Monerys AG Launches First Security Token Offering on Stobox 4

Switzerland's First Blockchain-Integrated Bank Goes Live on Stobox Platform, Marking Major Milestone for Institutional RWA Tokenization

Stobox announces that Monerys AG has launched its Security Token Offering on Stobox 4, marking the first client tokenization project to go live on the platform. This milestone represents a significant validation of Stobox 4's infrastructure capabilities and its readiness to support institutional-grade tokenized offerings.

The First Client STO on Stobox 4

Monerys AG becomes the inaugural client to deploy a live Security Token Offering through Stobox 4's complete tokenization infrastructure. This launch demonstrates the platform's operational readiness and its ability to meet the stringent requirements of regulated financial institutions.

The Monerys offering leverages the full Stobox 4 ecosystem:

- STV3 Protocol for secure, upgradable smart contract architecture

- Stobox DID for compliant investor verification

- Integrated KYC/AML through Sumsub partnership

- Arbitrum blockchain deployment for scalability and efficiency

This integration enables Monerys to conduct a compliant, transparent tokenization process from onboarding through token issuance and investor management.

About Monerys AG

Monerys AG is building Switzerland's first hybrid blockchain-integrated bank, combining Swiss regulatory frameworks with blockchain technology. The project operates under FINMA guidance with a structured path toward obtaining full banking licensure.

Regulatory Framework

The Monerys banking license process is guided by Switzerland's established financial regulatory framework:

FINMA-Guided License Path: The licensing process involves consultation with Swiss banking advisors, including former FINMA officers, following procedures that have been applied in previous successful bank approvals.

Proven Implementation Model: The bank's operational infrastructure involves 40 established Swiss vendors who have experience in banking system implementation, covering core banking technology, compliance systems, and operational requirements.

Independent Oversight Structure: The project includes external legal counsel appointed in Zurich to conduct quarterly audits, with regulatory capital requirements ring-fenced according to Swiss banking standards.

Capital Structure

Monerys has structured two parallel investment pathways:

Tokenized Securities Path: Offered through Regulation S and Regulation D frameworks for international and U.S. accredited investors respectively.

Conventional Equity Path: Standard equity investment structure.

Both investment paths convert 1:1 into shares of the licensed banking entity upon FINMA approval.

The economic structure allocates 55% of economic rights to investors, with the founder retaining a non-dilutable stake of ≥15% to maintain accountability through the licensing process.

Milestone-Based Execution

The project follows a phased capital deployment structure:

- CHF 25M allocated for regulatory filing preparation

- CHF 27M designated for regulatory equity at approval stage

- CHF 8M reserved for post-approval launch operations

Capital deployment progresses as specific regulatory and operational milestones are achieved.

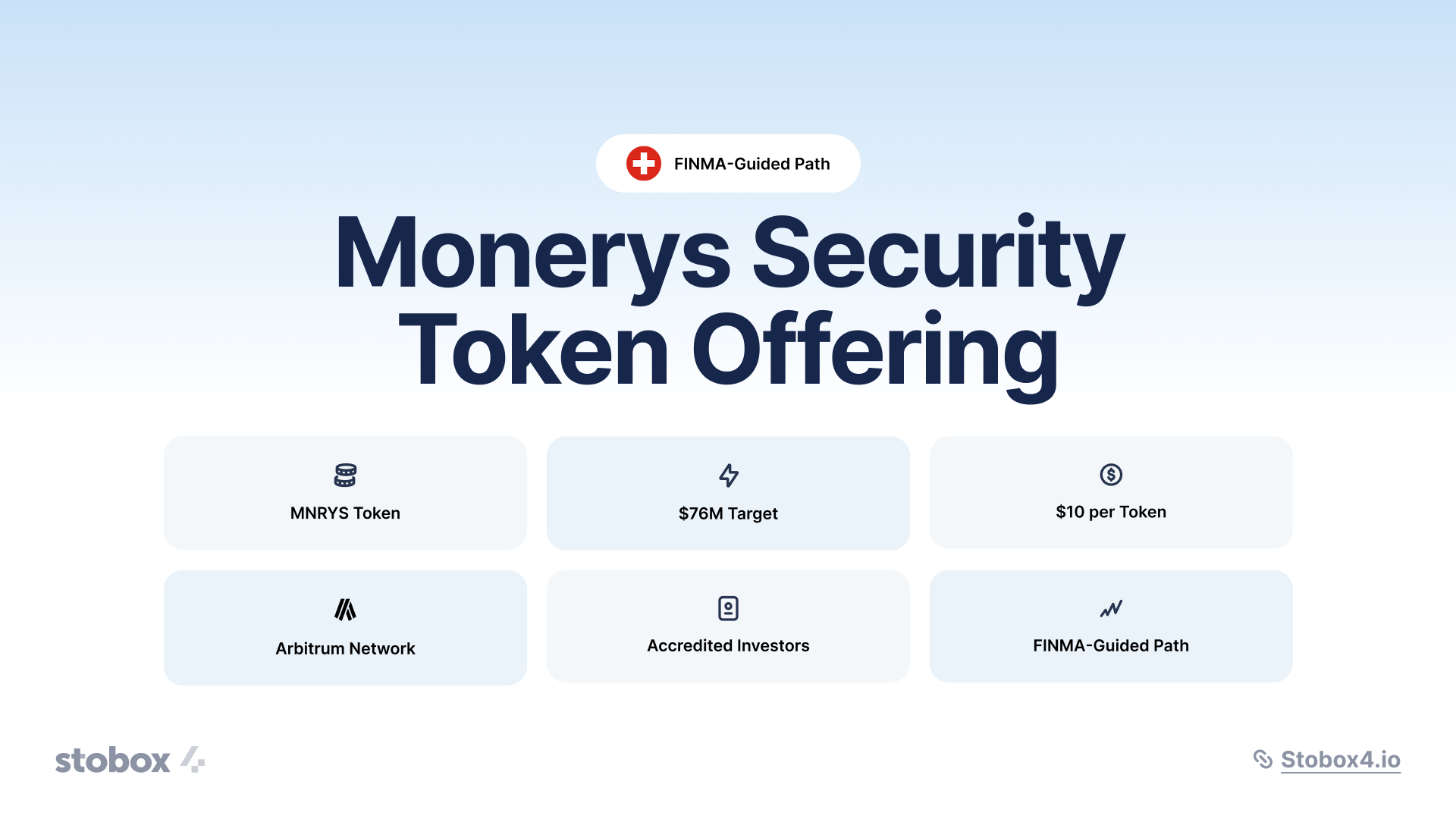

Token Offering Details

Token Information:

- Token Name: Monerys Security Token (MNRYS)

- Token Standard: ERC-20 (STV3 Protocol Architecture)

- Network: Arbitrum One

- Price per Token: $10 USD

- Fundraising Target: $76,000,000 USD

Security Structure:

- Security Type: Equity (Common Stock) Token

- Lock-up Period: 12 months

- Minimum Investment: $50,000 USD

- Accepted Currency: USDC (Arbitrum)

- Investor Eligibility: Accredited investors only

Issuing Entity:

- SPV: Monerys AG, Switzerland

- Corporate Website: https://monerysag.ch/

- Investment Platform: https://invest.monerysag.com/

Why This Launch Matters

The Monerys launch on Stobox 4 validates several critical elements:

Infrastructure Readiness: Stobox 4 successfully supports institutional-grade tokenization requirements, from regulatory compliance to technical architecture.

Regulatory Alignment: The platform accommodates complex multi-jurisdictional frameworks, including Swiss banking regulations, Regulation D, and Regulation S compliance requirements.

Scalable Architecture: The STV3 Protocol and integrated compliance systems demonstrate capability to handle substantial offerings with rigorous regulatory standards.

End-to-End Solution: From investor onboarding through token management, the platform provides comprehensive tokenization infrastructure without requiring external integrations.

Stobox 4's Role in Institutional Tokenization

This launch demonstrates Stobox 4's position as infrastructure for regulated tokenization:

Compliant-by-Design: Every component - from Stobox DID verification to STV3 smart contracts - incorporates regulatory requirements at the foundational level.

Institutional Standards: The platform meets the operational and security requirements expected by regulated financial institutions and their advisors.

Proven Methodology: Monerys utilized Stobox's structured tokenization framework, which guides issuers through legal structuring, compliance preparation, and technical deployment.

Partnership Ecosystem: Integration with established compliance providers like Sumsub ensures institutional-grade verification standards.

Technical Infrastructure Highlights

STV3 Protocol Architecture: Built on the Diamond Standard (EIP-2535), providing modular, upgradeable smart contracts that can adapt to evolving regulatory requirements without requiring token redeployment.

Stobox DID System: Decentralized identity verification ensuring all participants meet KYC/AML requirements before any transaction capability is enabled.

Arbitrum Deployment: Layer 2 scaling solution providing cost-effective transactions while maintaining Ethereum security guarantees.

Multi-Jurisdictional Compliance: Automated enforcement of investor eligibility rules based on jurisdiction, accreditation status, and regulatory framework applicability.

Looking Forward

The successful launch of Monerys AG on Stobox 4 establishes operational precedent for institutional tokenization on the platform. This milestone demonstrates that the complete tokenization cycle - from asset structuring through investor onboarding to token issuance - functions as designed in production environments.

Additional client projects are progressing through the Stobox 4 onboarding framework, with multiple offerings expected to launch throughout Q4 2025.

For businesses considering tokenization, the Monerys launch provides evidence of Stobox 4's capability to support complex, regulated offerings that meet institutional standards.

About Stobox 4

Stobox 4 is a comprehensive tokenization platform providing end-to-end infrastructure for Security Token Offerings and real-world asset tokenization. The platform integrates proprietary protocols (STV3, Stobox DID) with established compliance providers to deliver regulatory-aligned tokenization capabilities.

With $500M+ in tokenized assets and 100+ clients worldwide, Stobox provides the technological and methodological infrastructure for compliant digital securities issuance.

Platform Access:

- Business Registration: https://www.stobox.io/4/business/

- Individual Investor Access: https://www.stobox.io/4/individuals/

Explore how your organization can configure and publish tokenized assets on Stobox 4.