Infrastructure of Tokenized Finance: Why STBX Represents the Future of Real-World Asset Ownership

Infrastructure of Tokenized Finance: Why STBX Represents the Future of Real-World Asset Ownership

The world of investing is undergoing a fundamental transformation. Blockchain technology is no longer a speculative frontier — it's becoming the backbone of how real assets are issued, owned, and transferred. At the center of this shift stands Stobox, a turnkey tokenization technology provider, and its equity-backed security token, STBX. This article unpacks what STBX is, why it matters, and what Stobox's 2025 Annual Shareholder Report reveals about the company building the rails for tokenized capital markets.

What Is STBX? Real Equity, On-Chain

STBX is not a utility token. It is not a meme coin. It is not a speculative DeFi derivative.

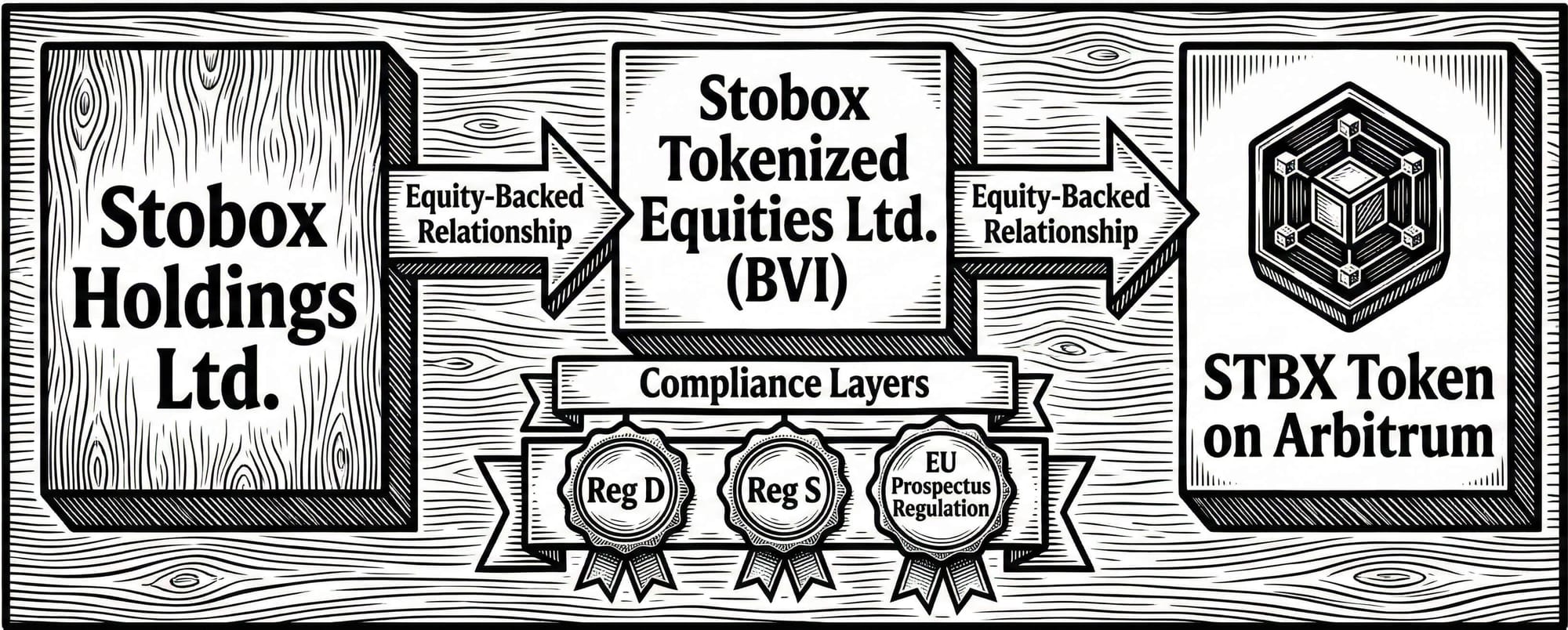

STBX is a security token directly tied to Stobox's Class-A equity. Every single STBX token represents one Class-A share of Stobox Holdings Ltd., issued through Stobox Tokenized Equities Ltd. (BVI) and deployed on the Arbitrum blockchain — one of Ethereum's most efficient and secure Layer 2 networks. Every share is recorded and transferred via blockchain technology, ensuring trust, security, and long-term growth potential.

What makes this significant is the structural honesty of the instrument. When you hold STBX, you hold a verifiable, on-chain ownership stake in the company behind the token. There's no abstraction layer, no vague "governance right," no promise of future utility that may never materialize. It is equity. It is regulated. And it is managed using the same Stobox 4 platform that the company provides to its enterprise clients — a powerful statement of confidence in its own technology.

STBX tokens comply with key securities regulations, including Regulation D (Rule 506(c)) for U.S. accredited investors, Regulation S for international participants, and the European Prospectus Regulation (Article 1(3)). This is not a grey-area offering. It is a structured, regulated equity instrument that happens to live on a blockchain.

Be part of a global shift where technology meets real investment opportunities. STBX represents a bridge between the traditional world of private equity and the new paradigm of programmable, transparent, borderless ownership.

The Benefits of Investing in STBX

1. Direct Equity Ownership on the Blockchain

STBX provides something genuinely rare in the digital asset space: a one-to-one mapping between a token and a real equity share in an operating technology company. This isn't a synthetic exposure or a wrapped derivative — it is the share itself, represented as an ERC-2535 token on Arbitrum. Ownership is transparent, verifiable on-chain, and managed through institutional-grade compliance infrastructure.

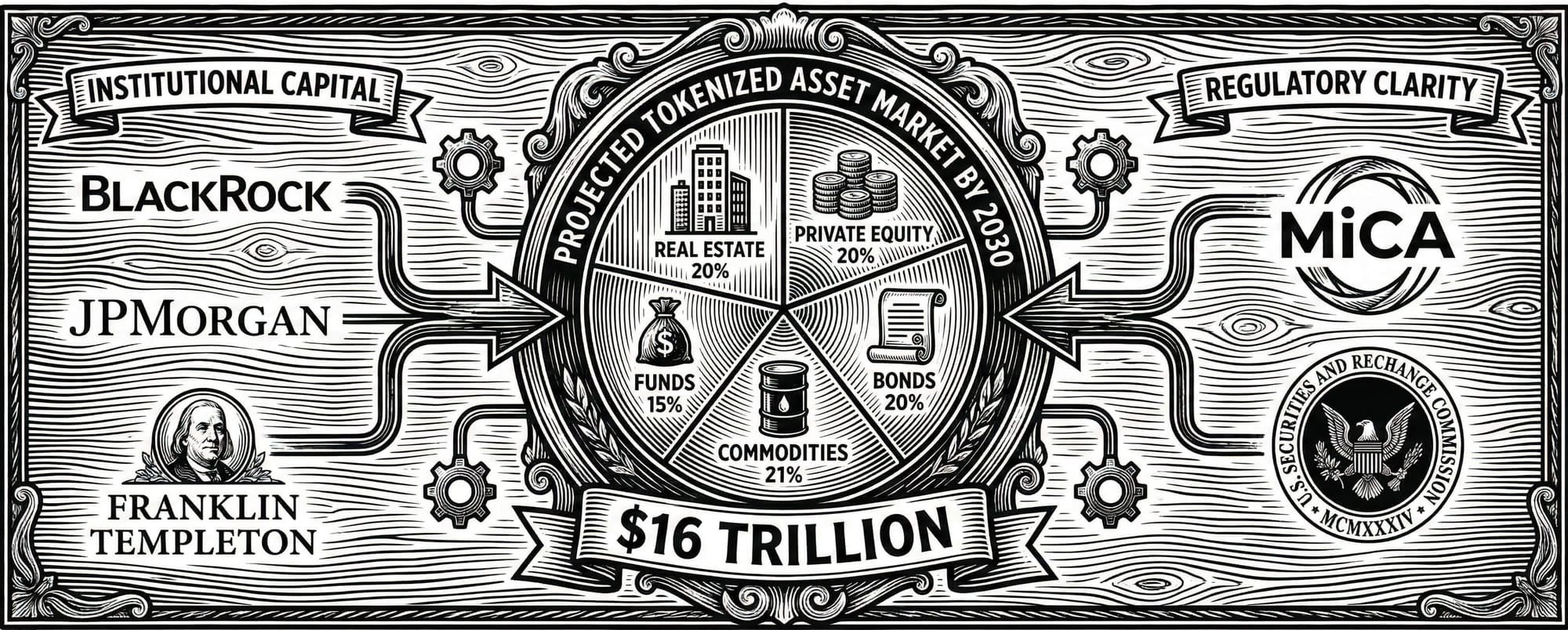

2. Exposure to a $16 Trillion Market Opportunity

The tokenization of real-world assets is not a niche trend. Boston Consulting Group projects tokenized assets to reach $16 trillion by 2030. BlackRock, JPMorgan, and Franklin Templeton are actively building tokenization capabilities. The MiCA regulatory framework is live in Europe. SEC frameworks in the United States are maturing. The question is no longer whether tokenization goes mainstream — it is who delivers it at scale. Investing in STBX is investing in the company positioning itself as the infrastructure provider for this wave.

3. Regulatory Compliance Built In

Unlike the majority of crypto tokens that exist in regulatory ambiguity, STBX is issued under recognized securities exemptions. This means investor protections, KYC/AML compliance, and a legal framework that institutional participants expect. For investors who have been cautious about digital assets due to regulatory risk, STBX offers a path that sits firmly within the established legal landscape.

4. Technology-Backed Competitive Moat

Stobox's core intellectual property — the Stobox 3 and Stobox 4 platforms — represents years of accumulated development, production hardening, smart contract architecture, compliance module integration, and multi-chain deployment expertise. Carried at $759,891 on the balance sheet under IAS 38 cost accounting, the replacement value of this IP is estimated at $3–7 million, and comparable infrastructure would require $7–10 million to replicate from scratch. That gap between book value and market value represents significant embedded upside for STBX holders.

5. Transparent, On-Chain Accountability

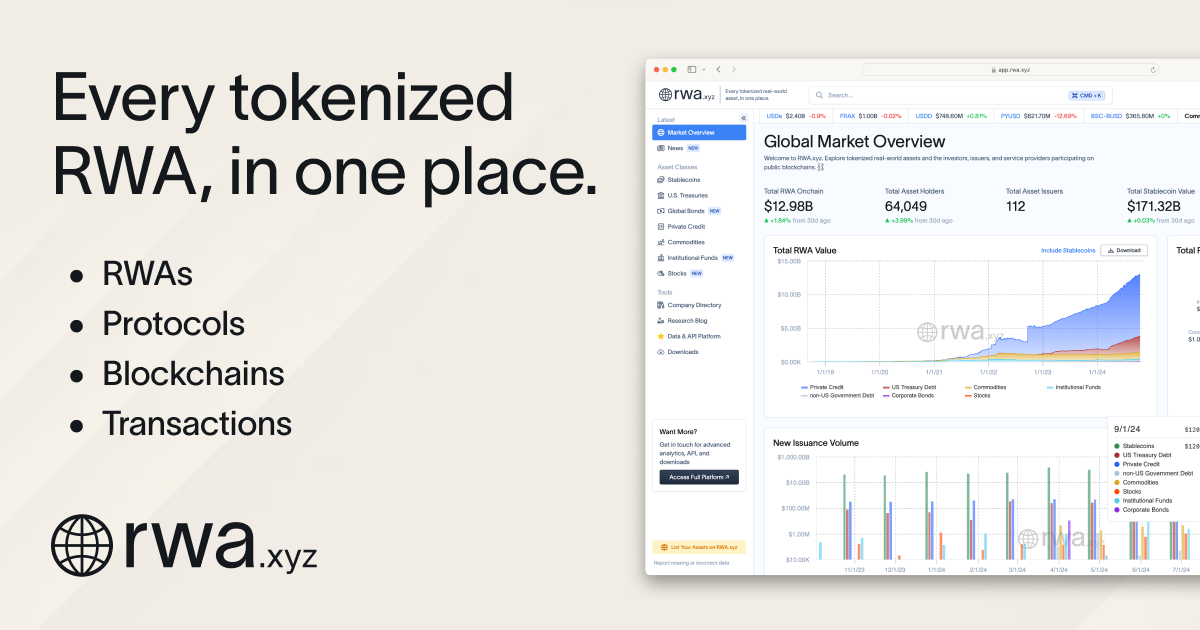

Stobox has committed to radical transparency by integrating with industry-standard analytics platforms — DefiLlama for TVL and protocol analytics, Dune Dashboards for custom on-chain data visualization, and RWA.xyz for real-world asset tracking. As visible in the on-chain data, STBX currently reflects a Total Value Tokenized (TVT) of USD 10,000,000 and a market capitalization of approximately USD 5.6 million, with a circulating supply of 1,128,957 tokens. This level of transparency is uncommon in private equity — and standard practice at Stobox.

6. Strategic Partnerships with Industry Leaders

Stobox has established operational integrations with Canton Network (enterprise-grade blockchain interoperability), tZero (regulated alternative trading system for digital securities), and Arbitrum (Layer 2 scaling). These are not speculative partnerships — they are production-level integrations that expand what STBX holders are invested in.

7. AI-Powered Future

Artificial intelligence is not a buzzword at Stobox — it is a core product roadmap priority. From smart document processing and automated compliance screening to intelligent deal structuring and AI-powered investor relations, Stobox is embedding AI across the entire tokenization lifecycle. STBX holders are positioned to benefit as these capabilities create operational leverage and product differentiation.

Inside the 2025 Annual Shareholder Report: What the Numbers Tell Us

On February 21, 2026, Stobox Group published its Annual Shareholder Report for the fiscal year ended December 31, 2025. It is a candid, detailed, and refreshingly honest document — the kind of transparency that investors in tokenized equity deserve. Here's what it reveals.

Record Revenue, With Clear Growth Trajectory

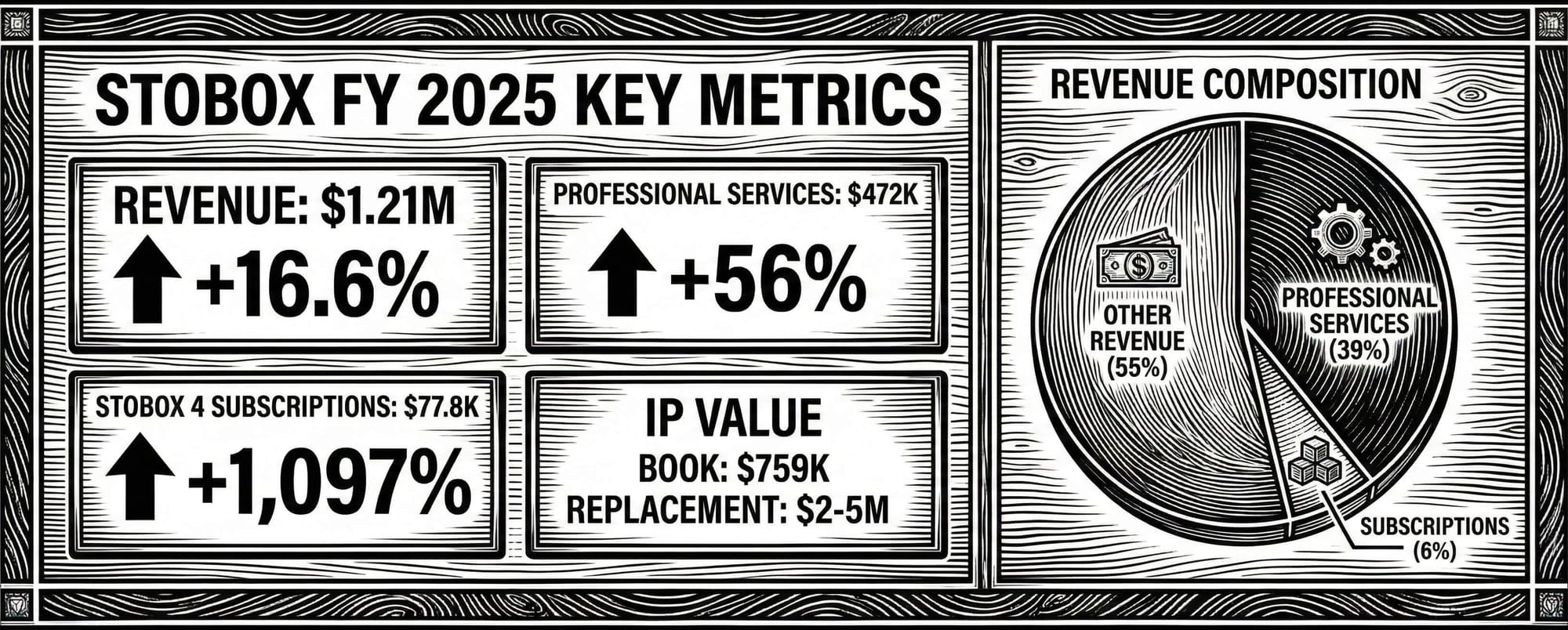

Stobox achieved total revenue of $1,210,610 in FY 2025, representing a 16.6% year-over-year increase. While headline revenue growth is encouraging, the composition of that revenue tells the more important story.

Professional Services — the core consulting and project management business — grew 56% year-over-year to $472,267, rebounding strongly from a dip in FY 2024. Tokenization Project Management alone surged 121.7% to $328,940. This indicates real, paying enterprise clients engaging Stobox for sophisticated tokenization work.

Technology & Platform Revenue came in at $116,225, reflecting the ongoing migration from the legacy Stobox 3 platform (DS Dashboard) to the next-generation Stobox 4. The Stobox 3 line declined 86.3% as expected, while Stobox 4 Platform Subscriptions grew from $6,500 in FY 2024 to $77,825 — a more than ten-fold increase that signals early product-market fit for the new platform.

The STBU Dependency — Acknowledged and Addressed

The report is direct about one of Stobox's most significant challenges: STBU token sales represented $611,575, or 50.5% of total revenue. This concentration is explicitly flagged as a material dependency, alongside a $918,153 STBU redemption liability on the balance sheet.

But Stobox isn't hiding from this — it's engineering a path through it. The company's strategy to reduce STBU dependency runs along two tracks. First, diversify revenue through growth in professional services and platform subscriptions (both showed strong momentum in 2025). Second, build deeper, genuine utility for STBU tied to real product usage — platform access, fee discounts, and AI-powered features gated through the token. The long-term path to STBU sustainability, as the report states, is utility, not speculation.

EBITDA: Investing Through the Trough

Stobox's EBITDA for FY 2025 was negative at ($321,909), with a -26.6% margin. This is a widening from FY 2024's ($105,530), though substantially improved from FY 2023's ($1,405,743). The increase in operating expenses was driven primarily by a 625% rise in Token & Digital Asset Operations costs (reflecting the STBU ecosystem buildout) and continued investment in R&D ($407,780 capitalized).

For a venture-stage technology company in a nascent market, negative EBITDA is expected. The critical question is whether the investment is building durable value. The evidence suggests it is: the IP being capitalized, the platform showing traction, and the institutional client pipeline growing.

The Balance Sheet: Venture Stage, With Real Assets

As of December 31, 2025, Stobox's consolidated balance sheet shows total assets of $1,015,339 against total liabilities of $1,099,959, resulting in negative equity of ($84,620). The company is candid about this: it is common for venture-stage technology companies investing in platform development.

The critical asset is intellectual property at $759,891 — the Stobox 3 and Stobox 4 platforms. This is carried at historical cost with no amortization, as commercial deployment is ongoing. The gap between this book value and the estimated $2–5 million replacement value is where much of the embedded value sits for STBX holders.

Founder capital contributions total $1,790,575, demonstrating significant skin in the game from the leadership team. STBX token holders have contributed $111,938 in paid-in capital. The entity structure spans seven consolidated companies across the BVI, USA, Qatar, Poland, and the UK, reflecting a truly global operation.

The Stobox Ecosystem: More Than a Token

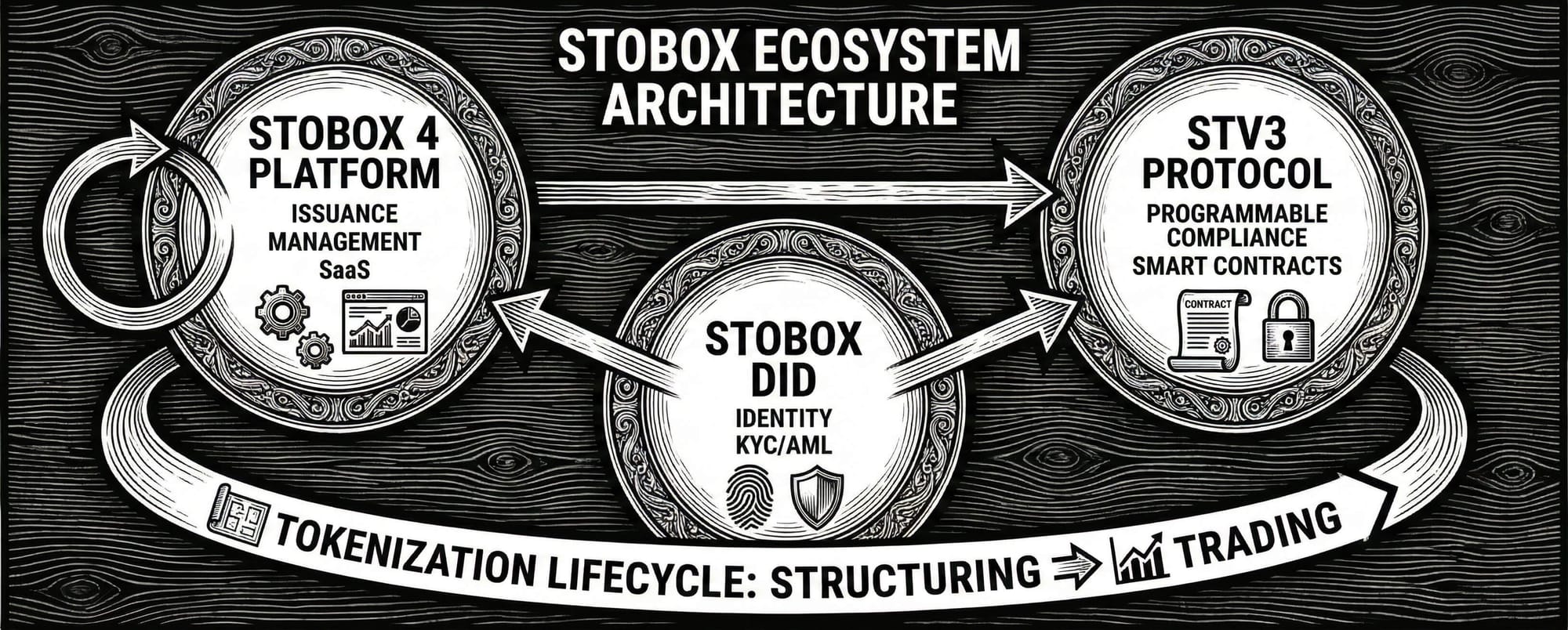

Understanding STBX requires understanding what you're investing in. Stobox is not a single product — it is an integrated ecosystem for regulated tokenization.

Stobox 4: Enterprise-Grade Tokenization Infrastructure

Stobox 4 is the company's flagship platform — a next-generation, enterprise SaaS solution for issuing, managing, and scaling tokenized assets with embedded compliance, automation, and regulatory alignment. It supports the full lifecycle of digital assets, from initial structuring and investor onboarding to governance, management, and eventual exit or redemption.

In October 2025, Stobox achieved a defining milestone: live tokenized asset offerings went operational on Stobox 4, including STBX itself. The platform now supports compliant Security Token Offerings with integrated KYC/AML through Sumsub, multi-chain deployment, and real-time portfolio management through the Stobox Wallet.

The fact that Stobox uses its own platform to manage its own equity tokenization is the strongest possible form of product validation.

STV3 Protocol: Programmable Asset Behavior

The STV3 Protocol provides programmable token standards that enable compliance rules, transfer restrictions, and governance logic to be embedded directly into the token's smart contract architecture. This is the layer that ensures STBX and other tokens issued on Stobox operate within regulatory boundaries automatically.

Stobox DID: Identity and Compliance Infrastructure

Stobox's Decentralized Identity (DID) system provides the identity verification layer required for regulated securities participation. It handles KYC/AML, accreditation checks, and jurisdiction-based eligibility — all on-chain, all verifiable, and all required for STBX participation.

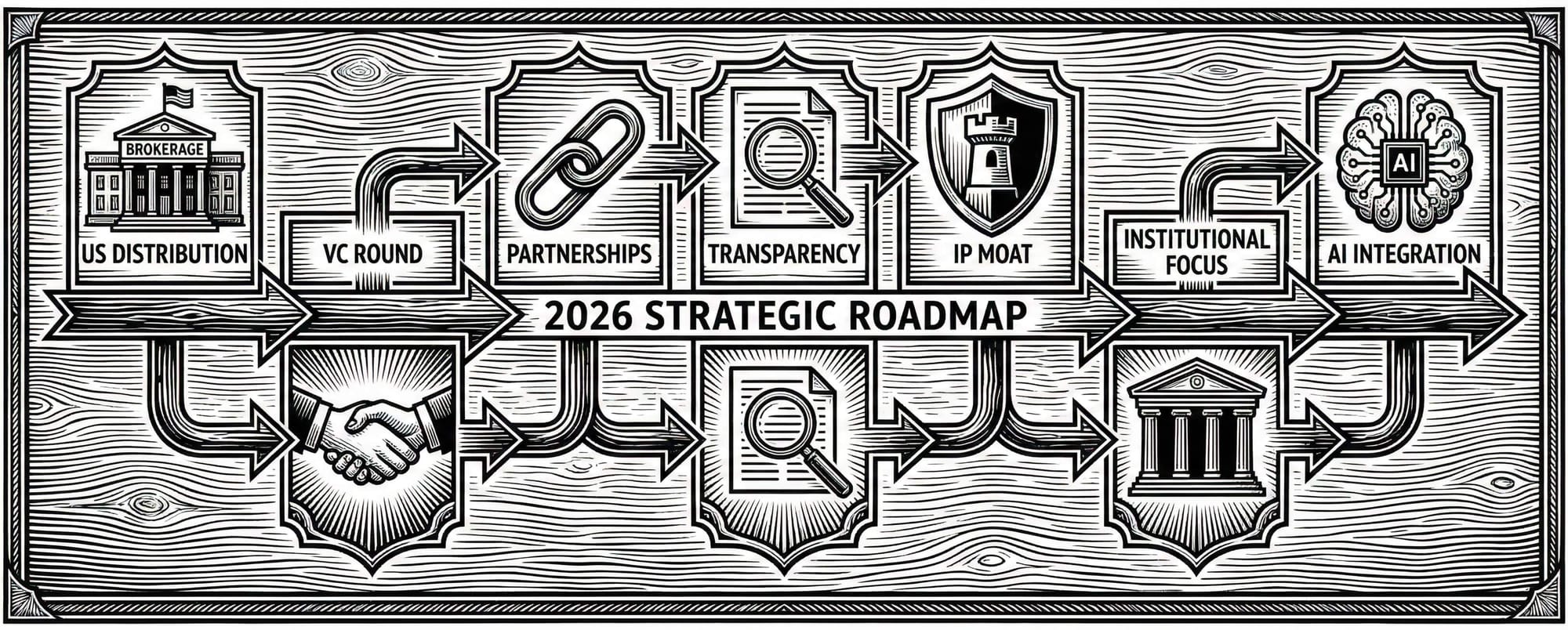

Strategic Outlook 2026: Seven Pillars of Growth

The 2025 Annual Report outlines seven strategic priorities that define Stobox's trajectory. For STBX holders, these represent the growth vectors that will drive long-term value.

1. US Brokerage Distribution

This is perhaps the single most important initiative. Stobox is focused on bringing tokenized securities to distribution via existing US brokerage networks, enabling retail and institutional investors to access tokenized assets through familiar infrastructure. This is the critical bridge between blockchain-native issuance and traditional capital markets — and the unlock for mass adoption.

2. VC/PE Fundraising

A venture capital / private equity round is in progress to scale operations, accelerate platform development, and expand market presence. The company is seeking partners who contribute strategic value beyond capital. For current STBX holders, successful fundraising would validate the company's valuation and potentially provide significant upside.

3. Strategic Partnerships

The Canton Network, tZero, and Arbitrum integrations position Stobox at the intersection of enterprise blockchain, regulated trading infrastructure, and cost-efficient Layer 2 execution. These are not announcements — they are operational integrations.

4. Transparency and On-Chain Accountability

The integration with DefiLlama, Dune Dashboards, and RWA.xyz (coming soon) sets a new standard for how tokenized equity companies report to their shareholders. This is radical transparency in action.

5. Technology IP as Competitive Moat

The $759,891 book value versus $7–10 million replacement value of Stobox's IP is not just an accounting footnote — it is the deepest competitive moat the company possesses. Three years of production hardening, multi-chain deployment, and institutional security cannot be replicated quickly.

6. Institutional Client Focus

The strategic shift toward institutional clients — asset managers, fund administrators, corporate treasurers, and real estate developers — supports higher contract values, recurring revenue, and client relationships that compound over time. This is the revenue diversification that will reduce STBU dependency.

7. AI Integration Across Tokenization

Stobox's AI strategy is comprehensive and production-oriented. Smart document processing, automated compliance screening, intelligent deal structuring, on-chain analytics, AI-powered investor relations, and internal operational AI agents all represent the embedding of artificial intelligence into the tokenization lifecycle. This is not a peripheral initiative — it is central to Stobox's product roadmap and competitive positioning.

The Macro Tailwind: Why Tokenization Is Inevitable

To invest in STBX is to invest in the thesis that tokenization of real-world assets is not a question of "if" but "when" — and, more importantly, "by whom."

The evidence is overwhelming. BCG's projection of $16 trillion in tokenized assets by 2030 is not an outlier estimate. BlackRock — the world's largest asset manager — has launched tokenized money market funds. JPMorgan has built blockchain infrastructure for institutional transactions. Franklin Templeton has tokenized US government securities. MiCA, the European Markets in Crypto-Assets regulation, is live and creating a clear legal framework. The SEC has been evolving its posture on digital securities.

The infrastructure layer — the platforms that enable compliant issuance, management, and trading of tokenized assets is where the structural value accrues. Stobox is building exactly this layer. And STBX is how you own a piece of it.

This is not a bet on a single token's price appreciation. It is a participation in the buildout of financial infrastructure that is becoming increasingly inevitable. The companies that solve the compliance problem, the enterprise integration problem, and the distribution problem will capture the value that flows through these rails for decades.

Risk Factors: Honesty as a Feature

No investment analysis is complete without a clear-eyed assessment of risks. Stobox's annual report is unusually forthcoming, and STBX investors should weigh these factors carefully.

STBU Concentration Risk — With 50.5% of FY 2025 revenue derived from STBU token sales and a $918,153 redemption liability, the company's revenue model is materially dependent on token economics that it is actively working to diversify.

Technology Risk — Smart contract vulnerabilities and blockchain infrastructure dependencies are inherent in any blockchain-based business. Stobox mitigates this through multi-chain deployment, security audits, and production-hardened infrastructure, but the risk remains non-zero.

Market Risk — The pace of tokenization adoption is uncertain. While institutional momentum is building, competition from large entrants (banks, exchanges, technology firms) could compress Stobox's market opportunity or margin.

Liquidity Risk — The company reports negative working capital and ongoing cash requirements for platform development. The planned VC/PE fundraising round is a critical milestone. STBX tokens themselves are currently private securities with limited secondary market liquidity.

Going Concern — The report notes negative consolidated equity of ($84,620). While common for venture-stage companies and mitigated by significant founder capital and ongoing revenue, this is a factor investors should understand.

Key Person Risk — Stobox is a founder-led organization with concentrated operational knowledge. This is typical of early-stage companies but represents a vulnerability in the leadership structure.

These risks are real. They are also the kinds of risks that exist in any venture-stage investment in a transformative technology category. The critical differentiator is that Stobox discloses them openly — a level of transparency that is itself a signal of corporate governance quality.

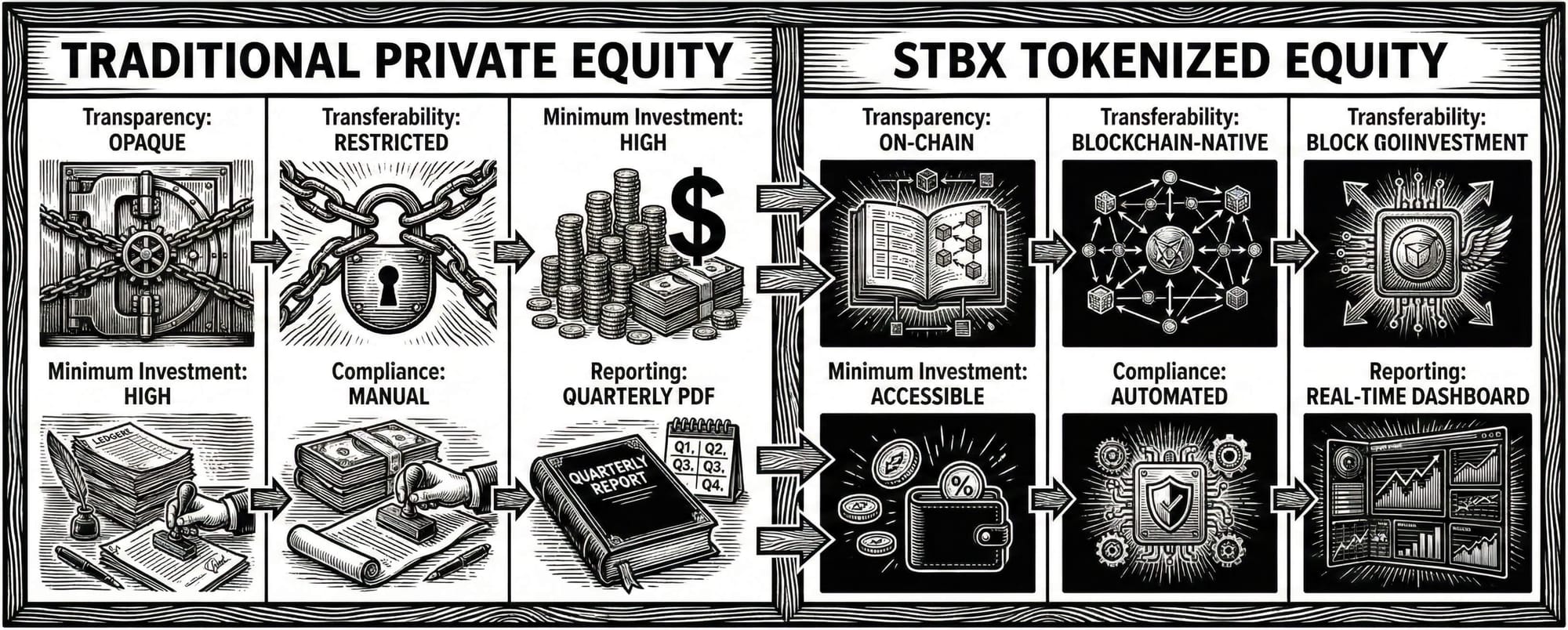

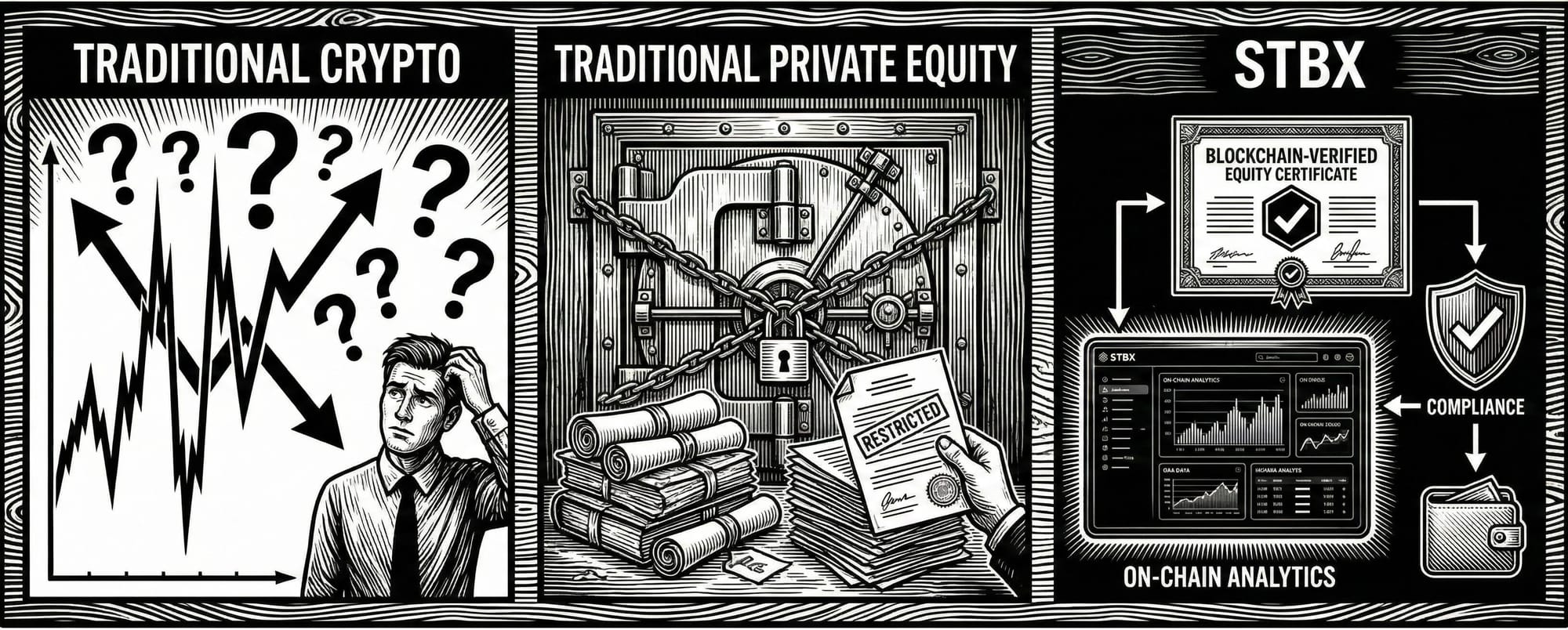

How STBX Compares: A New Category of Investment

STBX sits in a unique position in the investment landscape. It is not a crypto utility token subject to the wild sentiment swings of speculative markets. It is not a traditional private equity holding locked behind opaque fund structures. It is something genuinely new: regulated equity, issued on a blockchain, with on-chain transparency, compliance automation, and programmable ownership.

For crypto-native investors, STBX offers something the space desperately lacks — a token backed by real economic interest in a revenue-generating business, with a regulated legal framework and genuine accountability.

For traditional investors exploring digital assets, STBX offers a familiar equity structure — Class-A shares with regulatory compliance — delivered through modern infrastructure that provides transparency and accessibility beyond what conventional private equity can offer.

For institutional allocators evaluating the RWA space, STBX is both an investment and a case study — proof that the platform they might use for their own tokenization needs works in production, with Stobox's own equity as the reference implementation.

The Vision: Building for the Next Decade

As Gene Deyev writes in the shareholder letter: "We are not building for the next quarter. We are building for the next decade."

This long-term orientation is critical context for understanding STBX. Tokenization is still early. The market infrastructure is still being built. Regulation is still evolving. The clients are still being educated. But the direction is unmistakable.

Stobox has been in this space for over seven years — longer than most. It has shipped production software, onboarded real clients, navigated real regulatory frameworks, and tokenized its own equity on its own platform. The team has demonstrated the kind of operational persistence that separates companies that build lasting value from those that chase cycles.

STBX is an invitation to participate in that trajectory. It is equity in a company building the infrastructure that the next decade of financial markets will run on. It is recorded on a blockchain. It is verifiable on-chain. And it represents a genuine ownership stake in a team, a technology, and a vision that is positioning itself at the intersection of two of the most transformative forces in modern finance: tokenization and artificial intelligence.

The infrastructure is live. The platform is operational. The regulatory frameworks are crystallizing. The institutional adoption is accelerating.

The question is not whether tokenization will reshape capital markets. The question is whether you'll be positioned when it does.

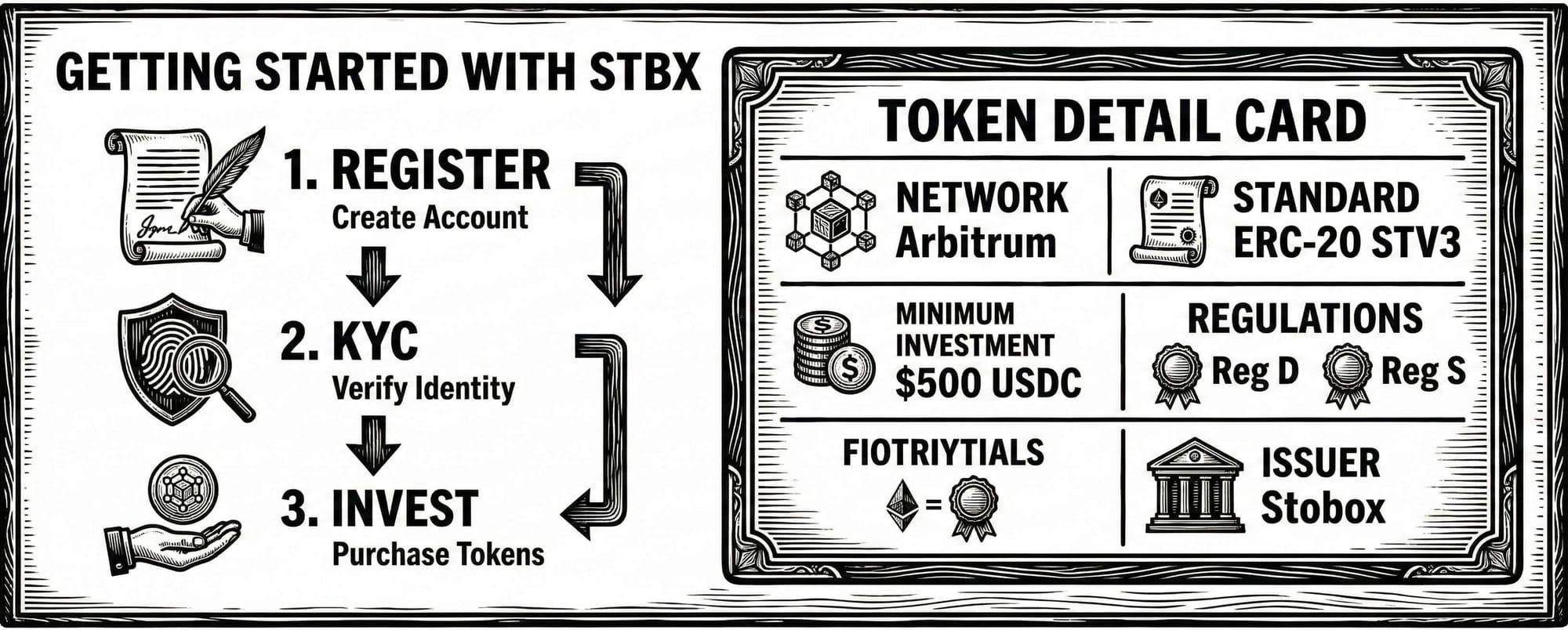

Getting Started with STBX

Investors interested in participating in STBX can begin the process through the Stobox 4 platform at assets.stobox.io. The process involves identity verification through Stobox DID, completion of KYC/AML requirements, and compliance checks — because STBX is a security token and regulatory compliance is non-negotiable.

The minimum investment is $500 USDC on the Arbitrum network. Full offering details, the prospectus, and compliance documentation are accessible to verified investors through the platform.

For more information about Stobox, its technology, and its ecosystem, visit the comprehensive documentation at docs.stobox.io/about.

Important Disclaimers

This article is for informational purposes only and does not constitute financial, investment, or legal advice. The information presented herein is based on Stobox Group's publicly available materials and Annual Shareholder Report for FY 2025. It does not constitute an offering memorandum, prospectus, or solicitation of investment.

STBX tokens are private securities offered under Regulation D (Rule 506(c)), Regulation S, and the European Prospectus Regulation (Article 1(3)). They are available only to eligible investors meeting specific regulatory criteria. Investing in private securities involves a high degree of risk, including the potential loss of the entire investment. STBX tokens are not publicly traded, and liquidity may be limited.

Past performance is not indicative of future results. Forward-looking statements in this article are based on current expectations and are subject to risks and uncertainties that could cause actual results to differ materially. Investors should conduct their own independent due diligence and consult with qualified financial, legal, and tax professionals before making any investment decisions.

The availability of STBX tokens may vary based on jurisdiction. It is the responsibility of each investor to confirm eligibility under applicable securities laws.