Stobox 4.2.1: Closing the Tokenization Cycle and Opening New Capital Pathways

Stobox 4.2.1 completes the tokenization cycle with AI-powered onboarding, MPC wallets, compliance verification, and STO module — enabling issuers to configure and publish investment-grade digital offerings with global partners Crowe and PwC.

Over the past 18 months, the Stobox team has pursued one clear mission: to make tokenization practical, compliant, and accessible for businesses worldwide. With the launch of Stobox 4.2.1, that mission has reached a turning point. For the first time, issuers can complete the entire cycle of securitization, onboarding, tokenization, and regulated offerings within a single ecosystem — while investors gain transparent and verified access to these opportunities.

Discover how Stobox 4.2.1 empowers businesses to launch tokenized assets with full-cycle infrastructure.

Building the Infrastructure for Tokenized Finance

At its core, Stobox aims to provide the technical infrastructure for tokenization while making it simple enough for non-technical users. Beyond technology, we offer turn-key services to help issuers prepare their assets legally, financially, and operationally for the market.

Unlike solutions that only cover one part of the puzzle, Stobox provides a regulated, scalable product that works across industries and jurisdictions.

We continuously improve the onboarding process so that tokenization becomes smooth, effective, and repeatable.

What’s Inside Stobox 4.2.1

The Stobox 4.2.1 update introduces a powerful suite of features that fully closes the tokenization cycle, giving issuers and investors everything they need within one ecosystem:

- Compliant Non-Custodial Wallets

Built with MPC (Multi-Party Computation) technology from Fireblocks, these wallets enable issuers and investors to securely store and manage real-world asset (RWA) tokens without relying on a custodian. This ensures maximum control and security while still meeting the highest regulatory standards. - Full Verification Layer

Integrated KYC (Know Your Customer), KYB (Know Your Business), KYT (Know Your Transaction), and AML (Anti-Money Laundering) checks create a robust compliance shield. Every participant, transaction, and business entity is verified on-chain, reducing fraud risk and ensuring global regulatory alignment. - AI-Powered Onboarding Framework

A guided onboarding assistant powered by AI simplifies the preparation process for issuers. From gathering legal and financial documentation to aligning with compliance standards, the framework accelerates what used to take months into a matter of weeks, while reducing errors and friction. - STV3 Tokenization Engine

Based on Stobox’s Diamond Standard–compliant smart contract architecture, the STV3 engine enables issuers to create modular, upgradeable, and fully auditable tokenized assets. This ensures that tokens can evolve as regulations change — without costly redeployments.

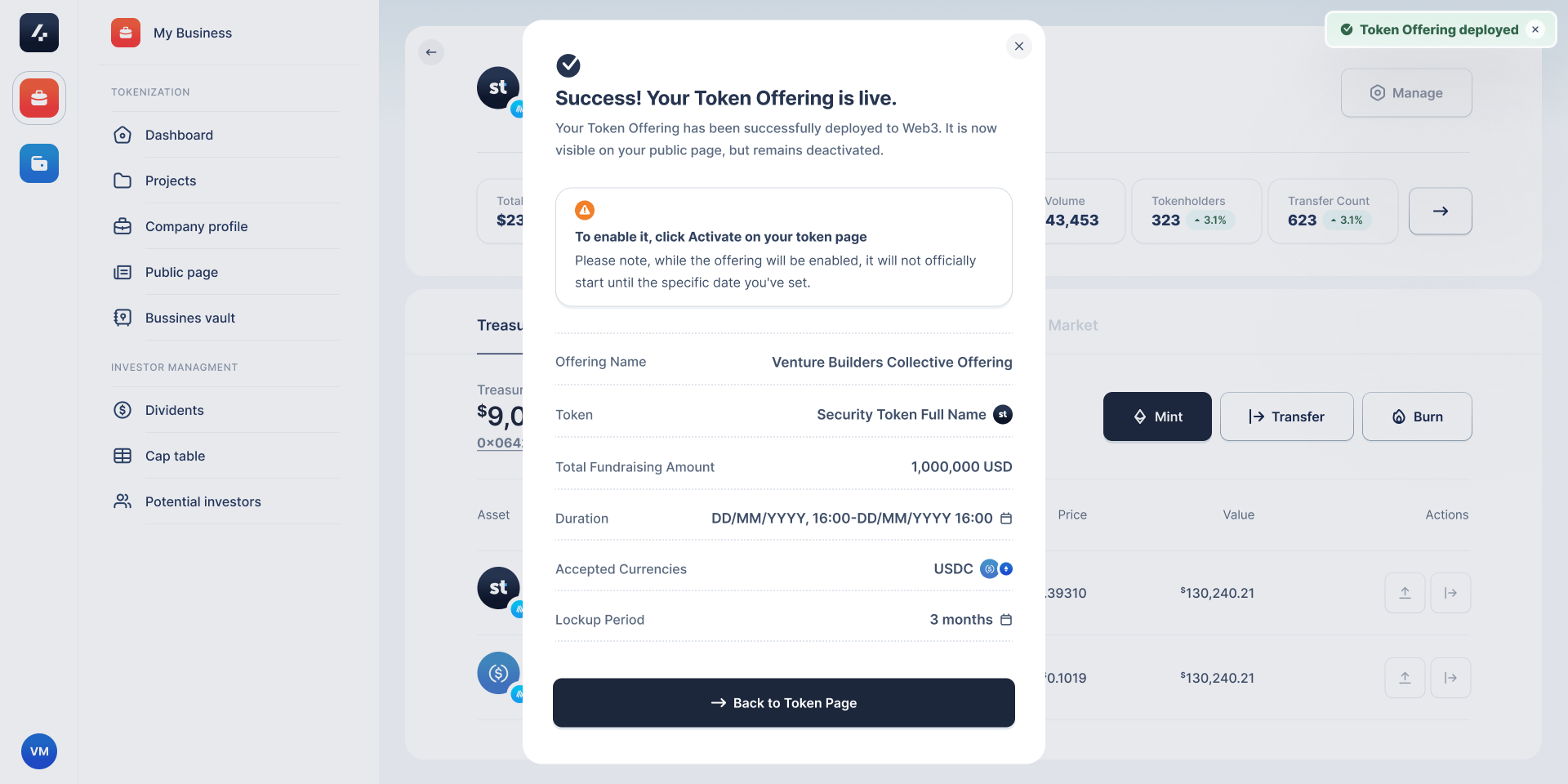

- Offering Engine

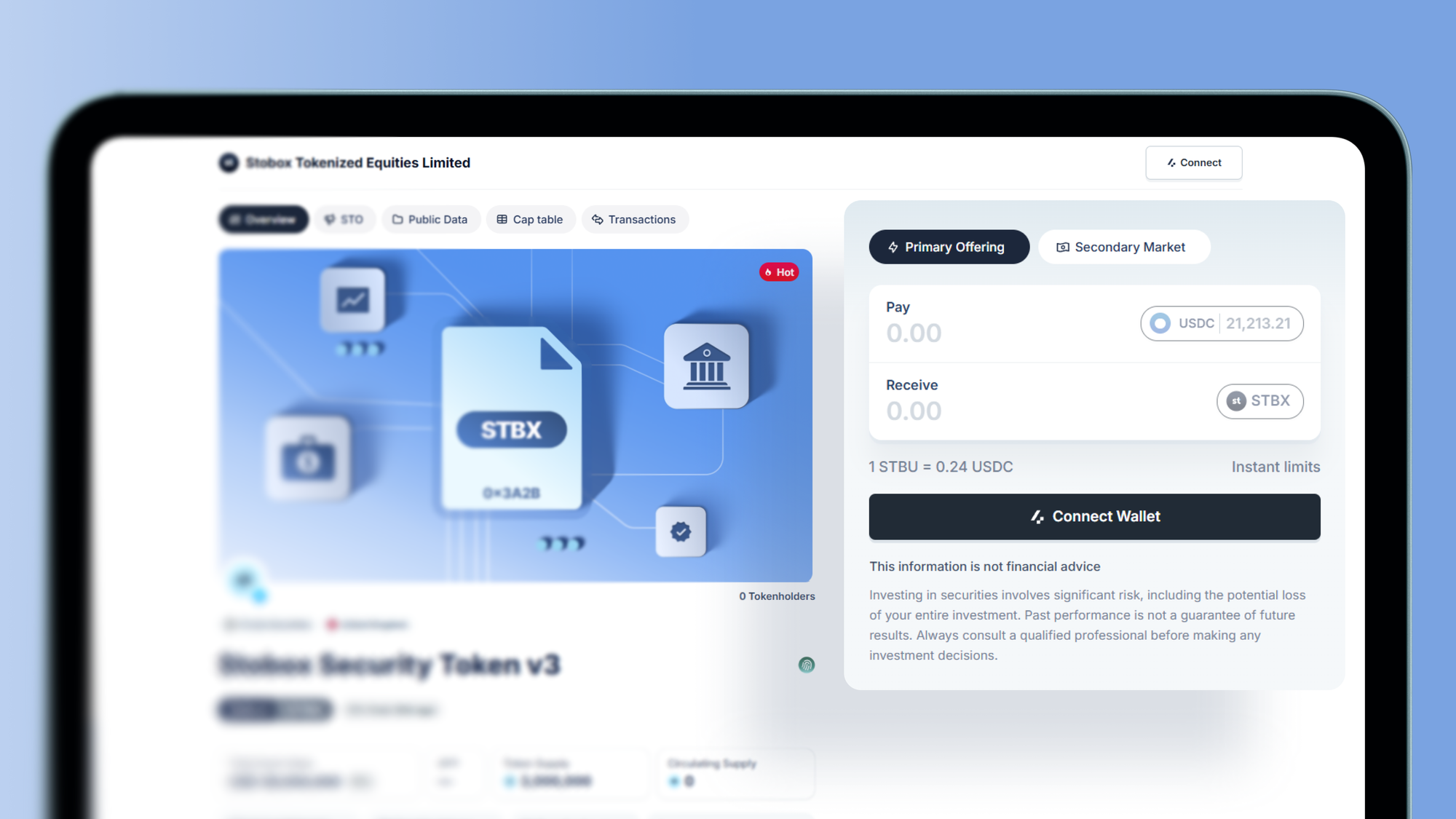

A dedicated module for structuring and managing regulated investment offerings. Issuers can design, launch, and track STOs (Security Token Offerings) with built-in lifecycle controls, public registries for transparency, and automated compliance features for fundraising. - Custom Investor Portals

Each issuer gets a branded, dedicated portal where investors can review documents, complete KYC, and directly purchase tokens. These portals display live offering data, proof of reserves, and cap tables — delivering a professional and transparent investor experience.

Together, these capabilities make Stobox 4.2.1 not just a product, but a comprehensive operating system for tokenization — uniting compliance, technology, and user experience into one seamless infrastructure.

Unlock the full potential of Stobox 4.2.1 features — from AI onboarding to STO management — tailored for your business.

Partnerships That Strengthen Issuers

Tokenization is not a silver bullet — it is a tool for high-quality companies to attract financing in a modern, transparent form. But for tokenization to succeed, issuers must first be prepared at the corporate, financial, and legal levels. This is why Stobox partners with internationally respected firms like Crowe and PwC, ensuring that every project entering the ecosystem meets rigorous global standards.

- Crowe (crowe.com) is one of the largest global networks of independent audit, tax, and advisory firms, known for its deep expertise in corporate audit, compliance, and financial structuring. Through this partnership, Stobox clients gain access to reliable due diligence, financial modeling, and auditing services — all essential in building investor confidence before launching a Security Token Offering (STO).

- PwC (pwc.com) is a worldwide leader in professional services, legal structuring, and strategic advisory. By working with PwC, Stobox clients benefit from guidance on corporate governance, cross-border legal frameworks, and investor-ready documentation. PwC’s brand and reputation also lend additional credibility to projects raising funds through tokenization.

Together, these partnerships ensure that tokenization is not just about issuing tokens — it’s about creating investment-ready opportunities that meet the standards of institutional investors, regulators, and the global capital markets.

By combining Stobox’s infrastructure with the professional oversight of firms like Crowe and PwC, issuers are able to approach tokenization with the same rigor as a traditional capital raise, but with the efficiency and scalability of blockchain.

Backed by global leaders like Crowe and PwC, Stobox 4.2.1 ensures your project is prepared for institutional standards.

More Than Technology: The Stobox Methodology

Stobox’s approach is built not only on advanced infrastructure but also on a structured 8-step methodology that guides issuers through the entire tokenization journey. While technology provides the tools, methodology ensures those tools are applied correctly, consistently, and in a way that meets both regulatory and investor expectations.

The framework compiles all the essential data points needed for a successful Security Token Offering (STO) — including asset verification, legal structuring, financial modeling, compliance checks, and investor alignment. By following this process, issuers reduce risks, avoid costly mistakes, and ensure their project is positioned for long-term sustainability.

Why is this methodology needed? Because tokenization is not just about issuing a token. Without proper preparation, even the most innovative technology cannot make an investment attractive or compliant. Issuers need to prove that:

- The asset is legitimate, verified, and free of disputes.

- The corporate and legal structure is aligned with regulatory requirements.

- The financial model is transparent and viable, showing investors how returns are generated.

- Investor protections, disclosures, and reporting mechanisms are clearly built in.

By systematizing these steps, Stobox ensures that tokenized assets aren’t speculative experiments, but rather investment-grade opportunities comparable to those vetted in traditional capital markets.

In short, the Stobox Methodology bridges the gap between technology and trust. It turns tokenization from a technical process into a structured financial product — one that regulators, investors, and institutions can confidently participate in.

The Security Token Offering Module

The highlight of this release is the Security Token Offering (STO) module, the final piece in the cycle:

Securitization → Onboarding → Tokenization → Offering

This closes the loop we have been building for the past 1.5 years. With STOs now fully integrated, issuers can seamlessly move from preparation to launch within Stobox 4.

Real Projects, Real Momentum

We are already working with 10+ clients who are onboarding to Stobox 4. Early projects include:

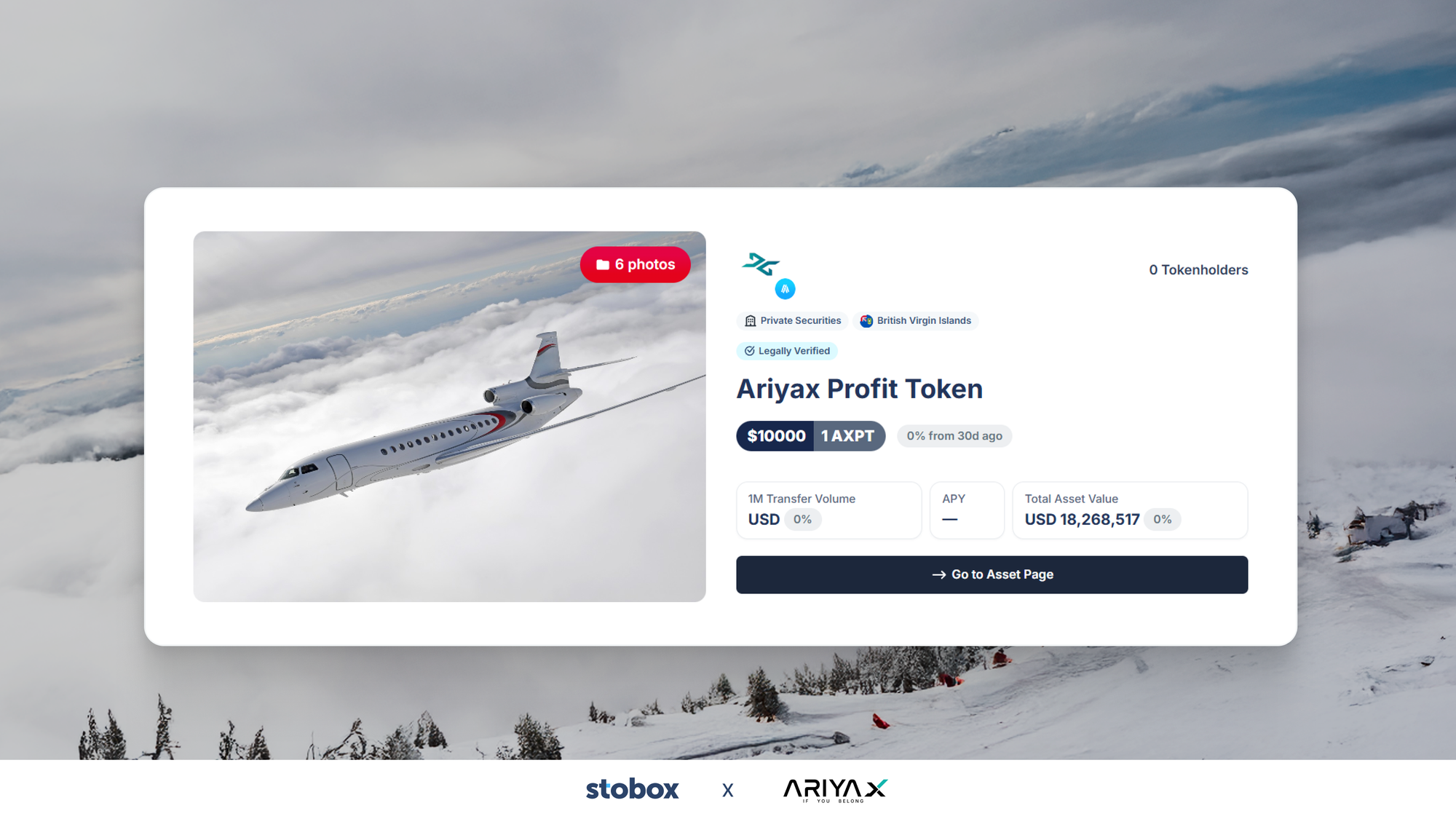

AriyaX — Aviation Financing. Dubai-based AriyaX redefines private aviation by combining aircraft acquisition, leasing, and charter with tailored financing solutions. The project delivers exclusive access and precision-driven aviation partnerships for elite clients worldwide.

Repository RWA — Real Estate Tokenization. Repository RWA provides AI-powered, compliant tokenization of real-world assets, from real estate to renewables. Its turnkey infrastructure simplifies issuance and management, opening global markets for businesses and investors alike.

PCM — Real Estate Development. PCM has built a reputation in Canada for delivering high-end residential projects that merge modern design, fine craftsmanship, and lasting value. With a focus on premium properties, PCM creates real estate assets that stand out for both their exclusivity and investment potential.

Monerys AG — Swiss Hybrid Bank. Monerys AG is building Switzerland’s first fully blockchain-integrated hybrid bank, combining fiat services with digital asset solutions. With FINMA alignment and tokenized liquidity, it offers investors a rare first-mover opportunity.

With the Stobox 4.2.1 update, these issuers can now launch their STOs anytime. Our team is actively working with their project teams to go live in the coming weeks. The first tokenized assets are expected to be available in early October.

This release is more than a product update — it is the foundation of a new era in tokenized finance.

By combining compliance-by-design, enterprise-grade infrastructure, and global partnerships, Stobox 4.2.1 transforms tokenization into a trusted, repeatable business process. For issuers, it means faster fundraising with less friction. For investors, it means transparent access to regulated opportunities. And for the industry, it marks the shift from experimentation to infrastructure.

The future of capital markets is digital, compliant, and on-chain — and with Stobox 4.2.1, that future is already here.

Start your tokenization journey with Stobox 4.2.1 — configure, publish, and manage digital assets in one platform.