AriyaX Launches Aviation Token AXPT on Stobox 4 Platform

AriyaX Capital launches the AriyaX Profit Token (AXPT) on Stobox 4, showcasing how aviation operations can be tokenized through technical infrastructure. The project highlights the platform’s ability to support complex real-world asset configurations with automated, transparent workflows.

We're excited to announce that AriyaX Capital Ltd., a pioneering aviation finance company, has officially launched their Ariyax Profit Token (AXPT) on the Stobox 4 Platform, enabling tokenized access to private jet charter operations for verified users worldwide.

This launch marks another significant step forward in Real-World Asset (RWA) tokenization, as AriyaX becomes one of the first companies to successfully tokenize aviation revenue streams through a blockchain-based technical infrastructure.

Tokenizing Aviation Operations Through Technical Innovation

AXPT represents an innovative approach to aviation finance. AriyaX has configured a profit-participation token that connects token holders to charter revenue streams from ultra-long-range private jets through automated smart contract infrastructure.

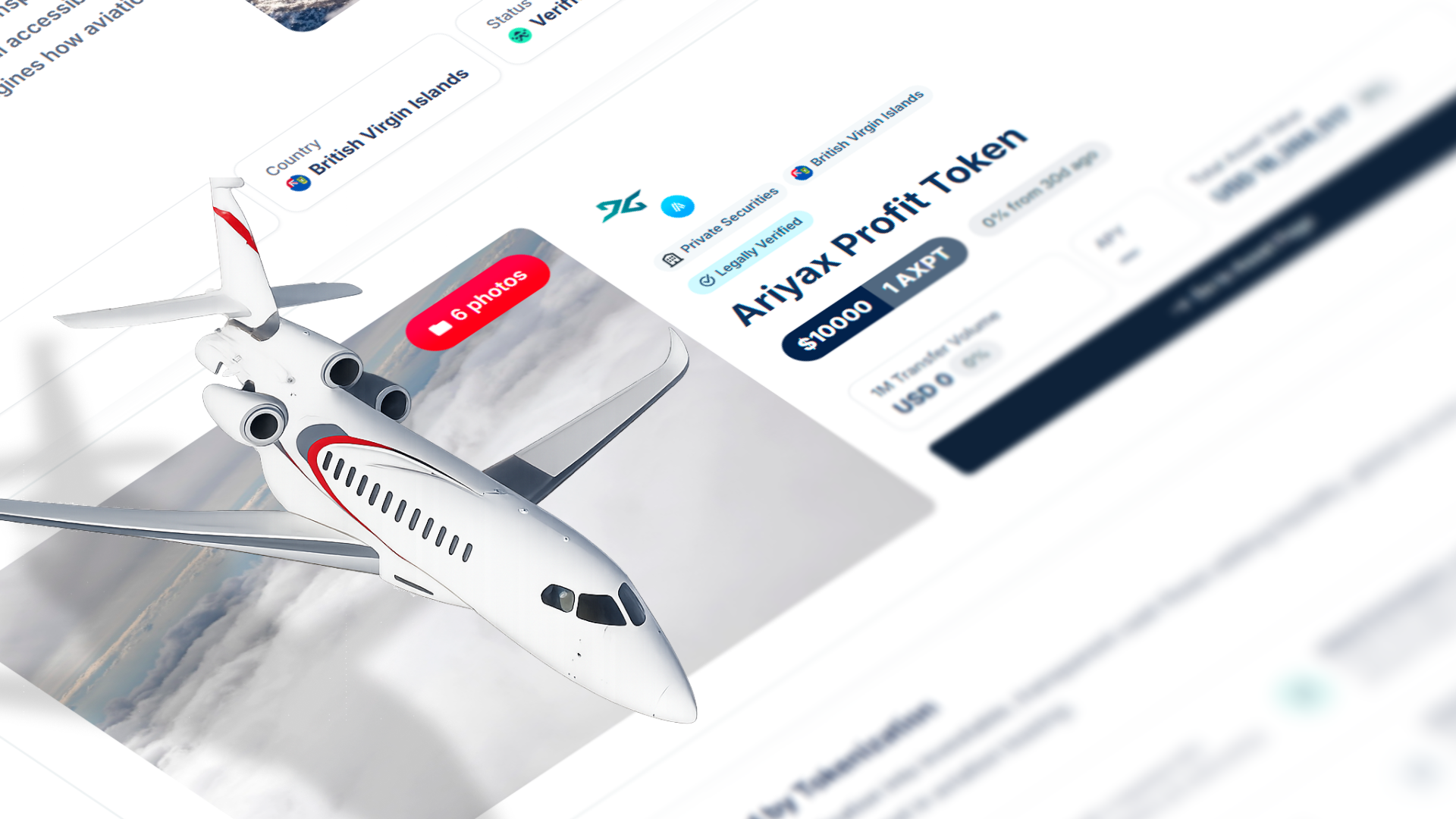

The token is now live on Stobox 4, with AriyaX having completed full verificationand established their branded project page at - https://invest.ariyax.com/, through Stobox's white-label technical infrastructure.

Transforming Aviation Access Through Technology

The private aviation market has historically been one of the most exclusive sectors. AriyaX's AXPT implementation on Stobox 4 demonstrates how tokenization technology can:

- Enable Digital Access: Verified users can explore the project with entry thresholds configured by the issuer

- Automate Operations: Smart contract automation handles distribution calculations and token holder management

- Provide Transparency: Blockchain technology ensures transparent, auditable operations

- Support Global Reach: Technical infrastructure enables cross-border token configuration

The AXPT Token Configuration

AriyaX has configured AXPT as a profit-participation token with the following technical specifications:

- Token Price: $10,000 per AXPT (as configured by issuer)

- Total Asset Value: $18.26 million

- Revenue Model: Charter operations (as described by issuer)

- Technical Standard: ERC-20 on Arbitrum blockchain

- Smart Contract: STV3 Protocol architecture

The tokens are deployed on the Arbitrum blockchain using Stobox's STV3 Protocol architecture, providing automated distribution capabilities and rules-based transfer logic. Through the integrated Stobox Wallet, users can manage their AXPT holdings alongside other tokenized assets.

Real-World Asset Implementation

AXPT is configured to represent participation in aviation operations. The issuer has structured the token to connect to revenue-generating operations involving ultra-long-range aircraft serving intercontinental private aviation markets.

AriyaX's implementation eliminates traditional aviation investment complexities through tokenization. The technical infrastructure handles automated distributions according to issuer-configured rules, while blockchain technology provides transparent tracking of all operations.

Aviation Finance Through Blockchain Infrastructure

What makes AXPT particularly innovative is how it transforms aircraft operations into tokenized, transparent structures. By implementing operational income streams through blockchain technology, AriyaX creates a new technical approach to aviation finance.

The Special Purpose Vehicle (SPV) structure, domiciled in the British Virgin Islands, provides the legal framework while the blockchain layer enables automated, transparent operations. This dual-layer approach combines traditional structures with blockchain technology.

Through Stobox DID verification module and configurable access rules, AriyaX implements verification requirements while maintaining the efficiency benefits of blockchain automation.

Expanding the Stobox Ecosystem

AriyaX joins a growing roster of companies choosing Stobox 4 for their tokenization needs. As a BVI-domiciled entity operating in the aviation sector, AriyaX demonstrates the platform's technical capability to support complex, cross-border tokenization projects across diverse industries.

The launch of AXPT showcases how Stobox 4 enables:

- Multi-jurisdiction technical configurations

- Industry-specific token architectures

- Revenue-sharing smart contract structures

- Professional project presentation pages

Access AXPT on Stobox 4

Verified users can explore the AXPT project through:

- Project Information: https://invest.ariyax.com/

Registration and verification are configured by the issuer to control access to project documentation and participation.

About Stobox

Stobox 4 is a comprehensive tokenization platform providing end-to-end infrastructure for Security Token Offerings and real-world asset tokenization. The platform integrates proprietary protocols (STV3, Stobox DID) with established compliance providers to deliver regulatory-aligned tokenization capabilities.

With $500M+ in tokenized assets and 100+ clients worldwide, Stobox provides the technological and methodological infrastructure for compliant digital securities issuance.

Platform Access:

- Business Registration: https://www.stobox.io/4/business/

- Individual Investor Access: https://www.stobox.io/4/individuals/