How does real estate asset tokenization really work?

Real estate tokenization is a process of making blockchain-based tokens by asset tokenization platforms that reflect a part of real estate ownership, making it easier for smaller investors to make any real estate investments.

What is the Tokenization of Real Estate?

Real estate tokenization divides real estate into digital tokens, allowing for fragmented ownership and easier access to real estate assets. This approach opens up access to real estate investing to a wider audience. Real estate tokenization is transforming the future of investing by providing a more efficient and inclusive way to participate in the real estate market.

What is Real Estate Tokenization?

Real estate tokenization is creating blockchain-based tokens by asset tokenization platforms that reflect a portion of real estate ownership. This makes it easier for small investors to make any real estate investment. This is an emerging trend in the industry that allows anyone to invest in real estate, such as the Empire State Building or luxury resorts.

Blockchain technology creates and manages tokens, providing a secure and transparent way to track ownership and transactions. Each token is unique and represents a specific fraction of the value or income of a real estate property.

Tokenization of real estate offers several benefits: increased liquidity, lower barriers to entry, and fractional ownership, making it easier for investors.

Benefits of Tokenizing Real Estate

Tokenization has several key advantages, especially regarding accessibility for small investors and the potential for global investment.

- Tokenization drastically reduces the minimum investment threshold. It represents the ownership of a building in the form of blockchain tokens; therefore, thousands of people can own one building. Your investors don’t need millions of dollars to purchase a property: they can start with as little as $500.

- Tokenized assets can be bought, sold, and traded worldwide, giving investors access to real estate markets that were previously inaccessible due to geographic or regulatory barriers.

- Tokenization can increase liquidity in the real estate market, as tokens representing real estate can be traded more easily than the actual properties themselves.

- Blockchain technology provides transparency while recording transactions in a public registry and offers security features that can help protect from fraud and fake.

- Tokenization can provide access to high-quality real estate assets typically reserved for institutional investors, allowing small investors to participate in premium markets.

The benefits of tokenization, especially in the context of real estate tokens, make it an attractive option for investors seeking to diversify their portfolios and access new investment opportunities.

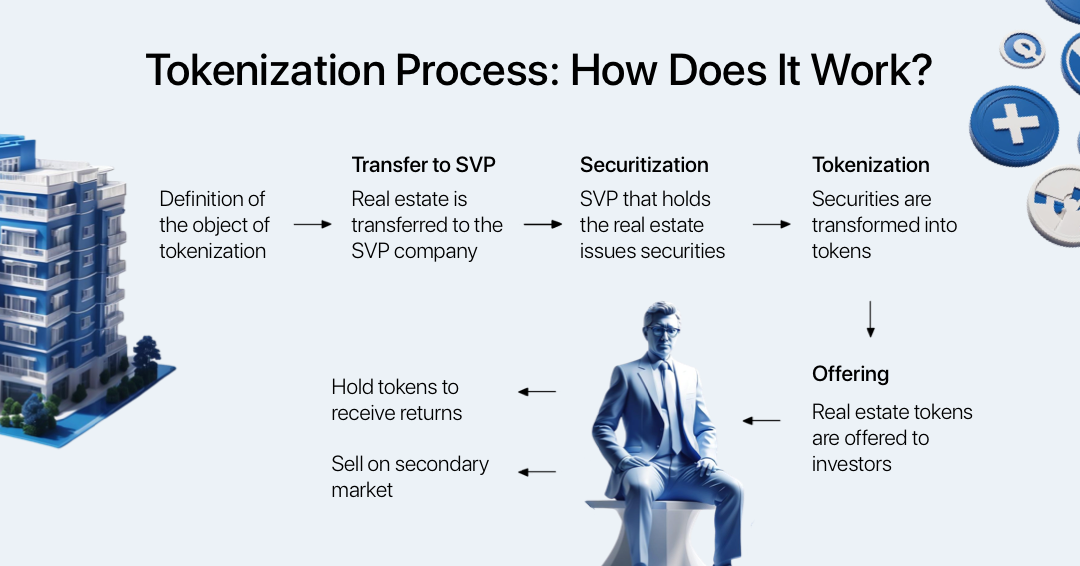

The Tokenization Process

Tokenization platforms make the process much easier. They provide the technology and infrastructure needed to tokenize real estate assets. Here's a detailed explanation of how it works, from start to finish.

Models of Real Estate Tokenization

There are two popular models for ownership structuring, each with its legal structure. These are direct and indirect ownership through special purpose vehicles (SPVs). Below we look at these models and their legal arrangements.

Direct Ownership Model

Investors own tokens that represent ownership of the underlying real estate asset. Each token presents a fractional ownership interest in the real estate asset, and investors have direct legal rights to their share of income, fees, and voting rights. With this ownership model, securities laws are followed, which is necessary to avoid legal problems.

Indirect Ownership through an SPV

In this model, an SPV is created to own a real estate asset and investors own tokens representing shares or interests in the SPV. The SPV manages the real estate and distributes profits to the token holders.

Token holders have a stake in the SPV, which owns the real estate asset. This structure allows for additional legal protection and flexibility.

The SPV may be subject to special regulations governing its operations and management.

Legal and Financial Considerations

The legal aspects of real estate tokenization vary significantly from jurisdiction to jurisdiction. But there are a few key points common to all jurisdictions:

- Real estate tokens are often considered securities because they represent ownership of an underlying asset with an expectation of profit. Therefore, issuers must comply with securities laws.

- Real estate token issuers must comply with anti-money laundering (AML) requirements and know their customers (KYC).

- Issuers must prepare legal documentation that discloses important information to investors. For example, the terms of the offering, the risks associated with the investment, and financial information about the underlying real estate asset.

- Securities laws protect investors and ensure they have access to accurate and timely information about the securities they purchase.

- Real estate asset tokenization platforms are also subject to regulation. They must comply with securities laws and regulations and have the licenses and permits to operate legally.

Advanced Tokenization Models

Special purpose vehicles (SPVs) are used to tokenize real estate. They help simplify difficult ownership structures and benefit investors and property owners.

How are SPVs used for real estate tokenization, and what are the benefits of this structure?

- With an SPV, real estate ownership is consolidated in one legal entity, facilitating management and tokenization.

- SPVs give investors and real estate owners limited liability protection. Thus, the liabilities of the SPV are limited to the assets it owns, which protects the personal assets of investors and property owners.

- SPVs make it easier for clients to invest in real estate. Instead of personally investing in real estate, investors can buy tokens representing ownership of the SPV. This provides them with a more liquid and traded investment.

- If the investment fails, only the assets of the SPV are at risk, which protects the other assets owned by the investors.

- The SPV structure provides investors with greater transparency and control over their investments. Smart contracts are used to automate profit distribution and voting rights.

- SPVs enable partial real estate ownership by allowing investors to purchase small shares.

Segregated Portfolio Company Model

Segregated portfolios, or segregated accounts, are investment accounts managed separately from others and have their own assets and liabilities.

This advanced model is helpful for those who wish to tokenize multiple properties. Instead of incorporating a separate company for each property, one company might own all to reduce the cost.

The problem with this model is that it implies a bigger risk. If one property is underperforming and the company cannot fulfill its obligations, it would have to use revenue from other properties, which other investors may own.

To solve this problem, you need a vehicle where each property would be part of a separate balance sheet, and assets and liabilities would be calculated separately for each property. This kind of company is called a segregated portfolio company. It was initially designed for investment funds that might have many different portfolios and want to protect investors if one or several of the portfolios are underperforming. You can use this idea for tokenizing multiple properties where one portfolio would represent one property: issue separate security for each piece of real estate that will represent the rights to cash flows from it.

Real World Applications and Examples

This example of real estate tokenization shows new opportunities for investors by splitting up property, increasing liquidity, and making the investment process easier.

Landshare

Landshare is an American company that was the first to launch tokenized real estate on the Binance blockchain. Landshare recently launched its third real estate offering and reached its fundraising goal in two days. This offering, dubbed Tokenized House Flip, allows investors to finance the renovation of properties that are then sold at a profit, with the profits distributed to token holders. Stobox's technology has facilitated this process by making it available worldwide to investors who invest as little as $50.

Future Trends

One key trend in real estate tokenization is its increasing active use. Clients are attracted by the potential for increased liquidity, reduced transaction costs, and access to a global investor base.

Another tendency is the development of the legal and regulatory base. As this market grows, regulators will provide clearer policy recommendations to protect investors and enforce securities laws.

Technological progress is also helping to drive the growth of real estate tokenization. For example, smart contracts automate the completion of transactions, reducing the need for third-party intermediaries and making the process easier. Real estate valuation and rental income increase transparency and trust in tokenized assets.

The growth of the real estate tokenization market is expected to accelerate as more investors and developers recognize the benefits of this technology. However, challenges remain, such as regulatory uncertainty, cybersecurity risks, and the need for standardization. Overcoming these challenges will significantly impact the adoption of real estate tokenization and its integration into the mainstream real estate market.

Conclusion

Real estate tokenization is changing real estate investment in a major way by transforming real estate into digital tokens, making it easier to access assets. This makes it possible for a wider audience to invest in real estate and provides more efficient market participation.

Despite regulatory uncertainty and risks, the prospects for real estate tokenization are promising. More and more investors and developers are recognizing its benefits. The tokenization market will grow, offering new opportunities for investors.