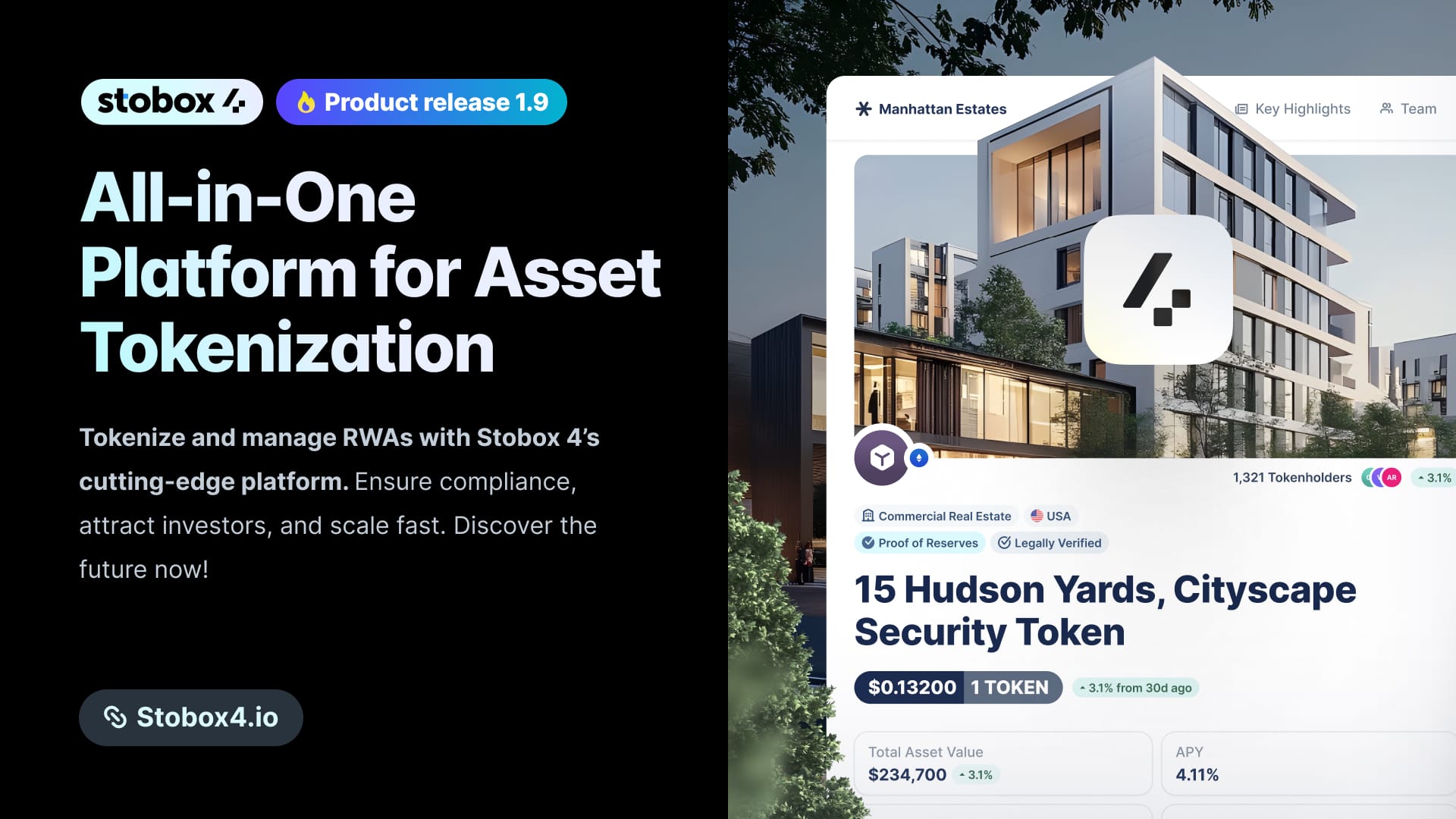

Stobox 4 Release 1.9: The New Standard for Compliant Tokenization

Stobox is proud to announce the official release of Stobox 4 Version 1.9, the most comprehensive tokenization platform ever designed for real-world assets (RWA).

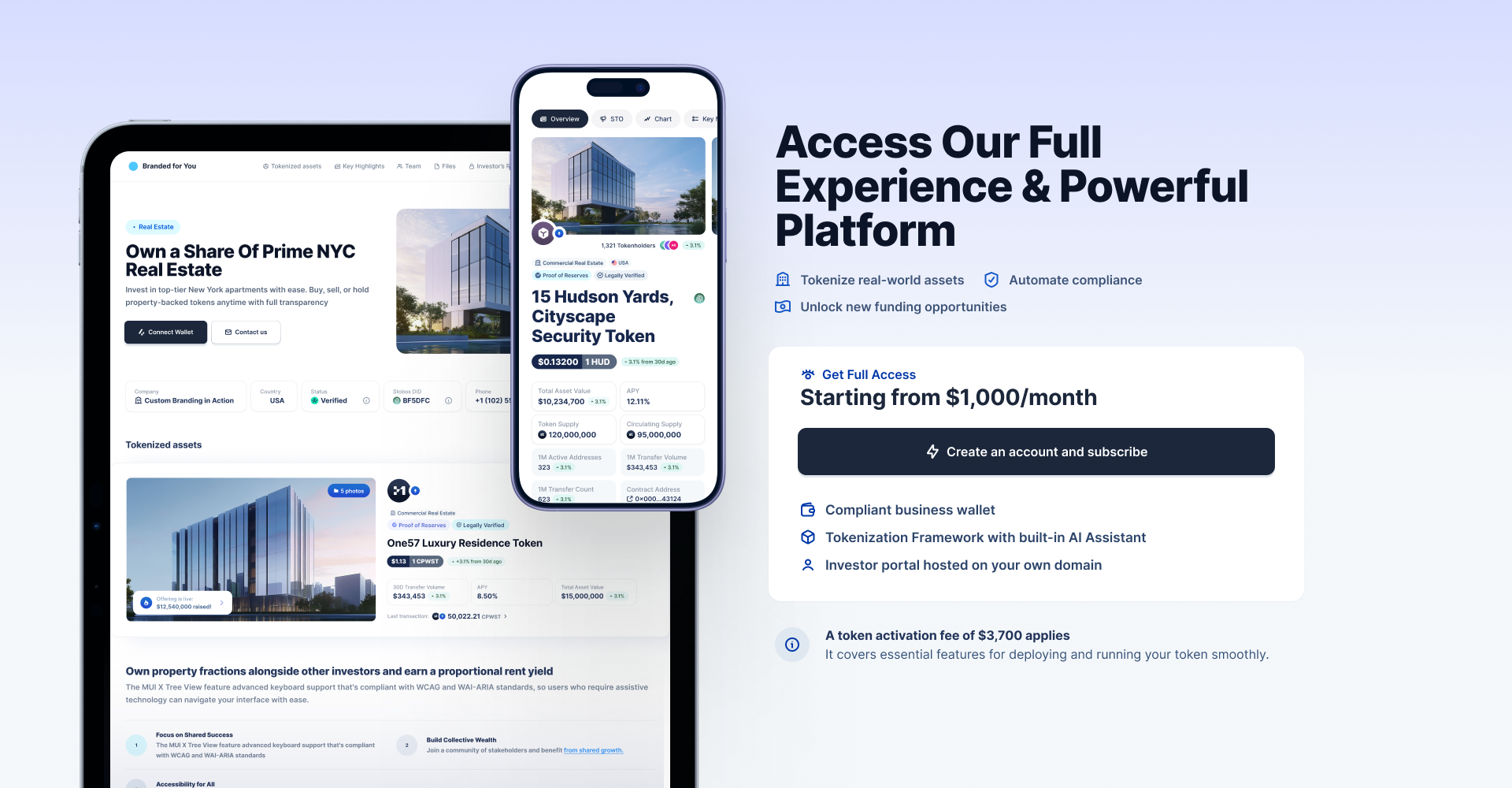

Stobox is proud to announce the official release of Stobox 4 Version 1.9, the most comprehensive tokenization platform ever designed for real-world assets (RWA). This update marks a pivotal milestone—not only with the introduction of new features, compliance modules, and AI assistance—but also by opening the doors to the first group of businesses officially onboarding to Stobox 4.

From onboarding to full investor engagement, Stobox 4 enables token issuers to transform physical and financial assets into transparent, legally compliant, and investable digital products.

Every company — regardless of size, industry, or location — should have the opportunity to tokenize their equity, debt, commodities, or other financial instruments.

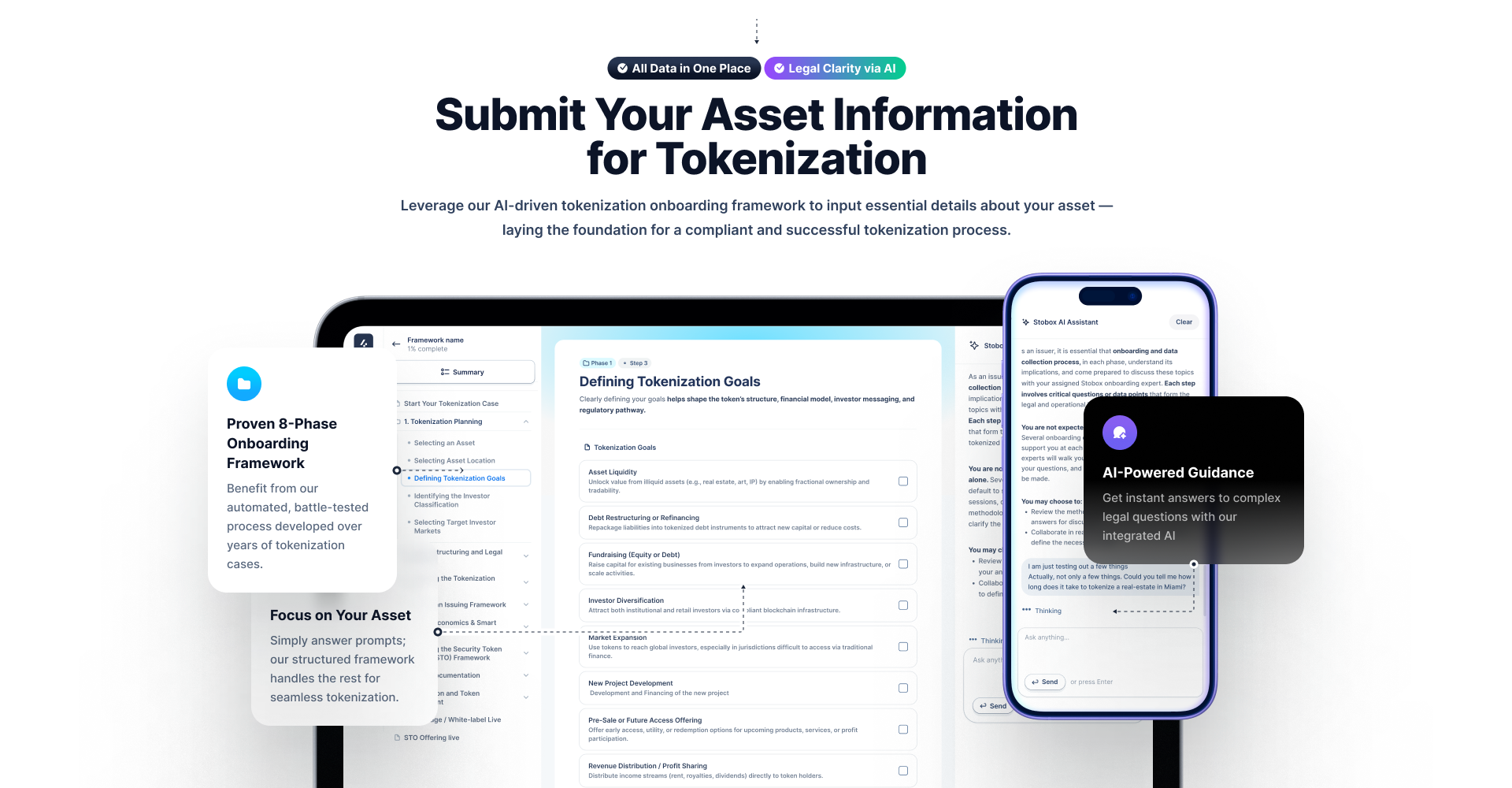

Structured, Compliant Onboarding Starts Here

The onboarding process begins with a streamlined, AI-guided data collection flow built around Stobox’s 8-phase framework. Issuers are walked step-by-step through legal and operational decisions such as:

- Selecting the jurisdiction and asset class

- Defining tokenization goals (e.g. liquidity, refinancing, market access)

- Establishing legal clarity on ownership and regulation

Integrated with the Stobox AI Assistant, the platform provides real-time, contextual answers to legal and regulatory questions, ensuring confidence in each submission.

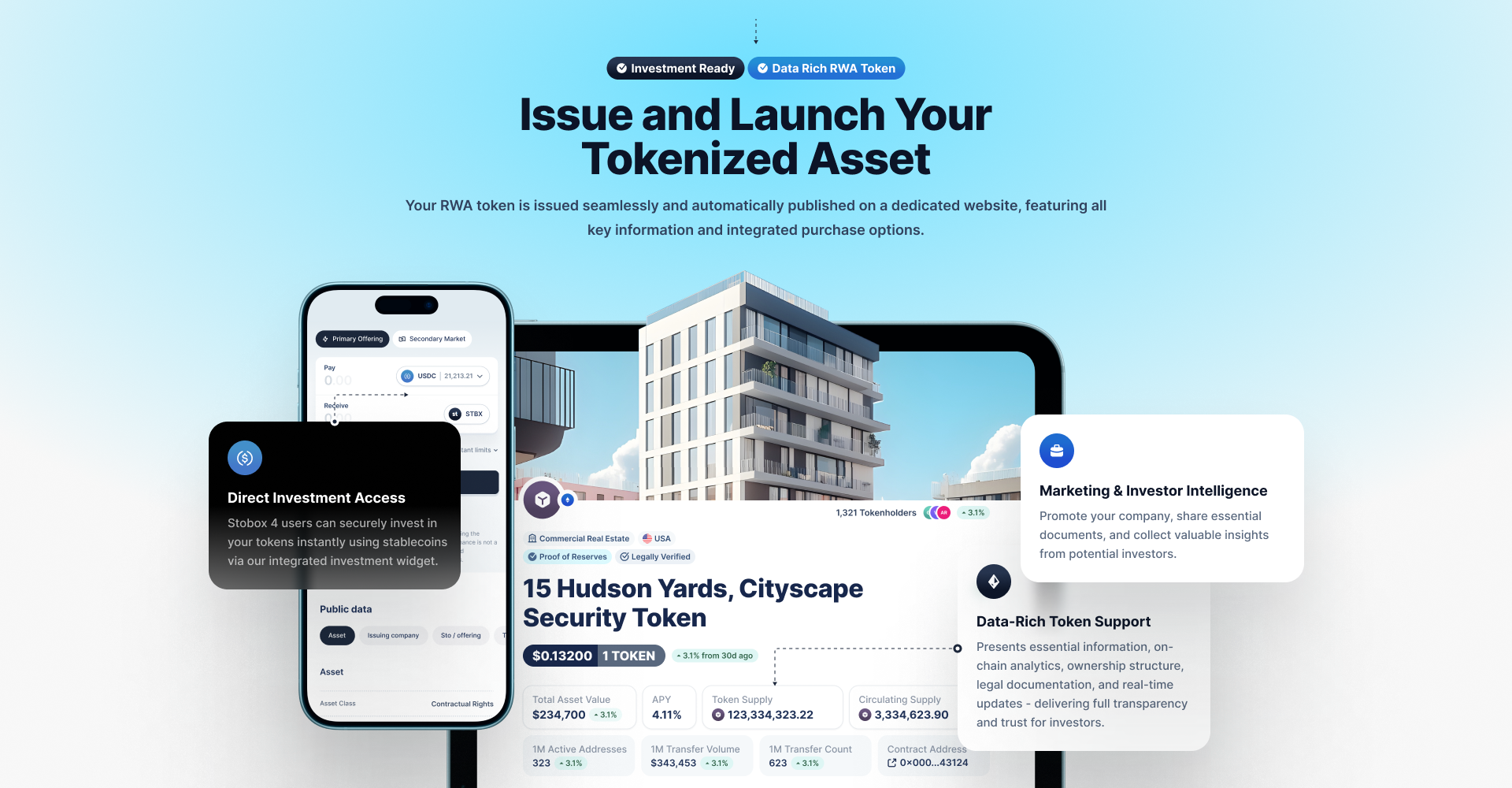

Publish Your Tokenized Asset

Once onboarded, issuers can publish their tokenized asset with a single click. Each token is launched with its own dedicated webpage showcasing:

- Verified legal documentation

- Proof of Reserves (where applicable)

- Token price, APY, supply, and cap table

- Investor purchase widget with stablecoin integration

The Data-Rich Token Page is tailored for investor transparency, allowing buyers to evaluate risk, ownership structure, and performance metrics before participating in the offering.

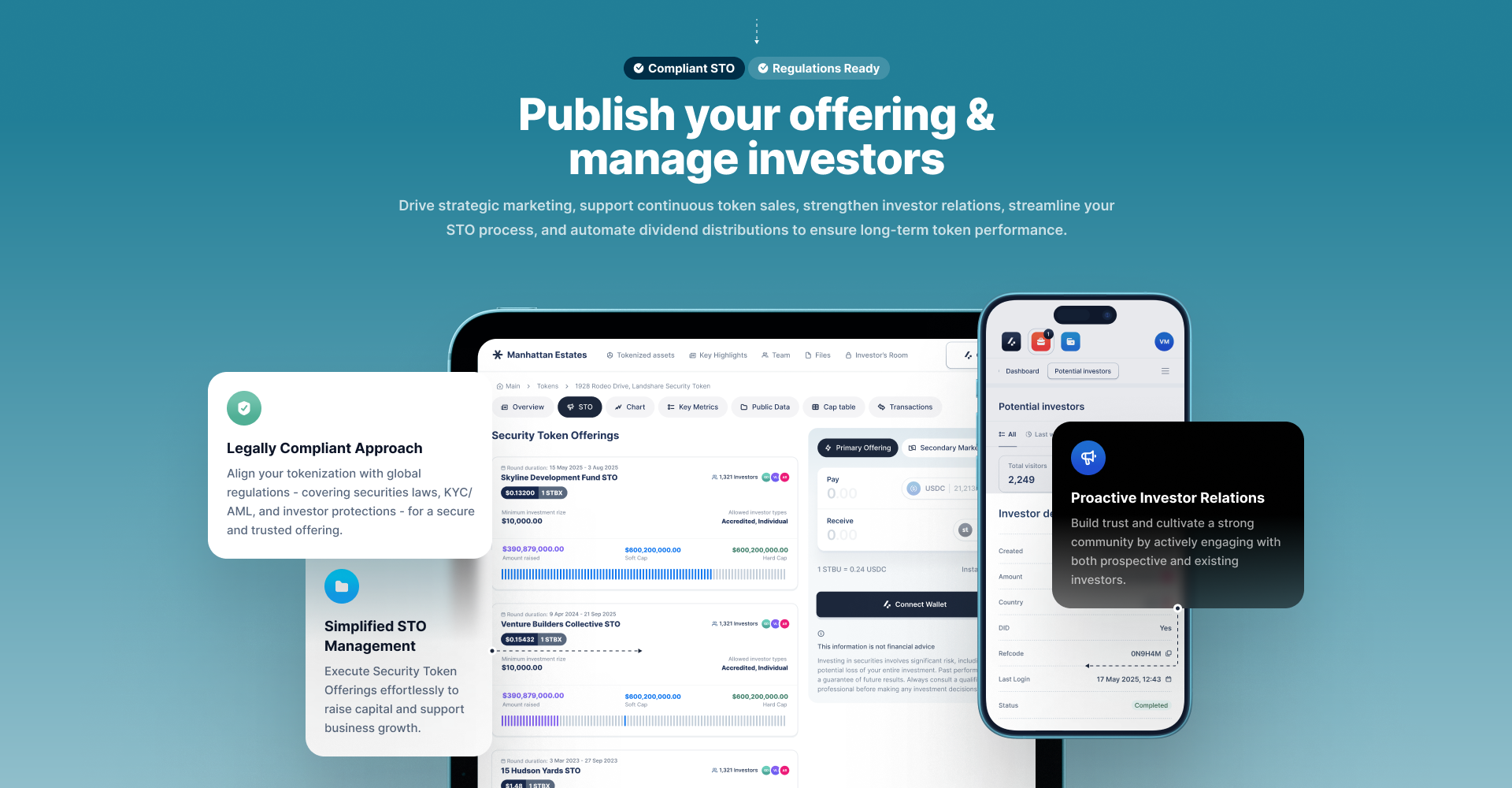

Manage Investors, Offerings & Compliance in One Hub

The new investor and STO management interface brings enterprise-grade tools for:

- Running public or private token offerings with pre-approved investor classes

- Monitoring performance metrics (volume, holders, funding raised)

- Ongoing compliance (KYC/AML, securities laws, reporting)

- Relationship management and investor communications

You can now distribute updates, track engagement, and manage multiple STOs or project tokens simultaneously—all in one dashboard.

Pricing and First Business Onboardings Begin

With the launch of Stobox 4 v1.9, Stobox is now officially welcoming its first wave of businesses to onboard to Stobox 4. These early issuers span real estate, commodities, and venture funding sectors, each looking to leverage tokenization for capital efficiency and global investor access.

The pricing structure reflects the enterprise value of tokenization done right:

- $1,000/month subscription: Includes platform access, business wallet, AI-driven onboarding, and investor portal on your own domain.

- $3,700 one-time activation fee: Covers initial token deployment, verification, and system configuration.

This tiered model makes regulated tokenization more accessible than ever, while delivering the full spectrum of features required for a secure and scalable launch.

We believe that the future of every business is on-chain. Just like websites became essential in the early 2000s, blockchain will become the underlying infrastructure for how businesses own, manage, and exchange value.

Join Stobox 4 Presentation for Real-World Asset (RWA) Businesses!

We’re excited to have you join us for this exclusive webinar, where we’ll explore how Stobox 4 empowers businesses like yours to tokenize assets with confidence and compliance. Whether you manage real estate, commodities, private equity, or other tangible assets, this session will walk you through the step-by-step tokenization journey — from legal structuring to token issuance and investor onboarding.