Introducing Stobox 4 (Beta)

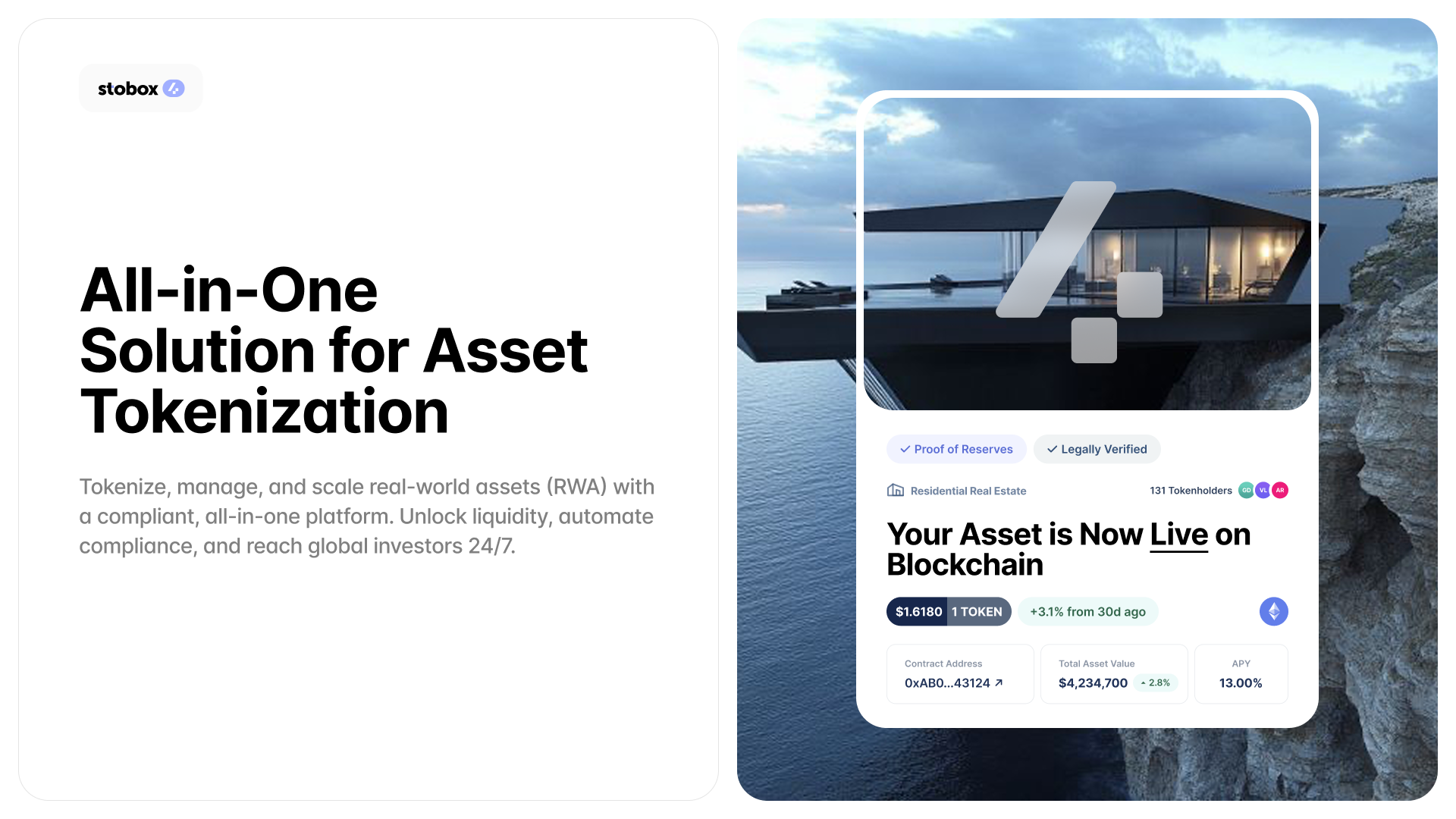

Stobox is proud to release Stobox 4 (Beta 1.8.3) — our next-generation platform for tokenizing real-world assets (RWAs).

Stobox is proud to release Stobox 4 (Beta 1.8.3) — our next-generation platform for tokenizing real-world assets (RWAs). Built for businesses, enterprises, and a new wave of global investors, Stobox 4 is the culmination of seven years of deep experience in tokenization, digital finance, and blockchain innovation.

We believe that the future of every business is on-chain. Just like websites became essential in the early 2000s, blockchain will become the underlying infrastructure for how businesses own, manage, and exchange value.

At the core of this transformation is the blockchain itself — a unified ledger that records and moves both assets and stablecoins. This allows for real-time, global transactions, enhances liquidity, and ensures transparency while meeting regulatory and tax requirements.

With Stobox 4, we make this future a reality — not just for crypto-native firms, but for any traditional business ready to move on-chain.

Our Vision: Any Company Can Be Tokenized

Every company — regardless of size, industry, or location — should have the opportunity to tokenize their equity, debt, commodities, or other financial instruments.

Tokenization opens the door to fractional ownership, global capital access, and greater liquidity. It also enables programmable finance and brings in new classes of investors and communities.

Stobox 4 merges the best of Traditional Finance (TradFi) with Real-World Asset Finance (RWAfi) and Decentralized Finance (DeFi), enabling companies to operate with the flexibility of blockchain while complying with real-world rules and regulations.

Every company — regardless of size, industry, or location — should have the opportunity to tokenize their equity, debt, commodities, or other financial instruments.

Built for the Future of Finance

Stobox 4 is not just a product — it's an infrastructure layer for the next generation of capital markets.

Whether you're an energy firm tokenizing infrastructure, a real estate developer raising capital from global investors, or a financial institution building blockchain-native products – Stobox 4 provides the compliance-first, enterprise-grade tools you need.

With global integration, cross-border compliance, and modular architecture, Stobox 4 is already powering tokenization projects in mining, finance, real estate, and banking sectors.

Stobox 4: Your Gateway to Asset Tokenization

The future of finance is on-chain, and Stobox 4 is here to bring that future within reach - not just for blockchain-native startups, but for any business ready to step into the token economy.

Sign-up with Stobox 4Whether you're looking to tokenize your company’s equity, real estate, debt instruments, or other real-world assets (RWAs), Stobox offers everything you need: legal structure, investor onboarding, compliance tools, secondary trading access, and most importantly – simplicity.

Let’s walk through what it means to start with Stobox 4, how it works, and why it represents the most powerful infrastructure for tokenized finance to date.

Join our live presentation to explore platform features, success cases, and next steps

Get Started with the Stobox Wallet

To begin your journey, you’ll first register and create your Stobox Wallet — a secure, enterprise-grade wallet built on MPC (Multi-Party Computation) technology.

Unlike traditional crypto wallets, which are vulnerable to single-point failures like private key loss or theft, Stobox Wallet divides key control across multiple secure parties. This makes it significantly more secure for businesses while keeping access easy and intuitive.

Your Stobox Wallet is more than just a wallet — it's also your primary identity on-chain, used to sign and authorize tokenization actions, investor transactions, and compliance approvals. This is enabled by Stobox DID (Decentralized Identity) — a blockchain-native identity layer that lets you operate legally and transparently across jurisdictions.

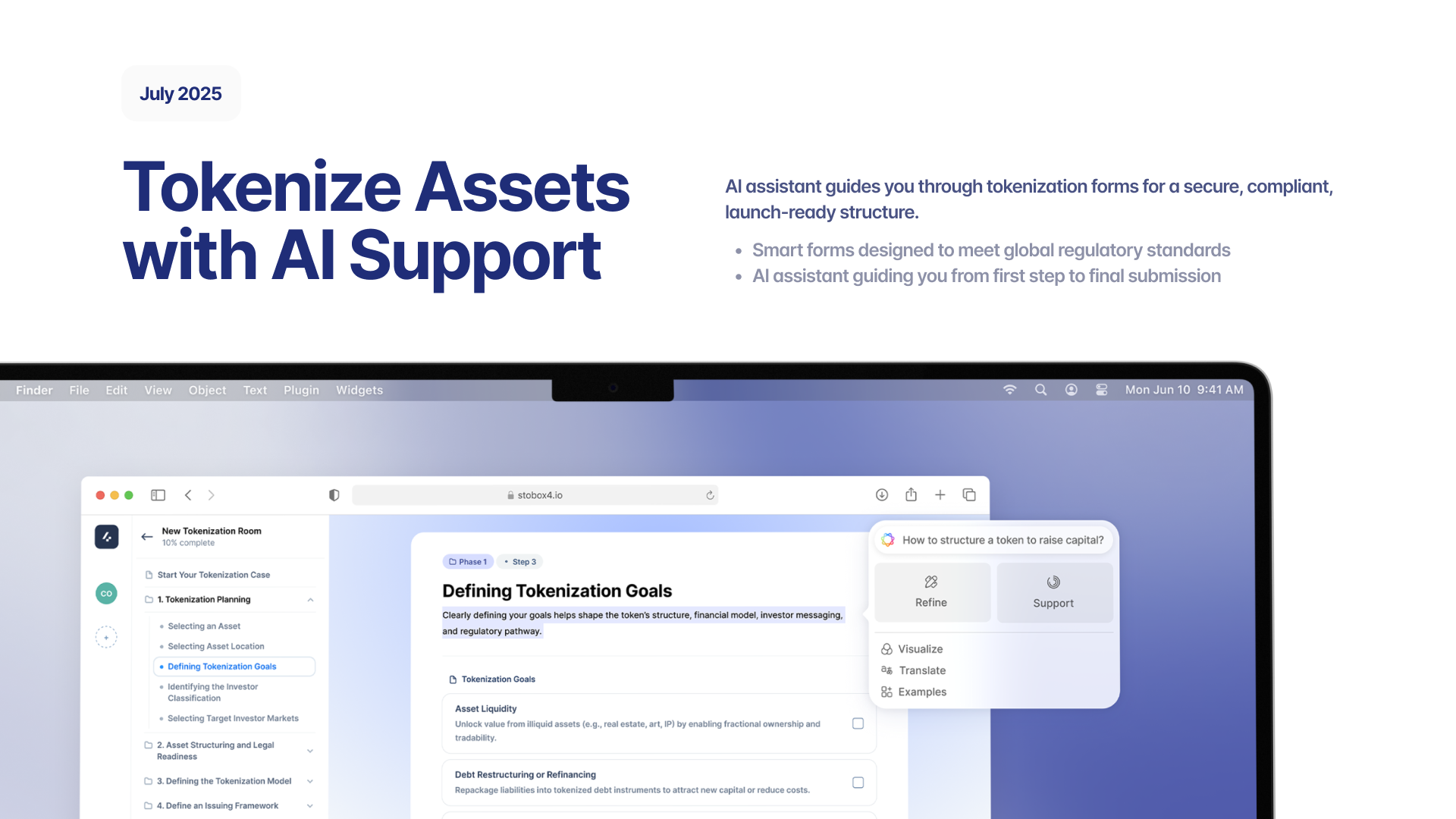

Start Tokenization with the AI-Powered Stobox Framework

Tokenization is a legal, financial, and technical process — and Stobox 4 makes it manageable with the Stobox Tokenization Framework, a step-by-step methodology refined over 7 years and 100+ tokenization cases.

The AI Assistant embedded in the platform guides you through each part of the process:

- Define your asset type (equity, debt, real estate, etc.)

- Upload legal documents and ownership proof

- Choose a jurisdiction and legal structure (SPV/SPC)

- Configure the token model (fixed price, revenue share, multi-round)

- Customize investor rules, rights, and lockups

- Set compliance restrictions (jurisdictions, accreditation, limits)

The onboarding process is dynamic and regulatory-aware, guiding issuers through every key decision point — from asset definition to legal structuring. With smart prompts and AI-driven suggestions, it helps reduce the risk of costly mistakes and accelerates your time to market. Each submission is checked by the system to ensure alignment with global regulatory standards before you go live.

Get Support from Stobox Experts & Trusted Partners

Tokenization is not just about launching a token — it’s a full project involving legal structuring, regulatory coordination, technical execution, and investor readiness. That’s why Stobox 4 doesn’t leave you to figure it out alone.

With your business subscription, you gain access to Stobox’s expert-led tokenization project management service — a dedicated team that helps you organize, plan, and execute your tokenization journey from start to finish.

Join our live presentation to explore platform features, success cases, and next steps

In addition, you’ll have access to Stobox’s network of legal and compliance professionals, ready to support. Whether you’re tokenizing equity, real estate, or debt instruments, you’ll have a partner by your side – not just a platform. This hybrid model of software + human expertise ensures you don’t miss critical details and can move forward with clarity and confidence.

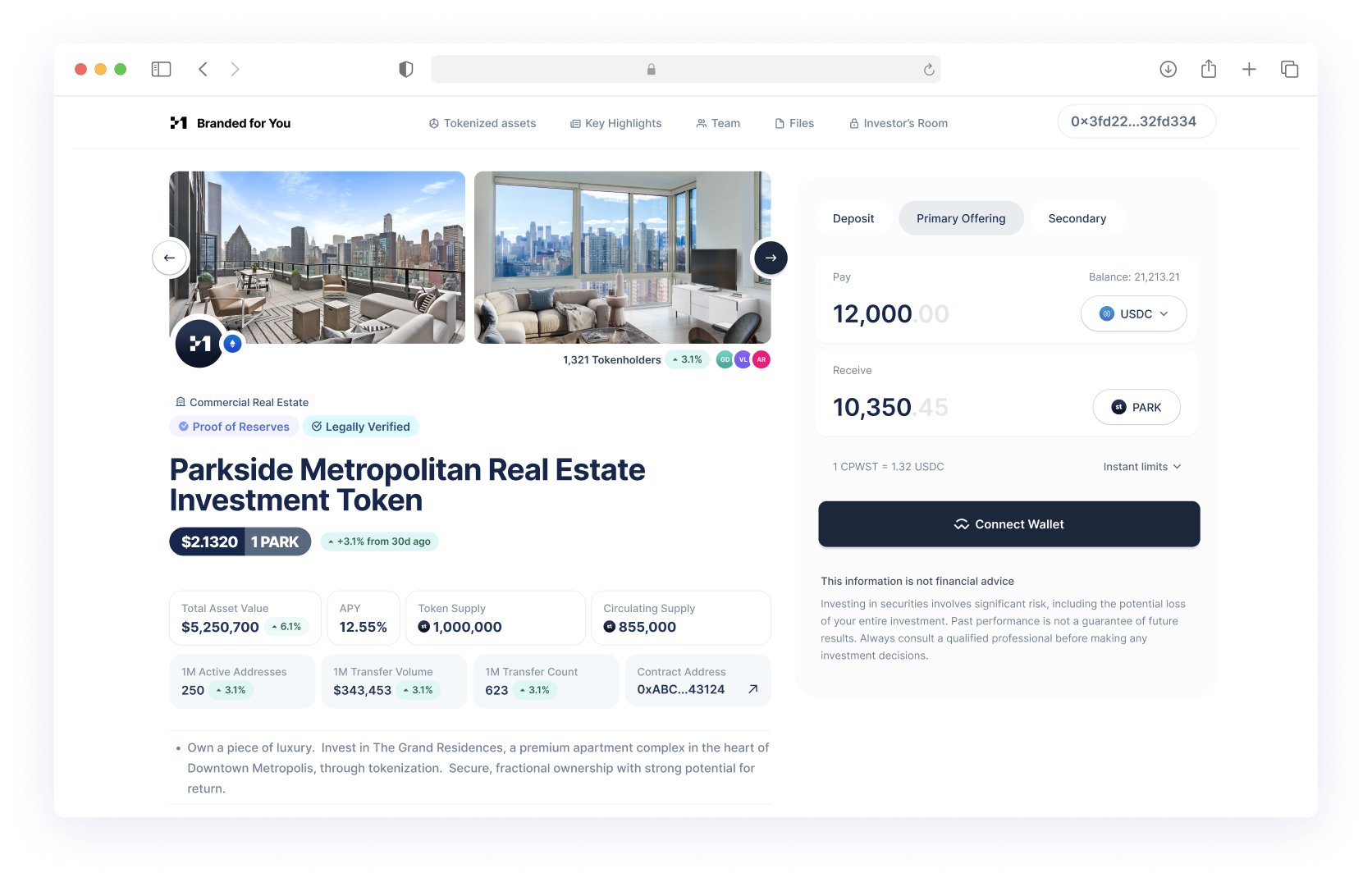

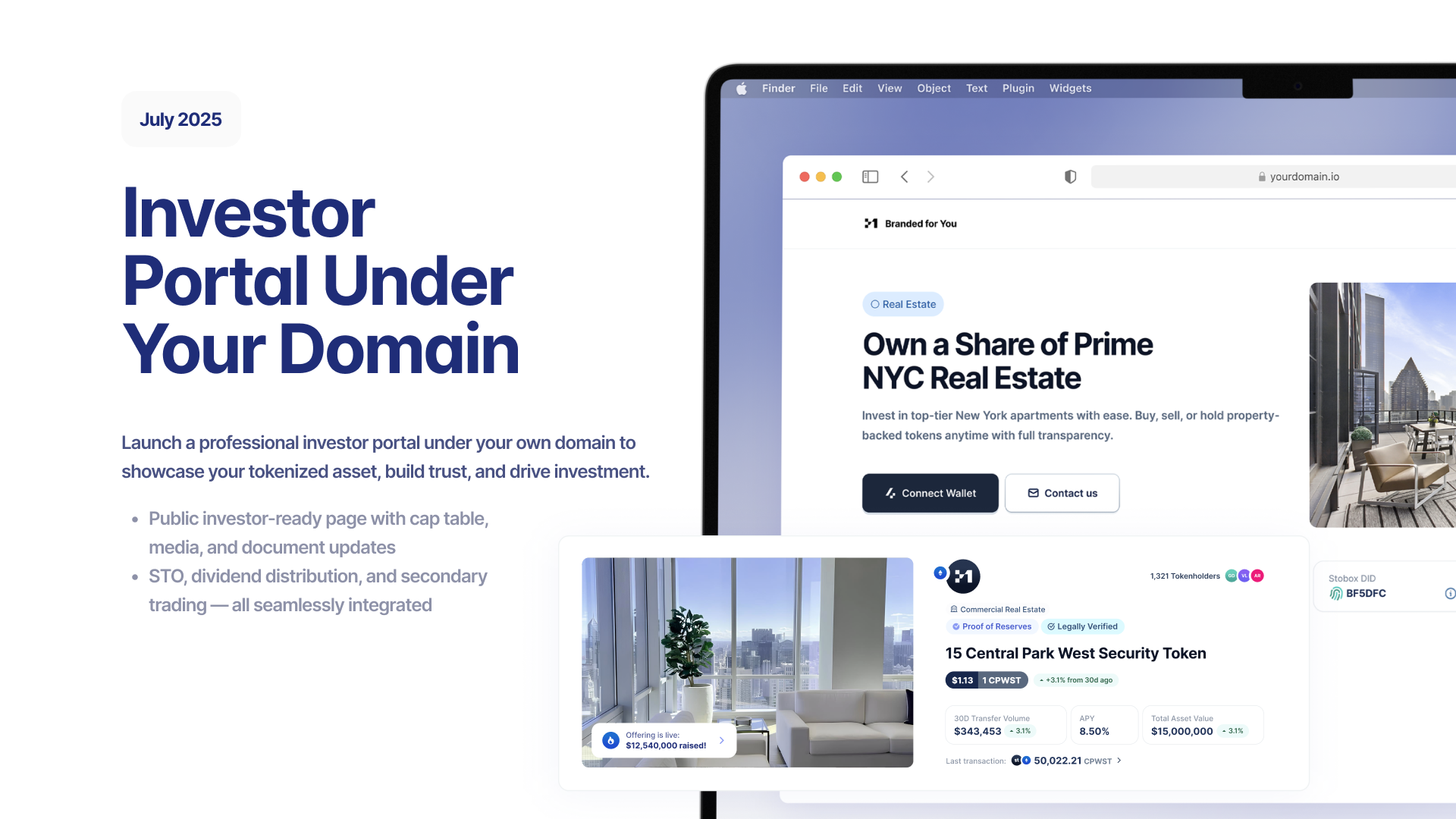

Open Your Branded Investor Portal

With your tokenization process underway, Stobox 4 allows you to launch a fully branded Investor Portal under your own domain — even before the token is formally issued or the STO is live.

This gives you a significant head start in preparing your investor base and building visibility for your offering.

The Investor Portal is more than just a website — it's a professional investment interface that presents your company and tokenized asset in a transparent, accessible, and investor-friendly way. Here’s what you can do with it:

- Build investor confidence with a custom offering page that reflects your brand identity

- Share your story: include a company overview, team bios, media content, and explainer videos to clearly communicate your vision

- Present your financials and legal documents to add credibility and demonstrate readiness

- Showcase token details such as the live cap table, funding terms, distribution rights, and key offering metrics

- Enable early investor engagement with integrated KYC onboarding, wallet registration, and whitelist access

Even before your Security Token Offering officially begins, launching your portal allows you to:

- Start building awareness and interest

- Capture early investor leads and build your mailing list

- Begin conversations with strategic or anchor investors

- Create momentum that can help fuel your public launch

In today’s digital capital markets, presentation and transparency are everything. The Public Investor Portal ensures you’re not just ready to raise capital — you’re ready to do it with professionalism, trust, and clarity.

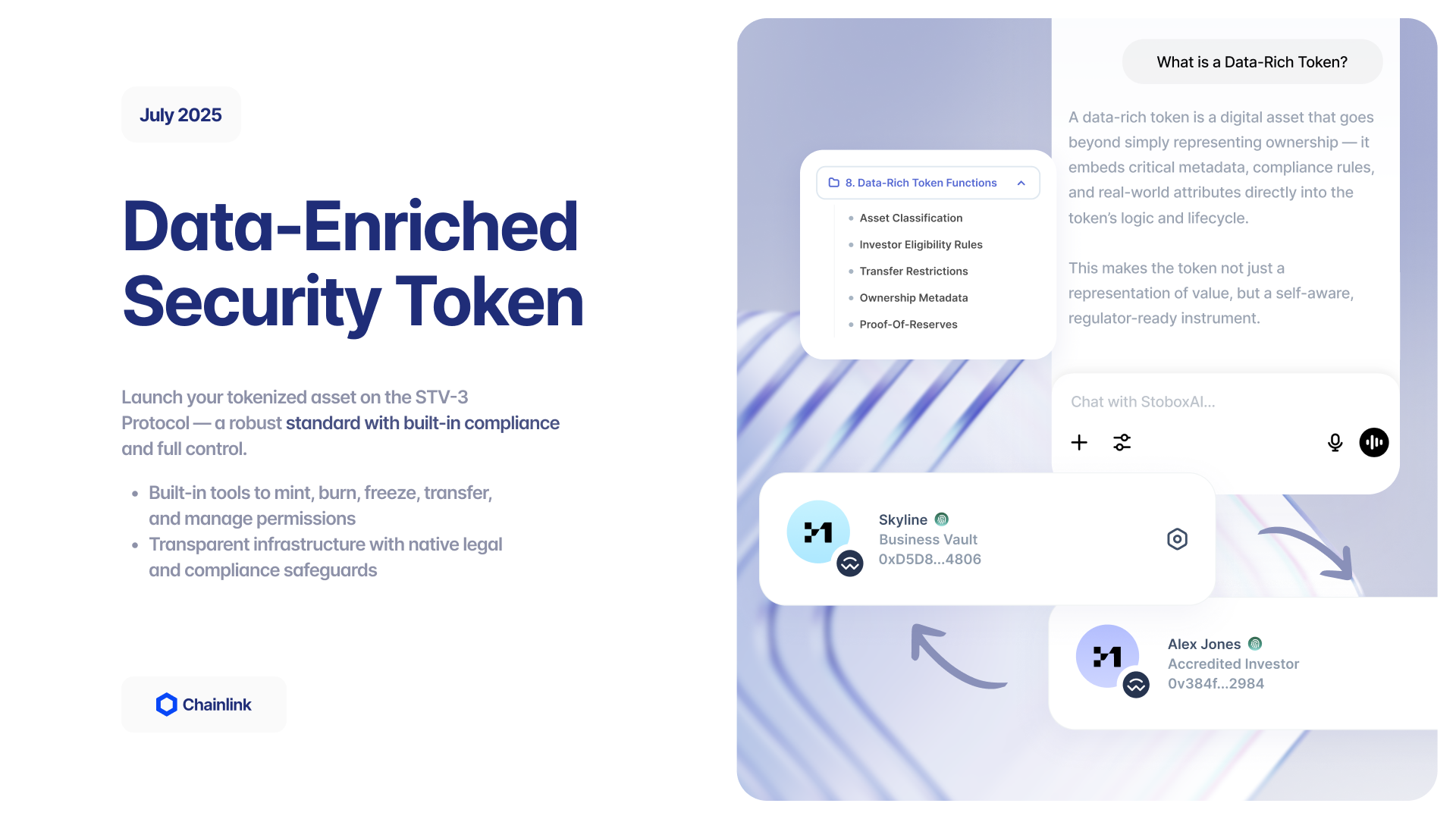

Create and Configure Your Security Token

With your asset structured and onboarding complete, it’s time to create your token — the digital representation of your real-world asset. Using Stobox 4, this process is precise, compliant, and fully under your control.

Your security token is created on the STV3 Protocol, Stobox’s purpose-built infrastructure for regulated digital assets. This protocol ensures not just token creation, but enforceability, governance, and long-term asset management.

The token configuration allows you to:

- Define token supply and precision — total number of units, decimals, and issuance caps

- Set investor permissions — who can hold, buy, or transfer your token (based on jurisdiction, accreditation, or lock-up rules)

- Embed compliance controls — such as transfer restrictions, whitelisting, and freeze/unfreeze functionality

- Establish issuer rights — including minting, burning, distribution, and revocation capabilities

Tokens created on STV3 Protocol are data-enriched, meaning they are not just digital wrappers — they contain structured metadata, legal references, and rule sets that make them suitable for regulatory audit, investor protection, and financial reporting.

Whether your goal is to raise growth capital, tokenize a real estate asset, or launch a blockchain-native equity round, Stobox 4 gives you the infrastructure, speed, and trust to do it right.

Join our live presentation to explore platform features, success cases, and next steps

Your token can now be held in investor wallets, transferred securely on-chain, and prepared for distribution – forming the technical and legal foundation of your Security Token Offering.

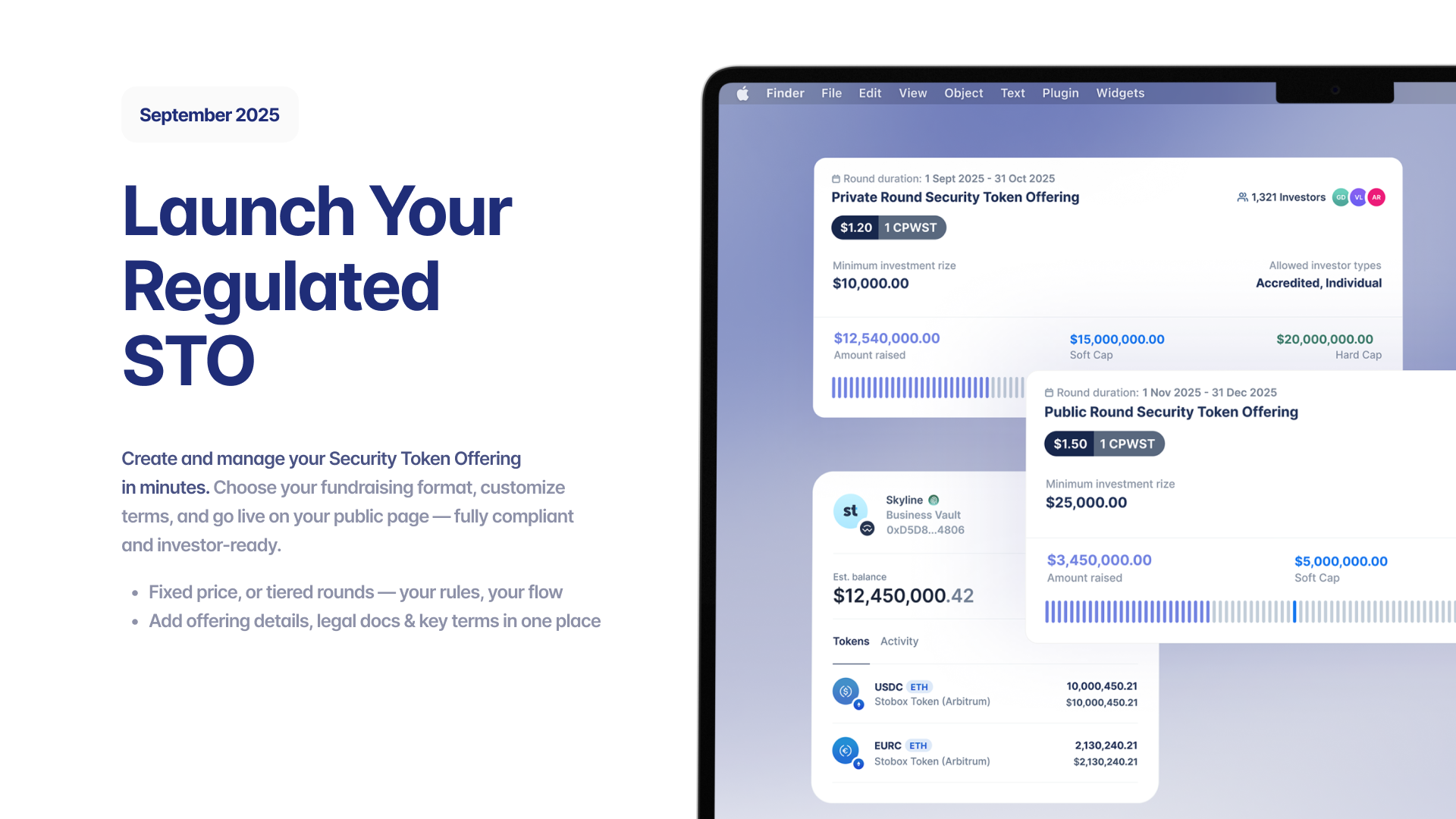

Launch Your STO — Go Live and Start Fundraising

With your security token ready and your offering details finalized, you're ready to launch your Security Token Offering (STO) — directly from your own branded Investor Portal.

Stobox 4 streamlines the launch with a simple, guided flow. You set the fundraising model and terms — fixed price, tiered rounds, or hybrid formats — and publish the offering instantly. The platform automates everything else:

- Investor onboarding with KYC/AML

- Stablecoin/crypto payment processing

- Token allocation and distribution

- Real-time dashboards and compliance checks

Your STO is now live, and your portal becomes a dynamic fundraising engine. Investors can explore your opportunity, pass verification, and invest in minutes – while you maintain complete control and transparency.

Most importantly, the STO is not just a digital campaign — it's a regulated financial process with built-in governance, reporting, and audit readiness.

Whether your goal is to raise growth capital, tokenize a real estate asset, or launch a blockchain-native equity round, Stobox 4 gives you the infrastructure, speed, and trust to do it right.

Join the Future of Tokenized Finance with Stobox

The future of asset ownership, investment, and capital markets is being built today — and Stobox 4 is your gateway to that future.

Sign-up to Stobox 4Stobox 4 is now open for onboarding. Whether you're looking to raise capital, tokenize real-world assets, or launch a fully compliant investor portal — this is your moment to step into the new era of finance.

Join our live presentation to explore platform features, success cases, and next steps

Whether your goal is to raise growth capital, tokenize a real estate asset, or launch a blockchain-native equity round, Stobox 4 gives you the infrastructure, speed, and trust to do it right.

Be an early mover. Be compliant. Be unstoppable. The tokenized future starts today — with Stobox 4.