Why do problems with the crypto market positively affect the security token market?

Over the past 24 hours, the value of the main crypto asset Bitcoin has fallen down to $15.5k, and in the context of the week, the asset has lost more than 20% of its value.

Today, those who follow the crypto market may feel panic and confusion. The price of bitcoin is rapidly falling amid bad news from the FTX exchange, although this case is far from the first, and, unfortunately, not the last case. All these cases greatly undermine the credibility of the industry and force regulators to be more attentive to market control.

Unfortunately, crypto giants growing like on steroids often neglect the basic principles of asset management and start playing with client money, which always ends badly. The last cases of Celsius or 3AC clearly showed what careless management can look like.

Over the past 24 hours, the value of the main crypto asset Bitcoin has fallen down to $15.5k, and in the context of the week, the asset has lost more than 20% of its value.

Crypto investments can bring fabulous returns, but even one day they can leave investors with a broken trough, especially those who are still playing on margin trading.

As many of you know, Stobox focuses on security tokens or tokenized securities and it is important to understand the difference between crypto tokens and blockchain securities. After all, with all the similarities, these are absolutely two different types of assets. Let's try to find out more...

Firstly, both utility and security tokens are built on smart contracts in the blockchain and have similar external characteristics, but a security token is primarily a corporate security, confirmed by a legitimate issuer. Security tokens are backed by real business assets. A classic cryptocurrency or utility value token is not backed by any real asset. This does not mean that it is bad, it means that investors in the event of a liquidation of a business are not entitled to any assets or compensations!

Secondly, security tokens are regulated assets, the issuance, and management of which fall entirely under securities laws. These are comprehensive provisions obliging issuers to act in accordance with established rules with full transparency for investors. Any student can create a utility token, list it on a decentralized exchange, and start attracting investors by promising mountains of gold. The lack of control has repeatedly depressed the industry and disappointed investors.

Thirdly, not only the way security tokens are sold differs from utility tokens, but their secondary trading. Cryptocurrency centralized exchanges do not have the same regulations and processes as securities exchanges. Often, crypto exchanges simply deceive their clients by seeing the accumulation of orders and using automated AI bots to make money in their favor. We are somewhat reminiscent of the Forex brokers market until it was equated with banking and not fully regulated. More than 1,000 cryptocurrency exchanges operate on the market, and only a few have licenses to trade security tokens, such as Bitfinex Securities.

That is why we believe that the more the cryptocurrency market storms, the faster the regulated finance market on the blockchain will develop, especially the security token market.

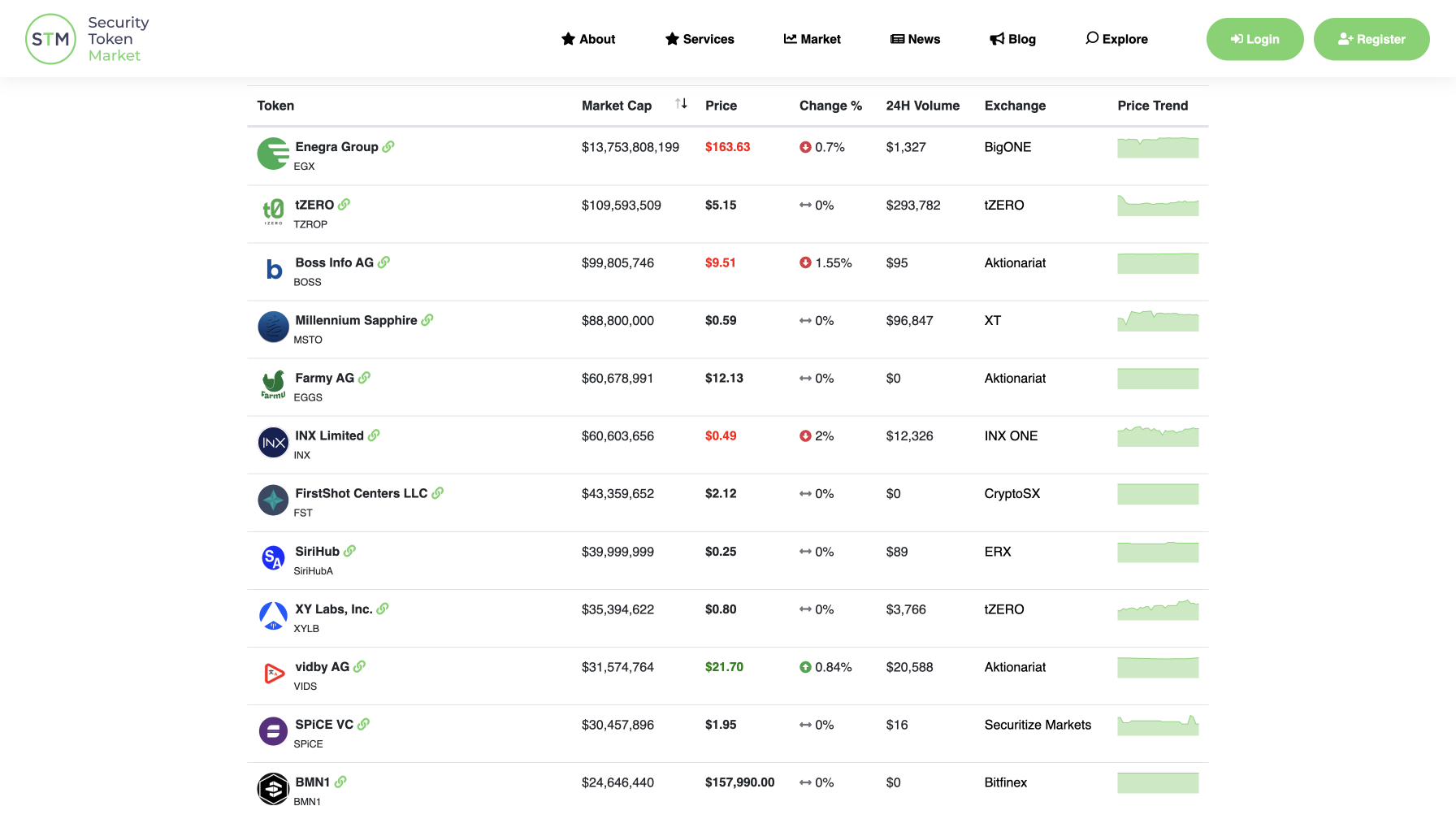

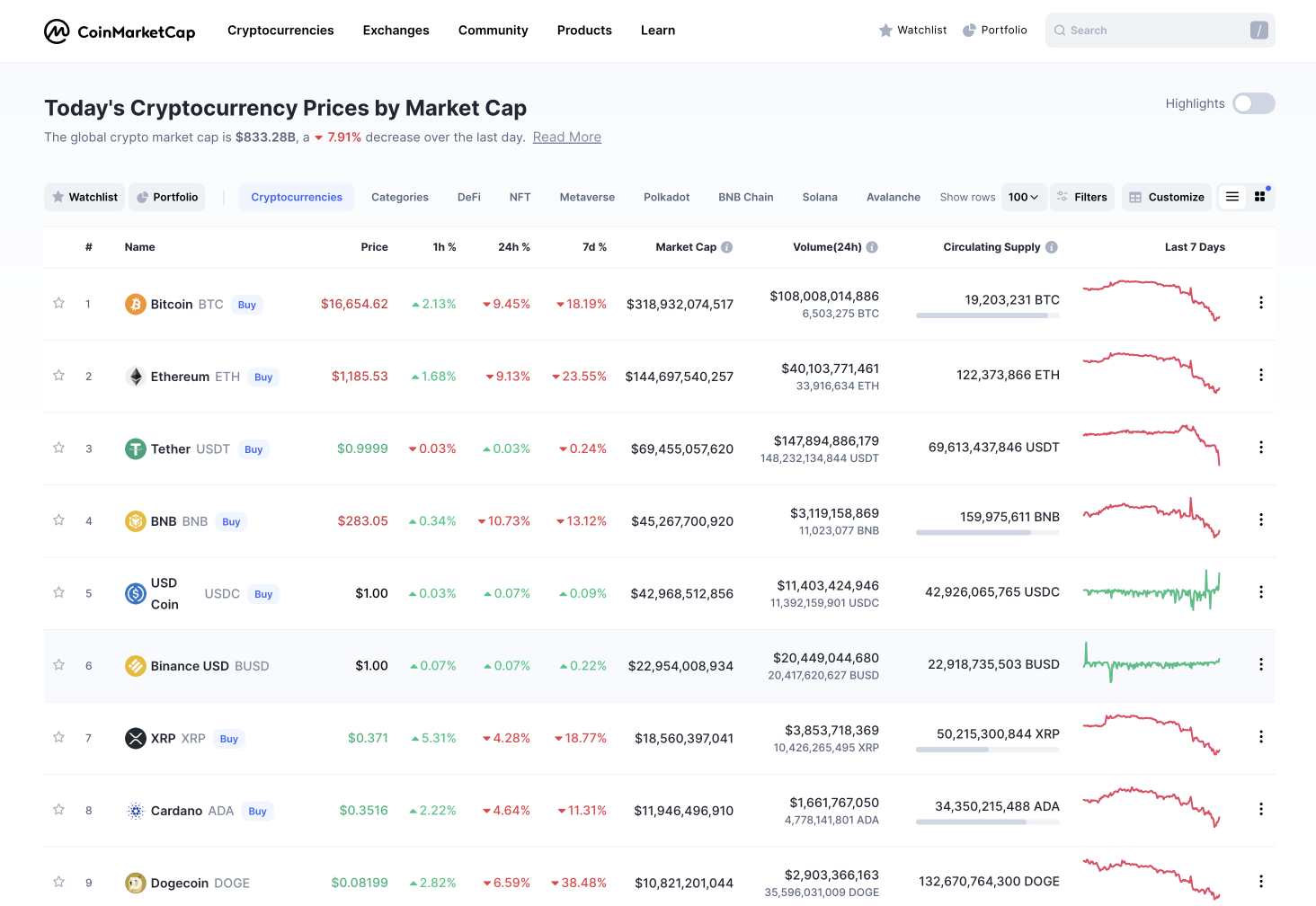

Below you can see a comparison of the price chart of the main tokens. On the left is data from STOMarket, and on the right is CoinMarketCap. There is no dependency between them. And this means that turbulences in the crypto market do not affect the security token market. And of course, because their main value is determined by the value of business assets, and not by the speculative component.

We at Stobox were able to foresee the fact that the regulation of assets on the blockchain would require regulation, so we relied on the development of technology products, taking into account all the requirements for compliance and regulation. Stobox clients issue and manage their own tokenized assets based on distributed ledger technologies.

We are open to collaborations and partnerships. We are willing to share information with our clients and help them really experience the benefits of tokenization. We are an award-winning tokenization company that provides technology and consulting to help clients leverage digital assets and tokenized securities.