October Update: From Infrastructure to Impact - First STOs Launch on Stobox 4

October marks a pivotal moment for Stobox 4 — the transition from infrastructure to impact. Four compliant tokenized asset offerings are now live, including STBX equity and AriyaX aviation projects, proving regulated tokenization operates efficiently at scale.

Stobox 4 transitions from infrastructure development to live operations with 4 compliant tokenized asset offerings launched, including STBX equity tokenization, aviation finance innovation with AriyaX, and $320M in total tokenized assets.

October marked the defining moment in Stobox 4's journey: the platform moved from preparation to delivery. After months of infrastructure development, compliance integration, and partnership building, tokenized asset offerings are now live and operational. Operating under the CASP regime as a registered VASP, Stobox 4 has proven that regulated, compliant tokenization works at scale.

This is not a milestone announcement. This is proof of execution.

Four Tokenized Asset Offerings Launch

The infrastructure we built through Stobox 4.2.1 is now delivering exactly as designed. In October, four compliant Security Token Offerings went live on the platform, demonstrating the end-to-end functionality of our tokenization ecosystem.

These offerings span multiple industries and jurisdictions, each one structured through our STV3 Protocol, secured with Fireblocks MPC wallets, and verified through integrated KYC/KYB compliance. Investors can now access, participate in, and manage tokenized assets directly through the Stobox 4 Wallet.

This achievement validates everything we've built: the technical infrastructure, regulatory framework, and operational systems all working together to enable compliant digital securities issuance.

Leading by Example: STBX Equity Tokenization

In October, Stobox demonstrated the power of our platform by tokenizing our own equity. STBX Security Tokens represent Class-A equity participation in Stobox Holdings Ltd., issued through Stobox Tokenized Equities Ltd. (BVI) and managed entirely on Stobox 4.

We're not just building tokenization infrastructure for others-we're using it ourselves. STBX is structured with the same compliance protocols, investor protections, and technical standards we provide to every client. This isn't marketing. It's validation through action.

STBX represents an opportunity for investors to own a stake in the company building the future of tokenized finance, with full regulatory compliance through Regulation D (U.S.) and comparable international frameworks.

Aviation Finance Innovation: AriyaX Launches AXPT

AriyaX Capital Ltd. launched the AriyaX Profit Token (AXPT) on Stobox 4, bringing private aviation charter operations into the tokenized asset ecosystem. This marks one of the first successful implementations of aviation revenue tokenization on blockchain infrastructure.

AXPT connects token holders to charter revenue streams from ultra-long-range private jets through automated smart contract distribution. The project operates through a BVI-domiciled SPV structure, demonstrating how traditional aviation finance can be transformed through compliant tokenization.

AriyaX's white-label project portal at invest.ariyax.com showcases how Stobox 4 enables businesses to maintain their brand identity while leveraging our technical infrastructure.

STBU Migration & Rewards Program

October introduced the strategic STBU Migration & Rewards Program, creating a direct connection between our utility token ecosystem and security token infrastructure. STBU holders who bridge their tokens to Arbitrum and deposit on Stobox 4 become eligible for STBX allocations worth up to 25% of their deposited STBU value, plus complimentary annual platform access.

This program demonstrates the unique synergy between STBX and STBU:

- STBX attracts institutional capital through compliant, regulated investment structures

- STBU powers platform operations and provides ecosystem access

- 25% of STBX proceeds flow back to STBU ecosystem support (20% buyback/burns, 5% liquidity)

With STBX STO now live on Stobox 4, this creates a permanent mechanism where institutional investment continuously benefits retail token holders-a first in tokenization economics.

Geographic Expansion: NeosLegal Partnership

Stobox strengthened its MENA presence through a strategic partnership with NeosLegal, a UAE-based crypto-native law firm led by Irina Heaver. With over 20 years of legal experience and 300+ Web3 projects structured globally, NeosLegal brings institutional-grade legal infrastructure to Stobox clients operating in the UAE and Gulf region.

This partnership provides:

- RWA and STO structuring

- Regulatory compliance and investor protection frameworks

- Legal entity formation and onboarding support

- Jurisdictional alignment with UAE virtual asset regulators

Combined with our existing Qatar licensing, this expansion positions Stobox 4 as the leading compliant tokenization platform across MENA markets.

Industry Recognition: EBC Key Opinion Leader

Stobox Co-Founder and COO Ross Shemeliak was selected as a Key Opinion Leader for Real-World Assets at the European Blockchain Convention, one of Europe's premier Web3 events. This recognition reflects Stobox's continued leadership in the RWA space, where we've built infrastructure powering $500M+ in tokenized assets across 100+ clients globally.

Growing Engagement on Stobox 4

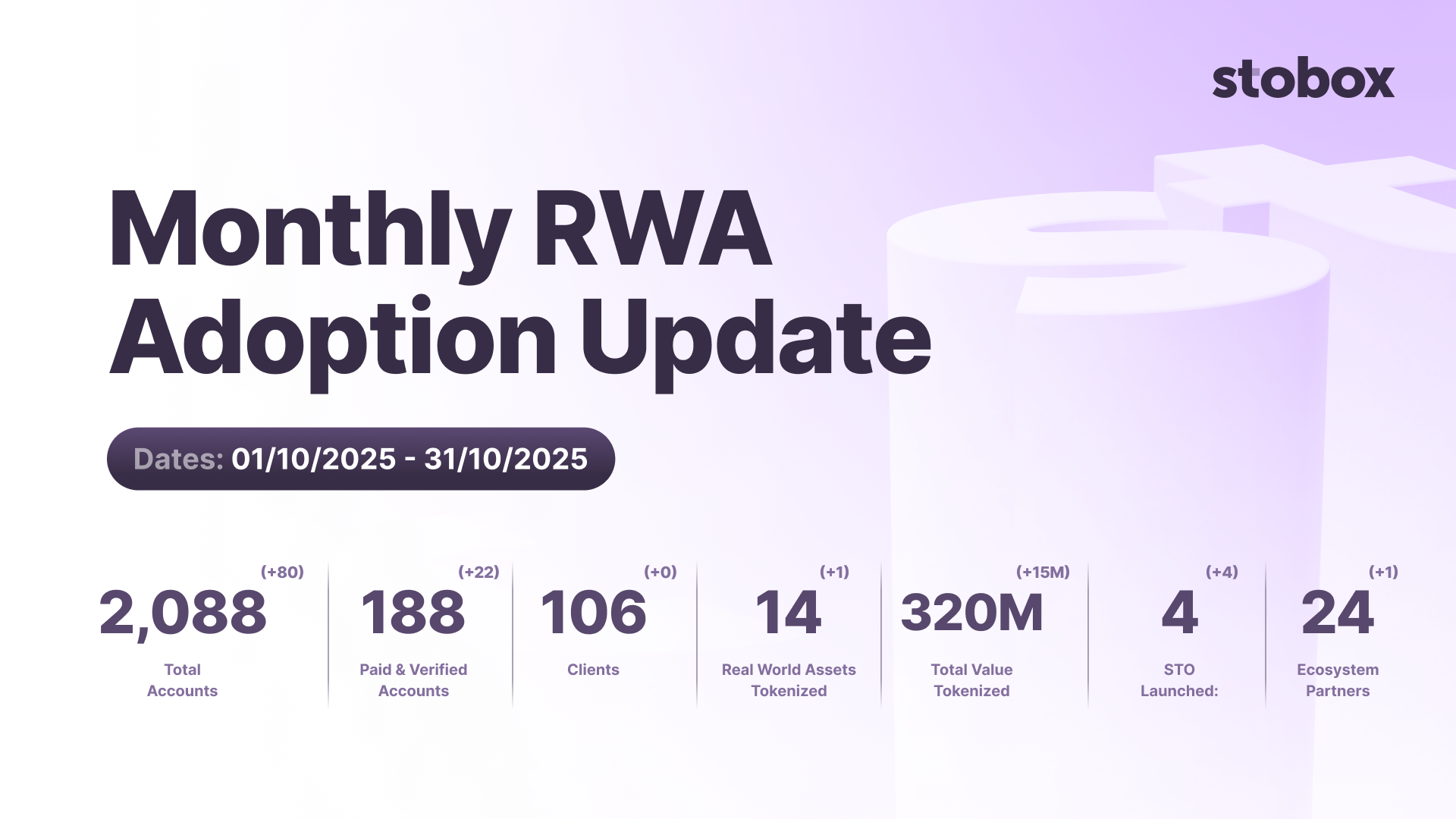

Stobox 4 closed October with continued platform growth and the most significant milestone to date: live tokenized asset offerings.

- Total accounts: 2,088 (+80)

- Monthly active accounts: Data reflects steady engagement as live offerings begin

- Paid and verified accounts: 188 (+22)

- Client base: 106 (stable as focus shifts to launching existing clients)

- Tokenized real-world assets: 14 (+1)

- Total value tokenized: $320 million (+$15 million)

- STOs launched: 4 (NEW - first compliant offerings live)

- Active ecosystem partners: 24 (+1)

October represents the moment Stobox 4 transitioned from promise to proof. With four compliant STOs now live, tokenized assets accessible through integrated wallets, and institutional partnerships expanding our geographic reach, we've demonstrated that regulated tokenization infrastructure works at scale.

The foundation is complete. The technology is proven. The compliance framework is operational. Now begins the next phase: scaling adoption as businesses worldwide recognize that tokenization isn't the future-it's the present.

Every milestone achieved in October validates our vision: making tokenization simple, compliant, and accessible worldwide. As we move forward, we remain committed to building regulated infrastructure that enables businesses to raise capital and investors to access new opportunities with confidence.

Ready to tokenize your real-world assets?

Join the regulated tokenization revolution with Stobox 4's comprehensive platform.