Types of Real Estate You Can Tokenize: A Complete Guide for Business Owners

Explore how various real estate types including residential, commercial, and industrial properties can be tokenized. Learn how Stobox 4 supports compliant configuration and management of tokenized assets through technical infrastructure.

Real estate tokenization is reshaping how property owners raise capital and how participants access investment opportunities in physical assets. Whether you manage residential buildings, operate commercial facilities, or develop industrial properties, understanding which types of real estate assets can be tokenized is essential for making strategic business decisions in today's digital economy.

This comprehensive guide explores the full spectrum of real estate assets suitable for tokenization, helping business owners identify the best opportunities for their portfolios and understand the technical infrastructure needed to execute successfully.

Quick takeaway: Real estate tokenization works across multiple asset classes, from single residential properties to complex portfolio structures, each offering distinct advantages for capital formation and participant access.

Discover how different real estate asset types can be tokenized on a compliant technical infrastructure designed specifically for property owners and developers.

Types of Underlying Real Estate Assets You Can Tokenize

Different real estate asset types present unique opportunities and considerations for tokenization. Understanding these distinctions helps business owners select the most suitable approach for their specific properties and business objectives.

Residential Properties

Residential real estate tokenization covers single-family homes, apartment buildings, condominiums, and villa complexes. These properties appeal to participants seeking exposure to housing markets without the capital requirements of traditional whole-property purchases.

Property owners can configure tokens representing fractional ownership in residential buildings, enabling multiple participants to hold stakes in a single property. This approach works particularly well for luxury residences, multi-unit apartment complexes, and vacation properties where rental income provides ongoing cash flow to token holders.

The Candela project in Tulum, Mexico, demonstrates this model effectively. The development tokenized luxury villas in a private residential community, with the first villa achieving full pre-sale before the platform launch. This case illustrates strong participant demand for tokenized residential real estate even during challenging market conditions.

Technical implementation: Residential property tokenization through Stobox 4 involves configuring the token structure to represent either equity shares in the property-owning entity or rights to specific cash flows. The platform's Tokenization Framework assists in structuring appropriate token parameters based on the residential asset characteristics. Verification workflows can be configured to meet jurisdiction-specific requirements for residential securities.

Commercial Properties

Tokenizing commercial real estate encompasses office buildings, retail centers, shopping complexes, and mixed-use developments. Commercial properties typically generate stable rental income from business tenants, making them attractive for tokenization structures focused on cash flow distribution.

Business owners operating commercial real estate can configure tokens that represent ownership stakes in income-producing assets. The regular lease payments from commercial tenants provide predictable revenue streams that can be programmed into smart contracts for automated distribution to token holders.

Commercial property tokenization offers business advantages including access to capital for property improvements, expansion financing, and refinancing opportunities without traditional debt structures. The ability to present projects to a verified participant base globally expands the potential capital pool beyond local markets.

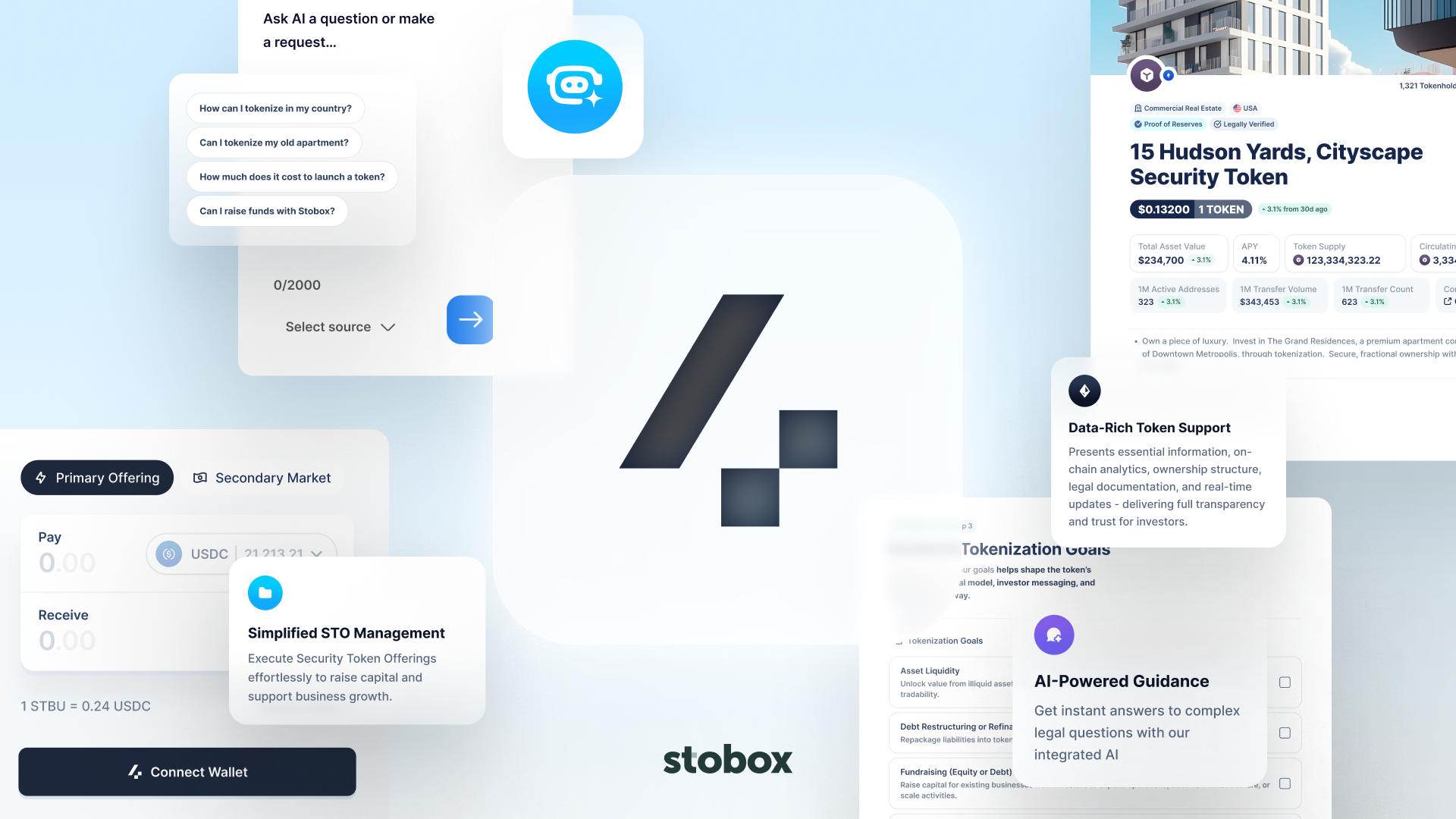

How Stobox 4 supports commercial tokenization: The platform's Financial Operations and Settlement Mechanics enable automated cash flow distribution according to predefined rules configured by the issuer. Commercial property owners can set up payout schedules that align with lease payment timing, ensuring transparent and efficient distribution to token holders. The Public Investor Portal provides participants with real-time visibility into property performance metrics published by the issuer.

Industrial & Logistics Assets

Industrial real estate tokenization covers warehouses, distribution centers, manufacturing facilities, and logistics hubs. This sector has experienced significant growth driven by e-commerce expansion and supply chain modernization, making it increasingly attractive for tokenization.

Industrial properties often feature long-term lease agreements with established corporate tenants, providing stable cash flows suitable for token structures. The large capital requirements for industrial facilities make fractional ownership particularly valuable, allowing participants to access this asset class with lower investment thresholds.

Tokenizing logistics facilities enables property owners to raise capital for facility expansion, technology upgrades, or portfolio acquisitions. The technical infrastructure supports configuring tokens that represent either direct ownership in the facility or claims on rental income streams.

Platform capabilities: Stobox 4's multi-blockchain support allows industrial property owners to select the most appropriate blockchain network based on transaction costs, speed requirements, and participant preferences. The platform currently supports Arbitrum, with plans to expand to additional networks post-beta like Ethereum, Optimism, and Plume networks.

Land & Development Projects

Raw land and properties under development present unique tokenization opportunities. Developers can configure tokens representing future ownership stakes in projects not yet completed, enabling capital formation during the construction phase.

Land tokenization works for agricultural land, undeveloped lots, and parcels designated for future construction. Development project tokenization allows developers to present their projects to potential participants before completion, providing the capital needed to execute construction while offering participants exposure to property appreciation potential.

This approach requires careful structuring to address the risks associated with incomplete projects. Clear milestone-based frameworks and transparent progress reporting help build participant confidence in development-stage tokenization.

Technical structuring with Stobox 4: The platform's Tokenization Framework guides developers through configuring tokens for pre-construction or development-stage projects. Issuers can upload project documentation, construction timelines, and milestone schedules to their public-facing issuer pages. The STV3 protocol's metadata capabilities enable embedding project-specific information directly into the token structure, providing participants with verifiable on-chain access to key project details.

Real Estate Cash-Flows & Revenue Streams

Rather than tokenizing ownership of physical properties directly, business owners can tokenize the income rights associated with real estate assets. This model separates cash flow rights from ownership, creating tokens that represent claims on rental income, parking revenue, or other property-generated cash streams.

Cash flow tokenization offers flexibility for property owners who want to raise capital while retaining full ownership and control of physical assets. Participants receive tokens representing entitlement to specific revenue streams without acquiring voting rights or ownership stakes in the underlying property.

This structure works particularly well for properties with diverse revenue sources such as mixed-use developments with retail, office, and residential components. Each revenue stream can be tokenized separately, allowing participants to select exposure to specific income types.

Automation capabilities: Stobox’s smart contract infrastructure enables automatic distribution of cash flows according to issuer-configured rules. Property owners can set up distribution schedules, minimum thresholds, and reserve requirements directly within the platform. The Financial Operations module tracks revenue collection and executes distributions transparently, with all transactions recorded on-chain for participant visibility.

Portfolio or Basket Tokenization

Portfolio tokenization involves grouping multiple real estate assets into a single token structure. Rather than tokenizing individual properties, this approach creates tokens representing ownership or cash flow rights across an entire portfolio of assets.

This model provides diversification benefits for participants and operational efficiencies for property owners managing multiple assets. A single token can represent stakes in residential, commercial, and industrial properties simultaneously, spreading risk across property types, geographic locations, and tenant profiles.

Portfolio tokenization resembles traditional Real Estate Investment Trusts in concept but leverages blockchain infrastructure for enhanced transparency and potentially lower operational costs. Property owners can add or remove assets from the portfolio according to predefined governance rules, allowing dynamic portfolio management while maintaining participant protections.

How Stobox 4 handles portfolio structures: The platform's Roles and User Management System enables issuers to configure governance frameworks for portfolio tokens. Property managers can be assigned specific permissions to handle day-to-day operations while maintaining oversight controls. The Tokenization Framework supports configuring tokens that represent baskets of multiple properties, with metadata structures that provide participants visibility into the underlying portfolio composition.

How to Choose the Right Type of Real Estate to Tokenize

Selecting appropriate real estate assets for tokenization requires evaluating several business and technical criteria. Not all properties are equally suited for tokenization, and careful assessment helps ensure successful outcomes.

Asset value and divisibility: Properties with higher values generally justify tokenization costs more effectively. However, platforms that support multiple tokenizations can make smaller properties economically viable by spreading infrastructure costs across numerous projects. Consider whether the property value can be meaningfully divided into token units that appeal to your target participant base.

Income stability and predictability: Properties generating consistent cash flows are particularly suitable for tokenization structures focused on income distribution. Long-term leases with creditworthy tenants provide the predictability that participants value. Development projects carry higher risk but may offer greater appreciation potential.

Location and market dynamics: Property location affects both regulatory considerations and participant appeal. Properties in jurisdictions with clear legal frameworks for tokenized securities face fewer compliance hurdles. Market dynamics including supply-demand balance, economic growth, and demographic trends influence long-term property value and income potential.

Regulatory readiness: Different property types and jurisdictions have varying regulatory requirements. Commercial properties in established markets may face simpler compliance paths than residential properties in emerging markets. Assess the legal framework applicable to your property type and location before proceeding.

Target participant profile: Consider who you want to reach with your tokenization. Residential properties may appeal to individual participants seeking real estate exposure, while commercial properties might attract institutional participants or accredited individuals seeking income-focused assets.

Technical infrastructure requirements: Evaluate the technical capabilities needed for your property type. Properties requiring complex cash flow distributions, governance rights, or ongoing reporting benefit from platforms offering comprehensive tokenization infrastructure rather than basic smart contract deployment.

Benefits & Opportunities by Type

Different real estate asset types offer distinct advantages for both property owners and participants. Understanding these benefits helps business owners position their tokenization projects effectively.

For residential properties: Participants gain access to housing markets with lower capital requirements than traditional purchases. Property owners can raise capital for renovations, expansions, or portfolio growth while potentially retaining majority control. Landshare, a US-based Stobox client, demonstrated the power of accessible tokenization by launching one of the first tokenized real estate platforms on Binance Smart Chain. Their third offering, a tokenized house flip project, reached its fundraising goal in just 2 days with investments starting at only 50 dollars. The model focused on property renovation and resale rather than rental income, offering participants estimated ROI of 9 to 17.4 percent. This case proves that tokenization enables even small-scale participants to access property investment strategies previously available only to professional developers.

For commercial properties: The stable income streams from business tenants provide predictable cash flows suitable for income-focused token structures. Property owners benefit from accessing capital markets without traditional debt constraints. The Manhattan property tokenization in 2018, which successfully tokenized a luxury condominium building worth over 30 million dollars, established that high-value commercial real estate could be effectively fractionalized on blockchain infrastructure.

For industrial and logistics assets: The growing e-commerce sector drives demand for logistics facilities, creating appreciation potential alongside rental income. Tokenization enables participants to access this growing sector with lower minimums than institutional-grade industrial property investments typically require.

For development projects: Developers gain access to capital during construction phases when traditional financing may be expensive or restrictive. Participants can enter projects at ground-floor valuations with potential for significant appreciation as construction progresses.

For cash-flow tokenization: Property owners retain full ownership and control while accessing capital through income rights. Participants receive income exposure without property management responsibilities or ownership-related obligations.

For portfolio structures: Diversification benefits reduce risk for participants by spreading exposure across multiple properties, locations, and tenant types. Property owners achieve operational efficiencies by managing a single token structure rather than multiple individual property tokenizations.

The Lüneburg historical preservation project in Germany demonstrated community-focused benefits by successfully raising 1.5 million dollars to renovate medieval architecture through tokenization. This case proved that tokenization extends beyond financial outcomes to enable cultural preservation and community development objectives.

Different real estate types require different technical configurations and compliance approaches. Learn how Stobox 4's flexible infrastructure supports your specific property type and business model.

Challenges & Risk Considerations by Type

While tokenization offers significant opportunities, business owners must understand the challenges and risks associated with different property types to implement appropriate mitigation strategies.

Regulatory complexity varies by asset type: Residential properties may face consumer protection regulations not applicable to commercial assets. Development projects require clear disclosure of construction risks and milestone-dependent delivery. Cash-flow tokenizations must navigate securities laws regarding income-bearing instruments. Property owners should work with legal counsel to structure tokenizations that meet applicable regulatory requirements in their jurisdictions.

Liquidity considerations differ across types: While tokenization theoretically enhances liquidity compared to traditional real estate, actual secondary market activity depends on participant demand, platform capabilities, and regulatory frameworks. Commercial properties with stable tenants may attract more secondary market interest than speculative development projects.

Property management responsibilities: Tokenization doesn't eliminate the need for effective property management. Whether tokens represent full ownership or income rights, underlying properties still require maintenance, tenant management, and operational oversight. Clear frameworks for management responsibilities and participant communication are essential.

Valuation challenges: Establishing fair token pricing requires accurate property valuations. Residential properties may have comparable sales data available, while unique commercial properties or development projects require more sophisticated valuation approaches. Periodic revaluations may be necessary for long-term tokenizations.

Technology and smart contract risks: While blockchain provides security benefits, smart contract vulnerabilities or platform issues can affect token functionality. Property owners should select technical infrastructure providers with strong security practices and comprehensive audit histories.

Market volatility: Real estate markets experience cycles affecting property values and rental income. Token values may fluctuate based on both property-specific factors and broader market conditions. Transparent reporting helps participants understand performance drivers.

Stobox 4's risk mitigation approach: The platform provides compliance-aware setup with configurable verification and access rules, though issuers remain responsible for regulatory compliance. The Stobox DID module supports identity verification and role-based access controls. Multi-device security through Fireblocks MPC technology protects wallet infrastructure. However, Stobox 4 provides technical infrastructure only and does not offer legal, regulatory, or investment advisory services.

Implementation & Platform Considerations

Successfully tokenizing real estate requires navigating technical, legal, and operational considerations through a structured framework. Stobox provides full-cycle tokenization solutions backed by years of expertise, guiding property owners through each phase of the process.

Stobox Tokenization Framework Benefits

Streamline Your Process: A clear, structured approach from start to finish reduces complexity and accelerates time to market.

Ensure Regulatory Compliance: Navigate complex legal frameworks with confidence using proven methodology. Stobox's compliance-aware infrastructure helps structure tokenizations that align with regulatory requirements, though issuers remain responsible for compliance in their jurisdictions.

Enhance Investor Confidence: Build trust through well-executed, compliant tokenization processes with transparent workflows and professional implementation.

Learn from 7 Years of Experience: Leverage Stobox's track record across 100+ projects representing over $500 million in tokenized assets to avoid costly mistakes.

The Four-Phase Implementation Process

Phase 1: Defining the Asset - Establish the foundation by defining real estate asset characteristics, business objectives, and target participant profile.

Phase 2: Defining Issuing Framework - Configure the technical and legal structure including issuing country, KYB verification, company identifiers, token types, ISIN registration, token rights, licensing requirements, and yield structure.

Phase 3: Preparing for Issuance - Finalize offering materials, complete regulatory filings, and prepare technical infrastructure for token deployment with compliance validation.

Phase 4: STO Compliance Validation & Launch - Complete final compliance checks and launch the token offering, enabling verified participants to acquire tokens according to issuer-defined access rules.

Implementation Workflow

Configuring the Case: Property owners define their asset type (residential, commercial, industrial, development projects) and initiate the tokenization process.

Access to Tokenization Framework: Verification processes confirm credentials to ensure compliance and unlock required infrastructure, implementing the four-phase framework with guidance at each step.

Launching Platform Dashboard: Property owners receive access to a secure dashboard for managing tokenized assets, participant tracking, token distribution, and compliance monitoring.

Tokenizing Assets & Start Offering: Smart contracts tokenize assets and present them to participants compliantly. Tokens become available through the issuer's public-facing page with automated verification.

Platform Capabilities

Stobox 4 supports the complete tokenization lifecycle through the Tokenization Framework for asset setup, AI Assistant for onboarding guidance, and the Asset Tokenization Module for economic modeling and compliance documentation. Public Investor Portals enable professional issuer pages under custom domains. Financial Operations modules automate cash flow distribution according to configured rules. Multi-blockchain support allows network selection based on transaction costs and participant preferences. Integration with Stobox DID provides identity verification, while the STV3 protocol embeds structured legal metadata directly into token smart contracts.

Future Outlook: Market Trends by Real Estate Type

The real estate tokenization market continues evolving with distinct trends emerging across different property types.

Residential tokenization growth: Single-family homes and multi-unit residential properties are seeing increased tokenization activity as platforms develop infrastructure supporting smaller property sizes. Fractional vacation home ownership through tokenization appeals to participants seeking property access without full ownership burdens. Geographic expansion into emerging markets creates new opportunities for residential tokenization.

Commercial property institutional adoption: Larger institutional property owners are exploring tokenization for portfolio liquidity management and capital formation. Office buildings and retail centers in primary markets are likely candidates for institutional-grade tokenization as regulatory frameworks mature. Integration with traditional commercial real estate investment vehicles may emerge.

Industrial and logistics sector acceleration: E-commerce growth continues driving demand for logistics facilities, making this sector attractive for tokenization. Cold storage, last-mile delivery centers, and specialized logistics facilities may see increased tokenization activity. Cross-border participant access through tokenization helps property owners tap global capital for industrial expansion.

Development project financing evolution: Tokenization may become a standard financing option for real estate development alongside traditional construction loans and equity placement. Milestone-based token releases and programmatic funding tied to construction progress could emerge as sophisticated structuring approaches.

Cash-flow and hybrid structures: Innovative structures separating ownership from income rights may proliferate, offering participants diverse exposure options. Hybrid models combining elements of ownership, income rights, and usage rights could emerge for specific property types like resorts or mixed-use developments.

Technology infrastructure maturation: Blockchain networks are improving scalability and reducing transaction costs, making tokenization economically viable for smaller properties. Integration between tokenization platforms and traditional real estate technology systems will streamline operations. Enhanced secondary market infrastructure through compliant decentralized exchanges may improve liquidity.

Regulatory framework development: Clear regulatory guidance in major markets will reduce compliance uncertainty and enable larger-scale adoption. International coordination on tokenized securities frameworks may emerge, facilitating cross-border participation. Industry standards for real estate token structures and disclosure requirements are likely to develop.

Stobox maintains active development of platform capabilities to support these evolving trends. The 2025 roadmap includes expanded blockchain support, enhanced AI-powered tokenization workflows, improved participant engagement tools, and integration with other decentralized finance protocols.

Conclusion & Next Steps for Business Owners

Real estate tokenization offers property owners across all asset classes new approaches to capital formation, participant access, and portfolio management. From residential properties and commercial buildings to industrial facilities, development projects, cash-flow rights, and portfolio structures, the technology supports diverse tokenization strategies tailored to specific business objectives.

Understanding which property types align with your business goals, participant targeting strategy, and operational capabilities is essential for successful implementation. Different assets require different technical configurations, legal structures, and management approaches. Residential properties emphasize accessibility and fractional ownership benefits. Commercial assets leverage stable income streams. Development projects focus on appreciation potential. Portfolio structures provide diversification advantages.

Key takeaways for property owners:

Property value, income stability, location, regulatory environment, and target participant profile all influence tokenization viability and structure selection. Benefits include expanded capital access, global participant reach, potential liquidity enhancement, operational transparency, and innovative structuring options. Challenges encompass regulatory compliance, valuation considerations, ongoing management responsibilities, and technology implementation requirements.

Successful real estate tokenization requires technical infrastructure that supports compliant token configuration, verification workflows, participant management, and ongoing operations. Platforms providing comprehensive capabilities rather than basic smart contract deployment deliver better outcomes for complex real estate projects.

As regulatory frameworks mature and technology infrastructure improves, real estate tokenization will likely become a standard option for property owners seeking capital and participants wanting real estate exposure. Business owners who understand the opportunities and requirements across different property types position themselves advantageously in this evolving landscape.

Ready to explore tokenization for your real estate portfolio? Stobox 4 provides the technical infrastructure for configuring, publishing, and managing tokenized real estate assets across all property types. Start Your Tokenization Journey.