The GENIUS Act Has Arrived: Why It’s a Game-Changer for Your Digital Dollars and the Dawn of the RWA Revolution

The GENIUS Act Has Arrived: Why It’s a Game-Changer for Your Digital Dollars and the Dawn of the RWA Revolution.

The world of digital assets is in constant motion, but on July 18, 2025, the industry experienced a seismic shift. On that day, the U.S. government signed into law the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, widely known as the GENIUS Act.

This landmark legislation represents the first major federal regulatory framework for cryptocurrency in U.S. history and is set to have profound implications for the entire digital finance landscape. It’s the first major piece of federal crypto legislation in U.S. history, and it’s poised to completely reshape the $250 billion stablecoin market. But this story isn't just about stablecoins. This is the moment the floodgates begin to open for the next frontier of digital finance: Real-World Assets (RWAs).

First, What Are Stablecoins and Why Do They Matter?

Think of stablecoins as the essential bridge between traditional money (like the U.S. dollar) and the digital world.

They are crypto tokens designed to hold a steady value, usually pegged 1-to-1 with a major currency. So, one stablecoin is meant to always be worth exactly one U.S. dollar.

This stability is the bedrock of the crypto ecosystem. While cryptocurrencies like Bitcoin or Stobox Token can have wild price swings, stablecoins offer a reliable medium of exchange and a safe store of value. They are used for everything from trading and lending to facilitating cross-border payments.

The market for these digital dollars is already massive, sitting at around $250 billion, and according to Citigroup analysts, could explode to $3.7 trillion by 2030.

So, What Is the GENIUS Act All About?

Until now, stablecoins have operated in a regulatory gray area—a "wild west." The GENIUS Act changes that by establishing a clear, nationwide framework for how they can be issued and managed in the U.S.

Here are the key provisions:

- Safety and Full Backing: The law mandates that all "payment stablecoins" be backed 100% by high-quality reserves, like cash or short-term U.S. Treasuries. This ensures that for every digital dollar in circulation, there's a real, verifiable dollar held in reserve. This is a direct response to catastrophic failures like the Terra/Luna collapse, which wiped out $40 billion and shattered investor confidence.

- A New Class of Licensed Issuers: To issue a stablecoin, a company must be a licensed bank or a qualified fintech firm approved by federal regulators like the OCC. This ends the era of anonymous or unregulated issuers. As a client alert from the law firm WilmerHale bluntly states, "GENIUS prohibits the issuance of payment stablecoins in the United States except by an approved US-based 'permitted payment stablecoin issuer.'"

- Focus on Utility, Not Speculation: The Act bans stablecoins from paying interest or yield to holders. This might seem like a drawback, but it's a deliberate move to shift the focus of stablecoins from being speculative investments to pure payment tools—in essence, digital cash.

- Radical Transparency: Issuers must publish monthly, publicly available reports on their reserves and undergo rigorous annual audits. This brings an unprecedented level of transparency and accountability to the market.

President Trump, upon signing the bill, called it "pure GENIUS," highlighting that it "closes a longstanding regulatory gap" and positions the U.S. as the "crypto capital of the world."

The Real Story: How the GENIUS Act Ignites the RWA Revolution

This is where the narrative pivots from just regulation to a full-blown revolution in investing. The GENIUS Act is the single most important catalyst for Real-World Assets (RWAs) we have seen to date.

RWAs are tokenized representations of tangible and intangible assets from the traditional world. Think of a digital token that represents:

- A fractional share of a commercial office building.

- Ownership of a single corporate bond.

- A piece of fine art or a luxury watch.

- A stake in a private equity fund.

The market for RWAs is already on a tear, growing from a mere $5 billion in 2022 to over $24 billion by mid-2025—a staggering 380% increase. But this is just the prelude. The GENIUS Act provides the missing ingredient that will turn this niche market into a multi-trillion dollar industry.

Here’s how the Act supercharges RWAs:

- It Creates the "Trust Layer" for Digital Assets: The biggest barrier to institutional adoption of RWAs has been trust. How can a pension fund or a bank invest millions into tokenized real estate if the digital dollars used for the transaction aren't 100% reliable? The GENIUS Act solves this. By creating federally regulated, fully-backed, and audited stablecoins, it establishes a "trust layer" for the entire digital asset economy. These aren't just any stablecoins; they are U.S.-regulated digital dollars. As Mastercard noted in a recent report, the Act "signals a new era of confidence in digital assets," which is the bedrock RWAs need to flourish.

- It Unlocks Unprecedented Liquidity and Interoperability: Safe, regulated stablecoins are the "trusted primitives" that will grease the wheels of RWA trading. They provide a stable, universally accepted unit of account for buying, selling, and collateralizing tokenized assets. This will transform illiquid assets like real estate and private credit into highly liquid, tradable digital instruments. An on-chain analyst excitedly posted on X, "RWA's about to flood the blockchain with trillions," because for the first time, there's a reliable currency to trade them with. This could reduce real estate settlement times from weeks to mere seconds.

- It Builds the Bridge for Institutional Capital: The Act brings major financial players off the sidelines and directly into the game. By allowing banks to issue their own stablecoins, it creates a direct on-ramp for their institutional clients. Firms like BlackRock and Fidelity are already gearing up for "branded dollars." Imagine a future where a major bank not only issues the stablecoin but also tokenizes a real estate fund and offers it to their clients—all within a single, regulated ecosystem. This integration is the key to unlocking trillions. Experts are no longer talking in hypotheticals; they are forecasting an RWA market of $10 trillion by 2030, with Deloitte projecting that tokenized real estate alone could hit $2.39 trillion by 2035.

- It Standardizes the RWA Marketplace: With a single, federally recognized standard for digital dollars, RWA platforms can now build products for a unified U.S. market instead of a patchwork of state-by-state regulations. This standardization will accelerate innovation, reduce legal costs, and make it easier for platforms like Stobox to offer tokenized assets to a broader audience. Tokeny, a tokenization platform, highlighted how the Act could "accelerate tokenization strategies" for institutions by providing compliant stables for seamless on-chain settlement.

Commenting on the new legislation, Gene Deyev, Founder & CEO of Stobox, stated:

"The GENIUS Act is the watershed moment we've been waiting for. By creating a trusted, regulated digital dollar, it provides the foundational trust layer necessary for the mass adoption of Real-World Assets. This is the green light for institutional capital to move into the tokenization space, and as Gene Deyev believes, it will catalyze unprecedented growth and solidify the future of a tokenized economy."

Are There Any Hurdles for the RWA Space?

Of course, the path forward isn't without challenges.

- Compliance Burdens: The same strict AML/KYC rules that make stablecoins safe could increase costs for RWA platforms, potentially favoring larger, centralized issuers.

- Centralization Risks: The "freeze/seize" mandates required for law enforcement could deter privacy-focused investors and push some activity offshore.

- The DeFi Question: The ban on yield might limit the attractiveness of RWAs within certain DeFi protocols that rely on interest-bearing collateral.

The Road Ahead: A Tokenized World

The GENIUS Act is far more than a piece of crypto regulation. It is the foundational step toward a new, tokenized economy.

In the short term (2025-2026): Expect a "tokenization rush." With safe stablecoins now available, we will see a wave of pilot projects from major institutions tokenizing everything from U.S. Treasuries to municipal bonds. The RWA market could see accelerated growth of up to 300% in the latter half of 2025 alone.

In the medium term (2027-2030): We will see the maturation of RWA markets. "On-chain commerce" for assets like real estate and private credit will become commonplace. KuCoin Insights forecasts the RWA market could reach $18.9 trillion by 2030, a figure that seems ambitious but is grounded in the new reality the GENIUS Act creates.

Long-term (2030+): We are looking at a future where the distinction between traditional and digital finance blurs. As one analyst described it, we are heading for a "digital asset revolution" where "everything from treasury management to collateral" is tokenized, fundamentally rewiring banking and investing.

For investors and businesses, this is the moment to move from observation to action. The era of speculative crypto hype is giving way to a new chapter defined by tangible, real-world utility. The GENIUS Act has laid the foundation, and the RWA revolution is being built upon it. The future of finance is tokenized, and it's happening now. While the world begins to react, Stobox is already opening the gate to this future.

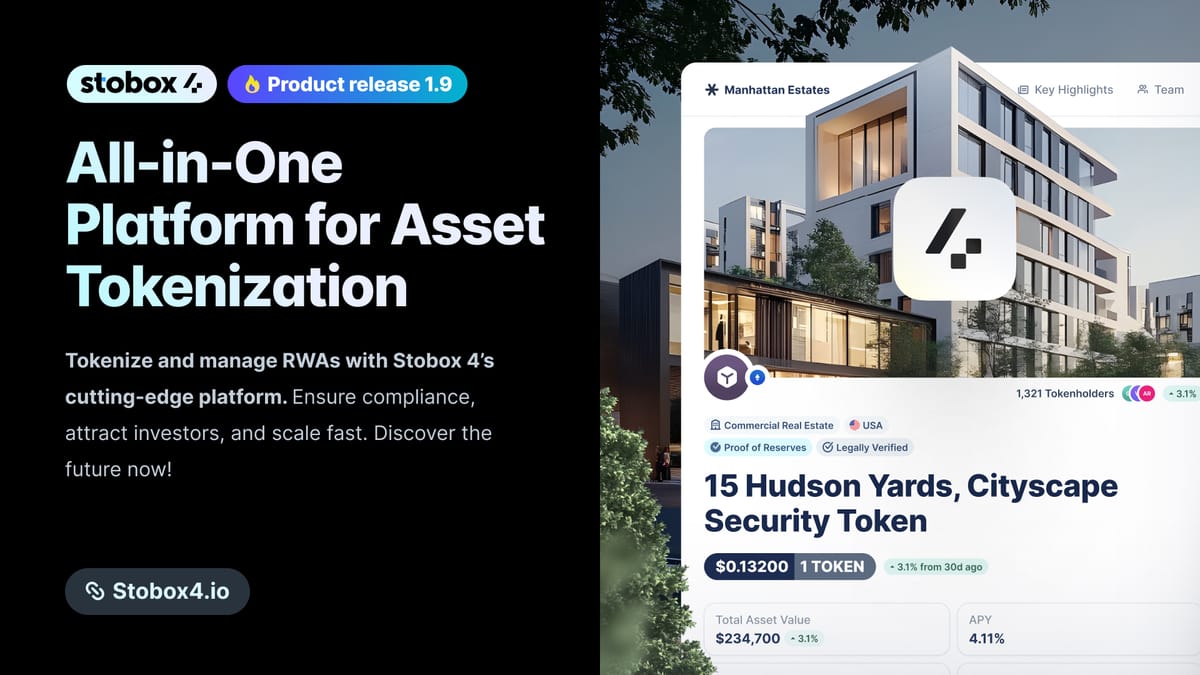

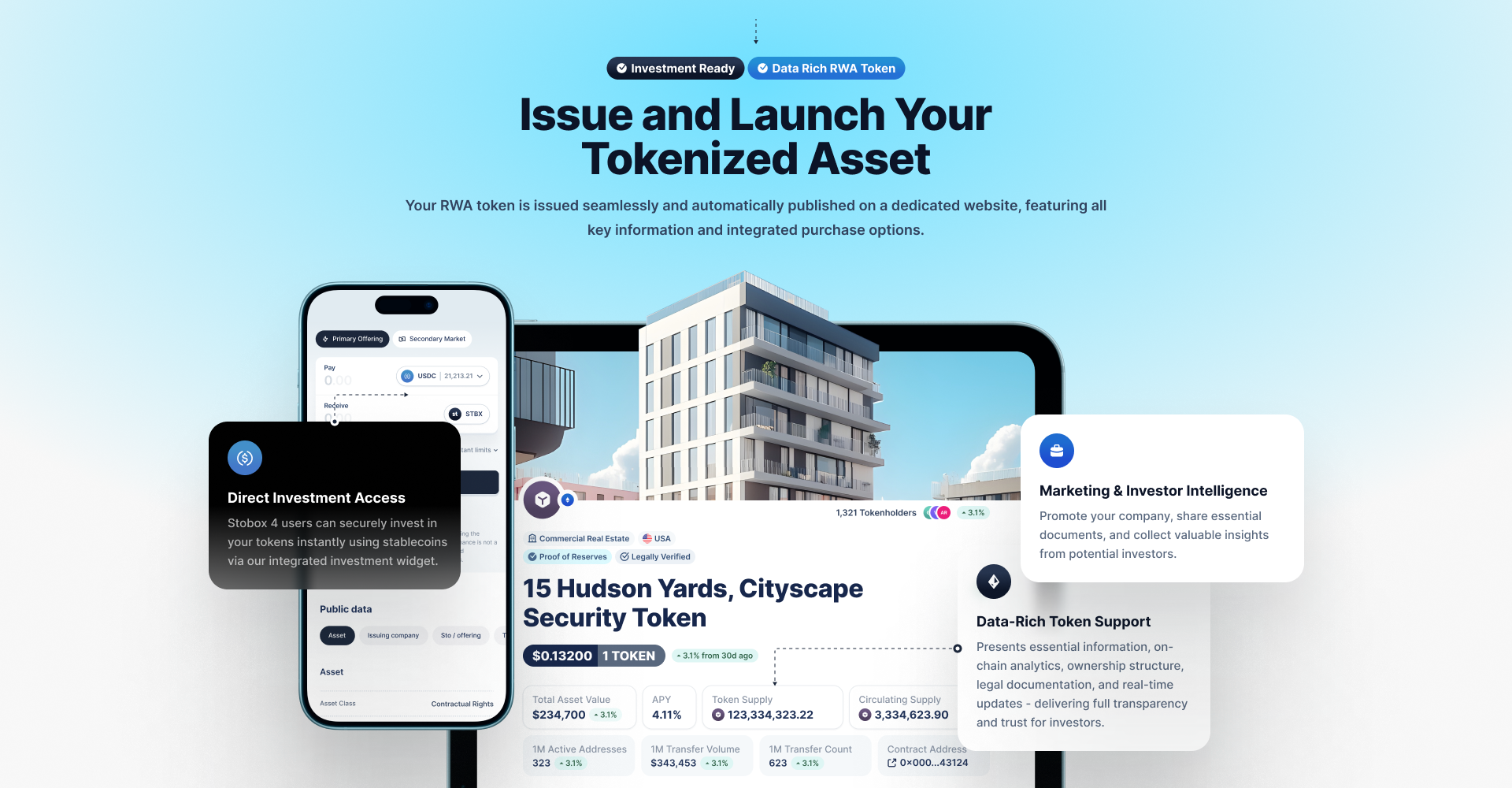

This is where Stobox 4 comes in. It is our comprehensive, all-in-one tokenization platform designed to empower businesses to step confidently into the digital asset economy.

Stobox 4 is more than just a tool; it's a complete ecosystem that handles every aspect of the RWA lifecycle—from the initial legal structuring and smart contract deployment to managing investor relations and facilitating secondary trading on a compliant marketplace. It is built to be the bridge between traditional finance and the on-chain world, making the complex process of tokenization simple, secure, and accessible.

The opportunity to lead is here. Don't miss your chance to be among the first to capitalize on this tectonic shift in finance.

Register on the Stobox 4 platform today and book a demo with our team to discover how you can turn your assets into liquid, tradable digital securities.

Every company — regardless of size, industry, or location — should have the opportunity to tokenize their equity, debt, commodities, or other financial instruments.