Asset Tokenization: Complete 2025 Guide & Platform Solutions

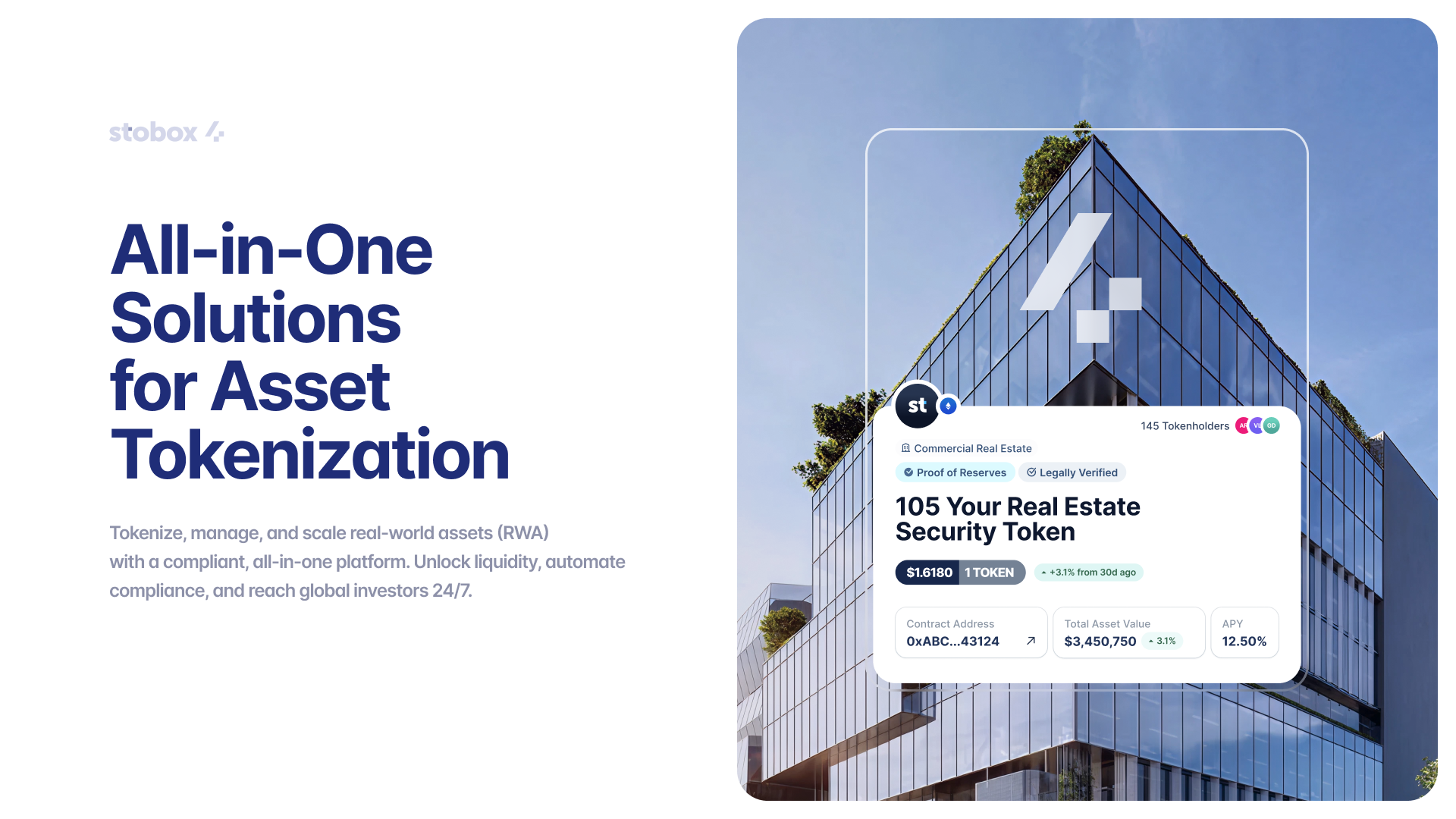

Asset tokenization transforms real-world assets into digital tokens, democratizing access to premium investments like real estate and private equity through blockchain technology.

The investment landscape is undergoing a fundamental transformation through asset tokenization, powered by next-generation platforms that make digital ownership accessible to everyone. For decades, access to premium assets like commercial real estate, private equity, or fine art has been reserved for institutional investors and the ultra-wealthy.

💡 Did You Know?

A $50 million office building in Manhattan can now be divided into 500,000 tokens at $100 each, making premium real estate accessible to retail investors worldwide.

Today, advanced blockchain technology and innovative platforms like Stobox 4 are rewriting these rules entirely. Asset tokenization is emerging as one of the most significant innovations in finance since the advent of digital trading platforms. By converting ownership rights into digital tokens on a blockchain, we're witnessing the democratization of investment opportunities that were previously accessible only to a select few. From traditional assets to revolutionary concepts like the tokenization of human capital through "Tokenization of Time," the scope of what can be digitized continues to expand.

🚀 Revolutionary Innovation

Stobox's "Tokenization of Time" creates the world's first tradeable markets for human expertise, enabling professionals to monetize their future working hours as digital assets.

This shift isn't just theoretical. Major financial institutions like JPMorgan, Goldman Sachs, and BlackRock are already deploying tokenization solutions, while innovative platforms provide turnkey services that eliminate traditional barriers. Real estate tokenization projects worth hundreds of millions are being fractionalized into affordable investment units. Art pieces, carbon credits, intellectual property rights, and even professional time are becoming tradeable digital assets that anyone can own a piece of.

The timing couldn't be more critical. As traditional investment yields remain under pressure and younger generations seek more accessible and transparent investment options, tokenization offers a compelling solution. Modern tokenization platforms now offer comprehensive ecosystems that handle everything from multi-blockchain support to automated compliance, making what was once technically complex accessible to any business or investor.

Whether you're a business owner looking to raise capital, an investor seeking portfolio diversification, or simply curious about the future of finance, understanding asset tokenization is no longer optional – it's essential for navigating tomorrow's investment landscape. With platforms offering everything from basic tokenization to sophisticated features like multi-party computation security and cross-chain interoperability, the infrastructure for the tokenized economy is already here.

Discover how Stobox 4 makes asset tokenization accessible for any business.

What is Asset Tokenization?

At its core, asset tokenization is the process of converting ownership rights in real-world assets into digital tokens that exist on a blockchain. Think of it as creating a digital certificate of ownership that can be easily bought, sold, and traded online. Instead of holding a physical deed to a property or a paper stock certificate, you own a digital token that represents your stake in the underlying asset.

🔑 Key Concept

A token serves as a digital record of ownership rights stored on a blockchain. When you own tokens representing real estate, you have legally-backed ownership rights including rental income and appreciation gains.

The fundamental concept is straightforward: a token serves as a digital record of ownership rights stored on a blockchain. When you own tokens representing a piece of real estate, you're not just holding arbitrary digital coins – you have legally-backed ownership rights to a fraction of that property, including potential rental income and appreciation gains. The blockchain acts as an immutable database that permanently records who owns what, creating a transparent and tamper-proof ledger of ownership.

This is where advanced blockchain and tokenization technology becomes crucial. Unlike traditional databases that can be altered or corrupted, blockchain provides an unchangeable record of transactions and ownership. Every token transfer is permanently recorded, creating an audit trail that builds trust and eliminates the need for many traditional intermediaries like transfer agents or clearinghouses.

🛡️ Security Innovation

Modern platforms utilize Multi-Party Computation (MPC) technology, ensuring private keys are never stored in a single location, dramatically reducing security risks while maintaining user control.

Advanced tokenization platforms also support multi-blockchain ecosystems, allowing assets to be tokenized across different networks like Ethereum, Polygon, or Binance Smart Chain. This multi-blockchain approach provides flexibility in choosing the most suitable network based on factors like transaction costs, speed, and regulatory requirements. The RWA (Real World Assets) tokenization methodology followed by leading platforms ensures that the legal and technical frameworks align properly, creating robust connections between digital tokens and their underlying assets.

It's important to understand what asset tokenization is not. Unlike cryptocurrencies such as Bitcoin or Ethereum, which derive their value from network effects and adoption, tokenized assets are directly backed by real-world value. A token representing a share of real estate tokenization has intrinsic value tied to the property itself, its income generation, and market conditions. Similarly, utility tokens like STBU serve specific functions within tokenization ecosystems, while security tokens like STBX represent actual ownership stakes with legal rights and obligations.

⚖️ Legal Distinction

Tokenized Assets vs NFTs: Tokenized assets are usually fungible (identical value), while NFTs represent unique items. However, innovative models like "Tokenization of Time" can create unique tokens representing specific expertise.

Asset tokenization also differs significantly from NFTs (Non-Fungible Tokens), which typically represent unique digital items like artwork or collectibles. Tokenized assets are usually fungible – meaning each token of the same asset class has identical value and can be exchanged interchangeably. If you own 100 tokens representing shares in a building, they're equivalent to any other 100 tokens from the same offering. However, the technology can also support unique representations, such as tokenizing individual professional hours in "Tokenization of Time" models, where each token might represent a specific expert's time with unique qualifications and rates. Learn more about the differences between tokenization and ICOs to understand these distinctions better.

See how our comprehensive platform handles the entire tokenization process

Who Is Asset Tokenization For?

Asset tokenization creates opportunities across the entire financial ecosystem, from businesses seeking innovative funding methods to investors looking for new portfolio diversification strategies. Understanding how different market participants can benefit from tokenization is key to grasping its transformative potential, especially with the availability of comprehensive turnkey solutions that eliminate traditional technical barriers.

Businesses

Asset tokenization opens new avenues for capital raising that were previously unavailable to many companies. Real estate developers can tokenize properties to access funding without traditional bank loans or institutional partnerships. Instead of selling an entire building to one buyer, they can sell fractional ownership to hundreds of smaller investors, often at better valuations and with more flexible terms.

Small and medium enterprises benefit particularly from tokenization for business's ability to democratize access to capital markets through comprehensive white-label solutions. A manufacturing company might tokenize future revenue streams or intellectual property, allowing them to raise funds while retaining operational control. Private companies that aren't ready for traditional IPOs can use turnkey tokenization services to offer equity stakes to a broader investor base without the regulatory complexity of public offerings. Modern platforms provide everything from legal structuring guidance to automated compliance monitoring, making the entire process manageable for companies without extensive blockchain expertise.

The emergence of innovative tokenization models like "Tokenization of Time" opens entirely new possibilities for service-based businesses and individual professionals. Consultants, doctors, lawyers, and other experts can tokenize their future professional hours, creating liquid markets for their expertise while providing predictable income streams.

Join 500+ companies using Stobox for fundraising and asset liquidity

Investors

For institutional funds and family offices, tokenization provides access to previously illiquid asset classes with improved portfolio management capabilities. They can now invest in fractions of premium real estate, art collections, or infrastructure projects that would have required massive capital commitments in traditional formats.

Retail investors gain access to investments that were historically reserved for the wealthy. A teacher or small business owner can now own a piece of commercial real estate in prime locations, invest in renewable energy projects, or hold shares in private equity-style deals – all with investment minimums that fit their budgets through tokenized investment opportunities. Advanced platforms offer sophisticated portfolio management tools, automated dividend distributions, and real-time performance tracking that rivals institutional-grade systems.

The tokenization ecosystem also introduces new investment vehicles like utility tokens (STBU) that provide access to platform services and fee discounts, and security tokens (STBX) that represent actual equity stakes with voting rights and profit participation. Investors can also participate in staking programs that generate passive income while supporting network security and governance.

Access exclusive tokenized assets through Stobox 4

Platforms

Digital exchanges and marketplaces represent the infrastructure layer of the tokenization ecosystem. These platforms facilitate the issuance, trading, and management of tokenized assets, creating new revenue streams through transaction fees, listing fees, and premium services.

Tokenization platform providers offer end-to-end solutions for businesses looking to tokenize their assets. Modern platforms like Stobox 4 handle the technical complexities of multi-blockchain integration, automated compliance management, and investor relations, making tokenization accessible to companies without extensive technical expertise. These platforms feature comprehensive analytics dashboards, white-label issuer pages, automated KYC/AML processes, and seamless wallet connectivity that creates professional-grade experiences for both issuers and investors.

The evolution toward multi-blockchain support means platforms can offer clients flexibility in choosing the most appropriate network for their specific needs, whether prioritizing low costs, high throughput, or specific regulatory requirements.

Funds & Family Offices

Tokenization enables the creation of entirely new fund structures with granular ownership and automated management features. Family offices can create tokenized funds that allow extended family members to invest in family assets with clear ownership tracking and simplified governance through smart contract automation.

Investment funds can use tokenization to offer more flexible redemption terms, automated dividend distributions, and enhanced transparency to their limited partners. This is particularly valuable for funds focused on illiquid assets like real estate or private equity. Learn more about how investment funds benefit from tokenization and new opportunities this creates, including the ability to create hybrid fund structures that combine traditional and tokenized assets within single vehicles.

Advanced tokenization platforms now offer specialized tools for fund management, including multi-signature governance, automated reporting, and compliance frameworks that meet institutional requirements while providing the efficiency benefits of blockchain technology.

Legal & Advisory Providers

The tokenization space creates significant opportunities for legal professionals specializing in securities law, blockchain regulation, and compliance frameworks. As tokenization touches multiple regulatory domains across different jurisdictions, experienced legal counsel becomes essential for successful projects.

Financial advisors and compliance consultants help navigate the complex regulatory landscape across different jurisdictions. They ensure that tokenization projects meet securities laws, anti-money laundering requirements, and investor protection standards while maximizing the benefits of blockchain technology through professional tokenization consulting services. Modern platforms provide comprehensive compliance frameworks and automated reporting tools that help legal professionals efficiently manage multiple client projects while ensuring adherence to evolving regulations.

The integration of advanced compliance technologies like decentralized identity (DID) solutions and automated KYC/AML processes creates new service opportunities for legal and advisory providers who can offer specialized expertise in these emerging technological frameworks.

What Can Be Tokenized?

The scope of assets suitable for tokenization is remarkably broad, encompassing virtually any asset that can be legally owned and valued. From traditional investments like real estate and stocks to emerging asset classes like carbon credits and digital royalties, tokenization is expanding the universe of investable assets. Understanding the full range of alternative investment types helps illustrate tokenization's transformative potential.

Real Estate

Real estate tokenization represents one of the most mature and successful applications of asset tokenization. Commercial properties, including office buildings, shopping centers, and industrial facilities, can be divided into thousands of tokens, allowing investors to own fractional shares starting from as little as $100.

Residential real estate tokenization enables property owners to unlock liquidity without selling their homes entirely. A homeowner in San Francisco might tokenize 30% of their property value to access capital while retaining control and continuing to live there. Land tokenization is particularly interesting for agricultural properties and development projects, where investors can participate in land appreciation and development profits.

Financial Assets

Traditional financial instruments are finding new life through financial asset tokenization. Private equity funds use tokenization to offer more liquid alternatives to their typically illiquid investments, allowing limited partners to trade their stakes before the fund's planned exit timeline.

Corporate bonds and debt instruments benefit from tokenization through programmable features like automatic interest payments and simplified compliance tracking. Startup equity tokenization enables early-stage companies to offer fractional ownership to a broader investor base while maintaining regulatory compliance through proper structuring.

Commodities

Physical commodities like gold, silver, and oil can be tokenized to provide easier access and storage solutions through commodity tokenization. Instead of dealing with physical delivery and storage costs, investors can own tokens backed by commodities held in secure facilities, with the option to redeem for physical delivery if desired.

Agricultural products present unique tokenization opportunities, from tokenizing crop yields before harvest to creating investment vehicles around sustainable farming practices. This allows investors to participate in agricultural markets while providing farmers with upfront capital.

Intellectual Property & Royalties

Patents, trademarks, and copyrights can be tokenized to create new revenue streams for inventors and creators. A pharmaceutical company might tokenize future royalties from a new drug, providing immediate capital while allowing investors to participate in long-term revenue streams.

Music and entertainment royalties represent a growing tokenization market. Artists can tokenize portions of their future streaming revenue, providing fans with investment opportunities while giving creators upfront funding for new projects. This model extends to book royalties, film profit shares, and other creative intellectual property.

Collectibles & Luxury Assets

High-value collectibles like rare art, vintage wines, classic cars, and luxury watches can be fractionalized through tokenization. A $10 million Picasso painting can be divided into 100,000 tokens, making fine art investment accessible to middle-class investors while providing the original owner with liquidity.

Luxury assets like yachts, private jets, and exotic cars benefit from tokenization by enabling shared ownership models. Multiple investors can own portions of these assets and coordinate usage through smart contracts, making luxury experiences more affordable and accessible.

Carbon Credits

Environmental assets like carbon credits and renewable energy certificates are increasingly being tokenized to improve transparency and tradability in sustainability markets. This enables more efficient pricing and broader participation in environmental impact investing.

Reforestation projects, solar installations, and other environmental initiatives can be tokenized to allow direct investment in climate solutions. Investors can participate in both environmental impact and potential financial returns from these projects.

Infrastructure

Large-scale infrastructure projects like bridges, toll roads, energy facilities, and telecommunications networks can be tokenized to democratize access to infrastructure investments. These assets typically generate steady cash flows over long periods, making them attractive for income-focused investors.

Renewable energy tokenization particularly benefits from tokenization, as investors can own portions of solar farms or wind installations and receive proportional shares of energy revenue. This creates opportunities for retail investors to participate in the clean energy transition while generating returns.

Key Benefits of Asset Tokenization

Asset tokenization delivers compelling advantages that address many limitations of traditional investment markets. These benefits span improved access, enhanced efficiency, and new capabilities that weren't possible with conventional financial instruments. Understanding these advantages of tokenized securities helps explain why tokenization is gaining momentum across multiple industries, particularly with the emergence of advanced platforms that offer enterprise-grade security and comprehensive automation features.

Fractional Ownership

Traditional high-value assets often required substantial minimum investments that excluded most investors. Tokenization breaks down these barriers by dividing expensive assets into affordable fractions. A $50 million commercial property can be split into 500,000 tokens at $100 each, making premium real estate accessible to retail investors who previously couldn't participate in such opportunities.

📈 Portfolio Benefits

Instead of investing $100,000 in a single property, investors can spread that amount across multiple tokenized assets, different asset classes, and various geographic markets, significantly reducing concentration risk.

This fractionalization doesn't just lower barriers – it also enables better portfolio diversification through sophisticated asset allocation tools. Instead of investing $100,000 in a single property, an investor can spread that amount across tokens representing portions of multiple properties, different asset classes, and various geographic markets, significantly reducing concentration risk. Advanced platforms now provide automated rebalancing features and portfolio analytics that help investors optimize their fractional holdings across diverse tokenized assets.

Modern tokenization platforms support complex fractional ownership structures through multi-signature governance systems, ensuring that fractional owners maintain appropriate control rights while enabling efficient decision-making processes for asset management and strategic decisions.

Increased Liquidity

Many valuable assets like real estate, private equity, and fine art have historically been illiquid, requiring months or years to sell. Tokenization creates the potential for these assets to be traded more easily, though actual liquidity depends on market demand and regulatory frameworks established by advanced compliance systems.

⚡ Efficiency Gains

Digital marketplaces can operate with lower transaction costs and faster settlement times than traditional asset transfers, making it more practical for investors to adjust positions when needed.

While tokenization doesn't automatically guarantee liquidity, it creates the infrastructure for more efficient trading through multi-blockchain support and cross-chain interoperability. Digital marketplaces can operate with lower transaction costs and faster settlement times than traditional asset transfers, making it more practical for investors to adjust their positions when needed. Advanced platforms utilize automated market-making mechanisms and liquidity pools to enhance trading efficiency.

The integration of DeFi (Decentralized Finance) protocols with tokenized assets opens new possibilities for liquidity provision, enabling token holders to use their assets as collateral for loans or participate in yield farming while maintaining ownership exposure.

Democratized Access

Tokenization removes many traditional gatekeepers from investment markets. Where private equity funds might require $1 million minimums and accredited investor status, tokenized versions can offer access with much lower minimums and simplified qualification processes through automated KYC/AML systems.

🌍 Global Impact

A retail investor in Poland can now own tokens representing New York real estate or Silicon Valley startups, expanding investment opportunities beyond local markets through comprehensive multi-jurisdictional compliance.

This democratization extends globally, allowing investors worldwide to participate in markets that were previously limited by geography. A retail investor in Poland can now own tokens representing New York real estate or Silicon Valley startups, expanding investment opportunities for everyone beyond local markets through comprehensive multi-jurisdictional compliance frameworks.

Advanced platforms now support multiple fiat currencies and payment methods, making global participation even more accessible. Integration with traditional banking systems and emerging payment rails reduces friction for investors from different financial backgrounds and regulatory environments.

Smart Contract Automation

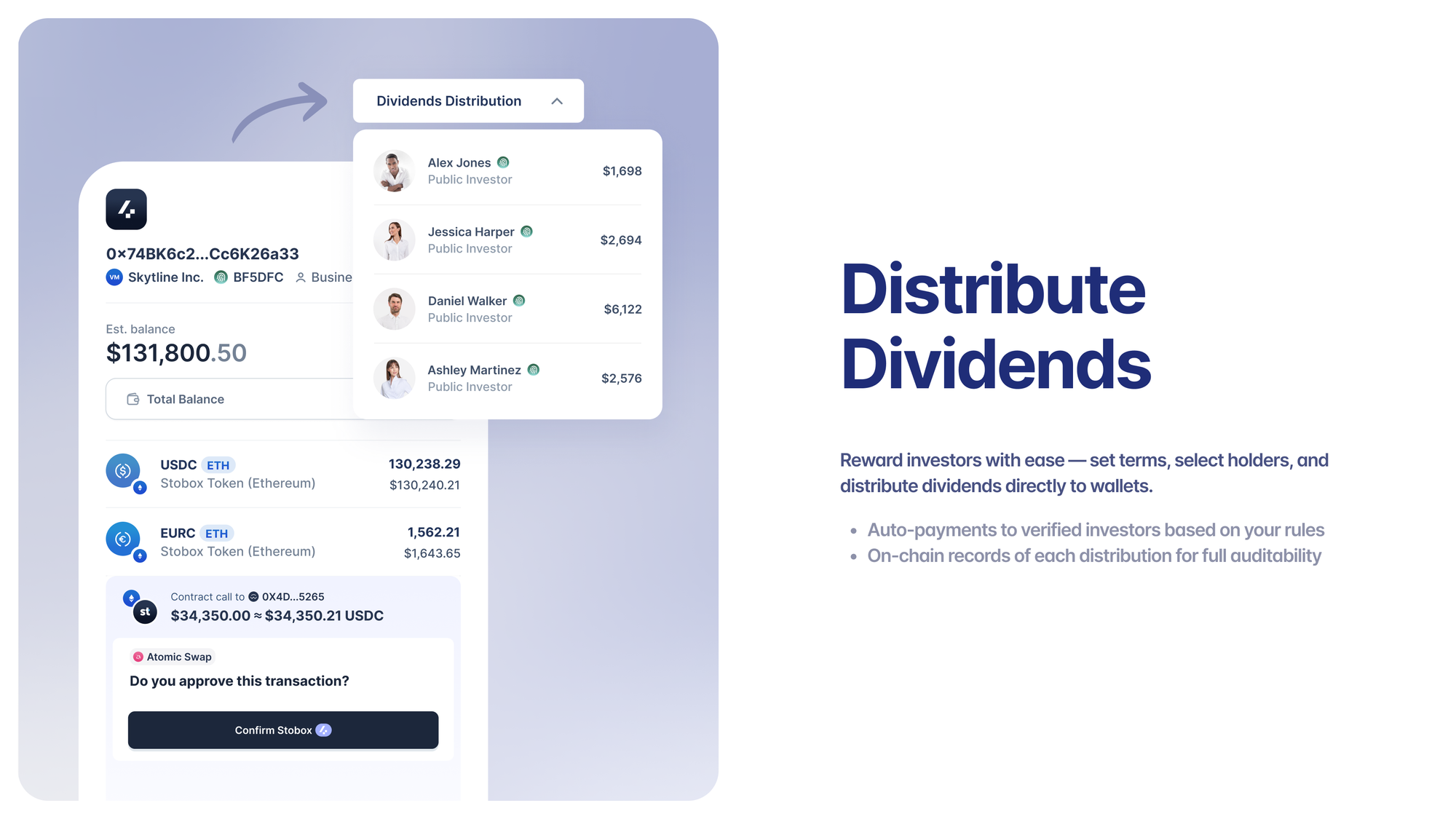

Smart contracts enable automatic execution of many investment processes that traditionally required manual intervention. Dividend distributions, voting rights, and profit sharing can be programmed to execute automatically based on predefined conditions, reducing administrative costs and human error while ensuring consistent execution.

🤖 Automation Examples

A tokenized real estate investment could automatically reinvest rental income, distribute profits based on token holdings, or trigger asset sales when certain performance metrics are met - all without human intervention.

These automated features also enable more sophisticated investment structures through programmable logic and multi-signature governance. For example, a tokenized real estate investment could automatically reinvest rental income, distribute profits based on token holdings, or trigger asset sales when certain performance metrics are met, all without human intervention through automated tokenization solutions.

Advanced platforms now support complex automated workflows including compliance monitoring, regulatory reporting, tax documentation, and cross-border payment processing, significantly reducing the operational burden on both issuers and investors while maintaining full regulatory compliance.

Lower Transaction Costs

By reducing the need for intermediaries like brokers, transfer agents, and clearinghouses, tokenization can significantly lower transaction costs through direct peer-to-peer transactions and automated processing. Traditional real estate transactions might involve 5-7% in fees, while tokenized transfers could reduce this to 1-2% or less through streamlined digital processes.

These cost savings make smaller transactions economically viable, enabling micro-investment strategies that were previously impractical. Where traditional systems might make a $1,000 investment impractical due to high fees, tokenized assets can accommodate micro-investments efficiently through automated processing and batched transactions, opening new markets for both issuers and investors.

Multi-blockchain support allows platforms to optimize for cost efficiency by selecting the most appropriate network for each transaction type, whether prioritizing low fees, fast settlement, or specific regulatory requirements.

24/7 Markets

Unlike traditional markets with limited trading hours, tokenized assets can potentially be traded around the clock through global decentralized exchanges and automated market makers. This global accessibility means investors aren't constrained by local market hours and can respond to opportunities or market changes in real-time across different time zones.

Continuous trading capability is particularly valuable for international investors who might otherwise face timing challenges when participating in foreign markets. It also enables more dynamic portfolio management, as investors can adjust positions based on global events and market movements as they occur through always-available trading interfaces.

Advanced platforms support 24/7 customer service and automated transaction processing, ensuring that global investors can access support and execute transactions regardless of their local time zone or traditional market hours.

Enhanced Security

Modern tokenization platforms utilize advanced security measures that often exceed traditional financial systems. Multi-Party Computation (MPC) technology ensures that private keys are never stored in a single location, dramatically reducing security risks while maintaining user control over their assets.

Multi-device security systems allow users to manage their tokenized assets across different devices while maintaining consistent security standards. The elimination of single points of failure through distributed key management creates more robust security than traditional centralized custody solutions.

Advanced audit capabilities and real-time monitoring systems provide continuous security oversight, while smart contract audits and formal verification processes ensure that automated systems operate as intended without vulnerabilities that could compromise investor assets.

Book a consultation with our tokenization experts

The Asset Tokenization Process

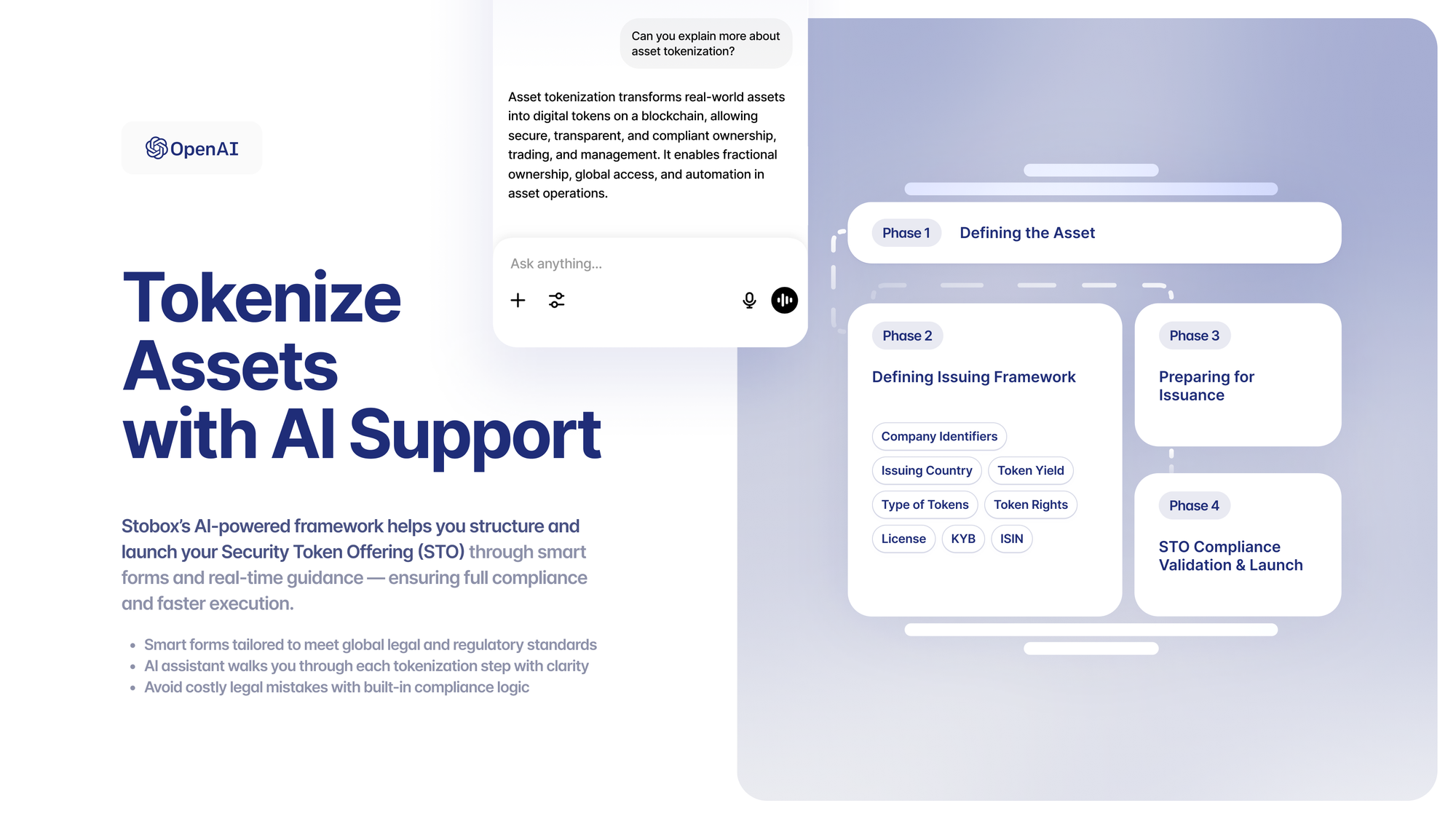

Successfully tokenizing an asset involves a carefully orchestrated series of steps that span legal, technical, and operational domains. Understanding this process helps both asset owners and investors appreciate the complexity and thoroughness required for legitimate tokenization projects. Modern platforms like Stobox 4 have revolutionized this process by providing comprehensive, automated workflows that guide users through each phase while maintaining institutional-grade compliance and security standards. For those considering tokenization, choosing tokenization providers carefully is crucial for project success.

Asset Selection

The tokenization journey begins with identifying suitable assets that meet specific criteria for digital transformation using the Stobox RWA (Real World Assets) tokenization methodology. Not every asset is appropriate for tokenization – the best candidates typically have clear ownership structures, established valuation methods, and sufficient market interest to ensure eventual liquidity.

The Stobox 4 platform features an intelligent Asset Selection wizard that guides users through a comprehensive evaluation process. This includes automated asset classification, valuation frameworks, and market analysis tools that help determine tokenization viability. Assets should have predictable cash flows or appreciation potential that can be easily understood by potential investors through clear documentation and transparent reporting mechanisms.

Advanced platforms now utilize AI-powered assessment tools that analyze asset characteristics, market conditions, and regulatory requirements to provide data-driven recommendations for tokenization structure and approach. The platform automatically generates detailed asset profiles that include valuation models, risk assessments, and projected investor returns based on historical data and market analysis.

Legal Structuring

Most tokenization projects require establishing a Special Purpose Vehicle (SPV) that legally owns the underlying asset and issues tokens representing ownership interests. This structure protects both the original asset owner and token holders by creating clear legal boundaries and limiting liability exposure through professionally managed legal frameworks.

The Stobox 4 platform provides automated Legal Structuring tools that streamline SPV formation across multiple jurisdictions. Users can access pre-configured legal templates, automated document generation, and guided workflows that ensure proper corporate structure while maintaining compliance with local regulations. Jurisdiction selection plays a crucial role in legal structuring guidance. Different countries and states offer varying levels of regulatory clarity, tax efficiency, and investor protection. Many projects choose jurisdiction considerations like Delaware, Singapore, or Switzerland that have developed specific frameworks for digital asset offerings while maintaining strong legal protections.

The platform's Legal Framework module automatically generates all necessary documentation including operating agreements, token purchase agreements, and disclosure documents while ensuring alignment with securities regulations in target jurisdictions. Integration with legal service providers enables seamless document review and regulatory filing processes.

Compliance Setup

Regulatory compliance represents one of the most critical and complex aspects of asset tokenization. Projects must navigate securities laws, anti-money laundering (AML) requirements, and know-your-customer (KYC) regulations across potentially multiple jurisdictions through sophisticated compliance management systems.

The Stobox 4 platform features advanced Compliance Framework tools that automate much of the regulatory burden. The integrated KYC/AML system supports multi-jurisdictional requirements and provides real-time compliance monitoring throughout the token lifecycle. Implementing robust KYC and AML procedures ensures that only eligible investors can participate while protecting the project from regulatory violations through automated verification and ongoing monitoring systems.

This typically involves identity verification, source of funds documentation, and ongoing monitoring of investor activities through the platform's comprehensive investor management system. Modern compliance solutions and decentralized identity solutions can streamline these processes while maintaining security through advanced cryptographic protocols. The platform automatically generates compliance reports, maintains audit trails, and provides real-time regulatory updates to ensure ongoing adherence to evolving regulations.

Token Issuance

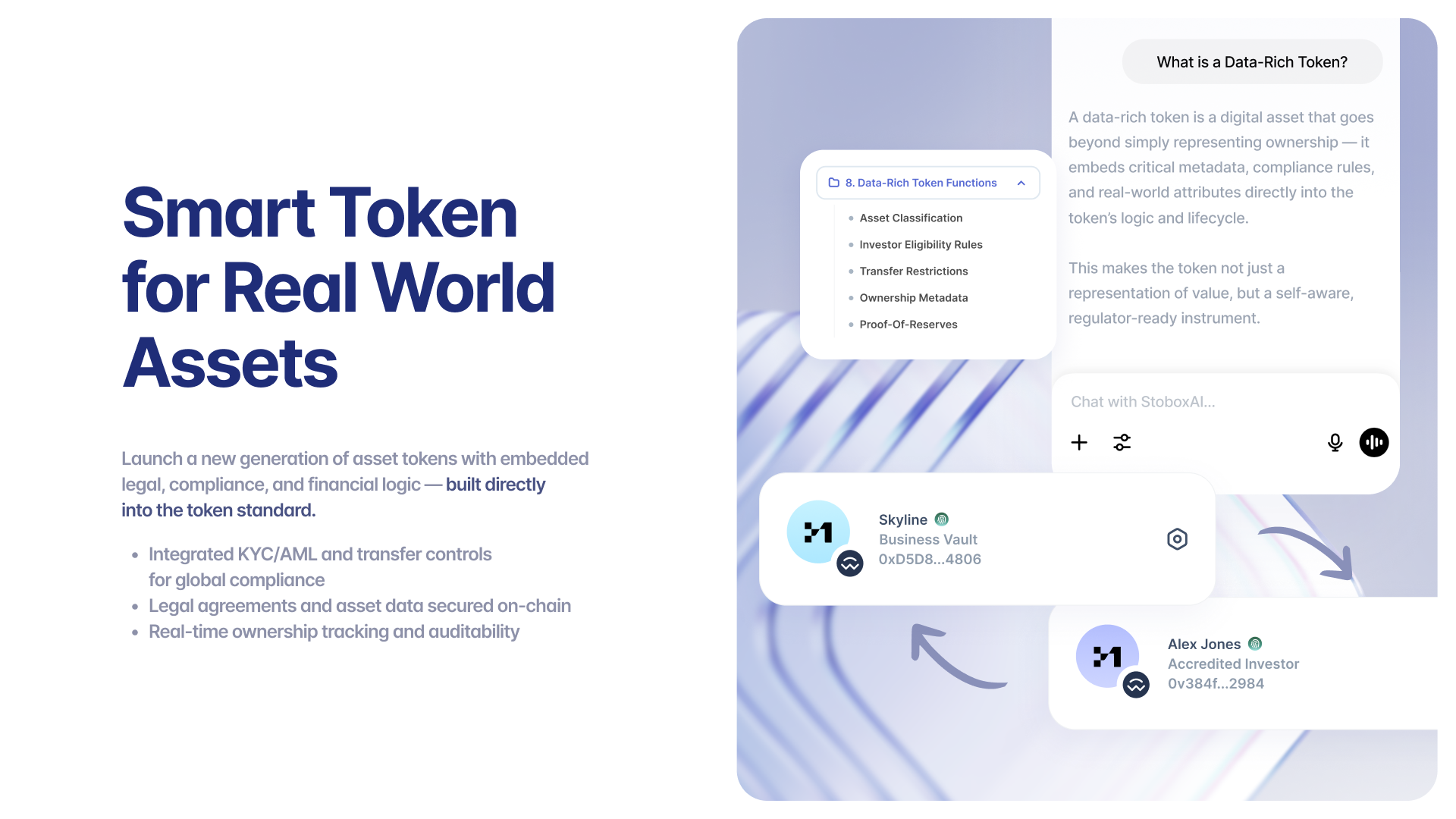

The technical implementation involves creating smart contracts that define token properties, distribution mechanisms, and ongoing management functions through the Stobox 4 Asset Tokenization Module. These contracts specify how many tokens will be issued, their relationship to the underlying asset, voting rights (if any), and profit distribution mechanisms through programmable logic and automated execution.

The Stobox 4 platform provides a comprehensive Token Issuance wizard that guides users through smart contract creation, testing, and deployment across multiple blockchain networks. The platform supports advanced features including multi-signature governance, automated compliance checks, and cross-chain compatibility to ensure maximum flexibility and security.

Security considerations are paramount during token issuance through enterprise-grade security protocols. Smart contracts must be thoroughly audited by independent security firms to identify potential vulnerabilities, and the Stobox 4 platform includes integrated audit tools and formal verification processes. The token issuance platform includes safeguards against unauthorized minting, transfer restrictions for compliance purposes, and emergency procedures for addressing technical issues through multi-layered security architecture.

The platform's Multi-Party Computation (MPC) technology ensures that critical operations require multiple authorized parties, eliminating single points of failure while maintaining operational efficiency through distributed key management systems.

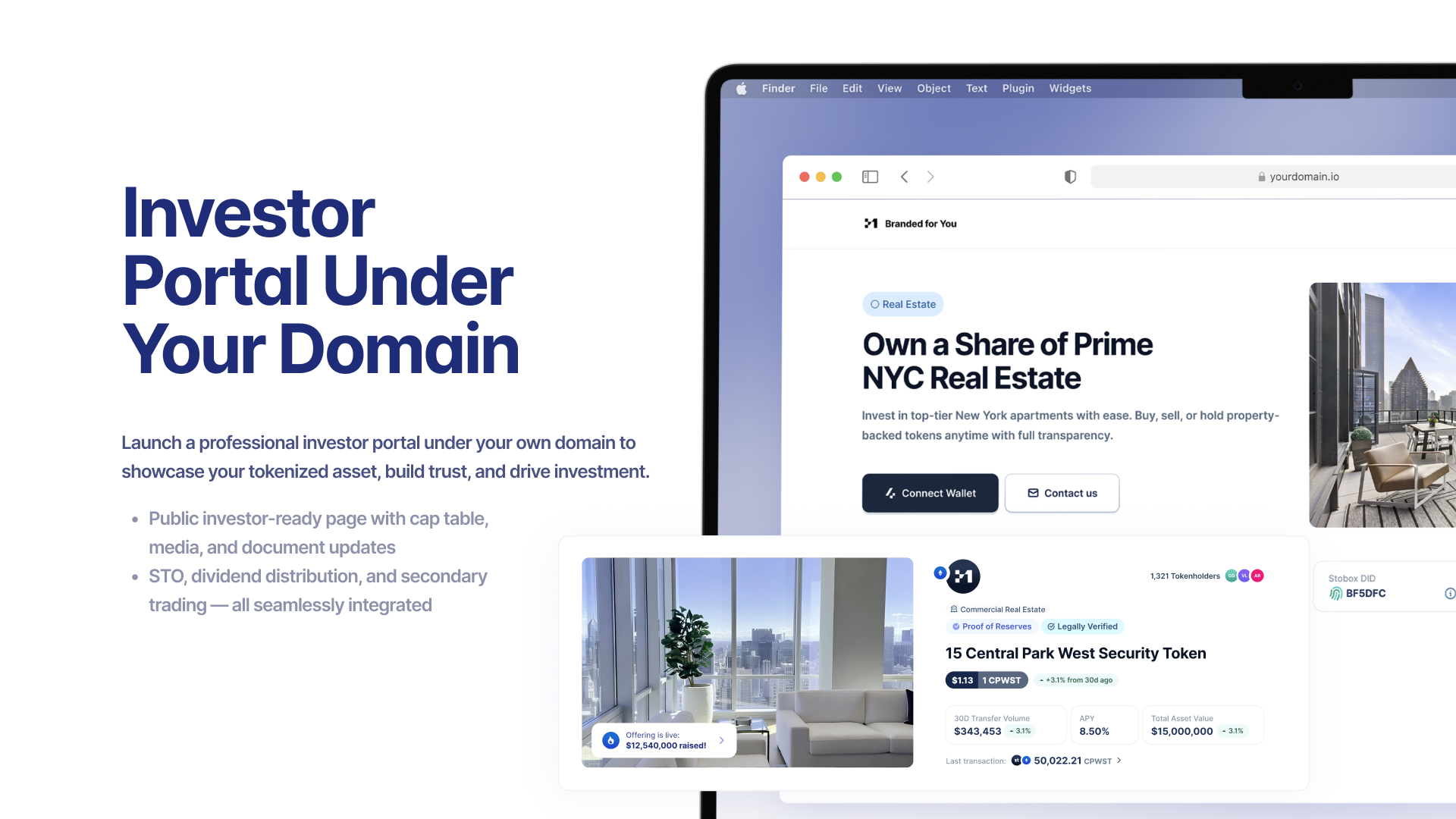

Primary Sale & Distribution

Marketing and selling tokens to initial investors requires careful balance between generating interest and maintaining regulatory compliance through sophisticated investor onboarding and communication systems. The Stobox 4 platform provides White-Label Issuer Page tools that enable projects to create professional, branded investor portals with integrated documentation, videos, and marketing materials.

Marketing materials must provide comprehensive information about the underlying asset, risks involved, and expected returns without making inappropriate promises or guarantees, all managed through the platform's content management and compliance review systems. The distribution process typically involves whitelisting qualified investors, conducting the token sale through compliant platforms, and ensuring proper allocation mechanisms through automated smart contract execution.

The Stobox 4 platform features a Structured Tokenization Flow that transitions from basic forms to a defined tokenization methodology with guidance from the onboarding team and AI support. Many projects use tiered sales structures that offer early investors better terms while reserving portions for different investor categories, all managed through the platform's sophisticated allocation and pricing algorithms.

Integrated Wallet Connect & KYC Flow enables investors to register and onboard via the Issuer Page using the Stobox Wallet, with seamless KYC integration and project subscription tools that streamline the entire investment process while maintaining full regulatory compliance.

Asset Management & Servicing

Ongoing asset management becomes more sophisticated with tokenized ownership structures supported by comprehensive digital infrastructure. Traditional property management, financial reporting, and investor communications must be adapted to serve potentially hundreds or thousands of token holders instead of a single owner or small group of partners through scalable technology solutions.

The Stobox 4 platform provides advanced Asset Management tools including automated reporting, transparent performance tracking, and streamlined communication with token holders through integrated investor relations systems. The Issuer Analytics Panel tracks engagement metrics including visits, registrations, and verification statuses while providing comprehensive performance data for informed decision-making.

Regular financial reports, asset updates, and distribution calculations are automatically generated and distributed to maintain investor confidence and regulatory compliance through the platform's comprehensive reporting and communication suite. The platform supports complex asset management workflows including maintenance scheduling, vendor management, and financial planning tools that ensure professional-grade asset stewardship.

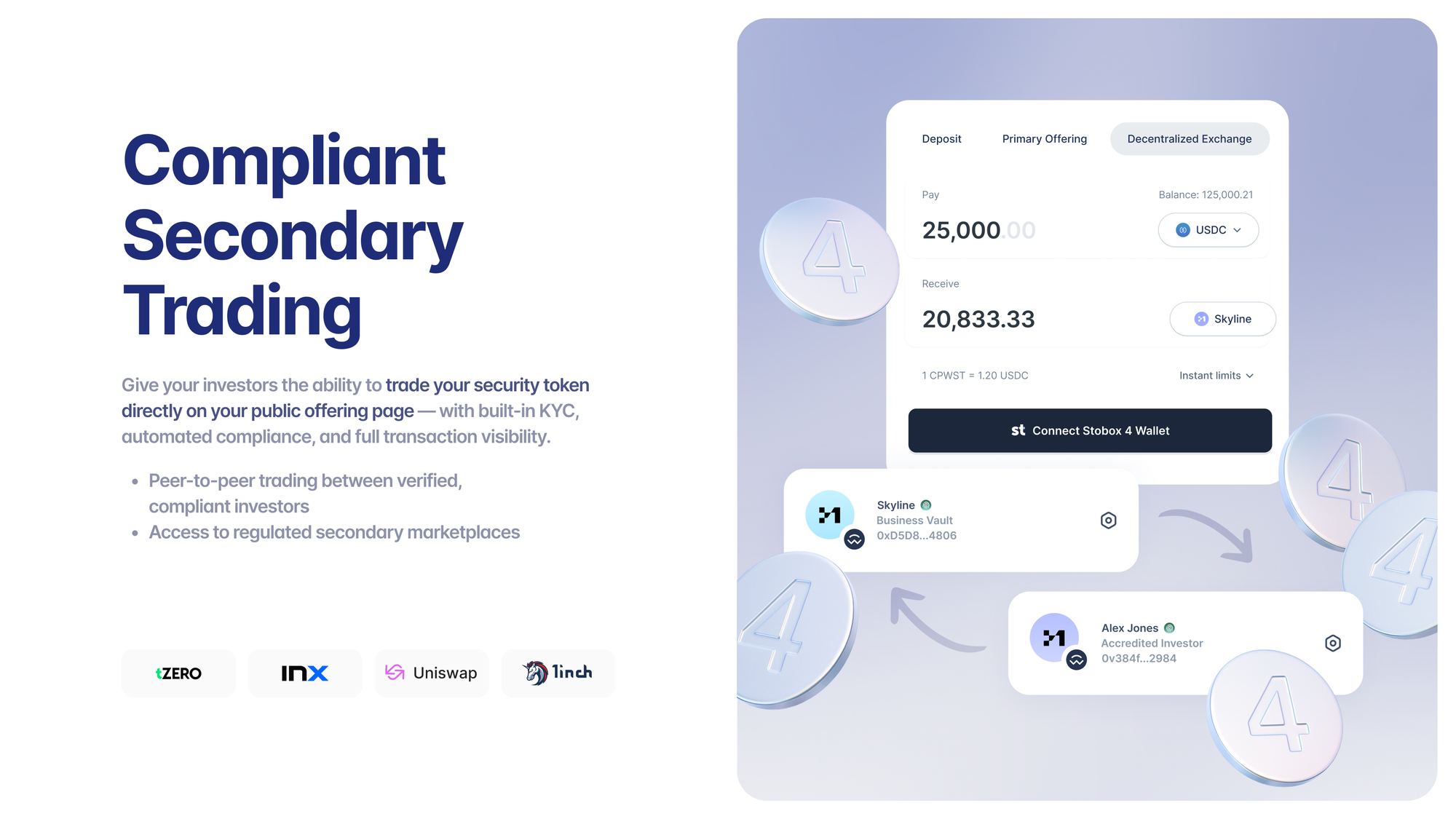

Secondary Market Trading

Enabling token trading requires establishing or partnering with compliant trading platforms that can handle the specific requirements of tokenized assets through sophisticated market infrastructure. The Stobox 4 platform integrates with multiple trading venues and provides comprehensive secondary market support including liquidity management, market making, and trading analytics.

These platforms must implement appropriate investor verification, transfer restrictions, and reporting mechanisms to maintain regulatory compliance through automated monitoring and real-time compliance checking. The platform's advanced trading infrastructure supports multiple order types, automated market making, and cross-platform interoperability to maximize liquidity opportunities.

Liquidity development often takes time as markets establish price discovery mechanisms and build sufficient trading volume through the platform's comprehensive market development tools. Projects may utilize the platform's integrated market-making services and incentive programs to encourage trading activity while the secondary market develops organically through community building and investor engagement features.

The platform's multi-blockchain support enables tokens to trade across different networks, maximizing liquidity opportunities while maintaining regulatory compliance through automated cross-chain compliance monitoring and reporting systems.

Our experts will guide you through every step of the process

Challenges and Risks

While asset tokenization offers significant opportunities, it also presents substantial challenges that must be carefully considered and addressed. Understanding these risks is crucial for both asset issuers and investors to make informed decisions and implement appropriate safeguards. However, advanced tokenization platforms have developed sophisticated solutions to address many of these challenges, transforming potential obstacles into competitive advantages through innovative technology and comprehensive risk management frameworks.

Regulatory Uncertainty

The regulatory landscape for tokenized assets remains fragmented and evolving across different jurisdictions. What's considered compliant in one country may violate securities laws in another, creating complex compliance requirements for projects seeking global investor participation through multi-jurisdictional offerings.

⚠️ Challenge Reality

Regulatory changes can dramatically impact existing tokenization projects. New rules might require additional compliance measures, restrict certain types of investors, or even prohibit specific tokenization structures entirely.

Regulatory changes can dramatically impact existing tokenization projects. New rules might require additional compliance measures, restrict certain types of investors, or even prohibit specific tokenization structures entirely. This uncertainty makes long-term planning difficult and can affect token values as regulatory environments shift across different markets and timeframes.

✅ Stobox Solution

The Stobox 4 platform features built-in regulatory intelligence that tracks regulatory changes across multiple jurisdictions and automatically updates compliance requirements, ensuring projects remain compliant as regulations evolve.

However, leading platforms address regulatory uncertainty through proactive compliance strategies and comprehensive legal frameworks. Professional regulatory compliance guidance helps navigate these complex requirements effectively through specialized expertise and automated compliance monitoring. The Stobox 4 platform features built-in regulatory intelligence that tracks regulatory changes across multiple jurisdictions and automatically updates compliance requirements, ensuring projects remain compliant as regulations evolve.

Advanced platforms maintain relationships with regulatory bodies and participate in industry standardization efforts, providing clients with early insights into regulatory developments and helping shape favorable regulatory outcomes through active engagement with policymakers and industry associations.

Security Risks

Smart contract vulnerabilities represent a persistent threat to tokenized assets. Bugs in contract code, inadequate security audits, or unforeseen attack vectors can result in permanent loss of funds or unauthorized token transfers. Unlike traditional finance, blockchain transactions are typically irreversible, making security paramount for investor protection.

🔒 Security Innovation

MPC Technology: The Stobox 4 platform utilizes Multi-Party Computation (MPC) technology that ensures private keys are never stored in a single location, dramatically reducing security risks while maintaining user control.

Custody and key management present additional security challenges. Investors must secure their private keys while token issuers need robust security for administrative functions. Human error, phishing attacks, or compromised security procedures can lead to significant losses that may not be recoverable through traditional recovery mechanisms.

Advanced tokenization platforms have revolutionized security through innovative technologies that exceed traditional financial security standards. Understanding overcoming digital asset risks and implementing secure tokenization platforms helps mitigate these threats through enterprise-grade security architecture.

The Stobox 4 platform utilizes Multi-Party Computation (MPC) technology that ensures private keys are never stored in a single location, dramatically reducing security risks while maintaining user control. Multi-device security systems allow users to manage assets across different devices while maintaining consistent security standards through distributed key management that eliminates single points of failure.

Comprehensive security audits, formal verification processes, and real-time monitoring systems provide continuous security oversight, while integrated insurance options protect against potential losses through institutional-grade risk management frameworks.

Liquidity Barriers

Despite tokenization's promise of increased liquidity, many tokenized assets still struggle with limited trading volumes and wide bid-ask spreads. Creating genuine liquidity requires sufficient market participants, which can take years to develop for newer asset classes through organic market development processes.

Regulatory restrictions often limit the pool of eligible traders, constraining liquidity development. Transfer restrictions, holding periods, and investor qualification requirements can prevent the free trading that's necessary for robust secondary markets, creating artificial barriers to natural price discovery mechanisms.

However, security tokens in volatile markets can still provide value even during challenging market conditions through innovative liquidity solutions and market-making mechanisms. Advanced platforms address liquidity challenges through comprehensive market development strategies and automated liquidity provision systems.

The Stobox 4 platform includes integrated market-making tools, liquidity pools, and cross-platform trading capabilities that enhance liquidity across multiple venues. Multi-blockchain support enables tokens to access liquidity across different networks, maximizing trading opportunities while maintaining regulatory compliance through automated cross-chain monitoring systems.

Operational Complexity

Managing tokenized assets requires new operational capabilities that many traditional asset managers lack. Integration between blockchain systems and existing business processes often proves more complex and expensive than initially anticipated, creating barriers to adoption for traditional financial institutions.

Technical infrastructure requirements include blockchain integration, wallet management, compliance monitoring, and investor communication systems. These technological demands can overwhelm organizations that lack sufficient technical expertise or resources, leading to implementation challenges and ongoing operational difficulties.

Stobox manages regulatory compliance, security, and technical implementation

Leading tokenization platforms have transformed operational complexity into competitive advantage through comprehensive automation and user-friendly interfaces. Turnkey tokenization solutions help address these complexities by providing comprehensive, ready-to-use platforms that eliminate technical barriers and reduce operational overhead.

The Stobox 4 platform provides complete operational automation including investor onboarding, compliance monitoring, asset management, and reporting through intuitive interfaces that require minimal technical expertise. Comprehensive API integration enables seamless connection with existing business systems, while white-label solutions allow organizations to maintain their brand identity while leveraging advanced tokenization infrastructure.

Educational Gaps

Both issuers and investors often lack sufficient understanding of tokenization's implications, leading to unrealistic expectations or inadequate risk management. The complexity of blockchain technology, smart contracts, and digital asset custody creates barriers to widespread adoption among traditional market participants.

Professional service providers, including lawyers, accountants, and financial advisors, frequently lack experience with tokenized assets. This knowledge gap can result in inadequate professional guidance and increased project risks, slowing market development and creating potential compliance issues.

Advanced platforms address educational gaps through comprehensive support and educational resources. Comprehensive tokenization education guides help bridge these knowledge gaps for all stakeholders through structured learning programs and ongoing support.

The Stobox 4 platform includes extensive documentation, video tutorials, and AI-powered guidance systems that help users understand tokenization concepts and navigate platform features effectively. Dedicated support teams provide personalized guidance throughout the tokenization process, while comprehensive training programs help professional service providers develop expertise in tokenized asset management.

Regular webinars, industry reports, and best practice guides ensure that all ecosystem participants stay informed about latest developments and regulatory changes, creating a more educated and capable market ecosystem that benefits all participants through improved understanding and risk management.

Current Adoption Examples

Real-world tokenization projects across various sectors demonstrate both the potential and current limitations of asset tokenization. These examples provide valuable insights into what works, what doesn't, and where the technology is heading.

Institutional Adoption

JPMorgan's Onyx platform has facilitated billions of dollars in blockchain-based transactions, including tokenized deposits and repo agreements. The platform demonstrates how major financial institutions can leverage tokenization for improved efficiency in traditional financial operations while maintaining regulatory compliance.

Goldman Sachs has explored tokenization through its digital assets platform, focusing on private market investments and alternative assets. Their approach emphasizes institutional-grade infrastructure and regulatory compliance, setting standards for how traditional financial institutions can embrace tokenization.

Real Estate Projects

The St. Regis Aspen Resort tokenization allowed investors to purchase fractional ownership in luxury real estate starting at $250,000 per token. This project demonstrated both the potential for tokenizing high-value real estate and the challenges of creating sufficient investor demand for illiquid assets.

Various real estate tokenization projects have emerged globally, with mixed success rates. Success stories like Candela's tokenized real estate in Tulum and CryptoRealKey's investment platform show how projects can successfully raise capital and provide returns to investors, while others have struggled with regulatory compliance, liquidity development, or operational execution.

Tokenized Funds

BlackRock's BUIDL fund became one of the largest tokenized Treasury funds, demonstrating institutional appetite for blockchain-based fund structures. The fund's success shows how traditional asset managers can use tokenization to offer enhanced transparency and operational efficiency.

Franklin Templeton has tokenized several of its money market funds, providing investors with blockchain-based shares that offer improved transparency and potentially faster settlement times compared to traditional fund structures.

Tokenized Debt & Carbon Credits

Ondo Finance has created tokenized versions of various fixed-income products, allowing retail investors to access institutional-quality debt instruments with lower minimum investments. Their platform demonstrates how tokenization can democratize access to traditionally exclusive investment products.

Carbon credit tokenization has gained traction as organizations seek more transparent and efficient ways to trade environmental assets. These platforms enable better price discovery and broader participation in carbon markets, supporting global climate initiatives.

Market Outlook

The future of asset tokenization will be shaped by regulatory developments, technological improvements, and growing institutional adoption. Several key trends are likely to define the market's evolution over the coming years, with innovative platforms like Stobox leading the future of asset tokenization through groundbreaking solutions that address current limitations while creating entirely new possibilities for digital asset management and investment.

Regulation & Standardization

Regulatory clarity is emerging in key markets, with frameworks like the EU's Markets in Crypto-Assets (MiCA) regulation and various pilot programs providing clearer guidelines for tokenization projects. The UK's Digital Securities Sandbox and Singapore's Project Guardian demonstrate regulatory willingness to support innovation while maintaining investor protection through carefully designed frameworks.

Standardization efforts are developing common protocols for tokenized assets, including standard smart contract interfaces, compliance frameworks, and interoperability standards. These developments should reduce implementation costs and improve market efficiency as the industry matures through collaborative development and shared best practices.

Organizations with regulatory compliance expertise and active participation in blockchain ecosystem leadership initiatives are well-positioned for this evolution. Leading platforms are proactively engaging with regulators and contributing to industry standards development, ensuring their technology and compliance frameworks evolve alongside regulatory requirements.

The Stobox 4 platform's built-in regulatory intelligence system automatically tracks regulatory changes across multiple jurisdictions and updates compliance requirements in real-time, ensuring projects remain compliant as regulations evolve. This proactive approach to regulatory management positions platform users at the forefront of regulatory compliance while reducing compliance risks and operational overhead.

Advanced platforms are also developing regulatory-first design principles that build compliance into the core architecture rather than treating it as an add-on feature, creating more robust and future-proof tokenization solutions that can adapt to changing regulatory environments.

Interoperability & Cross-Chain Development

Multi-chain infrastructure development is addressing the limitation of single-blockchain tokenization projects through sophisticated cross-chain protocols and interoperability solutions. Cross-chain bridges and interoperability protocols will enable tokenized assets to move between different blockchain networks, increasing potential liquidity and investor access while maintaining security and compliance standards.

Layer 2 scaling solutions are making tokenization more cost-effective by reducing transaction fees and increasing throughput, making micro-investments and frequent trading more economically viable. These improvements potentially expand the addressable market for tokenized assets through advanced tokenization technology that supports multiple blockchain networks and optimization strategies.

The Stobox 4 platform's multi-blockchain architecture enables projects to deploy tokens across different networks simultaneously, optimizing for specific requirements such as transaction costs, settlement speed, or regulatory compliance. This flexibility allows projects to access the best features of different blockchain ecosystems while maintaining unified management and compliance oversight.

Advanced interoperability features include cross-chain asset transfers, unified liquidity pools, and seamless user experiences that abstract away blockchain complexity while maintaining the security and transparency benefits of distributed ledger technology. These developments are creating a more connected and efficient tokenization ecosystem that maximizes opportunities for both issuers and investors.

Future developments include automated cross-chain arbitrage, dynamic network selection based on real-time conditions, and unified governance systems that enable coordinated decision-making across multiple blockchain networks, further enhancing the efficiency and accessibility of tokenized asset ecosystems.

Institutional Infrastructure Evolution

Traditional financial infrastructure providers are developing blockchain-compatible systems for custody, settlement, and compliance that meet institutional requirements for security, reliability, and regulatory compliance. This institutional-grade infrastructure development is essential for large-scale adoption of tokenized assets by pension funds, insurance companies, and other institutional investors who require enterprise-level operational standards.

Integration with existing financial systems through APIs and middleware solutions will enable tokenized assets to fit seamlessly into traditional portfolio management and trading systems, reducing adoption barriers for institutional investors while maintaining their existing operational workflows and risk management procedures.

Understanding financial sector transformation and implementing enterprise-ready solutions positions organizations at the forefront of this institutional evolution. Leading platforms are developing comprehensive institutional features including multi-signature governance, institutional-grade custody solutions, and enterprise-level reporting and analytics capabilities.

The Stobox 4 platform includes specialized institutional features such as advanced risk management tools, comprehensive audit trails, institutional-grade security protocols, and seamless integration with existing financial infrastructure. These capabilities enable traditional financial institutions to adopt tokenization without compromising their operational standards or regulatory obligations.

Future institutional infrastructure developments include integration with central bank digital currencies (CBDCs), automated regulatory reporting, real-time settlement systems, and sophisticated risk management tools that provide institutional investors with the confidence and operational efficiency needed for large-scale tokenization adoption.

Innovation in Asset Classes

The expansion of tokenizable asset classes continues to accelerate, with innovative concepts like "Tokenization of Time" demonstrating how human capital and professional services can be transformed into tradeable digital assets. This revolutionary approach enables professionals to monetize their expertise while creating new investment opportunities that were previously impossible to access or trade.

Emerging asset classes include intellectual property portfolios, future revenue streams, environmental impact credits, and various forms of intangible assets that benefit from the transparency and fractionalization capabilities of tokenization technology. These developments are expanding the total addressable market for tokenization beyond traditional asset categories.

Advanced tokenization platforms are developing specialized modules and frameworks for handling complex and innovative asset types, including dynamic pricing models, automated performance tracking, and sophisticated smart contract structures that can accommodate the unique characteristics of different asset classes while maintaining regulatory compliance and investor protection.

The integration of Internet of Things (IoT) sensors, artificial intelligence, and satellite monitoring with tokenized assets creates new possibilities for real-time asset tracking, automated performance measurement, and dynamic pricing that reflects actual asset performance and market conditions in unprecedented detail.

Stobox Vision and Platform Evolution

The Stobox 4 platform roadmap for 2025 includes groundbreaking features that will further revolutionize the tokenization landscape. Planned developments include enhanced AI-powered guidance systems, advanced analytics and reporting capabilities, expanded multi-blockchain support, and innovative features for managing complex tokenization scenarios.

White-label issuer page tools will enable organizations to create fully branded tokenization experiences while leveraging the advanced infrastructure and compliance capabilities of the Stobox platform. This approach allows organizations to maintain their brand identity and customer relationships while accessing institutional-grade tokenization technology.

The platform's structured tokenization flow with AI support will further simplify the tokenization process, making sophisticated asset digitization accessible to organizations without extensive blockchain expertise while maintaining professional-grade security and compliance standards.

Future innovations include predictive analytics for tokenization success, automated market-making algorithms, advanced governance tools, and integration with emerging technologies such as artificial intelligence and quantum-resistant cryptography to ensure long-term security and functionality.

The vision extends beyond traditional asset tokenization to encompass comprehensive digital asset ecosystems that support the full lifecycle of tokenized assets from initial conception through ongoing management and eventual disposition, creating a complete infrastructure for the tokenized economy of the future.

Book your free consultation and discover your tokenization opportunities

Conclusion

Asset tokenization represents a fundamental shift in how we think about ownership, investment, and value transfer, powered by advanced platforms that transform complex blockchain technology into accessible, institutional-grade solutions. By converting physical and financial assets into digital tokens, we're creating new possibilities for fractional ownership, global access, and automated management that weren't possible with traditional financial instruments, while revolutionary concepts like "Tokenization of Time" demonstrate how the scope of tokenizable assets continues to expand beyond conventional boundaries.

The technology has moved beyond experimental phases into real-world applications across multiple asset classes, supported by comprehensive platforms that provide enterprise-grade security and compliance automation. From BlackRock's tokenized funds to fractional real estate ownership and innovative human capital tokenization, the technology is proving its value in diverse contexts through sophisticated infrastructure that addresses the complex requirements of modern financial markets.

However, success requires careful attention to regulatory compliance, security implementation, and realistic expectations about liquidity development, all of which are addressed by advanced tokenization platforms that provide automated compliance monitoring, multi-party computation security, and comprehensive market development tools. The integration of artificial intelligence, real-time analytics, and cross-chain interoperability creates unprecedented opportunities for asset optimization and risk management.

For businesses, tokenization offers new capital-raising opportunities and ways to unlock value from illiquid assets through turnkey solutions that eliminate traditional technical barriers while maintaining professional-grade compliance and security standards. For investors, it provides access to previously exclusive investment opportunities with potentially lower barriers to entry, enhanced transparency, and sophisticated portfolio management tools that rival institutional-grade systems.

For the broader financial system, tokenization promises greater efficiency, transparency, and global connectivity through automated smart contract execution, real-time settlement capabilities, and seamless integration with existing financial infrastructure. The emergence of multi-blockchain ecosystems and cross-chain interoperability further enhances these benefits while reducing operational complexity and transaction costs.

The challenges are real – regulatory uncertainty, technical complexity, and education gaps continue to influence adoption rates and create implementation risks. However, these issues are being systematically addressed through improved infrastructure, clearer regulations, and growing market expertise, while leading platforms provide comprehensive solutions that transform potential obstacles into competitive advantages through innovative technology and proactive risk management.

As this technology continues evolving through platforms like Stobox 4 that incorporate advanced AI guidance, predictive analytics, and revolutionary asset classes, those who understand its capabilities and limitations will be best positioned to capitalize on the opportunities it creates while avoiding the pitfalls that have challenged early adopters. Whether you're exploring tokenization for fundraising, investment diversification, or operational efficiency, the infrastructure and expertise needed for success are now readily available.

The transformation is accelerating, and tokenization will play a central role in the future of finance – not as a replacement for traditional systems, but as a powerful enhancement that makes markets more accessible, efficient, and globally connected. Ready to explore how advanced tokenization can benefit your business or investment strategy? Start your tokenization journey with expert guidance tailored to your specific needs and objectives, leveraging cutting-edge technology that's shaping the future of digital asset management.