Stobox Partners with Particula to Strengthen Risk Assessment and Credibility in Tokenization

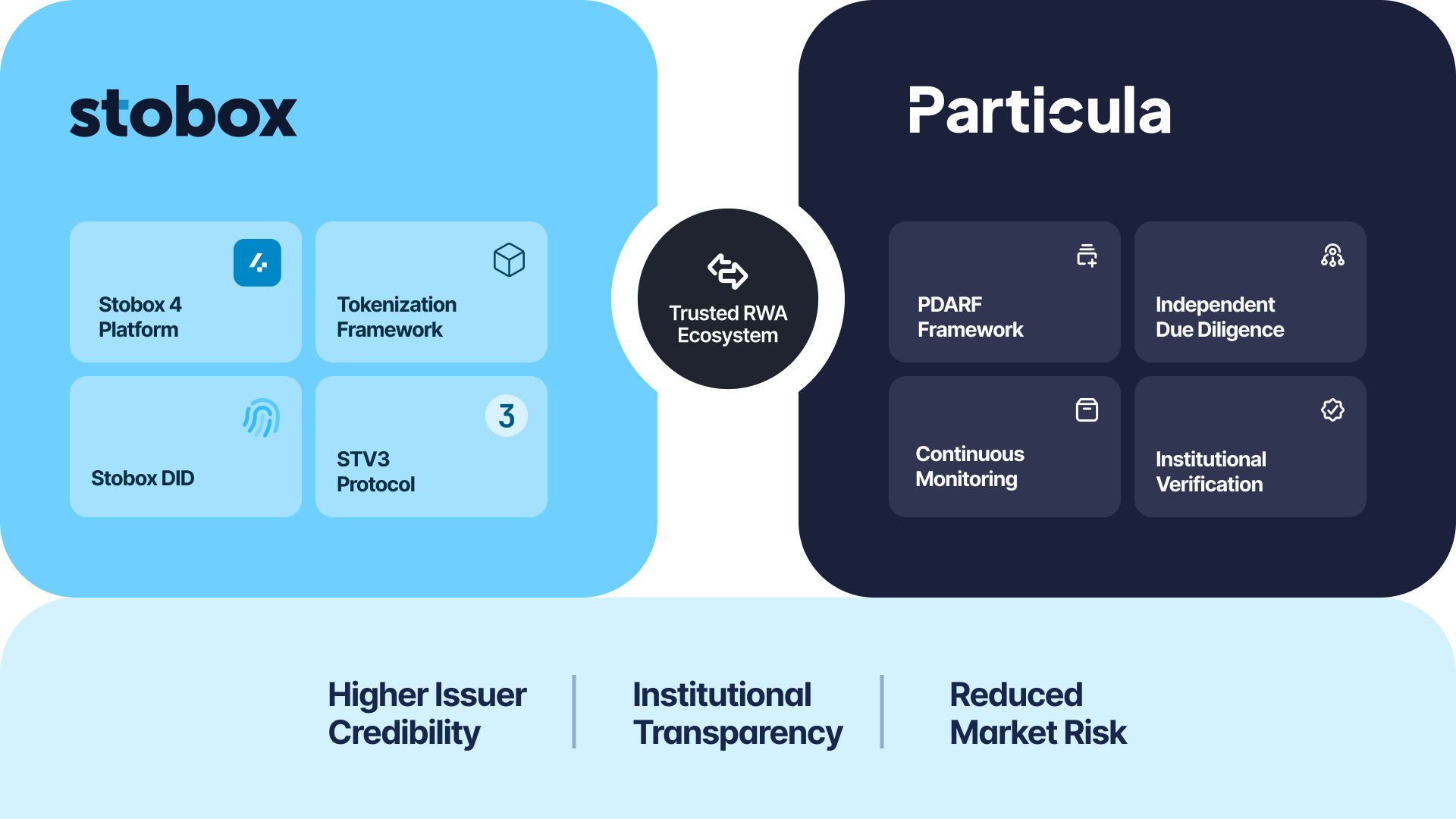

Stobox partners with Particula to integrate independent risk-rating and verification tools into the Stobox 4 ecosystem, strengthening transparency, due-diligence workflows, and issuer credibility across tokenized asset configurations.

Stobox is proud to announce a partnership with Particula, a leading institutional-grade risk-rating and verification platform for digital and tokenized assets. This collaboration strengthens Stobox’s ecosystem with advanced due diligence and risk-analysis tools, enhancing the trust and credibility of projects launched on the Stobox 4 Platform and within the Stobox Tokenization Onboarding Framework.

Raising the Standard of Trust in Tokenization

One of the major challenges in the tokenization industry remains asset verification and due diligence. Investors and institutional participants increasingly seek trusted, transparent validation frameworks before engaging with tokenized projects.

Through this partnership, Stobox and Particula are addressing that challenge head-on. By integrating Particula’s independent risk-rating framework, each tokenization project launched via Stobox will undergo a higher level of verification and analysis. This integration will improve issuer credibility, enhance investor confidence, and ensure that all Stobox clients meet institutional expectations for governance and transparency.

About Particula: Institutional-Grade Ratings for the Digital Asset Era

Particula is a next-generation digital asset risk-rating and analytics provider headquartered in Germany. Built by a team of former Moody’s executives and financial industry veterans, Particula combines the rigor of traditional credit scoring practices with modern data-driven technology to assess blockchain-based financial products.

Industry Credibility and Achievements

- Over 200 digital asset risk ratings completed, with more than $20 billion in tokenized assets under monitoring.

- Joined the Tokenized Asset Coalition, a consortium of leading RWA companies collectively driving over $1 trillion in tokenized asset initiatives.

- Welcomed Andreas Naumann, former Global Head of Relationship Management at Moody’s Ratings, as Senior Executive Advisor for Institutional Strategy, reinforcing the firm’s credibility with over 20 years of experience in financial innovation and risk frameworks.

- Developed the Particula Digital Asset Risk Framework (PDARF), a globally recognized methodology for evaluating structural, counterparty, and blockchain-layer risk.

Particula’s institutional approach ensures that tokenized assets can be evaluated, benchmarked, and monitored against international standards, a capability long awaited in the rapidly growing RWA sector.

Integrating Risk Ratings into the Stobox Ecosystem

The partnership with Particula will bring independent verification and continuous risk monitoring directly into the Stobox 4 platform and Tokenization Onboarding Framework, both of which form the backbone of Stobox’s enterprise-grade tokenization infrastructure.

Through this integration:

- Stobox issuers will gain higher credibility in the eyes of institutional and private investors.

- Each project will undergo independent due diligence scoring, reducing market risk and operational uncertainty.

- Stobox will strengthen its position as one of the few licensed and regulated tokenization providers offering fully verifiable, transparent onboarding for digital assets.

Together, Stobox and Particula are setting a new benchmark for trust, transparency, and investor protection in the tokenization industry.

About Stobox

Stobox is a licensed and regulated tokenization provider with seven years of experience in Real-World Assets (RWA). The company offers a complete ecosystem for compliant asset issuance, management, and secondary trading, built for both small and institutional issuers.

Stobox’s ecosystem includes:

- Stobox 4 - institutional-grade platform for RWA issuance and management

- Stobox DID - decentralized identity framework

- STV3 Protocol - next-generation standard for tokenized assets

- Stobox Tokenization Onboarding Framework - a comprehensive legal and technical blueprint for tokenized offerings

With over $500 million in tokenized assets and more than 100 clients across finance, energy, mining, and real estate sectors in the United States, Europe, and MENA, Stobox continues to define excellence in compliant digital asset infrastructure.

Enter the Tokenization Era with Stobox

If you are an asset owner, institutional investor, or business looking to tokenize with full transparency and regulatory assurance, Stobox provides everything you need to do it securely and credibly.Contact us today to explore collaboration or launch your tokenization project.

Enter the tokenization with Stobox.