Stobox 4 Release 2.0 (Beta): Powering the Next Era of Real-World Asset Tokenization

Stobox officially launches Stobox 4 Release 2.0 (Beta), the most comprehensive tokenization platform ever designed for compliant real-world asset management and enterprise-grade security token offerings.

On August 13, Stobox officially launched Stobox 4 – Release 2.0 (Beta), marking a major milestone in the evolution of compliant, enterprise-grade tokenization. This update moves our STV3 Protocol into full production, delivers end-to-end token lifecycle management, and introduces significant platform enhancements for issuers, investors, and businesses.

Release 2.0 is more than a feature update — it’s a foundational upgrade that positions Stobox 4 as the most complete environment for tokenizing, managing, and investing in real-world assets (RWAs).

All businesses — from startups to enterprises, across every industry and region — deserve the ability to digitize their equity, debt positions, commodities, and financial assets through tokenization.

STV3 Protocol in Full Production

The heart of this release is the STV3 Protocol, Stobox’s next-generation blockchain infrastructure for regulated tokenized assets. Built as an ERC-20 token implementation on the Diamond Standard (EIP-2535), STV3 enables modularity, scalability, and long-term upgradability by separating contract functionality into distinct facets.

Key features include:

- Role-Based Access Control — Assign granular permissions for minting, burning, and treasury operations.

- Validation Management — Define trusted addresses, enforce transfer rules, and run pre-transfer compliance checks.

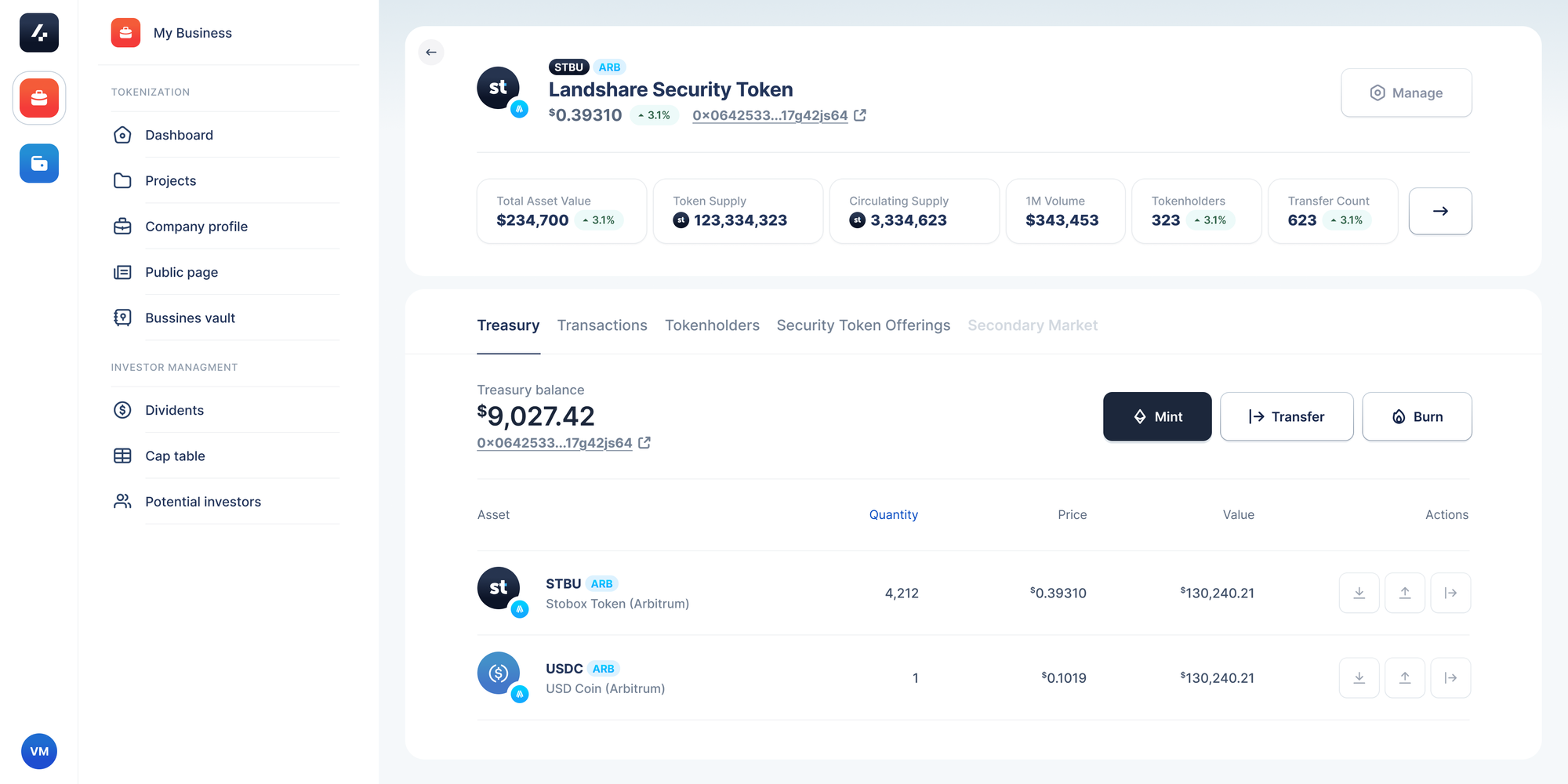

- Treasury Operations — Manage withdrawals, allowances, and associated DID/token metadata.

- Monetary Controls — Issue, redeem, and transfer tokens directly from treasury reserves.

- Emergency Controls — Force transfers, mint/burn, and pause/unpause protocol functions in critical situations.

This architecture delivers the flexibility and safeguards required for tokenizing regulated assets — blending enterprise-grade controls with blockchain-native efficiency.

Read more on Stobox STV3 Protocol

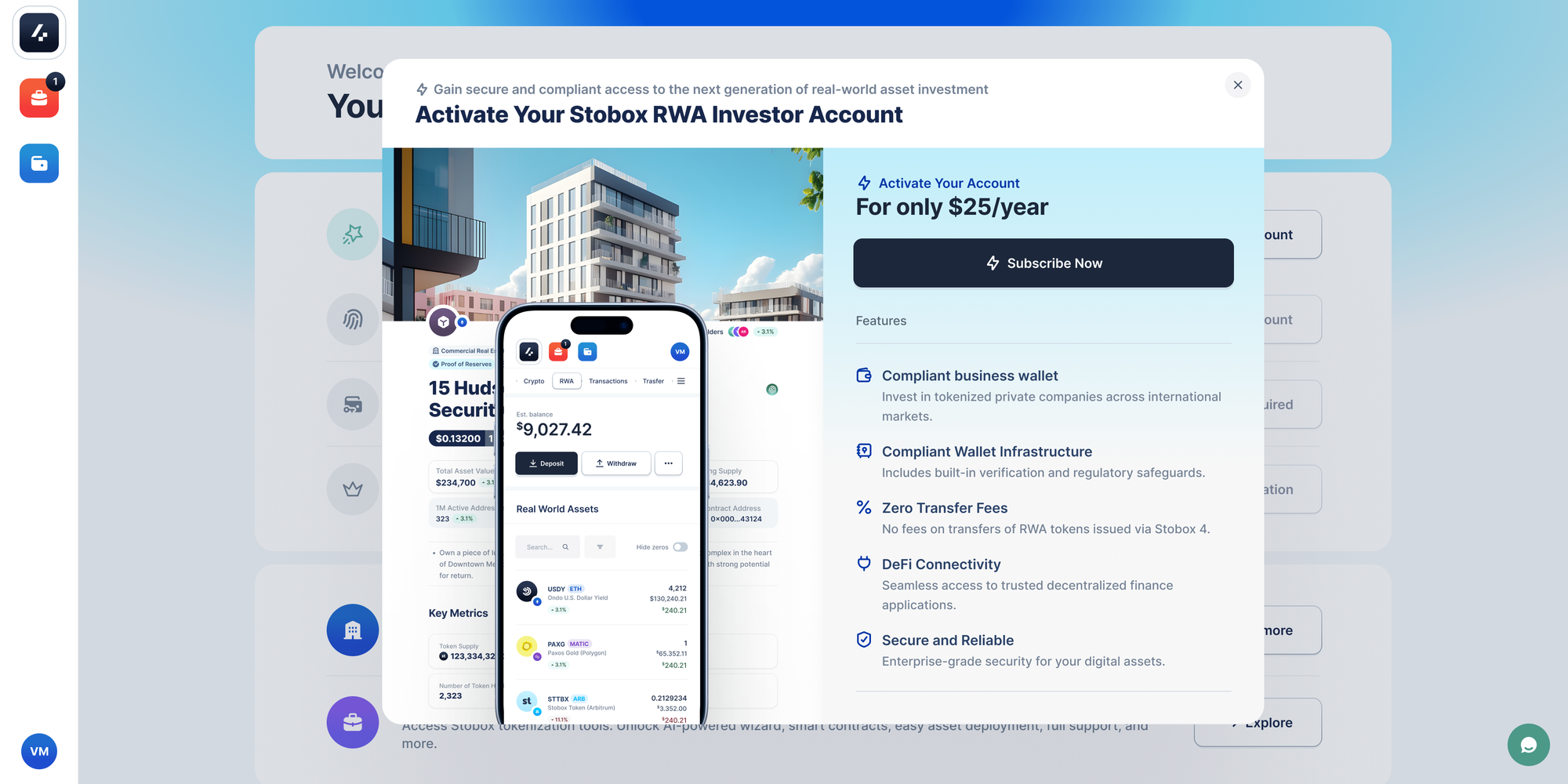

Accounts for Every Participant

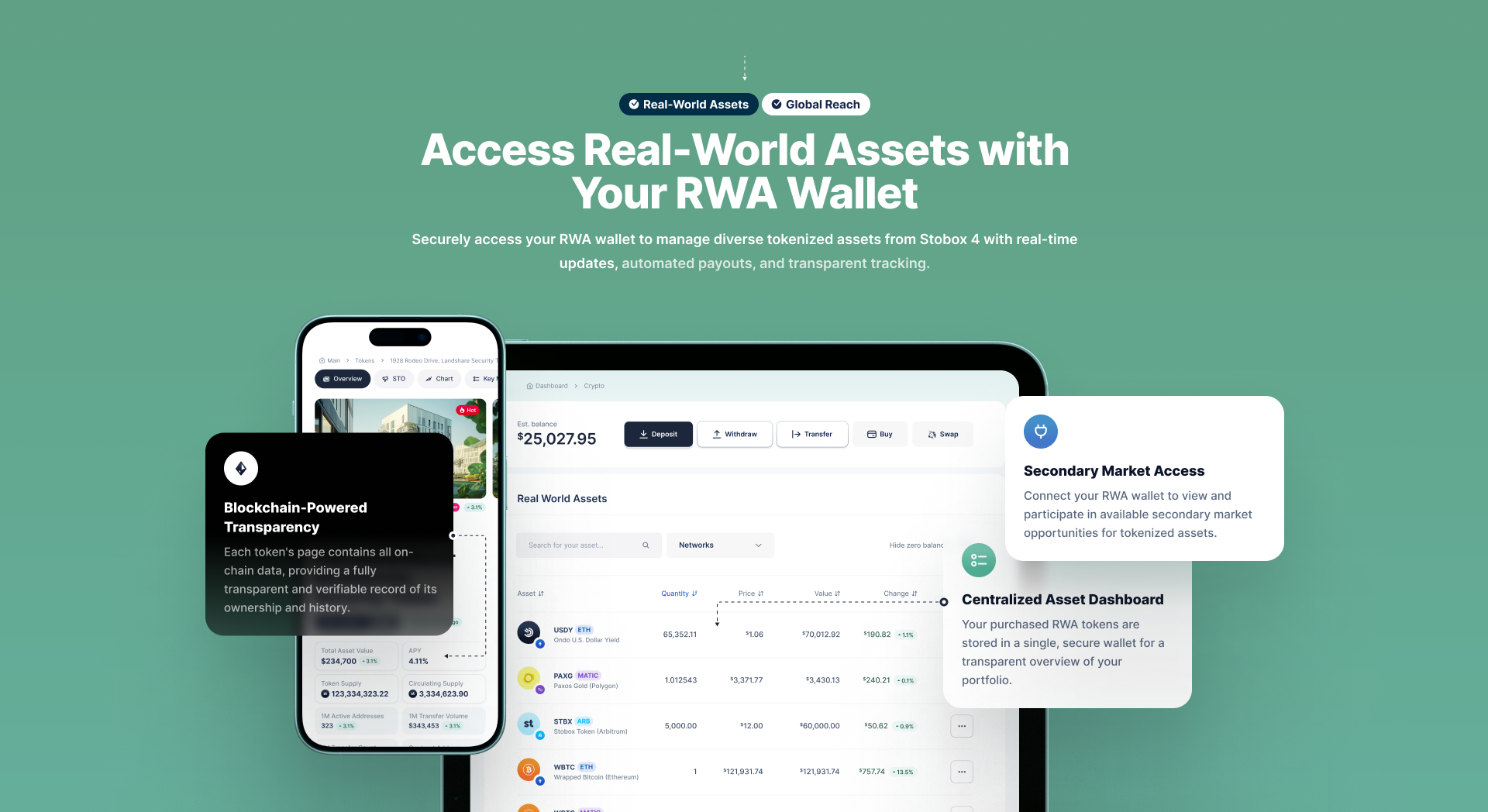

Stobox 4 now supports three core account types, each designed for a specific role in the tokenized asset ecosystem:

- Individual RWA Account

For the general public. Grants access to all core Stobox 4 features for managing and transferring tokenized assets within supported environments. Backed by KYC verification and a Stobox Decentralized Digital Identity (DID) to ensure compliant participation. - Professional RWA Account

For accredited participants who meet criteria under applicable financial regulations (e.g., SEC, MiFID II, or equivalent). Includes all Individual account features, plus eligibility for offerings reserved for accredited investors. Automated verification and premium access are coming soon. - Business Account

For issuers and enterprises launching tokenization projects. Unlocks compliance onboarding, STV3 deployment tools, public asset pages, embeddable widgets, and full lifecycle token management.

From concept to live offering in weeks, not months — Stobox 4 transforms complex tokenization into a streamlined, compliant process that any business can navigate with confidence.

How Tokenization Works on Stobox 4

Stobox 4 is designed to guide issuers from concept to fully live Security Token Offerings (STOs) in a clear, compliant, and efficient process. Here’s how it works:

1. Activate a Business Subscription

Set up your organization in Stobox 4 and enable your Business Account. This unlocks all issuer tools, compliance workflows, and smart contract deployment capabilities.

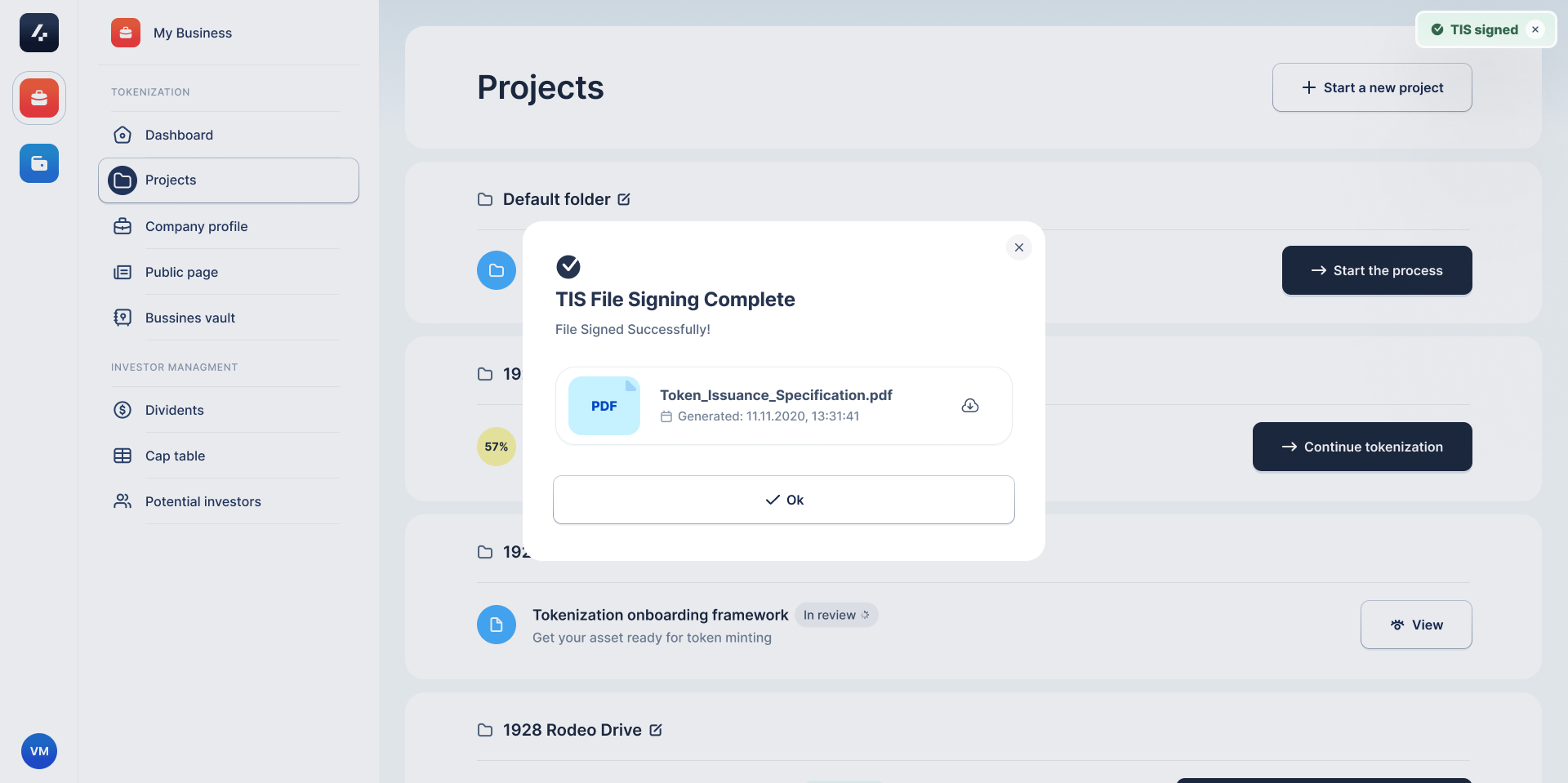

2. Complete the Tokenization Onboarding Framework

Work with Stobox experts to prepare your project for launch. This includes entity/KYB verification, asset ownership documentation, regulatory review, investor eligibility rules, and preparation of offering documentation.

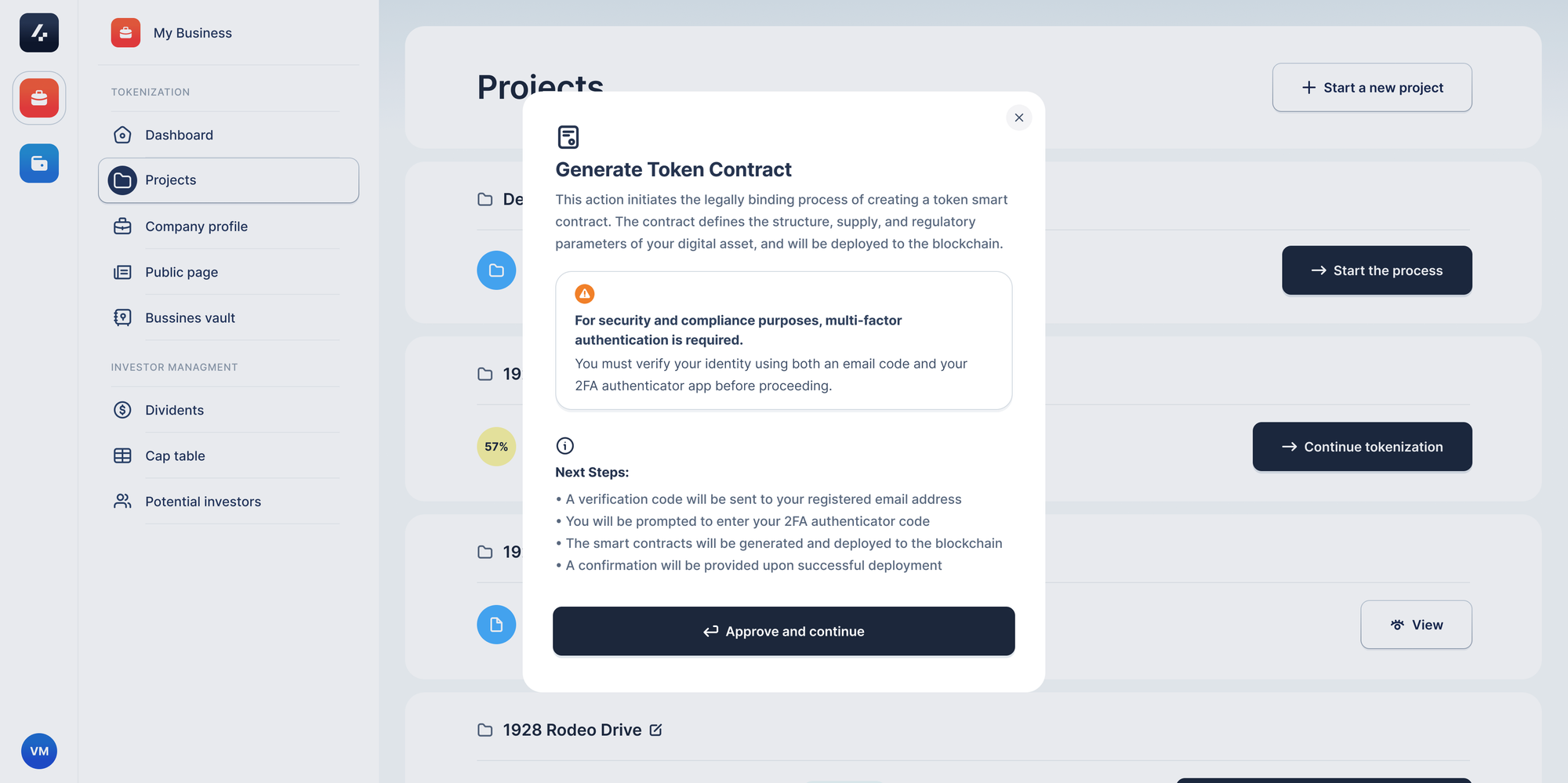

3. Deploy Customized Smart Contracts with STV3

Configure token parameters — including name, total supply, access controls, and validation rules — and deploy your asset’s smart contract using the audited STV3 protocol. Upon deployment, the system generates a Token Deployment Certificate confirming full legal and technical compliance.

4. Customize Your Business Space & Connect a Dedicated Domain

Brand your issuer portal and link it to your own custom domain. Each project operates on its own dedicated domain, with investment access available exclusively through that domain for transparency and trust.

5. Mint Security Tokens

Use the built-in Token Management Tools to mint and allocate tokens to the treasury or directly to investors, according to your issuance strategy (primary offering, vesting schedules, or staged releases).

6. Launch Your Security Token Offering (STO)

Go live with a professional Asset Page and embeddable widget displaying financial metrics, legal documentation, ownership details, and tokenholder data. This presentation is designed to meet investor expectations for clarity and transparency.

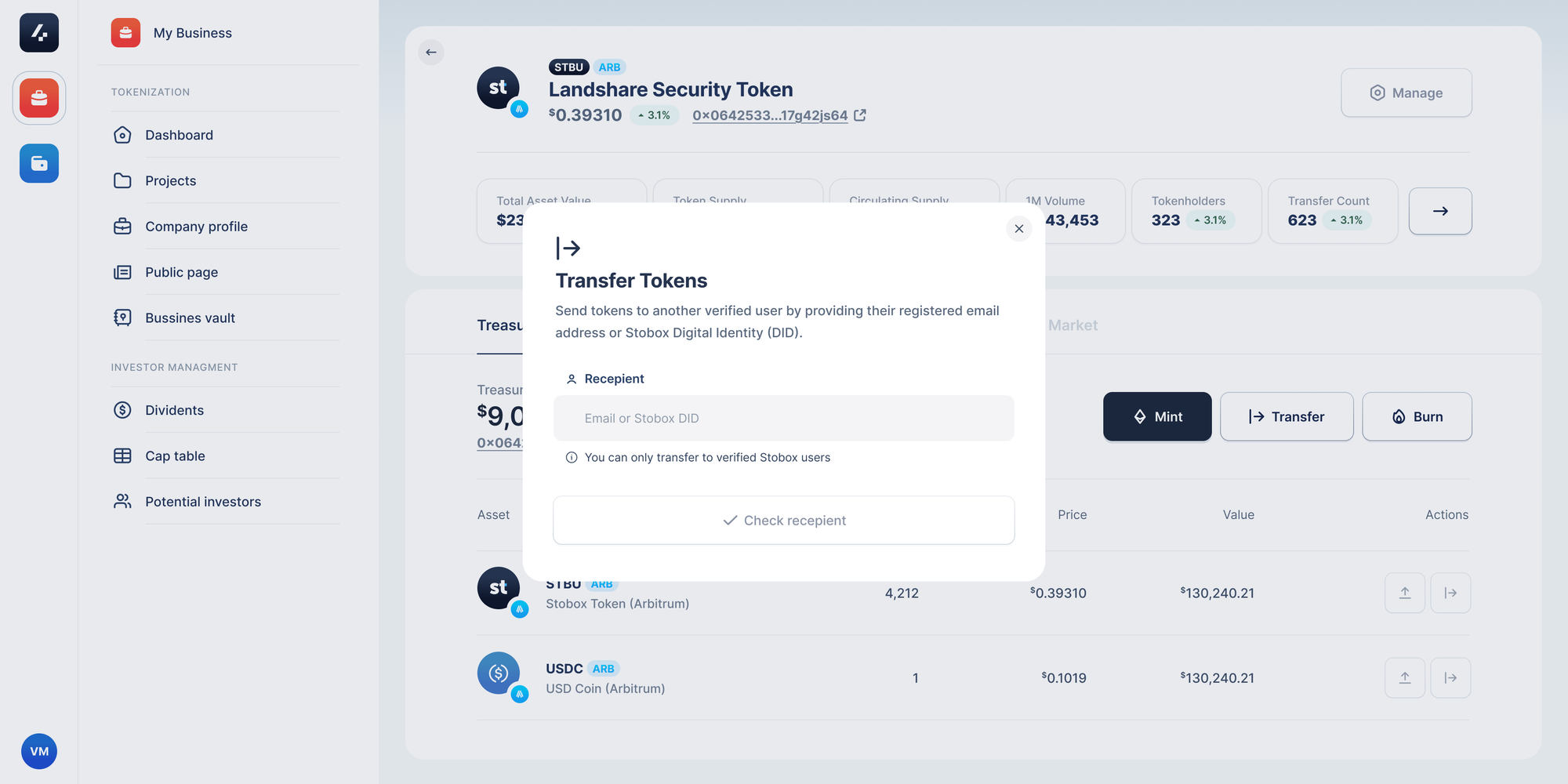

7. Onboard Investors Compliantly

Investors create either an Individual or Professional RWA Account, complete KYC, and receive their DID. Professional participants gain access to opportunities reserved for accredited investors once approved.

8. Operate & Manage with Confidence

Manage your treasury, issue or redeem tokens, perform transfers, enforce compliance validations, and use emergency controls if necessary — all from within the platform. Stobox 4’s UX improvements ensure operations are fast, clear, and intuitive.

Go-Live Pipeline

Eight client projects are currently queued to launch on Stobox 4, with the first companies going live under the STV3 protocol in the next 2–4 weeks. Each will operate under its own domain, with all investor activity channeled exclusively through that domain, connected to the Stobox 4 Wallet for unified asset management.

True innovation in RWA tokenization means eliminating barriers, not creating new ones — for issuers, investors, and regulators alike.

Why This Release Matters

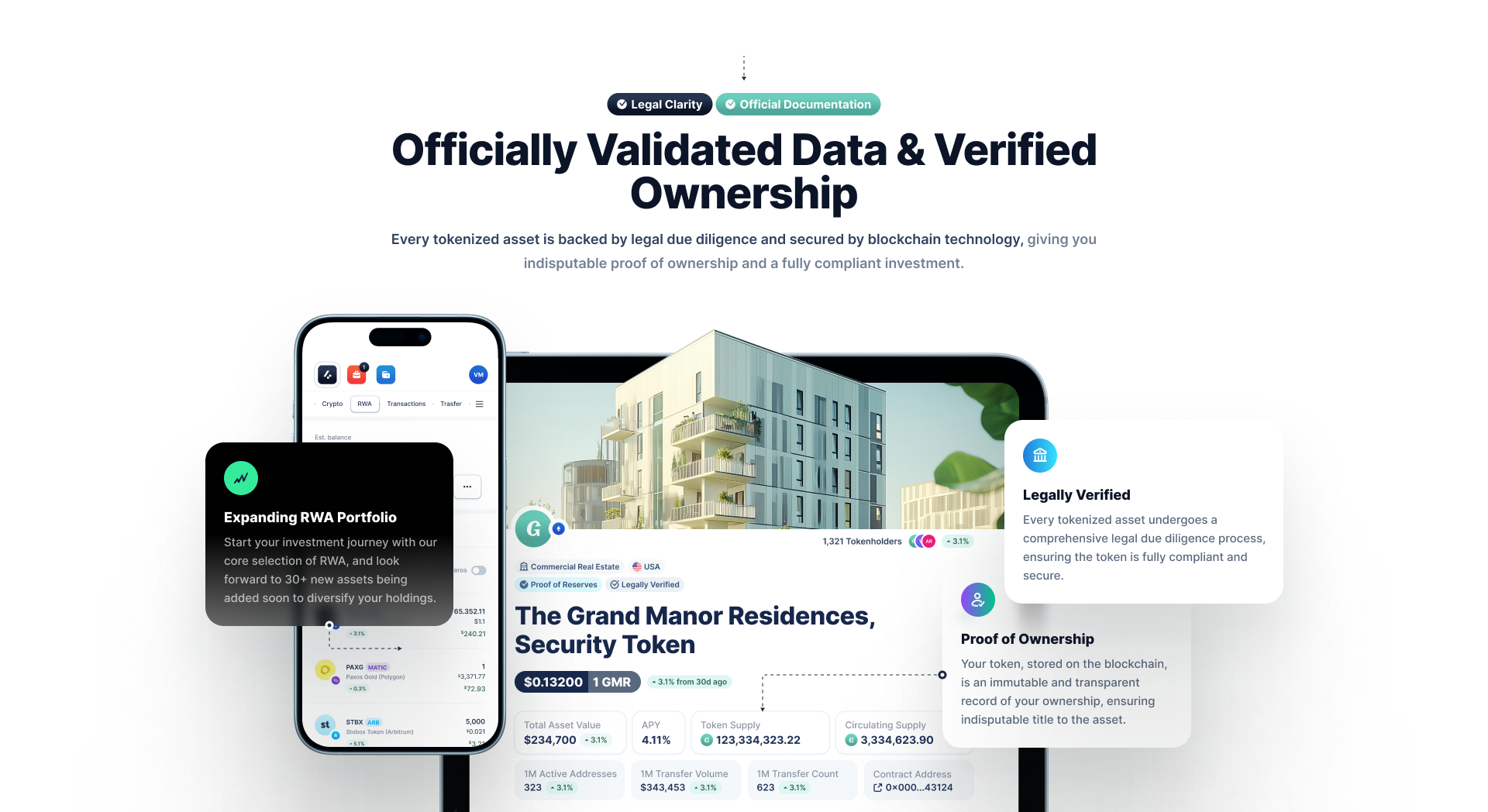

- Compliance by Design — Every token action is tied to a verified DID and enforced by validation rules, meeting the strictest regulatory standards.

- Issuer Autonomy — Full lifecycle control without dependency on external developers, with legally verifiable deployment certificates.

- Investor Transparency — Professional, branded domains and public asset pages consolidate all essential offering information in one place.

Get Started

- For Individuals: Register for an Individual RWA Account and start exploring compliant tokenized asset opportunities.

- For Professionals: Apply for a Professional RWA Account and prepare for access to accredited-only offerings.

- For Businesses: Register for a Business Account to launch your STO on Stobox 4 with STV3.