Reinventing Real Estate Investment Through Tokenization: The Inspiring Journey of GL Capital with Stobox

Reinventing Real Estate Investment Through Tokenization: The Inspiring Journey of GL Capital with Stobox.

As investment trends continue to evolve, the principle of diversification remains at the forefront. There's a growing inclination amongst investors to include alternative assets, such as real estate, in their investment portfolios. However, stepping into the realm of high-quality real estate often poses formidable barriers.

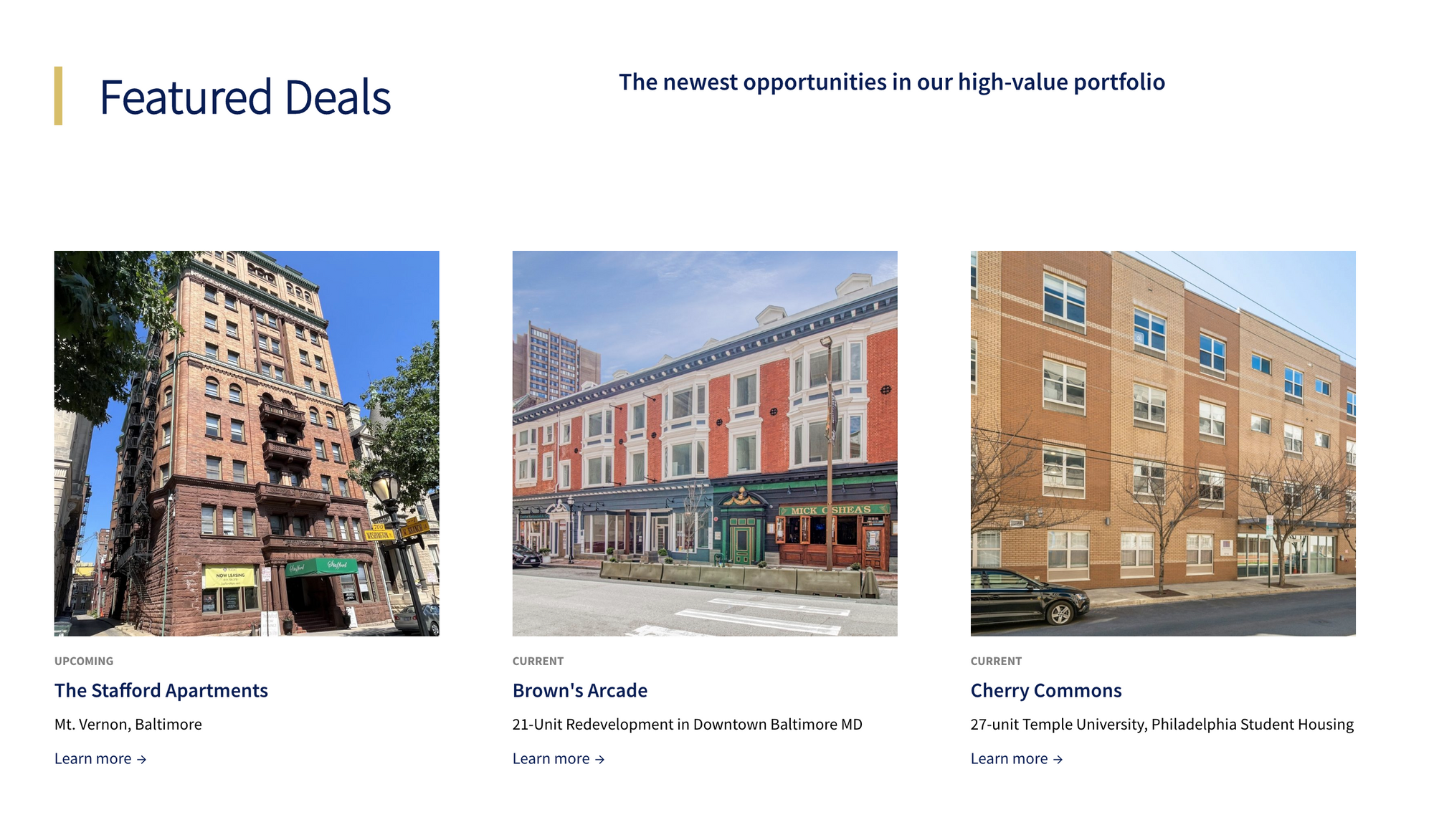

Addressing this challenge, GL Capital, an innovative private equity firm, is carving a fresh path, leveraging the expertise of Stobox, a market leader in digital asset tokenization.

They're employing tokenization and securitization of Real World Assets (RWA) as a strategic tool to broaden access to premium real estate investments.

Stobox: Pioneering Asset Tokenization

Stobox, recognized for its proficiency in executing comprehensive tokenization projects, welcomes GL Capital to its esteemed clientele. Utilizing the advanced DS Dashboard V3 from Stobox, GL Capital is primed to manage security tokens proficiently, thereby democratizing access to high-value real estate investments to a larger audience.

Tokenization is an innovative practice that uses blockchain technology to encapsulate an asset's value into a digital token. By facilitating GL Capital's tokenization needs, Stobox reaffirms its commitment to driving technological innovation in the field of asset tokenization.

GL Capital is issuing MFRET security tokens that denote equity ownership in a special-purpose vehicle (SPV) that holds the completed and operational apartments.

The Distinctive Appeal of Tokenized Real Estate by GL Capital and Stobox

The collaborative journey of GL Capital and Stobox presents a host of unique advantages to investors, with risk reduction being a standout feature. Given that the properties are already in operation, the conventional risks associated with project development and construction are mitigated. This collaboration between GL Capital and Stobox creates a unique investment opportunity that breaks down the barriers to top-tier real estate investments and paves the way for a new era in real estate investment.

Furthermore, GL Capital's tokenized real estate offerings, enhanced by Stobox's cutting-edge token management system DS Dashboard V3, promise an expected annual yield of 7%, supplemented by the potential appreciation of real estate prices. These enticing offerings underline the potential for significant returns, thereby attracting a wide array of investors.

Embarking on the Path to Global Outreach: A Unified Vision

At present, GL Capital's tokenized real estate offerings are limited to accredited investors in the US. However, the company is eyeing global expansion. With Stobox's globally acclaimed expertise in tokenization, GL Capital seeks to broaden its access to US real estate for international investors. This move towards global outreach holds promising prospects for both GL Capital and Stobox as they strive to affirm their positions as leaders in the sphere of tokenized real estate investment.

Tokenization is revolutionizing how investors perceive and approach traditionally illiquid assets like real estate.

Stobox, known for its focus on comprehensive tokenization projects, is playing a pivotal role in GL Capital's transformation with its MFRET security tokens. This significant step could pave the way for a more accessible, secure, and profitable environment for real estate investment.

Looking forward, the association of GL Capital and Stobox hints at a future where blockchain technology will be commonplace. By breaking down traditional investment barriers and fostering international investment opportunities, they're making real estate investment more accessible and profitable than ever.

Investing in GL Capital's tokenized real estate, facilitated by Stobox's sophisticated token management, not only presents an attractive opportunity for significant returns but also offers a chance to participate in a pioneering endeavor, one that's set to redefine the future of real estate investment.

Disclaimer:

Please note that Stobox Technologies Inc. ("Stobox") does not endorse, promote, or recommend the purchase, sale, or trading of securities or any financial assets. Stobox is a technology company that provides a platform for managing digital assets and is not engaged in any broker-dealer activities.

Stobox does not offer any form of advice, guidance, or recommendation regarding the suitability, profitability, or potential value of any particular investment, security, or information source. Any data, information, or insights provided by Stobox should not be interpreted as investment advice or a recommendation to invest.

Stobox does not guarantee the performance of any investment or the return on any investment. Investing in securities or financial assets involves risk, and investors should be prepared to bear the loss of their entire investment. Before making any investment decision, prospective investors should seek advice from their financial, legal, tax and accounting advisers, taking into account their individual financial needs and circumstances.

The provision of Stobox's services does not imply the endorsement of any particular investment or the confirmation of an investment's regulatory compliance. As a technology service provider, Stobox does not participate in the promotion, negotiation, or conclusion of any investment transactions.