Stobox 4 Roadmap: A Dive into Real-World Asset Tokenization

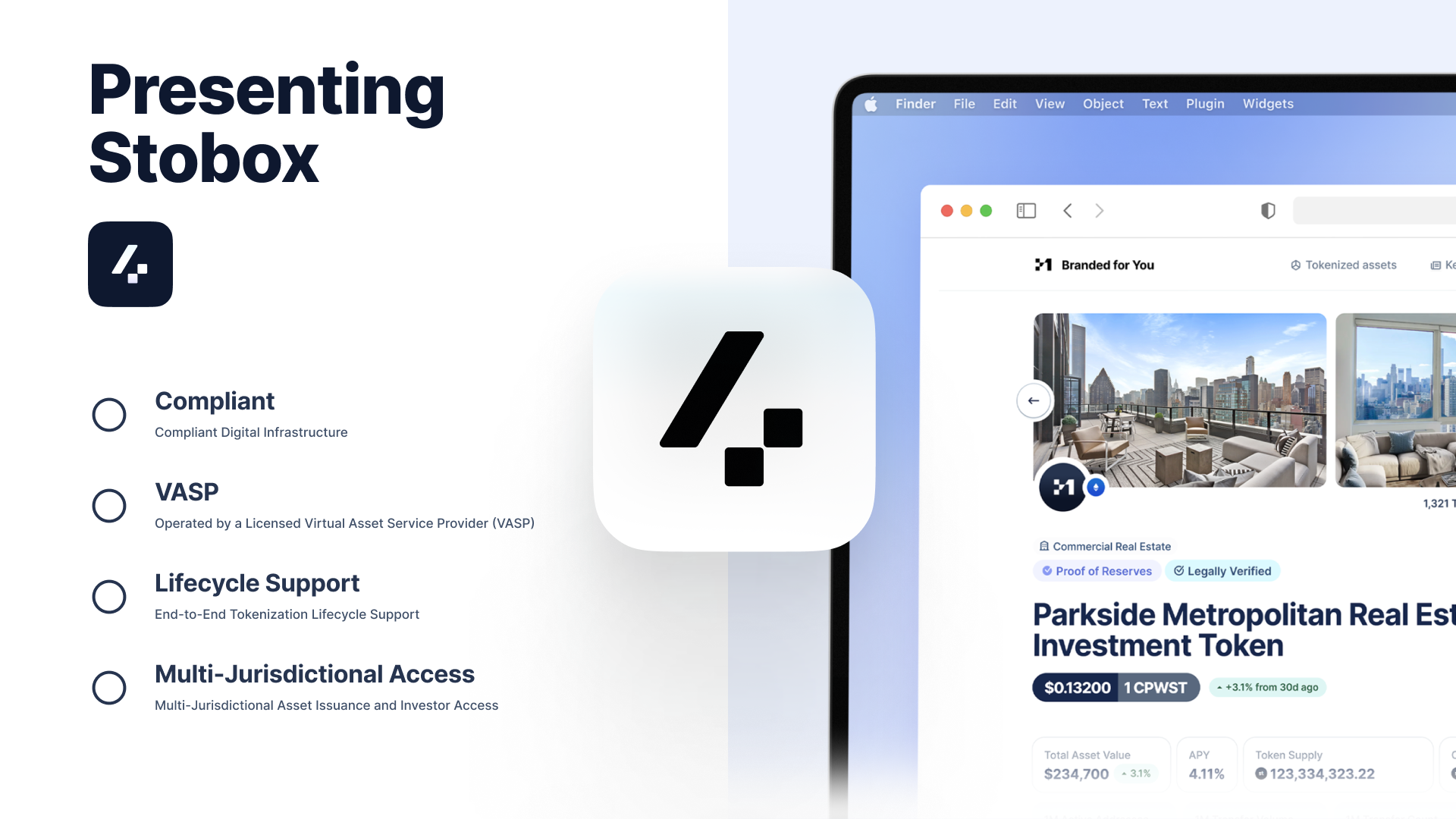

This article outlines the development roadmap for Stobox 4, a platform designed to facilitate the tokenization of real-world assets (RWA).

This article outlines the development roadmap for Stobox 4, a platform designed to facilitate the tokenization of real-world assets (RWA). The roadmap details planned advancements aimed at improving the platform's capabilities, user experience, and integration within the digital asset ecosystem.

At Stobox, our goal is to continuously enhance the platform to meet the evolving needs of businesses engaging with tokenized assets. Each release is planned to integrate new technologies and features that support the practical application of tokenization for various business needs.

Let's explore the key milestones on the Stobox 4 roadmap and understand what each development brings to the platform.

Release 1.9: Business Subscriptions, AI Framework & Issuer Portal

Live: 16 July 2025

This release introduces several core functionalities designed to enhance the initial experience for businesses using Stobox 4. It focuses on providing tools for starting tokenization onboarding and customizing an investor portal.

Key features in Release 1.9 include:

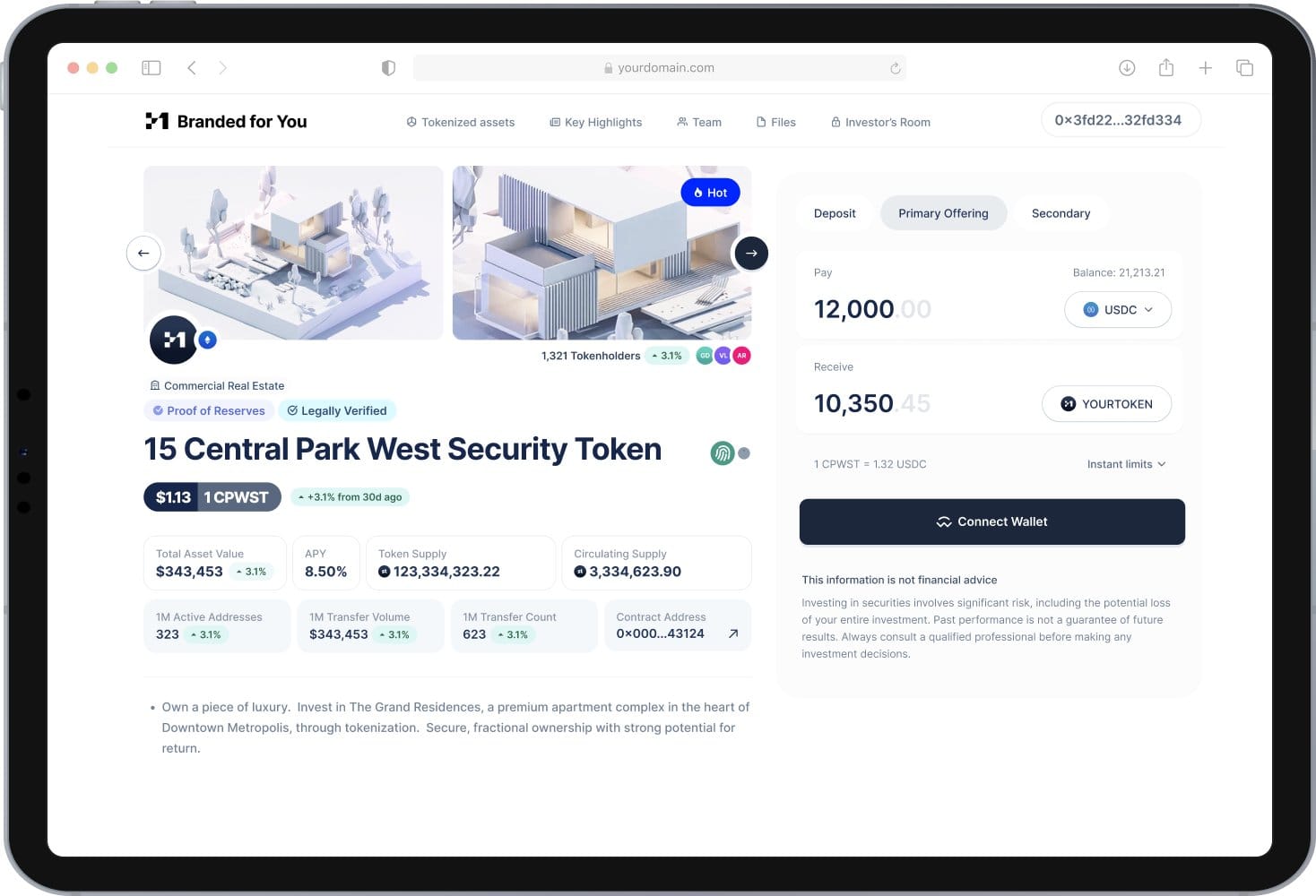

- Issuer Portal Publishing: This feature allows businesses to create a customized, branded portal for their token offerings. The portal can be hosted under a custom domain and integrates legal documents, media, and branding elements. This helps maintain brand consistency and professionalism for token issuers.

- Integrated Investor Onboarding: A streamlined Know Your Customer (KYC) process is integrated with the Stobox4 Wallet login. This simplifies the investor onboarding process, making it faster and ensuring regulatory compliance from the start.

- Business Subscription Enablement: Stobox 4 introduces tiered business plans, starting at $1,000/month. These plans are designed to offer scalable solutions for businesses of different sizes and tokenization needs.

- Investor Engagement Analytics: The platform provides analytics to track investor behavior, such as visits, registrations, and KYC completion rates. This data can be used to understand engagement and optimize outreach strategies.

- Structured Tokenization Framework: A guided workflow is implemented to help businesses follow a clear, structured approach to tokenization. This ensures that all necessary steps are followed for a compliant and efficient offering.

- AI Assistant Beta Launch: An AI Assistant is introduced in beta to offer support and guidance throughout the tokenization process. This feature aims to simplify complex decisions, automate routine tasks, and streamline workflows for issuers.

A boutique hotel chain, seeking to fund a new property, can use Release 1.9 to launch a branded issuer portal. They can tokenize fractional ownership of the hotel and use the integrated KYC to onboard investors. The AI Assistant can guide them through structuring the offering, and analytics can help them understand the effectiveness of their marketing efforts. This allows for a more diversified capital raise.

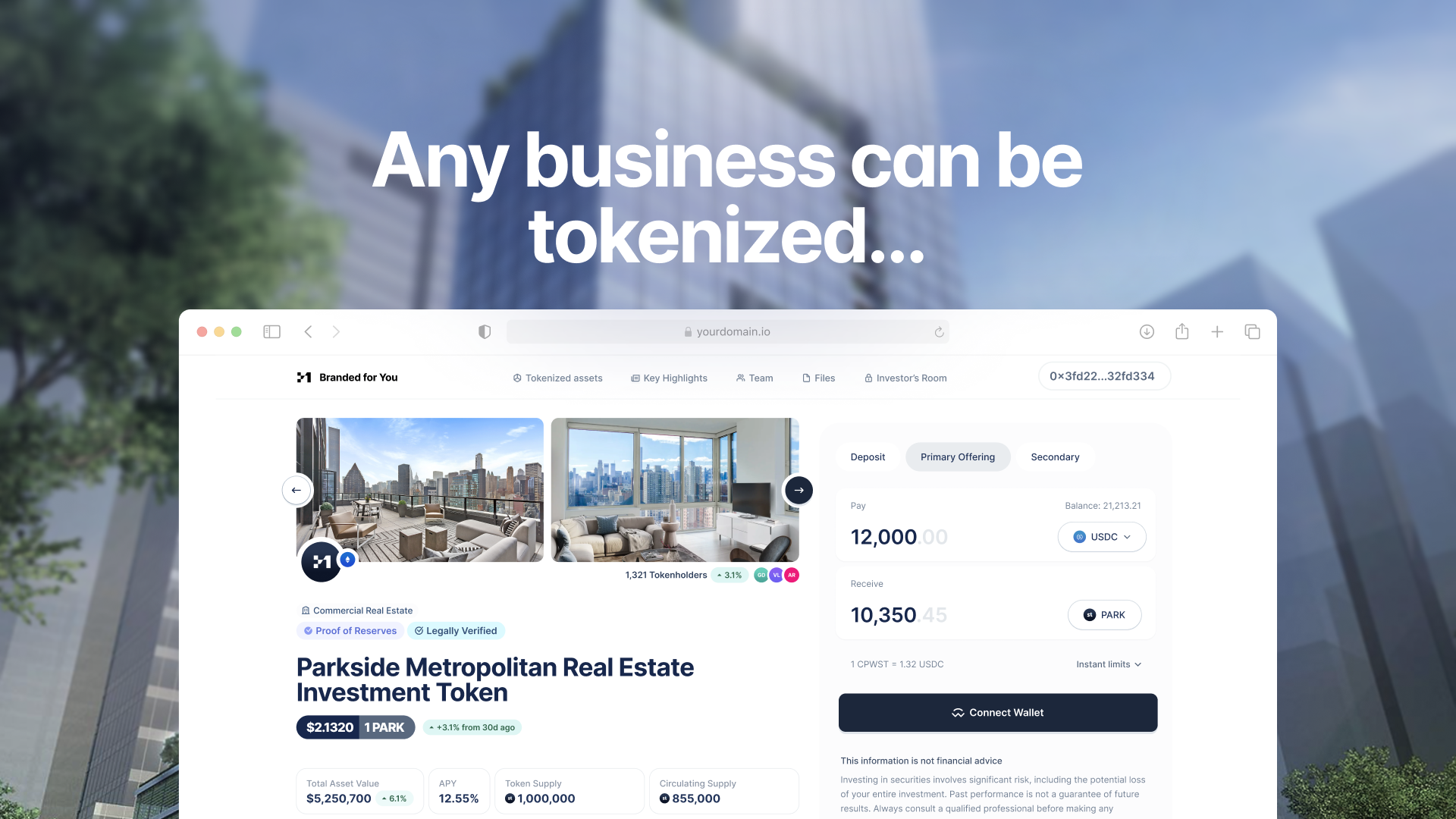

Every company — regardless of size, industry, or location — should have the opportunity to tokenize their equity, debt, commodities, or other financial instruments.

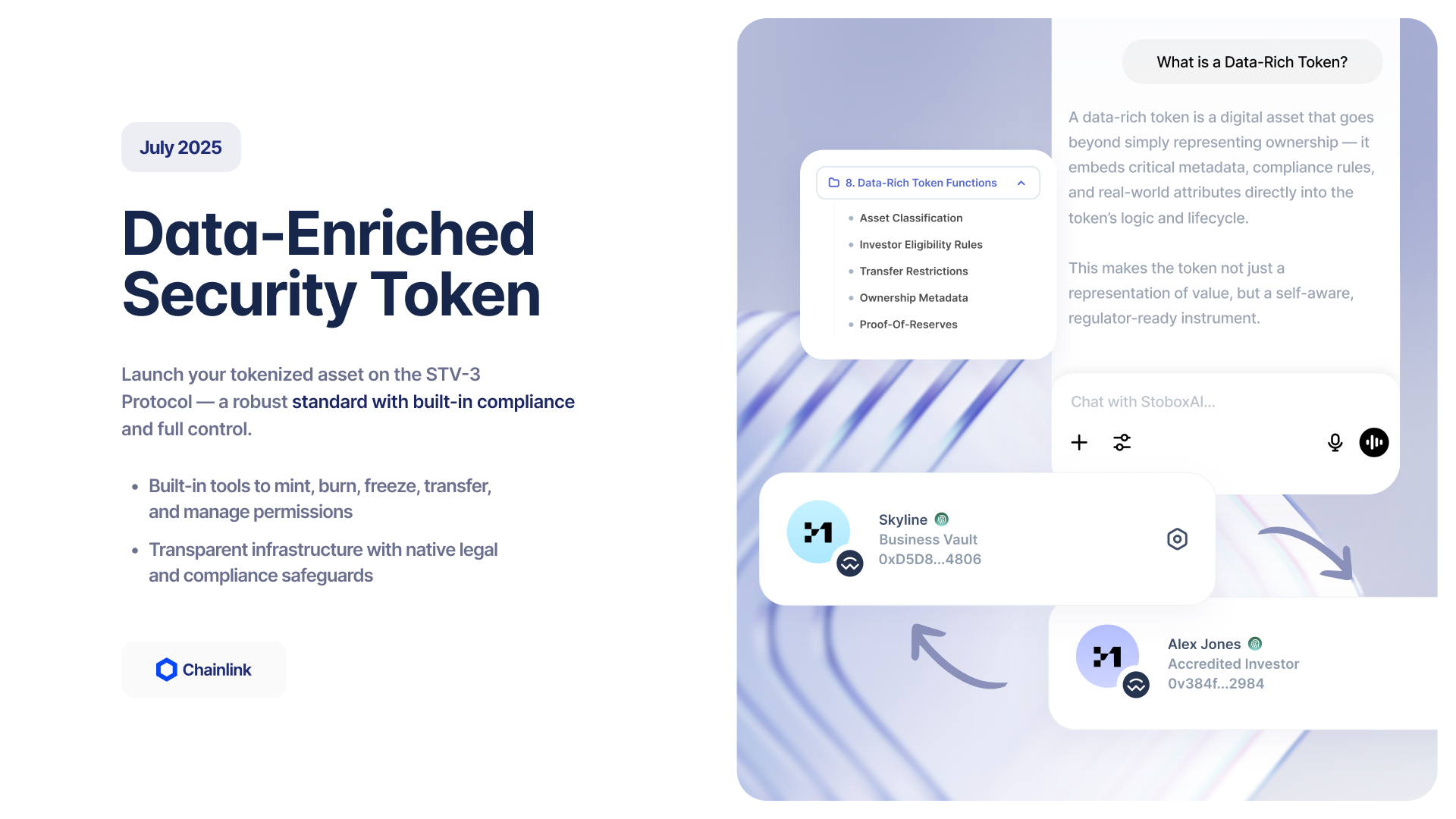

Stobox Security Token Launch on STV3 Protocol

Live: 16 July

This release focuses on integrating Stobox 4 with the broader Web3 ecosystem, specifically through the implementation of compliant security tokens. It represents a step towards standardizing and increasing the trustworthiness of security tokens, which can lead to wider adoption.

Key features in this integration include:

- STBX 2.0 Launch: This introduces a compliant, on-chain framework for issuing security tokens. It provides a legally sound and technologically advanced foundation for tokenized assets.

- Beta Data-Rich Token Format: A beta version of a token format is launched that embeds issuer identity, legal terms, and offering data directly onto the blockchain. This aims to enhance transparency and provide a single, verifiable source of information for each token.

- Issuer Portal Showcase with Asset Page: The issuer portal is enhanced to display comprehensive token information for investors through dedicated asset pages. This makes it easier for potential investors to understand and engage with tokenized assets.

A fund that develops solar farms can use the STV3 Protocol and data-rich tokens to issue compliant security tokens representing fractional ownership in their projects. The enhanced asset pages on the issuer portal can display the fund’s environmental credentials, projected yields, and legal terms directly on-chain. This transparency and accessibility can help them attract a wider range of investors.

We believe that the future of every business is on-chain. Just like websites became essential in the early 2000s, blockchain will become the underlying infrastructure for how businesses own, manage, and exchange value.

Stobox 4 Release 2.0 – STV3 Security Token Vault Production & Compliance Automation

Planned: 13 August 2025

This release focuses on bringing the STV3 Protocol to full production and introducing features for token management and compliance automation. The aim is to provide robust capabilities for scaling tokenization efforts.

Key features in Release 2.0 include:

- STV3 Protocol in Production: The STV3 Protocol will be fully operational for secure and compliant issuance of security tokens in a live environment. This provides a reliable foundation for tokenized assets.

- Security Token Minting & Management: Enhanced tools for creating and managing security tokens will be introduced. This includes integration with Fireblocks vaults for secure asset custody and support for manual distributions, giving issuers control over their digital assets.

- Accredited Investor Verification: A dedicated process for verifying accredited investor status will be implemented to ensure compliance with securities regulations. This automates a process that is often complex and time-consuming.

- Issuer Portal Enhancement: The issuer portal will be further improved with new token data modules and enhanced asset pages. This aims to provide more information and a better experience for both issuers and investors.

- Compliance Automation: Full AML/KYT (Anti-Money Laundering/Know Your Transaction) integration via Sumsub will automate compliance checks. This is designed to reduce manual effort, minimize errors, and improve regulatory adherence.

- Stobox AI Expansion: The AI Assistant will be expanded to offer more contextual guidance throughout the tokenization process. This aims to make the process more intuitive and efficient for users.

- Stobox Token Integration: Paid Stobox accounts receive a 25% discount when payments are made using STBU. Other benefits are also available.

- UI/UX Improvements: Continuous improvements to the user interface and user experience are planned to ensure smoother project and tokenization workflows. The goal is to make the platform powerful yet accessible.

A private equity firm managing various illiquid assets can tokenize its fund shares. Automated accredited investor verification can streamline onboarding, and enhanced minting and management tools, integrated with Fireblocks, can ensure secure custody. The AI Assistant can help navigate regulatory requirements, and the improved issuer portal can provide real-time insights to their limited partners (LPs). This can lead to reduced operational costs and increased transparency.

With your business subscription, you gain access to Stobox’s expert-led tokenization project management service — a dedicated team that helps you organize, plan, and execute your tokenization journey from start to finish.

Stobox 4 Release 2.1

STO Execution, Atomic Swaps, Governance & Investor Activation

Planned: September 2025

This release introduces functionalities for on-chain Security Token Offering (STO) execution, governance roles, and investor analytics. It aims to provide capabilities for managing security tokens, raising capital, and handling investor relationships.

Key features in Release 2.1 include:

- STO Execution via Atomic Swaps: The platform will enable verified investor token purchases through atomic swaps. This allows for secure and direct exchange of assets, aiming to streamline the capital raising process for STOs.

- Token & Investor Control: Issuers will gain control over their tokens and investors, including the ability to mint/burn tokens (for managing supply), freeze assets (for regulatory compliance or dispute resolution), and manage treasury operations. This level of control is intended for managing digital securities and adapting to market or regulatory conditions.

- Cap Table & Investor Management: Enhanced features for managing cap tables and investors will provide real-time ownership views and allow for manual actions. This ensures that the digital cap table is accurate and auditable.

- Business Roles & Governance: Role-Based Access Control (RBAC) will be introduced for various business functions, such as finance, recovery, and administration. This aims to ensure secure operational delegation and governance within an organization, providing control over who can access and manage critical functions.

- Protocol Compliance Enforcement: STV3 validator rule enhancements will strengthen protocol compliance enforcement, ensuring that transactions adhere to regulatory requirements. This is automated, on-chain compliance.

- Token Subscription Add-ons: New add-ons for token subscriptions will be introduced, including STO rounds and governance modules. These provide flexibility for structuring token offerings to meet diverse investor needs and business objectives.

- STO Integration on Issuer Portal: The issuer portal will feature full STO integration, including an offering module with KYC-gated purchase options. This aims to streamline the STO process for investors.

- Stobox4 Wallet STO Widget: A wallet-based purchase experience for STOs will be enabled through the Stobox4 Wallet STO Widget. This aims to make investing in STOs more accessible and convenient.

- Investor Analytics: Comprehensive investor analytics will be provided, including participation and purchase data, with CSV export options for detailed analysis. This data can be used to understand investor behavior and refine strategies.

- Marketing Tools Integration: Seamless integration with marketing tools like email, pixel, and Google Tag Manager (GTM) will be available. This aims to help issuers market their token offerings effectively.

We believe that the future of every business is on-chain. Just like websites became essential in the early 2000s, blockchain will become the underlying infrastructure for how businesses own, manage, and exchange value.

The Stobox 4 roadmap outlines the planned development of the platform, focusing on advancements in real-world asset (RWA) tokenization. Each phase, from the initial Release 1.9 to the planned institutional capabilities in December 2025, is designed to provide businesses with tools for compliance and liquidity in the digital economy.

The platform aims to transform illiquid assets into tradable digital instruments, open new capital markets, and streamline operations. This roadmap provides insight into the future of financial opportunities within the tokenized asset space.

To learn more about how Stobox can support your business, you can explore the platform or register with Stobox 4 for further information.