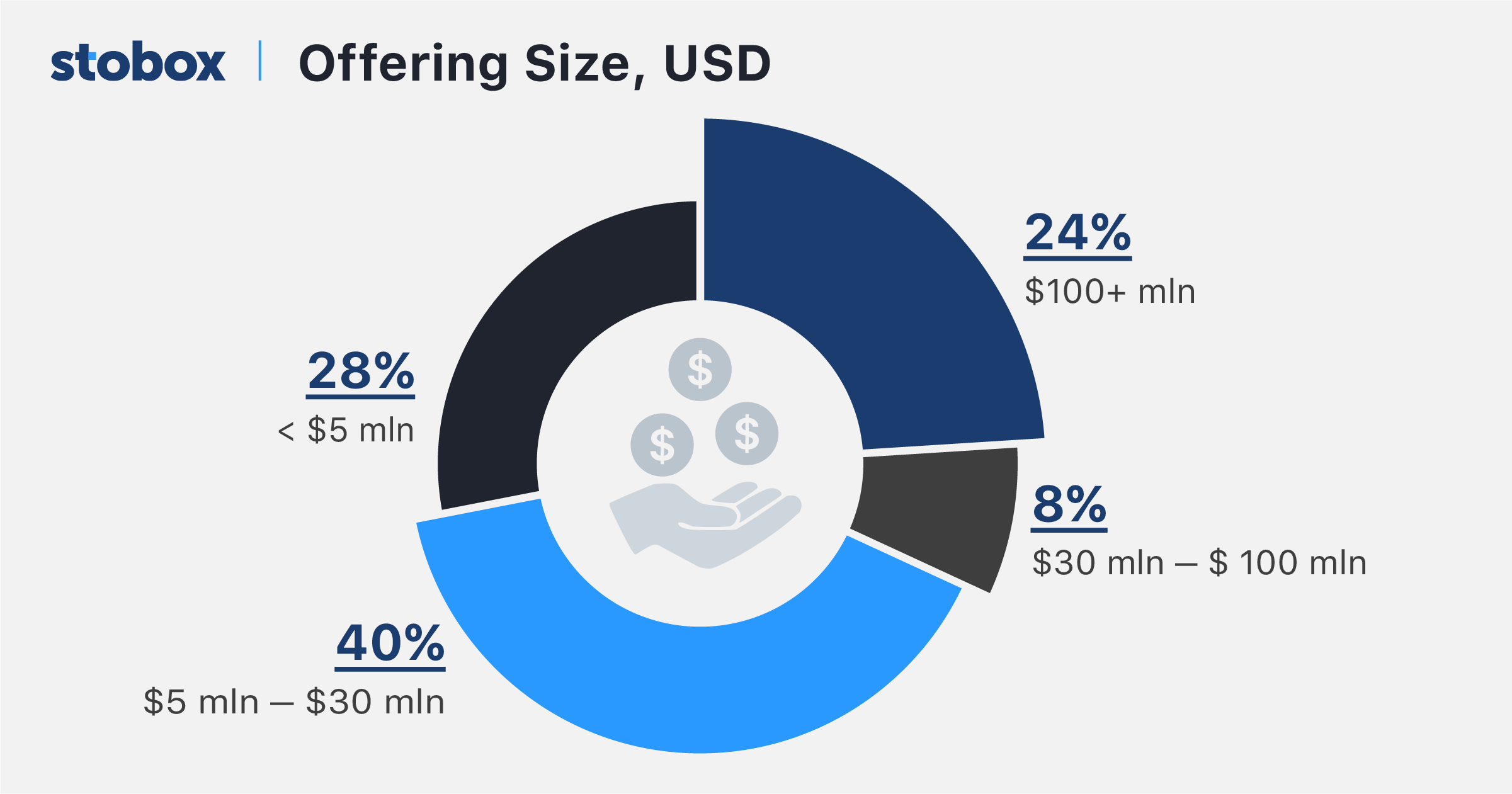

Sizes of Security Token Offerings

The last information block of our statistics is directly the size of the STO. Out of a sample of 60 cases, close to 30% of Stobox clients collect no more than $5 million, which is very logical given the overall development of the tokenization industry. Small-scale STOs are more preferable for small investors and therefore they are considered much more active than large tokenization projects. However, 40% of issuers raise between $5m and $30m.

It is important to understand that Stobox is a technology provider and does not directly affect the success of a particular service station. Issuers independently conduct the fundraising process, attracting investors through their marketing channels.

Over the past 5 years, Stobox has been developing the tokenization market by providing expertise and proprietary solutions to dozens of issuers worldwide.

Now is just the beginning of the tokenization industry, since most businesses have never even heard about the possibility of tokenization, and the market potential is in the trillions of dollars. Our mission is to provide asset tokenization to thousands of businesses by simplifying processes and streamlining our technology products. We continue to work on improving Stobox products and will delight our customers with new product features and updates.